|

Comparisons between the Japanese example, exhibited from 1990-2005, and

what the U.S. and Europe are experiencing.

When trust is misplaced

The world needs faith and trust to

function. We put our money in banks. We trust that the banks will still be

operating 20, 30 years from now and that our money will always be there as

and when we need it. Manufacturers buy from various suppliers. They trust

that the suppliers will deliver parts that meet their quality requirements

and do so on time. The suppliers, on their end, deliver the goods first and

trust that the manufacturers will pay them within a stipulated time.

Exporters ship their goods overseas. They trust that the letters of credit

they received will be honoured by the banks and that they will eventually be

paid. Banks deal with one another. They trust that their counterparties will

be around tomorrow, and that they will honour the trades done.

In short, trust is at the foundation of

the functioning of a modern economy. In his 2004 book, The Company of

Strangers, Paul Seabright, a professor at the Toulouse School of Economics,

explored the roots of this trust. One is the capacity to weigh the costs and

benefits of trusting others. Allied to this is an instinct to return favours

in kind, and to seek revenge when trust is betrayed. When workers are

treated generously, they work hard; when customers are swindled, they

express outrage. When suppliers bilk their customers, they gamble the

rewards of future commerce for a short-term gain.

Prof Seabright concluded that people

place their trust in others because it is less risky than the alternative.

'Self-sufficiency is fantastically risky,' he concludes. If we try to grow

our own crops and they fail, we will go hungry. If we try to build our own

homes, the foundation may not be strong enough and the houses may collapse.

'Integration with others massively reduces risk,' notes The Economist in a

recent article entitled 'The faith that moves Mammon'. 'Trust in strangers

may be at odds with some of our instincts, but it is a price worth paying

for a richer life.'

However, recent events have shown that

perhaps we have gone overboard with trust and faith. In many instances, we

were not so adept at weighing the costs and benefits of trusting others.

Trusting unbridled capitalism was clearly misplaced, as was the assumption

that the pursuit of individual self-interest will always result in social

welfare. Witness the recent melamine scandal in China. Regulators misplaced

trust in industries when they assumed they were capable of self-regulation.

Witness the excessive risks taken by the financial sector. Meanwhile,

individuals misplaced their trust in the so-called experts: the wealth

advisers, the fund managers. Witness the Lehman Minibonds debacle and

Bernard Madoff's Ponzi scheme.

Perhaps such reckless trust grew from a

relatively long period of stability. It led everyone to let their guard

down. The lesson for all now has to be: trust must be bestowed

discriminately, and with verification. It pays to be more questioning, even

suspicious, especially when it comes of one's life savings.

- BUSINESS

TIMES

Increased Global Risk

Going

down: global exchanges have nosedived over fears that Dubai’s financial

crisis will contaminate other markets

Economic, political, and market risks

will be higher in the coming decade than in the 20 years before the recent

crisis, says Tony Tan, deputy chairman of Government Investment Corporation

(GIC), Singapore's biggest sovereign wealth fund. As a result, he feels SWFs

have an important role to play as suppliers of capital and expertise,

something that has also been noted

by others.

Speaking on Saturday at the Asia-Pacific

Economic Cooperation CEO summit in Singapore, Tan first outlined his view of

the global economy. While global depression appears to have been avoided and

the short-term economic outlook is positive, significant risks remain, he

said, reflecting bearish views

he has expressed in the past.

Moreover, the global economic and

financial environment has changed "in at least three significant ways,

which will increase uncertainty and potential for volatility", Tan

says.

First, economic activity in major

over-leveraged developed countries, especially consumption in the US and the

UK, is unlikely to recover as robustly as in normal recessions. It could

take several years for these economies to fully recover from the crisis,

says Tan, and they will emerge with much higher and more worrying public

debt levels.

Second, economic growth will be

distributed unevenly, with key emerging economies outperforming their

developed counterparts. On the positive side, an emerging middle class in

the developing world will demand new products and services.

But emerging-market performance will also

differ. Economies with larger domestic markets and more market-orientated

and consistent policies, such as China, Brazil and India, will be better

placed to grow than others. And there will be challenges: over time the rise

of emerging markets -- especially China, India and Russia -- could, together

with competition for limited natural resources, lead to higher geopolitical

risks.

Third, Tan expects higher stagnation risk

in the medium term to be followed by higher inflation risk. "Over the

next one to three years, weak growth and excess capacity will be strongly

disinflationary," he says. "However, over the next five to 10

years, policy errors or political pressure could lead central banks to

accommodate higher inflation. In addition, robust emerging-market growth

could put huge pressure on natural resources and the environment."

All of this is happening in the context

of ageing populations, says Tan, especially in developed countries, which

dampen growth and savings and put pressure on much-reduced public finances.

"In short, over the next decade it

looks like economic, political, and market risks are going to be higher than

the last 20 years before this crisis," he says.

As a result, there are three important

roles for SWFs, says Tan. First, SWFs are investors that have a long-term

horizon that, in the wake of the consolidation of the global financial

system, will become important suppliers of global capital. In the future,

there will be a premium placed on investors who can look beyond shorter-term

performance, he adds.

Second, SWFs have a strong interest in

ensuring the global economy and financial system recovers and grows in a

vigorous and sustainable manner. They can therefore provide credible

insights and analysis of developments in financial markets and economies,

says Tan, particularly on issues concerning the restructuring of the global

financial architecture.

Third, SWFs want to be responsible market

participants and are not out to make quick returns by cutting corners or

seeking to contravene legal and regulatory regulations. Tan says SWFs such

as GIC -- through their regular interaction with policymakers and regulators

worldwide -- can help use their influence to shape policies for better

outcomes.

He also highlights the expertise GIC --

and other SWFs - provides. Via their private equity investments, they

partner with experts who provide managerial and other skills to companies.

"This could be in distressed assets, restructuring and workout

situations," adds Tan, "or in emerging markets where companies are

growing but talent is thin."

(In its annual

report published in September, GIC said it increased its

allocations to alternative investments, such as hedge funds, private equity

and property, to 30% from 23% in the previous fiscal year. It also

indicated that it plans to convert more of its cash holdings into

investments in emerging markets and natural resources.)

But all this rests on keeping

capital markets open. "If governments close their capital markets to

SWFs," said Tan at the Apec summit, "recipient countries will face

higher capital costs while SWFs will see their opportunity set

decrease." - 2009

November 16 FINANCE

ASIA

Bags of money to be made as tai-tais hock

their handbag

Chanel, Gucci, Hermes and Louis Vuitton

handbags are no longer just the best friends of tai-tais and socialites; a

money lender is also targeting the luxury items as collateral in a first for

the personal-loan market.

A television advertisement screened in

the past three weeks shows a cheerful woman walking out of Yes Lady Finance

with a cheque after pledging her baguette handbag for a personal loan.

These are a gimmick to make our name

heard," Tung said. "It is only the beginning of a bigger

business - property mortgages."

Escaping unscathed from the global credit

crunch, Tung and Yiu saw a business opportunity in the cash-strapped and set

up money-lending firms Yes Lady Finance and Yes Man Finance in April.

Targeting luxury handbags, Yes Lady assesses the value of popular handbags

and offers to lend up to 70 per cent of their market value, charging

interest below the industry average.

For example, for a Louis Vuitton handbag

valued at HK$20,000 in the second-hand market, Yes Lady will lend 70 per

cent of the value to the owner - HK$14,000 - and charge interest as low as

28 per cent a year. This means the owner will have to pay interest of HK$979

a month over a three-month maturity. By the due date, the owner has to

settle the outstanding loan or forfeit the handbag.

The government caps the interest

pawnbrokers can charge at 3.5 per cent a month (42 per cent a year). The

rate offered by Yes Lady is cheaper, and way below the maximum legal

interest rate of 60 per cent.

"It is a good fund-raising option

for some tai-tais," Tung said. "They may not want to sell their

handbags, which may be a gift from husbands and mean a lot to them."

However, Tung conceded that handbag

finance was limited by fashion trends and economic scale. His ultimate

business model rests on home financing, aiming to capitalise on the

government's decision last month to restrict bank lending to luxury-home

buyers. The maximum mortgage on a luxury home worth more than HK$20 million

was lowered to 60 per cent of the home's value, down from 70 per cent.

Despite Yes Lady's innovative strategy,

competition is punishing in a city with too many finance companies and banks

chasing borrowers.

Billy Mak Sui-choi, an associate

professor at Baptist University's department of finance and decision

sciences, said Yes Lady Finance could undercut its rivals by targeting

female borrowers and charging lower interest because it had handbags as

collateral, which meant its risks were relatively lower. "Its operation

is like a pawn shop. It may lead to some copycats opening up a new market

through collateral of laptops, luxury watches and lighters."

Partly because of high credit card

interest rates, finance companies thrive in Hong Kong, with the fray

dominated by major banks such as Citibank, HSBC and Standard Chartered and

other operators such as Aeon Credit Service (Asia), United Asia Finance,

Promise (HK) and Prime Credit. Some money lenders do not take any assets as

collateral and charge higher interest, but still lower than credit card

issuers. - 2009 November

2 SOUTH

CHINA MORNING POST

Not all real-estate magnates took a

beating, however, as the family of Singaporean tycoon Ng

Teng Fong moved up to join the top 100. Ng's family, who controls

Hong Kong developer Sino Land (0083), now has a combined wealth of US$5.5

billion.

Cheung Kong (Holdings) (0001) patriarch Li

Ka-shing, who was the fourth- richest person in Asia on the 2008

list, ranked as the second-richest person in Asia this year, behind Reliance

Industries chairman Mukesh Ambani. Li's global ranking fell to

No 16, from 11 last year, after his wealth shrank 39 percent to US$16.2

billion.

The

Kwok family of Sun Hung Kai Properties (0016) plunged to No 32 in the

global ranking, from 23, after US$9.4 billion of their riches disappeared,

leaving them with a measly US$10.5 billion.

Lee

Shau-kee, chairman of Henderson Land (0012), dropped to No 43 from 29

after US$10 billion of his wealth evaporated. He is left with US$9 billion.

- 2009

Crisis

over? Fund managers don't think so

Investors concerned leverage that caused

original problem has not been reduced

Senior fund managers around

the world are saying that the financial crisis still isn't over, despite the

improving economic data.

Over 150 leading institutional investors

from more than 15 countries, with over US$2.8 trillion of equity funds under

management, were interviewed over the past month by global business advisory

firm, FTI Consulting, Inc.

Almost two-thirds of them said they did

not believe the financial crisis was over, while 31 per cent said the crisis

was over, and 5 per cent were undecided.

Investors from the UK, the US and

Australia were the most pessimistic - 73 per cent of those from the UK, 76

per cent from the US and 80 per cent from Australia felt the crisis had not

ended.

Continental European and Asian investors

were slightly more optimistic with 59 per cent and 62 per cent,

respectively, saying the crisis was not over.

'Anecdotal evidence gathered during the

survey suggests that across the globe investors were still concerned that

the amount of leverage in the system that caused the original problem has

not been reduced,' said FTI's president & CEO, Jack Dunn.

'The prevailing view was that there has

been so much economic stimulus that markets cannot help but go up. The

concern was what would happen when government money runs out.'

He added: 'There is no doubt that the

on-going uncertainty is having follow-on effects throughout the global

economy. Among US companies alone, approximately US$163 billion of corporate

speculative grade debt is due to mature in 2010, with approximately US$266

billion set to mature in 2011, according to Standard & Poor's research.

These enormous financing requirements amidst still-fragile credit markets,

and weak demand apart from government stimulus, put a premium on a company's

ability to effectively manage both public perceptions and the underlying

business.'

Mr Dunn believes that this uncertainty

has driven many companies to look at alternative funding avenues - such as,

sovereign wealth funds, the equity markets, or more exotic capital raisings.

'For policy makers, it has meant

reassessing the regulatory environment and executive incentives that have

driven the market for many years,' he said.

Still, he added: 'These findings suggest

a paradox, in that despite the negative outlook, global equity markets have

rallied significantly in recent months. This indicates a willingness of

investors, for now at least, to focus on factors beyond the fundamental

issues that caused our current economic crisis.'

One-fifth of the investors surveyed were

based in the UK, another fifth in the US and yet another fifth in Asia -

including those from Hong Kong, Singapore, Korea, China, Australia and

India. Slightly more than a third of those surveyed were based in Europe,

with the rest being based in Australia.

- 2009 September 15 BUSINESS

TIMES

MEANWHILE

still:

In Canada, some Redemptions frozen

Investors are trying to bail out of

commercial real estate funds, but are finding it's not so easy, as Canada's Great-West

Lifeco Inc. becomes the latest money manager to freeze redemptions from

mutual funds that invest in buildings.

London Life Insurance Co.,

an arm of Great-West, said that investors won't be able to redeem their

investments in the $1.56-billion London Life Real Estate Fund because it's

impossible to sell buildings fast enough to meet requests. The Great-West

Life Real Estate Fund, with almost $3.16-billion in assets, was also frozen.

With markets in disarray, investors are

pulling money out of almost every asset class, but are finding that with

real estate, whether in fund or concrete form, it isn't always possible to

get out quickly. London Life's move follows a similar freeze on Friday by

UBS AG, which said clients could no longer get at their holdings in a

$6-billion (U.S.) property fund.

While the moves no doubt leave some

investors dismayed, they are unavoidable and help preserve value by avoiding

fire sales of the buildings owned by the funds, said Dan Hallett, who runs

an investment research firm.

"If it comes to a point where you've

got so many redemptions, you really do want them to freeze

redemptions," Mr. Hallett said. "Do you want to be in a position

when it's a forced sale of assets? Probably not. It's probably the best step

to take."

Putting assets that are hard to sell,

such as commercial real estate, into a mutual fund structure creates the

potential for such freezes, and that's one reason that there are only a

handful of such funds in Canada, Mr. Hallett said.

During the last big real estate downturn,

in the early 1990s, some funds converted to real estate investment trusts to

eliminate the problem, he said. Because REITs are publicly traded, an

investor who wants money back can sell units to another investor, meaning a

REIT doesn't have to sell assets to fund redemptions.

"It really boggles my mind why you'd

put such an illiquid asset in such a liquid structure," he said.

"It's really a mismatch. "

Both the London Life and Great-West funds

invest in all types of real estate, but most of their assets are office

buildings.

The commercial real estate market in

Canada has held up well so far, compared with other markets in the world,

but with new buildings under construction as the economy slows, many in the

industry expect building prices to slump and rents to soften.

- 2008 December 17 GLOBE

& MAIL

New US crisis brewing: mall, hotel

foreclosures

The same events poisoning the housing

market are now at work on commercial propertiesThe

full scope of the US housing meltdown

is not clear and already there are ominous signs of a new crisis - one that

could turn out the lights on malls, hotels and storefronts across the

country.

Even as the holiday shopping season

begins in full swing, the same events poisoning the housing market are now

at work on commercial properties, and the bad news is trickling in. Malls

around the United States are entering foreclosure. Hotels in Tucson,

Arizona, and Hilton Head, South Carolina, also are about to default on their

mortgages.

That pace is expected to quicken. The

number of late payments and defaults will double, if not triple, by the end

of next year, according to analysts from Fitch Ratings Ltd, which evaluates

companies' credit.

'We're probably in the first inning of

the commercial mortgage problem,' said Scott Tross, a real estate lawyer

with Herrick Feinstein in New Jersey.

That's bad news for more than just

property owners. When businesses go dark, employees lose jobs. Towns lose

tax revenue. School budgets and social services feel the pinch.

Companies have survived plenty of

downturns, but economists see this one playing out like never before. In the

past, when businesses hit rough patches, owners negotiated with banks or

refinanced their loans.

But many banks no longer hold the loans

they made. Over the past decade, banks have increasingly bundled mortgages

and sold them to investors. Pension funds, insurance companies, and hedge

funds bought the seemingly safe securities and are now bracing for losses

that could ripple through the financial system.

'It's a toxic drug and nobody knows how

bad it's going to be,' said Paul Miller, an analyst with Friedman, Billings,

Ramsey, who was among the first to sound alarm bells in the residential

market.

Unlike home mortgages, businesses do not

pay their loans over 30 years. Commercial mortgages are usually written for

five, seven or 10 years with big payments due at the end. About US$20

billion will be due next year, covering everything from office and condo

complexes to hotels and malls.

The retail outlook is particularly bad.

Circuit City and Linens 'n' Things have sought bankruptcy protection. Home

Depot, Sears, Ann Taylor and Foot Locker are closing stores. Those retailers

typically were paying rent that was expected to cover mortgage payments.

When those US$20 billion in mortgages come due next year - 2010 and 2011

totals are projected to be even higher - many property owners will not have

the money. Some will survive, but those property owners whose loans required

little money up front will have less incentive to weather the storm.

Refinancing formerly was an option, but

many properties are worth less than when they were purchased. And since

investors no longer want to buy commercial mortgages, banks are reluctant to

write new loans to refinance those facing foreclosure.

California, New York, Texas and Florida -

states with a high concentration of mortgages in the securities market,

according to Fitch - are particularly vulnerable. Texas and Florida are

already seeing increased delinquencies and defaults, as are Michigan,

Tennessee and Georgia.

The worst-case scenario goes something

like this: With banks unwilling to refinance, a shopping centre goes into

foreclosure. Nobody can buy the mall because banks will not write mortgages

as long as investors will not purchase them. -

2008 Novmeber 29 AP

|

'ongoing economic turmoil this FINANCIAL TSUNAMI

|

As at 2008 September 20 - BUSINESS

TIMES

- More

than 10,000 local investors holding Lehman Minibonds are affected by the

New York-based bank's collapse, with most losing between HK$500,000 and

HK$3 million. >> BLOOMBERG

- Value

Partners, (one of HK's top fund managers - V-nee Yeh [Mira's hubby] &

Cheah Cheng Hye) are down $1 bln USD since July >>

Reuters

Anxious Depositors Withdraw Cash From

Asian Bank

ANALYSIS

US$900b aftershock seen hitting US, Europe banks

They

face rising premiums as debts mature amid frozen primary market

(NEW YORK/LONDON)

The financial

earthquake that shook Wall Street last week may be followed by a US$900

billion aftershock as bank debt comes due in the next year.

US and European banks face soaring

premiums as a mountain of debt matures at a time when the primary market

remains frozen. As much as 150 billion euros (S$313.7 billion) in

euro-denominated debt is due in the next six months, according to Barclays

Capital, and US$673 billion of US dollar-denominated financial debt is set

to mature through the end of 2009, based on Morgan Stanley data.

That means banks, already suffering from

the worst credit conditions since the Great Depression, will be forced to

re-issue bonds at a steep price to roll over borrowings and raise fresh

capital or seek other options including reduced loan growth.

'Either they will have to pay up to get

it done or they will have to do other things, such as asset sales, which is

also difficult,' said Olivia Frieser, a bank credit analyst at BNP Paribas,

in London.

In Europe, there is cash to be put to

work and investors are expecting hefty discounts on senior debt. A 1.75

billion euro UBS five-year bond was launched at the end of August, for

example, at a 19-basis-point premium over secondary spreads and 125 basis

points over its credit default swaps.

'We're underweight on the financial

side, but senior paper is one area we would be looking into in the medium

term,' said Christian Doppstadt, head of corporate credit investment at

WestLB Asset Management, in Dusseldorf, Germany.

Wall Street's landscape changed

dramatically last week with the US government's US$85 billion loan to AIG,

once the world's largest insurer based on market value; the bankruptcy

filing of Lehman Brothers Holdings Inc, the parent of the fourth-largest US

investment bank, and the fire sale of Merrill Lynch, the largest US retail

brokerage, to Bank of America.

Uncertainty about how and when the US

government's planned US$700 billion rescue of the financial sector,

announced last weekend, will be implemented also means that credit spreads

remain near record wide levels.

'You've got to look through the

short-term uncertainty and put this in the context of what it is: It may not

be the end game but it's certainly a step in the right direction for risk

and for reopening the primary market,' said Simon Ballard, senior credit

portfolio manager at Fortis Investments, in London.

'When the market can stabilise and get

some confidence will be key to getting liquidity going, and that will become

a self-fulfilling prophecy as the new issuance will garner confidence,' Mr

Ballard said.

But ultimately higher borrowing costs in

the banking sector will be passed on to corporates.

The extra yield, known as the spread,

that investors demand to hold risky high-yield bonds over US and European

government bonds, also widened to record levels on Sept 18, a sign of rising

risk for those securities. Spreads narrowed the next day, which was last

Friday, on optimism over the federal mortgage bailout plan.

Those costs have deterred some borrowers

from issuing debt, but some may not have a choice now as the terms of

existing cheap bank credit facilities, negotiated before the credit crisis,

get used up or need to be renegotiated.

Global investment-grade corporate bond

sales fell to US$1.67 trillion, year-to-date, versus about US$2 trillion for

the same period last year and compared to a record US$2.6 trillion in 2006,

according to Thomson Reuters data.

Global high-yield bond sales dropped to

US$37 billion year-to-date, versus US$131 billion for the same period last

year and a record US$185 billion for all of 2006, Thomson Reuters data

shows. There have been no high-yield deals in Europe for well over a year.

'High-yield issuance is on track to be

down 50 per cent from last year,' said Martin Fridson, chief investment

officer of New York-based Fridson Investment Advisors, during the Reuters

2008 restructuring summit in New York on Tuesday. 'If anything, the

year-over-year decline will be a bit greater than that, as the issuance has

slowed to a trickle recently.'

Mr Fridson noted that financial paper is

not a material factor in the high-yield new-issue market, so refinancing for

those companies has more to do with how the investment-grade market for new

issues holds up.

In Europe, Barclays estimates that 50

billion euros worth of non-financial redemptions are due over the next six

months.

- 2008

September 26

Reuters

Impact of US crisis could worsen: Wen

He also said that China would aid any

international bid to defuse turmoil

(UNITED NATIONS) Cash-rich China weighed

in on the US financial crisis on Wednesday, with Premier Wen Jiabao warning

that its international impact could become 'more serious' and stressing the

need for concerted efforts to contain the turmoil.

He indicated that China, the world's

biggest holder of foreign reserves and second-biggest holder of US treasury

bills, was ready to help in an international bid to defuse the turmoil that

has rocked financial markets around the globe.

'The ongoing financial volatility, in

particular, has affected many countries and its impact is likely to become

more serious,' Mr Wen told the UN General Assembly.

'To tackle the challenge, we must all

make concerted efforts,' he told the UN meeting at the tail end of his

address, which touched on various issues, including a pledge to push ahead

with reforms to fuel growth in the world's most populous nation.

US president George W Bush, who is also

attending the UN General Assembly, had telephoned Chinese president Hu

Jintao on Monday to brief him about the financial turmoil and his

administration's bid to stage a US$700 billion Wall Street bailout to stem

the crisis.

Mr Hu told Mr Bush that China welcomed

Washington's efforts to stabilise the US financial markets and hoped that

they succeed, according to Beijing's state media.

But as Mr Wen spoke on Wednesday at the

United Nations, the Bush administration remained locked in a dispute with

the US Congress over the massive bailout package aimed at buying distressed

mortgages and mortgage-related securities from financial institutions.

Mr Wen hinted that China would help in

any international bid to defuse financial contagion arising from the US

crisis, saying that this was not the time for 'hostility' or 'prejudice'.

'So long as people of all countries,

especially their leaders, can do away with hostility, estrangement and

prejudice, treat each other with sincerity and an open mind, and forge ahead

hand in hand, mankind will overcome all difficulties and embrace a brighter

and better future,' he said. 'China, as a responsible major developing

country, is ready to work with other members of the international community

to strengthen cooperation, share opportunities, meet challenges and

contribute to the harmonious and sustainable development of the world.'

Mr Wen said that given the global nature

of issues threatening the world, including environmental problems,

terrorism, diseases, natural disasters and financial troubles, 'no county

can expect to stay away from the difficulties or handle the problems all by

itself'.

The premier also touched on global

concerns about China's direction after hosting the Olympics last month,

saying that Beijing would remain committed to 'peaceful development' and

'unswervingly pursue reform and opening-up'. He said 'only continued

economic and political restructuring, and reform in other fields can lead to

sustained economic growth and social progress, and only continued opening up

in an all-round way can lead the country to greater national strength and

prosperity.' - 2008 September

26 AFP

Beijing steps in to Boost Markets

China's government announced plans to buy shares and take other measures

to halt its plummeting stock market, a program analysts said will surely

boost investor sentiment, but at the cost of reintroducing other long-term

risks.

An arm of China's $200 billion sovereign-wealth fund intends to increase

its shareholding in three of the nation's largest banks with direct

purchases on the market, while other government entities will be encouraged

to load up on stock in listed companies that they control, according to

Chinese government statements Thursday. In addition, authorities canceled a

0.1% tax on stock purchases, although sellers will still have to pay the

tax.

Already the principal shareholder in three of China's largest banks,

Central Huijin Investment Co., will buy additional stock in Industrial

& Commercial Bank of China Ltd., Bank of China Ltd. and China

Construction Bank Corp., according to the state-run Xinhua news agency.

The report said the buying began Thursday and aims to "shore up their

share prices amid stock market slumps." No specifics on the planned

purchases were announced.

"It is absolutely a market-rescuing message from the

government," said Mao Nan, a strategist at Orient Securities Co. in

Shanghai.

The announcement came on a day when other Asian governments were taking

more technical and less blunt steps to support their financial systems, such

as adding cash to money markets. But that policy option would have limited

impact on China's economy given the immaturity of its financial system.

By buying shares directly, Beijing will employ its most powerful tool to

halt a painful market decline that has erased 64% this year from the

benchmark Shanghai Composite Index. The move also marks perhaps a last

chance to resuscitate the confidence of tens of millions of investors, and

appears to reflect a recognition in Beijing that its strategy to carefully

phase in market-oriented policies hasn't convinced the public that stocks

are a suitable place to put their $4 trillion in savings.

A sixfold gain in the Shanghai Composite Index between 2005 and late last

year made Chinese companies among the most valuable on the planet. The

Chinese market at its height was capitalized at almost $5 trillion. Much of

that value vanished in less than a year, as the index fell about 70% from

last year's all-time high of 6124.04 to Thursday's low point of about 1816.

The purchases will deepen China's government ownership of a market that

by some estimates is still about two-thirds controlled by state interests.

That state of affairs threatens to sustain a decade-long fear that big

shareholders will ultimately dump their stock, a factor that many blame for

this year's collapse and a previous grind earlier in the decade that erased

more than 40% of market value.

It is unclear whether the stock-market intervention suggests Beijing will

suspend its hunt for investments overseas. Chinese entities haven't entered

the fray to shore up Wall Street firms in recent weeks. Still, even as the

market bailout was being announced on Thursday, Bank of China said it would

pay 2.3 billion yuan ($336 million) to buy about 20% of Cie. Financičre

Edmond de Rothschild, the French arm of the LCF Rothschild Group headed by

Baron Benjamin de Rothschild. Word also emerged Thursday that China

Investment Corp., Huijin's parent, was negotiating to possibly increase its

investment in Morgan

Stanley.

Policy makers debated for months whether to pull the trigger and buy

shares, a person with knowledge of the situation said Thursday.

For much of the year, proponents of freer markets appeared to be winning

with their argument that authorities shouldn't target price levels. They

advocated instead building a credible trading system of fair rules, robust

infrastructure and trustworthy participants that would make the stock market

a base on which to build a fuller financial system.

But as the market rout continued, Beijing's credibility was on the line.

Investors, who had opened more than 100 million trading accounts, said the

market's biggest investor -- the government -- had a duty to defend it.

Others argued that authorities should invest at home, in what remains the

world's fastest-growing major economy, rather than gambling government money

with investments in overseas firms like Blackstone Group LP and Morgan

Stanley that so far appear unwise. More recently, the unprecedented bailouts

by the U.S. government of its financial companies have provided ammunition

to those calling for official stock buying by Beijing.

As part of the new effort to boost stocks, the central-government entity

that indirectly controls a vast array of major state-owned companies

indicated Thursday that repurchases of shares in listed companies would soon

begin. Among the companies in its stable is oil giant PetroChina

Ltd., the largest stock on the Shanghai exchange.

Gao Lingzhi, an analyst at Great Wall Securities in Shenzhen, said if the

market doesn't sustain the now widely expected rally when government

entities start buying stocks, investors will clamour for more support.

Key in the process will be five-year-old Huijin, established to hold

chunks of China's state-owned banks at the start of a complex restructuring

process that transformed them from deeply indebted institutions into some of

the biggest and most profitable publicly listed lenders in the world.

Huijin owns about 68% each of Construction Bank and Bank of China.

Together with China's Ministry of Finance, it holds 70% of ICBC.

Huijin's buying is likely to have a significant impact, because financial

stocks are the biggest companies on the market. Only a small percentage of

the banks' shares are listed on the stock markets, giving any purchaser

outsize ability to boost the share price. ICBC is the second-largest stock

on the Shanghai Stock Exchange, while Bank of China is No. 4. The banks all

trade on the Hong Kong stock exchange, too. -

2008 September 19 WALL

ST JOURNAL

"We

seem to be in the midst of a 'perfect storm' leading to more bankruptcies:

high levels of debt, high energy and raw materials costs and weakness in the

U.S. economy,"

An end to credit crisis: focus on how,

not when

It's time to look

back to the Asian crisis for a road map to the current crisis

The most consistent question I've

encountered with clients over the past year has been: 'When is it going to

be over?' Unfortunately, the answer to that question remains uncertain.

However, a question as important for investors to understand, we believe,

is: 'How will the credit crisis come to an end?'

The answer to this question provides

investors with not only a time window for action but also a road map that

they can follow as the next stages unfold in coming months.

Fortunately, for those of us who

experienced the Asian crisis in 1997-98, this question is one in which we

have specific insights into the answer.

While the credit crisis in the United

States began with words and acronyms that were foreign to many of us

(including sub-prime, CDOs, CLOs, leveraged loans, and auction-rate

securities), the nature of the crisis shares many similarities with the

Asian crisis.

Banks and borrowers over-leveraged

themselves, with borrowers purchasing over-valued assets (real estate),

which, when their prices stopped going up and eventually began falling,

resulted in declining collateral for loans and large losses among banks.

The situation in the US today is very

similar, albeit the leverage of the securities and the size of the US and,

increasingly, the European financial system involved greatly outstrip that

seen during the Asian crisis. So, looking back to the Asian crisis for a

road map to the current crisis, the keys to the end of the Asian crisis

centred on three areas: recapitalisation of the banking system,

de-leveraging of borrower balance sheets, and recovery in a demand source.

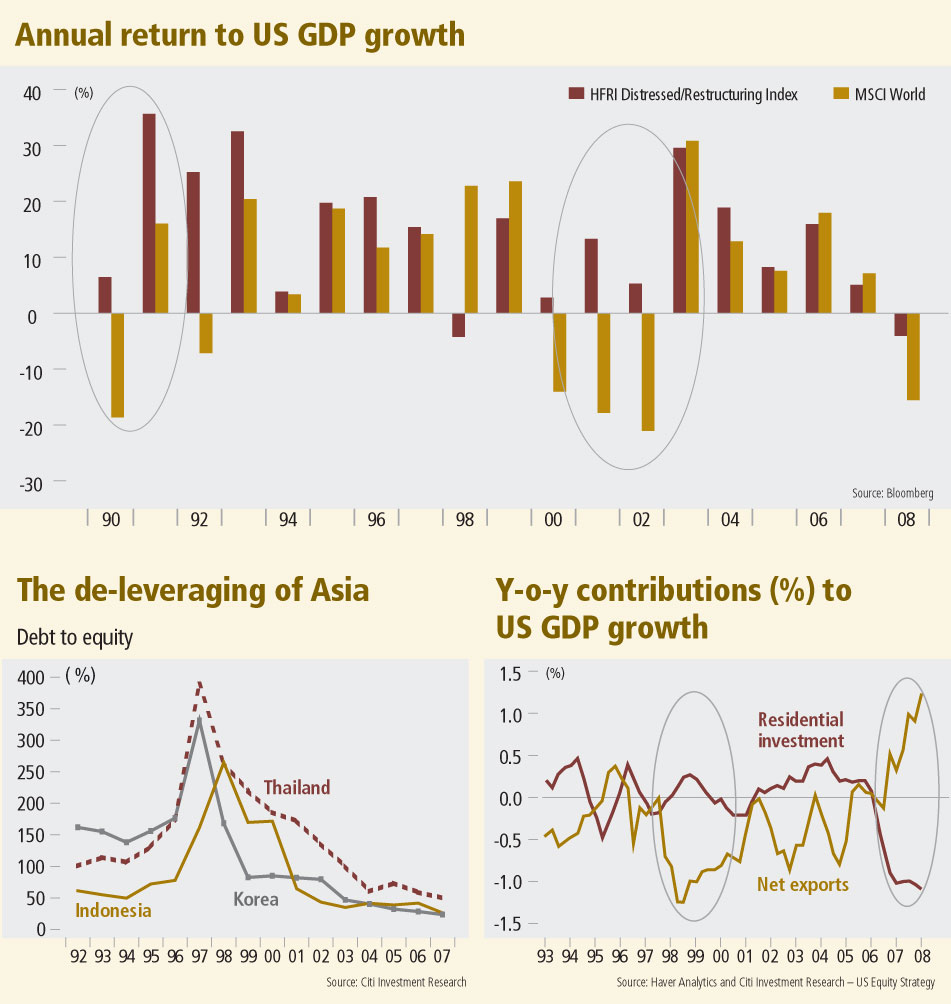

In the case of Thailand, Korea and

Indonesia in 1998, recapitalisation and demand recovery were external events

with the International Monetary Fund and local governments providing capital

to the local banking system, while the US rate cuts of 1998 provided a

catalyst for accelerating export growth to support demand in Asia while

domestic economies repaired themselves.

De-leveraging of Asian balance sheets

proved to be a longer-term project with debt-to-equity ratios, which peaked

at 200-400 per cent in 1997-98, taking six years before stabilising in the

30-50 per cent range.

The US appears to be following a similar

path to recovery. According to Bloomberg, global banks have raised US$354

billion in new capital since July 2007, beginning the recapitalisation

process among global banks. However, losses to date among the same banks

have totalled over US$500 billion, according to Bloomberg, suggesting that

ongoing recapitalisation through new equity issues or asset sales will

continue to be needed in the months ahead.

While potentially painful for existing

shareholders in some banks, the pools of capital at sovereign wealth funds,

private equity, hedge funds, and a handful of banks untouched from the

global credit crisis bring confidence that funding for this recapitalisation

process exists globally.

Like in the Asian crisis, a key component

to the recapitalisation process was banks selling distressed loans to

'workout funds' or distressed asset managers. In the current crisis, we

expect this process will be key as well. As important as recapitalising the

financial system will be a return of a demand driver for US/global growth.

During 1998-99, distressed Asian economies benefited from a re-acceleration

in US growth allowing the export sector of local economies to grow while

domestic sectors (real estate and banks) could de-leverage and repair

balance sheets.

Indeed, this is the path the US economy

is currently following, according to colleagues in the US. Since the onset

of the credit crisis, US exports have been a key offset to declines in

residential construction (see chart), much like seen in Asia during its

crisis.

With the European and Japanese economies

more recently succumbing to the global slowdown, global demand drivers

increasingly rely on developing economies. Even with the expected slowing in

growth in developed economies, Citi expects emerging markets growth to

remain strong, though decelerating to a forecast GDP growth of 6.1 per cent

in 2009. As a result, fiscal stimulus in global economies appears to be a

key component to the recovery path from the global credit crisis. This will

serve as a stabilising factor for slowing export demand in emerging

economies while supporting developed market export demand.

With this support from emerging market

demand, developed economies will still need to do their part as well. Fiscal

stimulus in developed economies will be important to stabilising domestic

demand (like seen in Japan post-1989), especially given the size of

developed domestic economies relative to their exports.

With recapitalisation of global

financials looking set to continue and a rebalancing of growth within

economies ongoing, we expect one last similarity to emerge between the

current period and those seen in the post-Asian crisis and post-tech bubble

periods. During these other periods of repair, a persistent increase in

volatility characterised the market environment, creating opportunities for

traders capable of trading a variety of asset classes on both the long and

the short side.

So, for investors navigating the current

environment, while the answer to the 'when' question remains difficult,

clarity on the question of 'how' leads us to believe that attractive

opportunities for investors looking forward are focused on taking advantage

of the recapitalisation of global bank balance sheets via distressed asset

funds.

Indeed, historically, distressed asset

funds have provided attractive returns in difficult market periods in the

light of their role in repairing US bank (as in 1990-1992) balance sheets

and US corporate balance sheets (as in 2001-2003).

Looking longer term, investors will have

an opportunity to capitalise on the fiscal stimulus that we expect to emerge

in developed and emerging economies, in particular focused on upgrading

infrastructure globally. Private equity opportunities in this area appear

best suited to match the long-duration nature of the opportunity and to

mitigate the impact on investor returns of downward, cyclical pressure on

construction exerted by the current global economic slowdown.

Lastly, while we expect growth in

emerging economies to outpace those in developed markets, valuations and

earnings risk in emerging markets leave near-term cyclical risk ahead for

investors. Investors may wish to capitalise instead on opportunities that

are emerging as a result of the current, high volatility environment.

However, given the limitations that most

individual investors encounter, especially trading on the short side of the

market and in non-traditional asset classes, global macro funds present an

attractive opportunity in the current environment. -

2008 September 3 BUSINESS

TIMES The

writer is head of research & strategy, investments, Citi Private Bank,

Asia-Pacific

Asian market fallout set to get far

worse

Property, stocks will be hit bad as

foreign capital is pulled

Fallout in Asian financial markets and institutions from the sub-prime crisis could

become more serious now as foreign capital, from the US and other leading

markets, is withdrawn, speakers at a symposium in Tokyo predicted yesterday. Asian

property markets - in China and Vietnam especially - are likely to be hit

hard while stock markets could take a battering, along with banks and other

financial institutions, they suggested.

'There

may be a sudden shift in capital flows as a result of fallout from the

sub-prime crisis,' warned South Korea's former commerce minister Duck Koo

Chung at the conference organised by the Asian Development Bank Institute (ADBI)

and the North East Asia Research Foundation (NEAR).

'Coming

weeks will be crucial' in this regard, Mr Chung later told Business Times.

ADBI

dean Masahiro Kawai, who told the conference that 'global financial turmoil

may continue longer than hoped for', suggested to BT that a flight from

Asian property market investment by banks, investment funds and various

stock market vehicles could damage these institutions as the property boom

unwinds.

The

warnings came as a sobering counter to the widely held view that Asian

markets and institutions are likely to escape relatively unscathed from the

sub-prime credit crunch that has wrought havoc upon major investment banks

and others in the US and Europe. The theory of a 'decoupling' of Asian

economies from outside problems has similarly been shattered by recent

events.

Recent

weeks have seen the collapse of a series of property development firms in

Japan as US and other investors pulled funds from them. The most recent

collapse - developer Urban Corp - marked Japan's biggest corporate

bankruptcy this year and the implication of yesterday's warning at the

conference was that firms elsewhere in Asia could be facing a similar fate.

Mr

Chung told BT that property markets in China and Vietnam are especially

vulnerable, while South Korea's property market is also facing problems

along with those of other East Asian economies. 'There will be another round

of credit crisis in developing economies', as money is 'pulled', he said.

Foreign direct investment as well as portfolio investment in many Asian

economies has been directed into property, added Mr Chung, who is now

chairman of NEAR.

The cause of the US dollar's strength in recent weeks has been partly to do with

the repatriation of investment funds from overseas, and this process could

accelerate now as a fresh credit crunch threatens, in spite of injections of

financial liquidity by the US Federal Reserve, Mr Chung commented. 'This

will lead to a further correction in asset markets' in Asia and elsewhere,

he suggested.

'We

have been planting the seeds of the current crisis for many years,' said Mr

Chung, who noted that Asia had supplied much of the financial liquidity that

fed asset bubbles in the US and elsewhere. Now that US credit markets have

seized up, the Fed is having to pump liquidity but this 'can only jeopardise

the anchor position of the dollar' in global financial markets.

Recent

Fed actions 'imply an expectation of continuing stress in financial

markets', and meanwhile, economic slowdown has hit both Japan and Europe, Mr

Kawai noted at the conference.

- 2008 August 29 BUSINESS

TIMES

Lessons

for financial regulators

The most recent issue of The Economist

has an article titled 'Confessions of a Risk Manager'. It provides an

insight into how US financial institutions built up so much exposure to

collaterised debt obligations (CDOs) and other asset-backed securities.

First, the risk managers were lulled by

the most benign risk environment in 20 years; they couldn't see where the

problem could have come from. Second, while default risk was priced in,

liquidity risk was not. Thus, that the price of an AAA asset with virtually

no default risk could fall by 20 per cent seemed inconceivable - but it

eventually did. Third, CDOs and other asset-backed securities were fairly

new concoctions. Hitherto, risk managers had focused on loan portfolios and

classic market risk. Rigorous credit analysis was done on loan portfolios to

minimise loan loss provisions. Meanwhile, equities, government bonds and

foreign exchange, and their derivatives, were well managed in the trading

book and monitored on a daily basis. CDOs and other asset-backed securities

sat between market and credit risk. In the words of the risk manager: 'The

market-risk department never really took ownership of them, believing them

to be primarily credit-risk instruments, and the credit-risk department

thought of them as market risk as they sat in the trading book (which are

marked to market).' Finally, the explosive growth and profitability of these

structured credit products cowed the risk department into continuing to

approve these transactions. To the bankers and traders, risk managers don't

bring in the dough, yet they have the power to say no and prevent business

from being done. They were seen as obstructive and a hindrance to bankers'

ability to earn high bonuses. So risk managers came under tremendous

pressure to not spoil the party.

All this happened in many financial

institutions. In due course, their books were overflowing with CDOs and

asset-backed securities. Through it all, the US Federal Reserve was more a

cheerleader than a stern enforcer of standards.

Time and again, we have seen how

financial institutions and markets - lured by the prospect of instant riches

- have built up excesses that eventually posed systemic risks. This is not

unlike a wayward child who gorges himself on sweets until he gets sick;

hence it is the parents' duty to set a limit. Likewise for financial

institutions and the markets, it is the job of risk managers and regulators

to be firm and put their foot down to curb the exuberance of money-grabbing

bankers.

To their credit, the Singapore authorities

have never shied away from enforcing standards or curbing market enthusiasm.

However, timing, as always, is a tricky thing to get right. But looking back

at the events of the last 12 months and with the benefit of hindsight, it is

safer for financial market regulators to err on the side of caution.

- 2008 August 15 BUSINESS

TIMES

Mountains of losses may bury markets

Financial

crisis is the worst the world has faced since the 1930s, crack panel tells

The Business Times

The global financial shock sparked by the US

sub-prime mortgage crisis is far from over, according to leading

international financial experts. There is still a major risk of a 'meltdown'

as economies battle what is shaping up as the worst slump since the 1930s, a

group of them - including financial guru Marc Faber and investment veteran

Mark Mobius - warned at a symposium organised by The Business Times.

Total losses suffered by financial

institutions worldwide in the wake of the sub-prime debacle will run into

trillions of dollars - possibly as much as US$10 trillion, rather than the

billions envisaged originally, some suggest. And the US budget deficit could

'explode' as Washington seeks to stem a real estate haemorrhage and restore

confidence

The experts' analysis (which appears

inside on Page 13) is a far more sobering assessment of the dangers facing

the world economy than has generally been presented so far. It comes as

markets are again suffering tremors - with the US Federal Reserve once more

forced to pump confidence-boosting liquidity into the financial system.

Equity markets are threatened with an

'avalanche' as financial system aftershocks continue, the expert panel

warns. And according to Mr Faber, this could turn into a drawn-out process

or 'water torture' bear market.

Former Wall Street executive and one-time

World Bank group official Ernest Kepper reckons stock valuations could fall

as much as 40-50 per cent from their peaks a year or so ago.

And Mr Mobius says: 'There is a big risk

of a meltdown of the (US) financial systems brought on by a lack of

confidence.'

Lehman Brothers' New York managing

director and chief US economist Ethan Harris rejects any suggestion that US

government debt is 'not safe' amid the crisis at mortgage giants Fannie Mae

and Freddie Mac.

But Mr Faber suggests: 'We are in the

midst of an unprecedented credit growth slowdown that will hit all asset

classes one after the other as liquidity tightens and deleveraging becomes

the order of the day.

'First, home prices came down. Then

financial stocks. And now, commodities, material and energy stocks. Bonds

will eventually tumble too. Even art prices will fall.'

Inflation is seen as the immediate threat

as food, fuel and other commodity prices soar. But governments may soon find

themselves battling deflation, the experts warn.

Mr Kepper says: 'As the financial

avalanche builds and recession hits oil-importing countries, the combination

of a severe US recession and a global slowdown will shift the focus away

from inflation to the slipping demand for real goods.

'This will lead to a reduction in prices

when supply exceeds demand. There will be downward pressure on labour

markets and rising unemployment, while at the same time, commodity prices

fall in accordance with reduced demand.'

William Thomson, a former vice-president

of the Asian Development Bank and now head of a financial advisory group,

says the sub-prime crisis is 'undoubtedly the worst in the developed world

since the 1930s'.

He reckons the only period remotely

similar is the bear market of 1973-75, which was driven by surging oil

prices and stoked annual inflation rates to around 20 per cent. 'That has

not yet arrived but may well be in the pipeline,' he says.

But he believes the situation is far

worse this time because the US financial system is extraordinarily stretched

and stressed.

'Last time, we only had the minor

bankruptcies of Franklin National Bank and Continental Bank to contend

with,' he says. 'Then, there were no derivatives. But now, they amount to

more than 10 times world GDP and a greater multiple of bank capital. Within

that total, the most toxic ones are those of unlisted, opaque,

over-the-counter variety amounting to over US$50 trillion - again multiples

of US bank capital. - 2008 August 1 BUSINESS

TIMES

Making sense of the bear market

PARTICIPANTS

Moderator: Anthony

Rowley, Tokyo correspondent for The Business Times.

Panellists:

- Marc Faber, an investment adviser and publisher

of the Gloom, Boom and Doom Report.

- J Mark Mobius, president of Templeton Emerging

Markets Fund Inc, and director and executive vice-president of Templeton

Worldwide Inc.

- Ethan Harris, managing director and chief US

economist at Lehman Brothers, New York.

- Ernest Kepper: A former official of the

International Finance Corporation and Wall Street investment banker who

now heads an Asian financial consultancy.

OVERVIEW

Since the sub-prime mortgage crisis burst upon the

US a year ago, there have been market rallies and claims that the worst is

over, only to be followed by fresh plunges in values and sentiment. Are we

near the bottom now, or just at the start of a long, slow meltdown? Our

experts take the latter view.

Where can investors find a safe haven in this sea

of trouble and uncertainty? Gold is still a good refuge, suggests one

expert, who expects the price go as high as $2,500 an ounce.

More fundamentally, our experts see developing

markets in Asia and beyond as the promised land that will emerge relatively

strong from a potentially massive destruction of wealth in the old world.

The needs of these emerging markets for food and natural resources will be

strong, so farmland and plantations could be good investments.

Anthony: I'm delighted to welcome such a

strong panel - a mark of how seriously you gentlemen view the current global

financial and economic situation. It's especially pleasing to welcome back

some old friends - Marc Faber, Mark Mobius and Ethan Harris.

Marc, let's start with you. Are we looking at a

financial system "avalanche" rather than a technical bear market,

in equities and bonds?

Marc: I believe that the secular bull

market in equities and bonds, which lasted from 1981/82 to anywhere between

2000 and 2007 has come to an end and that a water torture bear market has

begun. If an enormous quantity of money is printed by central banks equities

may avoid a severe bear market of say 40% to 50% but a trading range would

still follow and no net gains - certainly not in real terms - would be

achieved.

Mark: This may become the case in the US

where there is a big risk of a "meltdown" of the financial system,

bought on by a lack of confidence. However, emerging markets, equities have

corrected more due to poor market sentiment and contagion from what is

happening in the US, rather than any major deterioration in fundamentals.

Ernest: I say this is an 'avalanche.' I am

anticipating a fall in equity prices in the range of 40 to 50% relative to

the peak--- much more severe than the 25% fall which we see in a recession..

Two main reasons are that major economies other than the US will have severe

interruptions in growth and that the consumer - especially US. consumers who

most likely have gone further into debt than their credit cards would allow

by making a home equity loan or taking on the second mortgage will most

likely be under pressure to repay. It appears that the U.S. consumer's debt

burdened situation will put him in a "no way out" financial

quandary with a fall in home prices, fall in equity prices, rising inflation

and a reduction in jobs. I expect this scenario to unfold over the next 12

to 18 months.

Bill: In no way can this be seen as a

normal bear market. This is undoubtedly the worst financial crisis in the

developed world since the 1930s. The only period remotely similar was the

bear market of 1973-75, which was itself a part of the extended 1966-82 bear

market in US shares. That bear market was driven in part by a 13 fold

increase in oil prices from 1972 to 1980. This time we have had a 14 fold

increase in oil prices from the $10 low of 1999. Last time we had massive

inflation of 20 percent per annum. That has not yet arrived but may well be

in the pipeline.

However, in my view, the situation is far worse

this time since the US financial system is extraordinarily stretched and

stressed. Last time we only had the minor bankruptcies of Franklin National

Bank and Continental Bank to contend with. Then there were no derivatives.

This time, they amount to more than 10 times world GDP and a greater

multiple of bank capital. Within that total the most toxic ones are those

unlisted, opaque, over the counter variety amounting to over $50 trillion,

again multiples of US bank capital.

The revolution in market finance that began with

the deregulation of the 1980s may be about to eat its young, as we have seen

with the putative bailouts of Fannie Mae and Freddie Mac; if nationalization

goes ahead the US visible national debt increases by $5 trillion and is

effectively double. The US would no longer qualify to join the Euro!

The US budget deficit could be on the verge of

exploding upwards. Including war costs, it is already over 4 percent of GDP.

The economic slowdown and Presidential candidate Obama's plans for

healthcare, whist noble and justifiable, even after tax increases, could

send the deficit north of $1 trillion or 7 percent of GDP by 2010.

Anthony: What do you think the total

"wealth loss" might be as a result of recent crises (in terms of

falls in market cap, sub-prime losses and other losses by banks and

investment banks, derivatives market losses in general)? Does anyone really

know - or is the whole thing too opaque to estimate?

Ethan: Estimating the losses of financial

institutions is extremely difficult, but something in the $500 bn to $1

trillion range makes sense. The good news is that much of that has already

been revealed at the major money center institutions and they have been able

to recapitalize. It is also important to not double count--when a mortgage

defaults the loss is the difference between the loan size and what is

recovered, and we should not add to that the individual pieces at each stage

of ownership of the loan. To put the loses in perspective, the total value

of assets owned by US households is $72 bn and the net worth of US

households is $56 billion. Moreover, many of the losses are borne outside

the US. Thus the second round losses--the drop in the stock and housing

market--is larger and a bigger threat to global growth.

Bill: When Chou En-Lai was asked by Henry

Kissinger if he thought the French Revolution had been a success he

responded 'it's too soon to tell'. That applies to the current situation.

But we could be looking at $6 trillion in mark downs of housing wealth, $3-4

trillion in stock market losses if we get a 25-35 percent mark down in the

market - and it could be worse - and then we have the losses of the banking

system. So we are talking about possibly $10 trillion as compared with a GDP

of $13 trillion. Proportionally, I would look for the UK to suffer

similarly. It's not chicken feed.

Marc: Right from the start my estimate of

the losses was about USD 1 trillion in the US alone. However, if we add the

losses from a decline in housing wealth and stock market wealth the losses

are a multiple of that.

Ernest: Overall, the fallout could easily

be in the many trillions of dollars. No-one really knows (especially central

banks and finance ministries) -- but if we quickly add some basic financial

areas where there are already are losses to those we can expect it is easily

2-3 trillion.

The two US mortgage backers losses are in the

trillions -- the loss to the 10 million privately owned real estate

homeowners is also in the trillions. When you estimate in the range of a US$

250 billion loss in each of the following sectors -- equities, consumer debt

instruments (such as car loans, credit cards and student loans which have

also been repackaged and sold as asset-backed securities), corporate bonds,

specialized insurance companies which guaranteed bonds and mortgages to

collateral mortgage instruments, the loss in tax revenue to states from real

estate taxes, the bankruptcy of a major broker whose revenue has been based

on charging fees rather than earning income from addressing and dealing with

credit risk, the bankruptcy on one or more hedge funds, construction company

losses and bankruptcies of and derivatives, it will be a multi trillion

dollar loss.

Anthony: Do you think that inflation or

deflation is the greatest threat facing the global economy - i.e. commodity

price inflation versus the collapse in asset values (real estate and stocks

etc).

Marc: We are in the midst of an

unprecedented credit growth slowdown and this will hit all asset classes -

one after the other, as liquidity tightens up and as de-leveraging becomes

the order of the day. First home prices came down, then financial stocks and

now commodities, material and energy stocks, and art prices will follow.

Bonds will eventually also tumble. In the meantime it is likely that

consumer price inflation will accelerate.

Mark: In view of aggressive monetary

expansion by the US, the risk of inflation is probably greater. In emerging

markets, another big risk is also the abandonment of the market economy

philosophy and a cessation of privatization of state owned companies.

Bill: This is the great debate. The losses

are deflationary but the monetary and fiscal policies are hugely

inflationary. So far the secondary effects of wage inflation are the dogs

that have not barked yet, but the unions are clearly getting restive in

Europe and the pressures are so intense on US wage earners that it surely

must just be a matter of time before they try and restore some of their lost

incomes.

Ultimately, governments never repay their debts in

real terms. I look for the US to try and inflate its way out of its mess

whilst, all the time, denying it is happening and quoting the manipulated

inflation data. But one only needs to look at the private estimates of M3

growth to see that it has been growing at 18 percent per annum, double what

it was when they stopped publishing the information and double the worst

time in the stagflationary 1970s.

Ernest: Probably inflation initially. But

as the avalanche builds and recession hits oil-importing countries, the

combination of a severe US recession and a global slowdown will shift the

focus away from inflation to the slipping demand for real goods which will

lead to a reduction in prices when supply exceeds demand. There will be

downward pressure on labour markets, rising unemployment, while at the same

time commodity prices fall in accordance with reduced demand. Equity market

prices are presumably based on value, while commodity market prices are the

result of supply and demand.

As the Fed approaches a zero interest rate policy,

its ability to have an impact on the economy will be reduced. This is

because the Fed has been playing a bigger role in financial stability issues

rather than growth issues.

Anthony: How safe is US government debt as

an investment now, given the stress of financing financial system bail-outs?

Ethan: It is absurd to think that US

government debt is not "safe." The potential liabilities the

government is taking on are small relative to the size of government debt

and even in a worst case scenario, debt as a share of GDP is unlikely to

approach the highs of the US 15 years ago or in other major economies such

as Japan and Italy. Moreover, the Fedlearned its lesson from the 1970s and

is very unlikely to allow a sustained inflation acceleration.

The big challenge for US debt is not new: it is

the huge surge in costs as the baby boom generation retires. In terms of the

dollar, it is also wrong to focus on US government liabilities. What matters

to the dollar is the overall borrowing requirement of the economy--that is

the current account deficit. The current account deficit is improving as

exports surge and imports stagnate. The deficit is still too big, but at

least it is moving in the right direction. Looking ahead, further

improvement is likely as Americans rediscover the virtues of conventional

saving, rather than relying on asset price appreciation to accumulate

wealth.

Marc: Since the government can print money

US debt is 100% safe. What is, however, not safe is the US dollar. So,

investors may eventually get their money back in a currency - the US dollar

- which will hardly be worth anything.

Mark: Looking at the U.S. fundamentals, the

perceived safety of U.S. government debt is under stress which is why

central bankers have been diversifying their reserves. Of course in a

general loss of confidence then such debt could become risky.

Bill: You will be repaid in US dollars with

less purchasing power than when you subscribed. Whilst this crisis continues

and the management of the White House and the Fed remain unchanged, the US

dollar is a poor bet and a worse investment.

Ernest: While US. Treasuries have not been

particularly rewarding buys, mainly because of excessive debt loads, it is

default swaps and derivative products plus counter-party risk management

instruments and arrangements on the market by foreign countries that raise

concern.

Anthony: What is the safest thing to

"hold onto" in this avalanche - gold, other commodities, cash etc?

Marc: For the next three months the US

dollar should be fine. On weakness physical gold should be bought as it is

the only "honest" currency. I would avoid industrial commodities.

Farmland and plantations should also be relatively attractive.

Mark: I would still maintain that the best

strategy would be to have a diversified portfolio between equities, bonds,

commodities and cash. We continue to find fundamentally stock companies

trading at attractive prices as a result of the global market correction.

Ethan: Investors should remain conservative

in this environment. Even commodities are not a panacea. For example, the

surge in oil prices in the face of a clear weakening in oil demand, suggests

part of the run-up this year is unsustainable.

Bill: Gold, in my opinion, is the asset of

last resort. It is no one else's liability and has shown its value in crises

over the millennia. That situation remains unchanged. It is still cheap

relative to oil on a historical basis and is only 40 percent of its all time

high on an inflation adjusted basis. New supplies coming onto the markets

are constrained by high costs and a lack of mining skills after a generation

when no new graduates entered the sector.

Given the global geopolitical tensions added to

the banking crisis, gold remains a superb insurance policy. Before the

present cycle exhausts itself I would not be surprised to see gold reach all

time highs on an inflation adjusted basis i.e., $2500. Silver is also

interesting here since it is a minor precious metal with expanding

industrial applications. On an inflation adjusted basis it is even cheaper

than gold. There are an ever expanding range of instruments to tap the

commodity space with ETFs and ETNs - long and short. There are also natural

resource funds of hedge funds.

Anthony: Amongst equities and bonds, what

(if anything) is there to go for now? Emerging markets versus advanced

markets?

Marc: I think for the next three months the

US will continue to outperform emerging markets - as it has done already

this year - and this not because the US market went up but because it went

down less than emerging markets. I also think that Japan will outperform the

US and other markets. High yielding equities in Asia, including Singapore

REITs, should be okay but up-side potential is limited.

Mark: There's always something to buy.

While global growth is slowing down and inflation has been increasing,

emerging markets are still expected to grow at a much faster rate than

developed markets. They, thus, representing an investment opportunity.

Moreover, 'frontier' markets [those at an earlier stage of development than

established 'emerging' markets] are also looking interesting.

Bill: I believe we are entering a new phase

in the global economy, one with increased government regulation, controls

and spending. The old Thatcher-Reagan supply side revolution is likely to

take a breather and a return to modified Keynesian policies is a

possibility.

This is driven by the increased scepticism in

developed economies about globalization, largely because the rewards have

not been adequately distributed. This accords with the likelihood that the

36 year cycle in US Presidential elections will probably make the Democrats

the leading party of government in the coming years with all that means for

interference in the economy - and inflation.

The extent to which the growing scepticism of

globalization in developed economies affects the future growth of emerging

markets cannot be determined at this time. At the margins growth may be

reduced slightly but the fundamental factors changing the shape of the

global economy are too strong to be derailed. Emerging markets remain a

field of great opportunity, especially after recent declines in countries

like China, India and Vietnam. Others with essential commodities are

exciting. Powered by Chinese and Indian investment, Africa could have a

renaissance. Those with financial imbalances like those in Eastern Europe

should be avoided.

KEY POINTS

- This is the worst financial crisis since the

1930s and equity prices have more room to fall.

- All told, the total losses could run into

trillions of dollars.

- High inflation is likely to persist, at least

for some months.

- Investors can seek refuge in precious metals

and selected emerging markets.

- 2008 August 1

BUSINESS TIMES

Market crash: Hold on to your hats

For

the patient and disciplined investor such trying times also represent

excellent opportunities to pick up bargains

Most people in the investment world hate

the words 'market crash'. It's everything that investors want to avoid. But

because markets move in cycles, bear markets are inevitable - and we are in

a bear market right now. The US financial crisis that started with the

sub-prime problems has reached a new level, with the US Federal Reserve

having to assemble a rescue plan for Fannie Mae and Freddie Mac, two of the

largest mortgage lenders in the US.

The continued rise in oil and commodity

prices has caused inflation to surface as an additional problem, especially

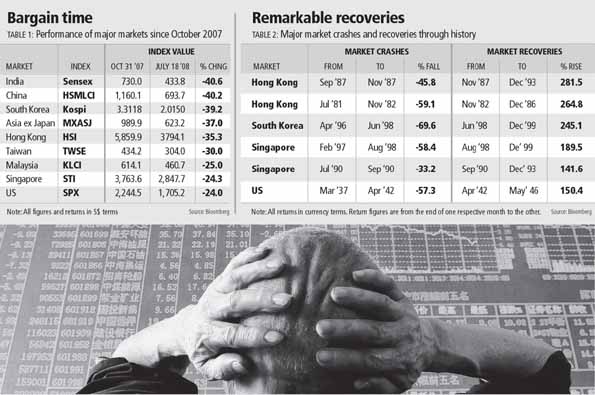

in Asia. Markets have corrected sharply since October 2007, when some were

at or near historic highs. As at July 8, all markets shown in Table 1 have

crashed by more than 20 per cent over the eight-and-a-half months. Some

markets, like China and India, have fallen more than 40 per cent. What

should investors do?

A good idea is to look back at history -

to keep things in perspective. There have been massive sell-downs and

crashes in the past, caused by some event or another. Table 2 shows some

notable market crashes and the recoveries that followed.

Panic and risk missing out on the

recovery

Investors looking at Table 2 will note

that during most of these market crashes, economies were going through

recessions, the Asian financial crisis, and in the case of the US, World War

II. But despite how gloomy things might have seemed at the time of the

crashes, the markets recovered, and the subsequent recoveries resulted in

those markets going up 100 per cent or more.

Therefore, it is important that investors

do not panic and dump everything they hold when they are caught up in a

market crash. The impulse to sell in such circumstances is understandably