|

Photo by Nolita

Our good friends purchased the gorgeous Vineyard

Knoll Estate where The Bachelor is currently filmed.

We are so looking forward to chillax amongst the 200 acres of Pinot Noir and

Chardonnay grapes this year.

You can rent this when we are not

there. The home is tastefully furnished with 6 bedrooms and 4

bathrooms. Rental rate, subject to availability is:

- Night: $1,675 - $2,100

- Week: $10,575 - $13,225

- Month: $28,175 - $35,225

Without doubt, this is the best

development site available, for those with the appetite to develop in this

low interest rate environment.

There is a lot of history to this site

and it is located directly opposite the Transbay Terminal which the City

of San Francisco has been moving forward to create state-of-the-art

transportation hub for the Bay Area and Northern California to integrate

regional bus service, BART, Muni and the Caltran line, which will

eventually offer high-speed rail service to Los Angeles.

The highly successful Millenium

project is directly across the street which was a joint venture by our

good friends at Sun Hung Kai Properties in Hong Kong with Millenium.

Their chairman & founder of SHKP, now deceased, and my Father's good

friend purchased the site of the Millenium San Francisco moons

ago. He was a far-sighted and kind person. My good

friend Donald put together that joint venture.

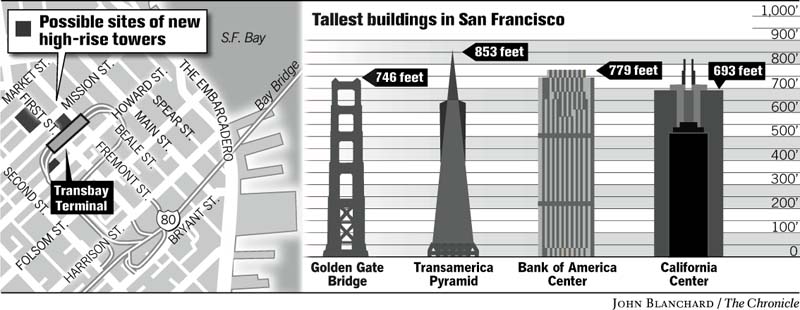

Computer renderings show how changes proposed for the Transbay Terminal

area might alter the skyline. The red images are towers higher than 850 feet.

The blue ones are towers now allowed.

The investment market, as indicated by

the transactions below, is still strong despite world economic

uncertainty. Those in the know recognize the long-term

value of investing in San Francisco and it tends to be instiutional

investors or The Seriously Rich.

ARCHIVED

HISTORICAL FACTS:

The Seriously Rich are 'upping' prices in Bay area

Out in the East Bay, the wealthy are congregating in Piedmont and

Alamo. Known for the country like feel right by Mt. Diablo, Alamo saw

their home sales skyrocket by 85%. Neighbouring Oakland, Piedmont also

jumped up their home sales by 56%.

Down in the South Bay, Hillsborough, Cupertino and Saratoga made the

list. While all fifteen cities had median home values over $1 million,

many of them were in the low $1 million range. Hillsborough blew all the

other towns on the list away with a median home value of $2.1 million -

almost twice the values of some of the other communities that made the

cut. This is probably also due to the fact that Hillsborough does not have

any type of multi-family housing - no apartments or condos and your house

- or estate - has to be a minimum size.

In an effort to preserve the stately nature of grand homes, the

incorporated town regulates a minimum house size (which has shifted with

different zoning laws) and a minimum lot size of one-half acre.

Cupertino and Saratoga have benefited from the rising tech riches of

Silicon Valley. Apple is based in Cupertino, and what employee doesn't

want a short commute? Don't forget other tech giants like HP and Oracle

who have started and stayed in the South Bay, and helped the pockets of

employees get fatter.

Significant sales in 2010*

351 California snapped up by Turkish

buyer

Polidev

International, a new San Francisco-based real estate fund backed by

investors from Istanbul, bought 351 California St. at auction today for

$35 million. There were no other bidders.

- 2010 June 10

Everybody knows that the debt of

California is even larger than the debt in Greece so we watch carefully

for trends that could indicate of what's to come next. The population

of California is larger than the whole nation of Canada.

The plan to sell top-notch state-owned office buildings for quick cash could

cost California taxpayers about $1.3 billion over the long haul, according to

documents associated with the proposed sale.

Through a move known as a “sale-leaseback” the state hopes to generate

$2 billion or more by selling 11 office properties, most of them in the

Sacramento region, and lease them from the new owners for 20 years.

The sale, prompted by the state’s budget crisis, would provide some

immediate benefits, such as paying off debts on the buildings, freeing up

about $660 million for the general fund and shifting repair and maintenance

costs to new landlords.

That might provide a modicum of relief to cash-strapped California, but it

also would mean taxpayers would foot the bill for about $5.2 billion in rent

over the next two decades.

Bids from prospective buyers are due Wednesday and the state’s Department

of General Services, which is handling the transaction with CB

Richard Ellis, has said the response has been “tremendous.”

The proposal has raised eyebrows around Sacramento.

“Looking at it from a taxpayers’ perspective, there are question

marks,” said Bob Dean, who heads the Sacramento office of commercial real

estate brokerage Grubb

& Ellis. “What are we obligating ourselves to pay for the next 20

years? Is it a healthy decision?”

In today’s market, tenants are looking for ways to reduce operating

costs, but the leaseback deal would escalate the state’s annual costs, Dean

said.

The Department of General Services plans to perform a more detailed

analysis of the costs and benefits once the bids come in — one that could

paint a better long-term picture, state officials say. They cautioned it might

be too early to scrutinize the financial implications.

“In the final analysis if it doesn’t pencil, we’re not obligated to

sell the property,” said Gerald McLaughlin, a senior real estate officer

with the department. He noted that the extra money paid in rent over time

could be mitigated by the “time value” of money, meaning that funds in

hand today are worth more than the same amount in the future. It’s a view

shared by others in the real estate business.

“On the surface it may not look like a good deal, but when you understand

the time value of money, it probably is a good deal,” said Chris Strain, who

heads brokerage Cushman

& Wakefield’s Sacramento office.

The sale would provide stability to the state by shifting liabilities to

landlords for major repairs, General Services spokesman Jeffrey Young said.

The office properties include the massive East End Complex on Capitol

Avenue, the Attorney General building on I Street, the Franchise Tax Board on

Folsom Boulevard and properties in San Francisco, Los Angeles and Oakland.

Short-term windfall

Gov. Arnold Schwarzenegger’s office last year asked General Services to

start examining a possible asset sale as the governor questioned whether the

state should be in the real estate business, Young said. Representatives of

the governor did not return calls seeking comment about the deal.

California owns about 10 million square feet of offices in the Sacramento

region and leases 7 million square feet. It has built or purchased property

with the idea of saving money over time through ownership. But unforeseen

expenses, such as repairs that could run upwards of $40 million at the state

Board of Equalization building in Sacramento, have the state’s experts

rethinking the strategy.

And operating buildings generally costs California more than it would a

private owner, which can farm out services to the lowest bidder.

General Services budgeted $71.9 million in annual maintenance costs for the

11 properties. According to CB Richard Ellis’ financial analysis, the

upkeep, security and landscaping on the buildings would cost a prospective

buyer about $50 million, a 30 percent savings.

The Legislature last year voted to authorize the sale after state workers

determined which assets would make the best sellers. Pressure to sell might

have increased due to the state’s financial condition. The Legislative

Analyst’s Office has said the state must address a general fund budget

shortfall of at least $20.7 billion before the Legislature enacts its next

budget.

Under the deal as envisioned, the state would earn about $2 billion through

the sale, then retire debt on the buildings at a cost of $1.3 billion to $1.5

billion. That leaves $660 million left to pay for general fund programs if the

state gets its asking prices.

If the sale goes through, the state would no longer be responsible for an

estimated $1.9 billion for repair and maintenance over the next 20 years;

those costs would become the new landlords’ responsibility.

- 2010 April 9

BUSINESS

JOURNAL

American Assets purchased the remaining 75% interest in the Landmark at One Market for $528

per square foot, in an off-market transaction.

- 2010 July

The

'sophisticated' investor appears to be working out their issues

quietly if this article dated 2010 March 2nd is any indication.

San

Francisco-based Shorenstein Properties has taken ownership of the

distressed Santa Clara Towers from Tishman Speyer in a consensual

transaction

ESSENTIALS

|

Santa

Clara Towers consists of twin, 11-story towers totaling

422,485 rentable square feet.

Built

in 1986 (Tower I) and 1998 (Tower II), the buildings feature

striking glass and granite exterior facades which stand out along

Silicon Valley’s 101-Corridor.

Santa

Clara Towers is located at the intersection of Highway 101 and

Great America Parkway, one of the most sought after locations by

both high-technology and service and sales related companies.

Highway 101 allows for immediate access to the core of Silicon

Valley and the San Francisco Peninsula, along with a myriad of

transportation options. |

| Property

Address |

3945

& 3965 Freedom Circle

Santa Clara, CA 95054

USA

|

| Year

Constructed |

1986/

1998 |

| Project/Building

Architect |

Hoover

Associates |

| Building

Owner |

Tishman

Speyer

Santa Clara Towers, L.P.

Santa Clara Towers II, L.P. |

| Previous

Building Owner |

McCandless

Management Corporation |

| Year

Purchased |

2007 |

| Building

Lender |

Lehman

Brothers |

| Structure |

Structural

steel |

| Number Of Floors |

11 |

| Rentable Area |

3945:

208,403

3965: 214,080 |

| Major

Tenants Square Footage |

McAfee

(208,368), Amkor Technologies (19,983), Wayne Mascia

Associates (10,939), Marubeni (9,634) |

| Floor

Plate Size |

20,000

sqf. |

| Floors

Above Grade |

11 |

| Slab

To Slab Height |

+/-

13.5’ |

| Floor

To Ceiling Height |

Floor

1 = 20’

Floors 2-10 = 9’ to t-bar

Floor 11 = 1‘ to t-bar |

| Window

Details |

Tinted

black glass in aluminum frames |

| Column

Spacing |

Typical

exterior 25’ x 40’ |

| Bay

Depth |

38’

to 42’ |

| Elevators |

Each

building has 6 elevators. |

| Parking |

1,408

stalls |

| Major

Tenants |

McAfee,

Amkor Technologies, Wayne Mascia Associates, Marubeni |

San Francisco-based Shorenstein

Properties has taken ownership of the distressed Santa Clara

Towers from Tishman Speyer in a consensual transaction.

The deal comes two years after

Shorenstein bought the $51 million mezzanine loan on the

210,000-squar- foot building, at 3945 & 3965 Freedom Circle in

Santa Clara.

Tishman Speyer spokesman Rich

Matthews said the company and its lenders “explored various ways

to restructure the debt, and ultimately decided that the best

course of action would be for the mezzanine debt holder to assume

ownership of the property.”

“The recent deterioration of

commercial real estate markets across the U.S. has created many

situations where the values of properties have fallen well below

the debt that encumbers them. This is especially true in the

Silicon Valley area and is true for Santa Clara Towers,” said

Matthews.

Tishman Speyer bought the

buildings from Birk McCandless for $213 million in 2007. One of

the two granite towers is 100 percent leased to McAfee Inc.; the

other has several tenants.

A Shorenstein spokesman

confirmed that Shorenstein Realty Investors Nine, L.P., which is

the holder of the mezzanine debt on Santa Clara Towers, has agreed

to assume ownership of the two 11-story office buildings. After

the transfer of ownership, the property will be managed by

Shorenstein Realty Services, an affiliate of Shorenstein

Properties.

“Consistent with all assets

in its real estate portfolio, Shorenstein intends to invest new

capital to maintain Santa Clara Towers’ premier status and high

occupancy rate and to position the asset to take advantage of the

anticipated recovery in the Silicon Valley office market,”

stated Shorenstein.

Other assets currently owned

and operated by Shorenstein Properties and its investment funds in

the Silicon Valley and the mid-Peninsula office markets include

601 California Ave. in Palo Alto; 5000 & 7000 Marina Blvd. in

Brisbane; 1400 & 1500 Seaport Blvd. in Redwood City; the

Oyster Point Business Park in South San Francisco and Cisco Tower

in Santa Clara. Shorenstein Properties owns and manages 24.2

million square feet nationwide. - 2010

March 2 BUSINESS

JOURNAL |

Nob Hill's Huntington

Hotel is for sale

The Cope family, which has

counted the Huntington

as a family member for some 70-odd years, has placed the iconic San

Francisco hotel on the block in an unusual portfolio deal that also

includes La Playa in

Carmel-by-the-Sea and the ground lease for the Stanford Court Hotel in

San Francisco.

This portfolio, which is being sold as a

corporation, has been in the family for years, so this is not a case of

owners needing to shed distressed assets. Rather, this is an estate

management play following the November 2005 death of the family patriarch,

Newton Cope.

The properties have reportedly been marketed

before, but without fetching a price that met family expectations.

The family's real estate holdings, Nob Hill

Properties, Inc., is currently headed by John Cope, a past president of

the Hotel Council of San Francisco.

The portfolio does not have an asking price.

The Huntington has never been for sale, and La

Playa, situated on almost two acres near the beach in Carmel proper, is

all but irreplaceable.

The Huntington has 140 rooms and 40 suites, the

popular Nob Hill Spa and Big Four Restaurant and bar. It was built as a

residential tower in 1924, and has no brand affiliations.

La Playa is as much a landmark property as the

Huntington. It has 75 rooms, two ocean-view suites and six cottages. Like

the Huntington, it comes unencumbered, which means that the buyer can

choose a brand of its choosing to manage the hotel, which usually commands

a premium. Carmel has made it all but impossible to build new hotel

properties.

The Galleria Park Hotel at 191 Sutter St. has

177 rooms and 15 suites and is managed by Joie de Vivre Hotels. The hotel

is not for sale, but rather is offered as a long-term ground lease

agreement through August 2039.

Informed sources say there has been significant

early interest from international buyers, some of whom may be looking to

enter Northern California with trophy properties like the Huntington and

La Playa.

Other sources say that the portfolio may be

challenging to sell because the three properties come as a package and are

being offered as a corporation rather than as a traditional, fee-simple

transaction. - 2010 May

12 BUSINESS

JOURNAL

Napa Marriott Hotel sale - $131,386 per

unit

Sunstone Hotel Investors Inc. said

Wednesday it was closing on the sale of a 274-room Marriott hotel here.

The sale price is $36 million. Sunstone paid $21 million for the property

in 1998.

The name of the buyer has not yet been made public. Sunstone says it would

have had to invest $6 million or $22,000 per key in the asset in the near

term in order to comply with Marriott’s brand standards.

Also on Wednesday Sunstone said it would sell about 20.7 million shares of

common stock with which it hopes to generate $100 million to pay off

credit lines and to fund a debt buyback. Taking into account the dilution,

Sunstone’s stock price stood at $5.26 in late afternoon trading

Thursday, down ($0.56) nearly 10% on the day. The share price is down

about 70% over the past year.

Sunstone says the moves, including a recent tender offer for outstanding

notes, are designed to help Sunstone weather the recession, which has

lowered tourism and business travel spending. The stock sale proceeds will

be used in part to repay any amounts drawn on the company’s credit

facility and to cover costs related to its tender offer for $123.5 million

[principal amount] of 4.60% Exchangeable Senior Notes due 2027, which

expired this week. The repurchase will be consummated with $85 million in

cash, the company said.

-- 2008

May

Taiwanese real estate investor Steven Pan has

finalized the purchase of 49 Stevenson St. for $24.2 million, the latest

sign that San Francisco's long-dormant investment market is starting to

come to life.

The $190-a-square-foot sale price represents a

40 percent decline for the value of the property, which the city currently

assesses at $41 million. The seller was Invesco.

The sale price would be consistent with the

other two similar second-tier downtown buildings that have sold in the

last six months. In November the Shorenstein family

bought 188 Spear St. for $170 a square foot, a 56 percent drop from the

$385 a square foot, or $56.9 million, the city assessed the

147,000-square-foot property for the last fiscal year. Another Class A

financial district building that sold last year, 250 Montgomery St.,

traded for $172 a square foot, also a 56 percent drop from its previous

sale in 2006.

Another Class A financial district building that

sold last year, 250 Montgomery St., traded for $172 a square foot, also a

56 percent drop from its previous sale in 2006.

The city's most recent office building sale was

211 Main St., which the CIM Group bought for $112 million, or $300 a

square foot. That building fetched a higher price per square foot because

it is 100 percent leased to Charles Schwab through 2018.

In the mid-1990s Pan cut a wide swath through

downtown San Francisco real estate circles, amassing a 1

million-square-foot portfolio with properties like the 700,000-square-foot

Pacific Center at 22 Fourth St, and the Chevron building at 225 Bush St.

He sold most of his properties between 1998 and 2000, telling the Business

Times at the time that “we’re so used to bargains and now it’s

absolutely impossible to find opportunities here.”

The San Francisco Business Times reported in

December that Pan had the building in contract. At the time TRI Commercial

Managing Director Anton Qiu, who has frequently represented Asian buyers

interested in San Francisco, predicted that the 49 Stevenson St. sale will

be the start of a trend.

“Since last summer I have noticed a lot of the

overseas investors who used to be active in the mid-90s are back,” said

Qiu.

Qiu said the Asian buyers have access to cheaper

debt than U.S. investors do, and thus are willing to settle for lower

capitalization rates, which is the ratio of annual net operating income

produced by a building divided by its value.

“The local guys were looking 9 cap and foreign

buyers looking at a 7 cap,” he said. “The cost of funds makes the

difference. They can pay a little more.”

Pan, which Forbes magazine ranks No. 34 on

Taiwan’s Richest 2009 with a net worth of $650 million, owns hotels and

is chairman of the Formosa International Hotels Group. His father, S.R.

Pan, started out in the Bay Area more than 40 years ago, buying up several

hundred acres along the Alameda shoreline and looking for good deals.

“If you own a bargain, you have to create

value with it,” Pan said in a 1998 Business Times interview. “To

create value, you don’t just sit on it.”

- 2010 January 11 BUSINESS TIMES

Millionaire households in Bay Area

Here's a breakdown by county of Bay Area

households with $1 million or more in financial assets:*

| County |

Households |

|

| Alameda |

23,402 |

| Contra Costa |

20,829 |

| Marin |

7,047 |

| Napa |

2,468 |

| San Francisco |

11,391 |

| San Mateo |

14,486 |

| Santa Clara |

31,246 |

| Solano |

6,262 |

| Sonoma |

8,485 |

*Includes liquid financial assets such as

checking, savings and retirement accounts, mutual funds, stocks and bonds.

Figures don't add up to Bay Area total cited in text, which is based on a

market research region that doesn't precisely overlap county boundaries.

- Source: Claritas,

Merrill Lynch, Capgemini

2008 June 25

SAN FRANCISCO CHRONICLE

MARIN

COUNTY

Despite a 40 percent drop in real

estate prices in the Bay Area during the economic

downturn, affordable housing in Marin and other counties remains out of

reach for many working families.

That is the conclusion of a report issued

Thursday, "Priced Out: Persistence of the Workforce Housing Gap in the

San Francisco Bay Area," issued by the Washington D.C.-based Urban Land

Institute Terwillger Center for Workforce Housing.

"Despite this 40 percent drop,

working families are priced out of the housing market, and the rental market

as well," said Kevin Herglotz, spokesman for the center. "And with

the economy getting better the situation will only get worse."

The severity of the problem threatens the

region's future economic viability and, unless policy changes are made, new

home development will leave significant unmet demand, leaving thousands of

working families "priced out" of affordable housing options, the

report concludes.

"The basic need for affordable

housing is, in fact, growing, while the resources available are

diminishing," said Dave Coury, executive director of the Marin

Continuum of Housing and Services. "The old practices of restricting

land available for higher density affordable housing has resulted in an

inequitable and unsustainable situation. We import more than one-third of

our workers in the county at lower paid job levels, which is the fastest

growing segment in Marin."

Less than 10 percent of the homes for

sale in the Bay Area are affordable to a family in Marin making a combined

annual income of about $90,000, according to data provided by the report's

authors.

"Marin is probably the worst

affected in the entire Bay Area because the housing costs there are very,

very high," said Adam Ducker, managing director with Washington

D.C.-based RCLCO, which developed data for the report.

Approximately 30 percent of the Bay

Area's 2.7 million households fall in the workforce household income range.

That income can range as high as $100,000 annually and includes professions

such as teachers, firefighters and nurses.

The study analyzed the housing market in

Marin, along with Sonoma, Alameda, Contra Costa, Napa, San Mateo, Santa

Clara, San Francisco and Solano counties. It found that only 15 percent of

the existing homes for sale in the Bay Area are affordable to workforce

households earning the median family income. That compares with between 50

and 60 percent in regions across the country similar to the Bay Area.

Every county in the Bay Area ranked as

being one of the least affordable in the country. Only New York City ranked

less affordable.

The report also found that high housing

costs are pervasive in the rental housing market, which serves 42 percent of

workforce households in the Bay Area. Workforce households have a much

higher propensity to rent in the Bay Area, especially among families, than

in similar metropolitan regions across the country.

And expensive Bay Area rents require a

workforce household to pay more than 30 percent of their incomes on housing,

more than in other metropolitan regions across the country.

The report concludes that the Bay Area

suffers from a workforce housing shortage that is among the most acute and

widespread in the nation. Despite the recent housing market downturn, the

high cost of housing remains a critical challenge to the long-term economic

health of the Bay Area because workers cannot afford to live here.

"If current trends continue, new

construction will fail to meet the significant projected demand for

workforce housing in the future," said Jim Wunderman, president and CEO

of the Bay Area Council. "Unless these issues are seriously addressed,

not only will Bay Area families continue to be priced out of housing

options, but the region's future economic viability will be

threatened."

There are groups working to address

affordable housing in Marin. The Marin Workforce Housing Trust, a

public-private partnership that was founded in 2004 to expand workforce

housing in Marin County, has raised more than $3 million and offers

low-interest loans from both for-profit and nonprofit developers seeking to

build affordable housing in Marin.

In October 2008 the county established an

affordable housing impact fee charged to builders depending on the size of a

structure.

And last year the Marin Community

Foundation announced plans for a $10 million, five-year plan aimed at

boosting the supply of affordable housing in Marin.

- 2010 February 18 MARIN INDEPENDENT JOURNAL

The City has floated a concept to

raise the heights of buildings in the Downtown Core. The idea would be to raise height limits on several blocks south of Market

Street to allow two towers as tall as the 853-foot Transamerica building and a

third that would climb at least an additional 150 feet -- to more than 1,000

feet tall. >>MORE

Most expensive House sold

Housing

DataSan Francisco HomesSan Francisco Apartment marketSan Francisco WaterfrontPresidio Will Fairmont Hotel Tower become Condos? Nob

Hill Condo Home

in Pacific Heights Japan Town Wine

Map of Napa

Silicon Valley High-Tech Rents Tumble

Rent in Silicon Valley for high-tech commercial real estate fell almost 30

percent in 2002, extending a slide that began a year earlier, according to a

study released on Thursday.

Annual rent for high-tech work space in Silicon Valley averaged $15.24 per square foot in the fourth quarter, down 29

percent from $21.48 per square foot in the first quarter, according to commercial real estate services company Cushman and Wakefield.

Average annual rents in the region had been as high as $50.88 per square foot in the first quarter of 2001.

Silicon Valley, home to scores of big and small technology companies, has been hammered by the high-tech industry's

downturn, sending local commercial rents tumbling as companies consolidated facilities while slashing payrolls.

Silicon Valley had about 30.15 million

square feet of commercial space suited for high-tech companies available for

rent in the fourth quarter of 2002, up 37 percent from 21.96 million square

feet of such vacant space in the first quarter of last year.

The region's vacant high-tech real estate was a low 3.1 million square feet in the third quarter of 2000 when Silicon

Valley's local economy was booming.

The unemployment rate in Santa Clara

County, the region's heart, was 7.8 percent in November, down from 8.1 percent

in the prior month but up substantially from 1.3 percent in December 2000 amid

the dot-com boom and torrid business investment in tech goods and services of

all kinds. - Reuters

2 January 2003

|