|

Retailers,

landlords lock horns

Retailers

want rent cuts as income has contracted 20-30% but landlords argue not all

have been hit equally

Hit by

weak sales and high rents,

Singapore's retailers are bleeding - and they want landlords to help them

out by cutting rents. But landlords are saying that rent cuts of 20-30 per

cent all round - which is what the Singapore Retailers Association (SRA)

publicly called for last week - are neither needed nor feasible. Instead,

building owners are looking at ways to help tenants with sales. 'Rent is

always a function of sales. Therefore, the most scientific way to look at

sustainable rent for each trade is to look at each retailer's occupancy

cost,' said Lim Beng Chee, chief executive of CapitaLand's retail arm.

CapitaLand, which owns and/or runs 16 malls, is Singapore's biggest retail

landlord.

Typically, landlords calculate

occupancy cost as rent divided by gross revenue. For CapitaLand's retail

trust CapitaMall Trust (CMT), the average portfolio occupancy cost was

about 16 per cent in 2008. Most tenants' occupancy costs fall within the

15-18 per cent range, according to CapitaLand.

Frasers Centrepoint, which has seven

shopping malls, says it has been meeting tenants to work out solutions

based on what their specific or critical needs. 'Outright rent rebates are

not a sustainable option given the tight profit atmosphere that every

business is currently operating in,' said a spokesman.

At the Causeway Point and Anchorpoint

malls operated by listed Frasers Centrepoint Trust (FCT), the respective

average occupancy cost was 12.7 per cent and 15.7 per cent in 2008. But

the average occupancy cost at a mall cannot be applied across the board to

all tenants. For instance, a supermarket with a much smaller profit margin

will not be healthy within the average range, while other trades - such as

accessories, fashion and cosmetics - can afford higher occupancy costs

because they have better margins. Most developers, therefore, fix rents on

a case-by-case basis.

SRA says retailers' income has

contracted 20-30 per cent in the past few months, but landlords say not

all retailers have been hit equally - so they are not willing to drop

rents for all tenants. 'The financial crisis is not hitting all malls

equally. Most of our malls are still showing healthy numbers, both in

sales, traffic and occupancy costs,' said Frasers Centrepoint.

Landlords say they monitor tenants'

sales closely and can easily tell when a tenant is in serious trouble.

CapitaLand, for example, evaluates tenants' sales and occupancy costs on a

monthly basis - store by store and trade by trade - using a system that

captures data at each tenant's point-of-sales. The data is then uploaded

into a central database, often daily. Mr Lim, therefore, is confident that

the company will be able to spot tenants that are in real trouble and help

them accordingly.

But retailers say landlords can never

really understand what is happening on the ground. A spokesman for RSH

said: 'Should landlords be defining what is viable for their tenants?

Every tenant has a level of profitability they have to achieve to sustain

their business, and that level varies from retailer to retailer. Each

label or retail concept works with a margin and cost base, and that varies

even for brands within the same category. Would landlords have the

knowledge or information on these margins and costs, which is

information-privy only to retailers themselves?'

Retailers are also frustrated that

landlords still seem to be 'waiting' and 'assessing' the situation -

instead of acting to stop the slide. They say that instead of taking the

bold and necessary step of cutting rents, landlords are trying to help

tenants manage their occupancy costs in other ways - which, according to

them, are not working on the ground.

Frasers Centrepoint, for one, said it

has stepped up advertising and promotions (A&P) for its malls. 'We

have increased our expenditure about 10 per cent to focus on more tactical

promotions we feel will help increase tenant sales,' the company said.

Likewise, Mr Lim said CapitaLand has in

place a slew of measures it can activate to help its tenants. These

include relocation to a higher floor within a mall where rent is cheaper,

downsizing store space and to trying to boost gross revenue through

promotions such as push sales in atriums.

The last strategy - giving discounts

and holding promotions to increase revenue - is already common as

retailers try to prop up revenue artificially to pay their rents and

improve cash flow. But in the long run, this strategy is not sustainable,

tenants say.

'The formula (rent/gross turnover) is

such that retailers have to generate sales even when the market is bad,

and many resort to more discounts and more promotions. So even if the

turnovers increase, margins fall,' said Douglas Benjamin, chief executive

of retail group FJ Benjamin. 'Just looking at occupancy costs is not

accurate when it comes to measuring the health of a tenant. You have to

look at the margins as well.'

And there is no doubt that margins are

being hit. FJ Benjamin says that for the industry as a whole, margins are

down 20-30 per cent. SRA also said last week that retail margins are now

almost negligible - if not negative. Increased A&P expenditure will

not help much at a time when the entire market is depressed, one retailer

told BT.

And landlords, retailers complain, are

not just refusing to cut rents - they are, in fact, looking to increase

rents about 20 per cent when the time comes for leases to be renewed. When

talks on lease renewal for his Mothercare store at VivoCity began, the

mall began by asking for 22 per cent more, Pang Kim Hin, chairman of the

baby goods retailer, told BT. His story is just one of many such

complaints from tenants in recent weeks.

Landlords maintain that they are only

asking for the kind of rent increases that tenants can afford to pay. In

2008, Frasers Centrepoint renewed 27 leases at rents that were on average

17.5 per cent higher than preceding rates. And CMT said 363 new and

renewed leases were signed in 2008, at rents 9.3 per cent higher than than

preceding rates. Typically, preceding rental rates were committed about

three years ago. Many landlords, which are listed companies, also point

out that retail rents are their only sources of income. CMT, for example,

reported gross revenue of $511 million in 2008. If the retailer were to

cut rents 30 per cent across the board, revenue could fall by an estimated

$153 million. This means that the trust's distributable income, which was

$238 million in 2008, could fall to just $85 million - something that is

sure to upset the trust's international institutional investors.

The same applies for other

Singapore-listed retail trusts such as FCT and Suntec Reit. Cutting rents

and, consequently, distributions by significant amounts is akin to sending

a signal to international investors that Singapore's economy is in dire

straits, a reit manager said.

Frasers Centrepoint explained: 'As with

any business in this economic climate, we are also subject to a similar

predicament. The costs of doing business has affected landlords as well,

with borrowing costs having increased substantially.'

In light of all this, some landlords

say not all businesses can or should be saved during a downturn. 'In cases

where the tenants have over-expanded or if their business model or product

is not sustainable, the most logical and win-win solution for us is to

facilitate an amicable way to pre-terminate the leases to prevent further

losses to the tenants,' said CapitaLand's Mr Lim, adding that the

developer takes this approach during good times and bad.

- 2009 March 5 BUSINESS

TIMES

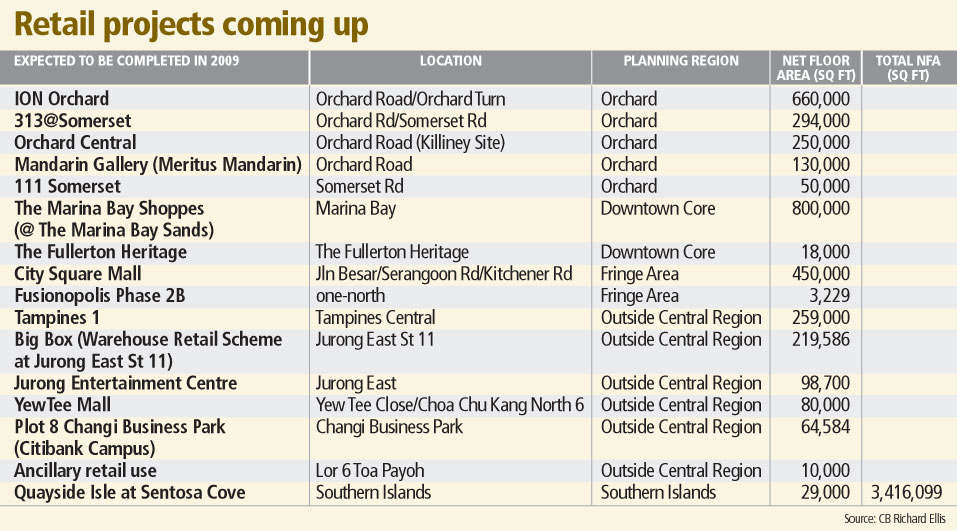

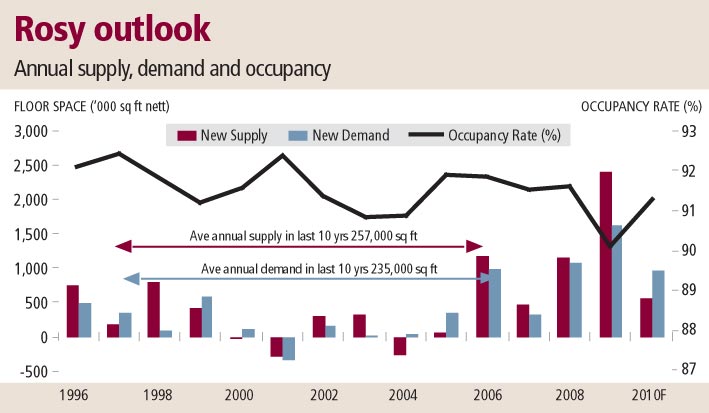

Prime retail rents to slip 5-15%

New retail space of 3.4m sq ft available in '09, and spending slowdown

Retail landlords

are headed for a rough patch as consumer spending weakens amid the economic

downturn and with 3.4 million sq ft of new retail space scheduled for

completion next year, property consultants say.

Knight

Frank's head of retail Sherene Sng predicts that average rents for prime

retail space in Orchard Road and at suburban malls could slip 5-15 per cent

in 2009. 'For super-prime retail space on Orchard Road, the decline, if any,

will be capped at around 5-10 per cent at most, because there's not that

much super-prime space around and most of it is in malls that are very well

managed,' she said.

For

full-year 2008, Ms Sng expects retail rents island-wide to be pretty much

flat, increasing no more than 5 per cent.

CB

Richard Ellis said yesterday retail rents stagnated in the third quarter of

this year, and trimmed its full-year 2008 forecast for prime Orchard Road

rents.

It

now expects Orchard Road rents to edge up 2-3 per cent in 2008, lower than a

3-5 per cent increase it predicted earlier this year. However, CBRE is

maintaining its 3-5 per cent increase forecast for prime suburban mall rents

in 2008, due to the captive market of HDB heartland shoppers these malls can

count on, as well as limited new supply of retail space in the suburbs.

Some

41 per cent of the 3.4 million sq ft of new retail space slated for

completion next year will be in the Orchard Road belt - coming from

developments like ION Orchard, Orchard Central, 313@Somerset

and Mandarin Gallery.

'This

will bump up total private Orchard Road retail stock some 36 per cent in

just 2009 alone and undoubtedly raise concerns about space absorption,

despite the fact that retail take-up tended to be somewhat supply-led in the

past,' CBRE said.

The

biggest contributor to new retail space on the island next year will be The

Marina Bay Shoppes at Marina Bay Sands, with 800,000 sq ft of net lettable

space, according to CB Richard Ellis. The Downtown Core region, where the

development is located, will account for 24 per cent of new retail space

being completed here next year.

Knight

Frank's Ms Sng says the big factor affecting retail rents next year will be

not so much the completion of 3 million-plus sq ft of new space but a

slowdown in sales as people tighten their belts and cut spending due to the

economic downturn.

'This

will cause retailers to become more cautious and adopt a watch-and-wait

attitude and hold back business plans,' she said. 'Some smaller retailers

operating as sole proprietorships or partnerships may also be affected by

the stockmarket crash. Of course, there will be some retailers that are

still doing well - but they too will use the weaker economic climate to

secure more attractive rents from landlords when they renew leases or open

new stores.'

CBRE's

data shows that in Q3 2008, the average monthly prime retail rent in Orchard

Road was $36.80 per sq ft, while the average super-prime rent there was

$54.40 psf. The average prime retail rent in the suburbs was $29.30 psf. All

three numbers were unchanged from Q2.

CBRE's

director (retail services) Letty Lee declined to forecast retail rents going

ahead. 'A number of factors will determine the rate of rental change for the

rest of this year and the next,' she said.

'The

full impact of the financial meltdown on the job market is still unknown. In

the meantime, consumers will remain cautious and may cut spending as a

result.

'The

financial turmoil will also affect tourism, which will in turn affect

consumer spending. Landlords may be pressured to reduce rents as a result.

We are still assessing the situation and it is difficult to make a

projection at this stage.'

Colliers

International said in a report yesterday that while year-end festivities may

provide some relief for retailers, consumer spending is likely to remain

subdued given the poor economic outlook and the drop in foreign visitors.

Any

retail rental growth is therefore expected to be minimal in the last quarter

of the year. 'As such, rents are projected to increase by up to 5 per cent

for the whole of 2008,' Colliers said.

- 2008 October 24 BUSINESS

TIMES

Retail property market remains stable in Q2: DTZ

Turnover rents

rise; limited growth for fixed gross rents

Buoyed by positive consumer sentiment and

the Great Singapore Sale period, the retail property market remained stable

in the second quarter of this year, according to a market report by real

estate consultancy DTZ.

Turnover rents in Q2 rose, but there was

limited growth for fixed gross rents. DTZ noted that tenants were 'resisting

committing at higher rents for both new retail space and lease renewals'.

First-storey monthly fixed gross rents

remained largely unchanged quarter on quarter, hovering at an average of

$42.40 per square foot (psf) for prime areas such as Orchard/Scotts Road,

$33.70 psf in suburban areas and $27.10 psf in other city areas.

The retail market is expected to remain

stable, despite competition from additional supply that will come on stream

over the next few years. Malls such as ION Orchard, Orchard

Central and 313 @ Somerset are slated for completion by 2009.

As much as 5.4 million square feet of

retail space will be added to the mix between the second half of this year

and 2012. Marina Bay Shoppes by developer Marina Bay Sands will account for

the biggest chunk of that space, with 15 per cent or 800,000 sq ft, closely

followed by CapitaLand and Sun Hung Kai Properties' ION Orchard at 663,000

sq ft. - 2008 July

3 THE

BUSINESS TIMES

Retail rents rise in Q3 but retail sales

at a high

Rents for shops on Orchard Road may have

increased by another 12 per cent in the third quarter to $44.30 per square

foot (psf) per month, but retailers are unfazed, especially as the latest

figures show that the second quarter of this year saw the strongest sales

for 10 years.

According to a report by property

consultancy Knight Frank, retail sales value (excluding motor vehicle sales)

in the second quarter hit a 10-year high of $8.15 billion.

The figure for the quarter was also an

improvement on the previous interim high of $7.8 billion seen in the final

quarter of last year.

Not surprisingly then, rising rents in

the Orchard Road vicinity as well as the Marina area, where rents increased

by 3.7 per cent quarter-on-quarter (q-o-q) to an average $28.90 psf per

month, are not upsetting retailers too much.

Knight Frank director (research and

consultancy) Nicholas Mak says: 'With the planned revitalisation of the

Orchard area, retailers are optimistic that their retail sales figures are

able to offset the increase in rentals.'

Knight Frank also expects full year

figures to hit a record high, pointing out that at end-July 2007, total

sales figures already stand at $18.4 billion compared to $29.5 billion for

the full year of 2006.

Nash Benjamin, the CEO of FJ Benjamin,

which owns Guess, Gap and Celine here, has noticed that rents have been

rising but he says: 'The bottom line is whatever rental you pay must finally

be relative to the business, otherwise tenants will not be able to invest.

We are fortunate that most malls we work with have a good understanding of

this principle.'

With space getting more expensive,

retailers are becoming more sensitive to rentals on a per square foot basis

too.

Steven Goh, spokesman for the Orchard

Road Business Association, believes the situation is not so much that

retailers are prepared to pay higher rents for a prime space but more that

they have become more savvy in measuring how 'productive' their businesses

are.

'For instance, a restaurant that was

2,500 sq ft before may streamline its operations to 2,000 sq ft because it

gives the optimum return of $100 worth of sales on a per square foot basis,

which can justify the rental,' he explains.

Another example Mr Goh gives is that of

fashion boutiques, which on average, must make between $120-$150 psf in

sales. And the concern is not so much about rent. 'The pressure is actually

to find new concepts,' he says.

Perhaps a sure sign that retailers and

their landlords are doing well is when a shop decides to expand, even when

rents keep rising.

High-end leather goods retailer Tod's, in

the equally high-end mall Paragon, has just moved into bigger and better

premises with frontage on Orchard Road, increasing its store size by about

50 per cent.

Patrina Tan, deputy general manager of

marketing at Paragon, says it does not discuss rents but does concede that

all landlords do see the expiry of an existing lease as an opportunity to

review rent levels. 'Rentals are always relative,' she adds.

She also reports that the sentiment among

the tenants at Paragon is definitely 'positive'.

The outlook for the future remains good

too despite close to 2 million sq ft of retail space scheduled to be

completed by next year. And at Knight Frank, Mr Mak says he does not expect

demand to decrease either.

For the rest of the year, Knight Frank

expects occupancy to increase by about one percentage point q-o-q. This will

bring islandwide occupancy to between 93 and 94 per cent and Orchard Road

occupancy to about 95.8-96.5 per cent.

Knight Frank also expects rentals for

prime retail space to increase 15-20 per cent year on year, with capital

values rising by 10-15 per cent. -

2007 October 9 SINGAPORE BUSINESS TIMES

|