|

| Less fuss, more buzz soon: STB says details of pedestrian

mall improvement works on Orchard Road will be released shortly. But

retailers are keener on an amelioration of the traffic situation,

which they say is so bad that it requires an in-depth overhaul, not

just cosmetic surgery. |

That could come soon, with the announcement of a masterplan by the

Singapore Tourism Board (STB). Retailers, however, say that the traffic

situation is serious enough to warrant an in-depth overhaul, rather than

just cosmetic surgery.

STB would not say what is in store except that details of pedestrian mall

improvement works would be released shortly.

Sources, however, say that there are plans to reduce the number of lanes

on Orchard Road and widen the pedestrian mall. And there could also be a

separate initiative by the government to provide covered linkages between

the malls.

It is understood that STB had recently engaged Orchard Road stakeholders

for their views and is now in the process of re-evaluating this feedback.

The $40 million makeover was first mooted in Parliament in early 2005.

A year later, the inter-agency Orchard Road Rejuvenation Taskforce (ORRT)

said that the work to transform the shopping strip would begin in early

2007.

Work has yet to begin in earnest - save for a crosswalk lighting project

at Bideford Junction - and the hold-up appears to be the proposed plan to

reduce the number of lanes in Orchard Road, as well as the cost of improved

infrastructure like covered linkways.

Singapore Retailers Association executive director Lau Chuen Wei said

that what retailers and businesses want is a solution to the traffic flow,

'so that people going to Orchard Road can navigate the junctions, side roads

and merging traffic more easily'. She added: 'Closing off a lane to make way

for pretty trees and lamp-posts is not really a solution.'

There are no secondary service roads for certain stretches of Orchard

Road, so goods deliveries have to be made via the main thoroughfare,

clogging up lanes. 'What Orchard Road needs urgently is an in-depth study of

traffic flow to ease congestion. It's not a matter of imposing toll charges,

but actual infrastructure,' Ms Lau said.

There have been suggestions that a whole system of covered linkways and

underground passages be built to improve connectivity, but Steven Goh,

spokesman for the Orchard Road Business Association, notes that some of the

existing underground links are not really utilised.

Cushman & Wakefield (C&W) managing director Donald Han reckons

$40 million may be enough for 'cosmetic surgery' like the provision of

street furniture and interactive street light crossings but may not be

enough for 'major transplant operations' such as providing more subsidies

for shopping centre owners to link buildings.

Orchard Road is nevertheless popular. In a recent C&W report, it was

noted that Orchard Road sees about 1.5 million visitors every week. And even

if it is not the most popular shopping street in the world, it is at least

ranked by C&W as the 13th most expensive in terms of rental.

Mr Han said: 'To be fair, the Urban Redevelopment Authority and STB have

gone a long way in their efforts to revitalise Orchard Road.' There are now

street vendors, kiosks, restaurants, coffee bars on the walkways. 'In the

past, these were not allowed,' he added.

The real revamp of Orchard Road is likely to be in the hands of

developers like Hong Kong-based Park Hotel Group (PHG), which bought the old

Crown Hotel in 2005 and now plans to redevelop it into a high-end shopping

mall and boutique hotel.

For PHG director Allen Law, the proposition to buy and redevelop the old

hotel is a no-brainer. 'Orchard Road is one of the best roads to walk along

- the weather is nice, the air is clean, and there is a lot of greenery to

enjoy. People don't want another air-conditioned mall filled with all the

standard brand names; they want an experience. Focusing on the uniqueness is

vital to success,' he said.

CapitaLand is another developer with a big stake in Orchard Road through

its upcoming Ion Orchard shopping mall.

CapitaLand Retail CEO Pua Sek Guan is equally bullish on the strip's

future. And as iconic as Ion is going to be, Mr Pua understands that the

Orchard Road experience 'cannot be re-created in one mall alone'.

Although Ion will not have a covered walkway to the neighbouring mall, Mr

Pua said CapitaLand will be creating a 3,000 square metre public space

fitted out with water features, LED screens and audio systems for public

entertainment. The cost? 'It's not a small sum,' he said.

Tangs CEO Foo Tiang Sooi says he is all for 'strengthening the precinct'

too. The revamp, when the details are announced, may indeed have some

adverse changes but Mr Foo says: 'One has to take a broader view.'

- 2007 August 18 SINGAPORE

BUSINESS TIMES

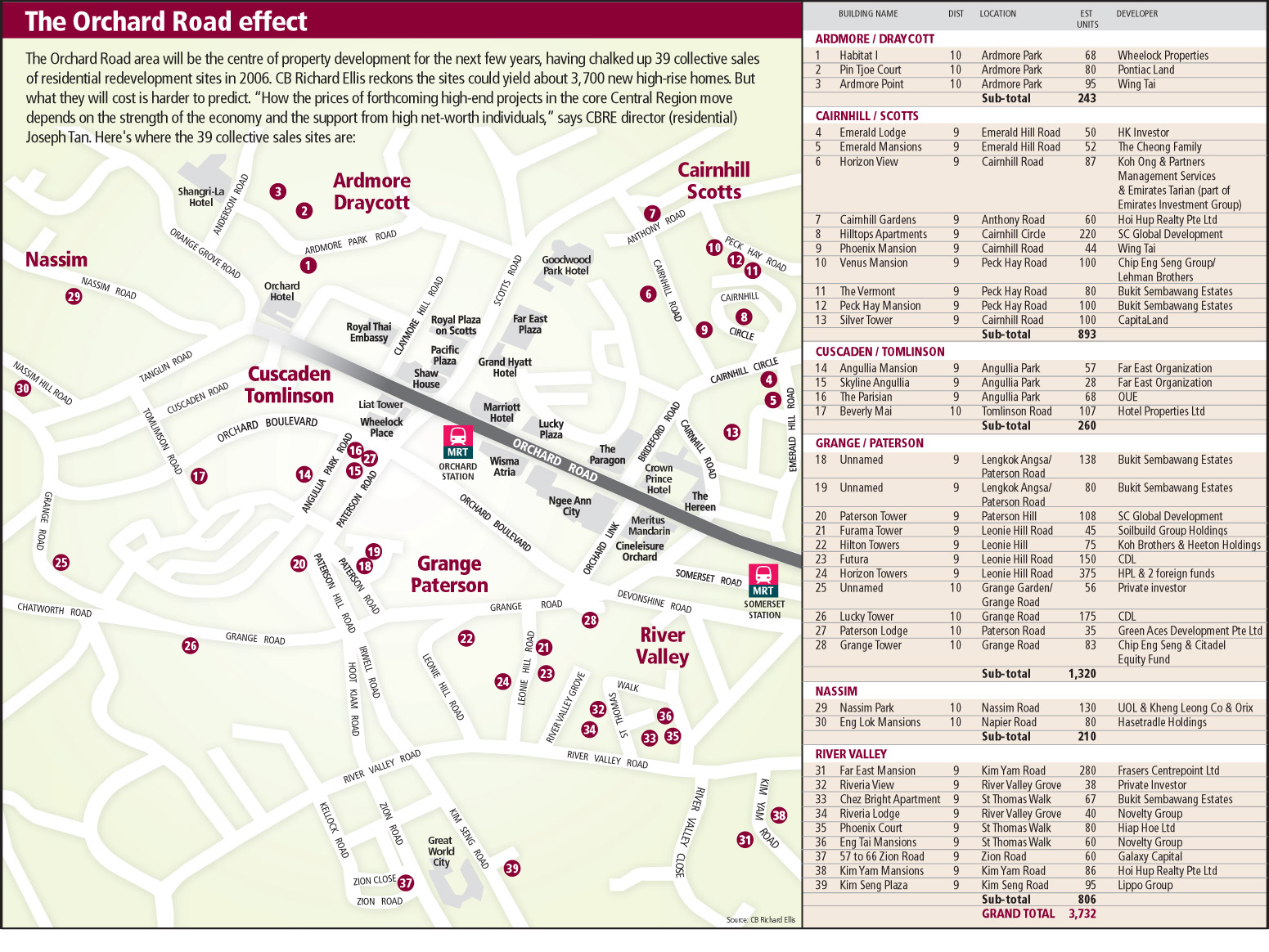

The Orchard Road effect

The Orchard Road area will be the centre of property development for the

next few years, having chalked up 39 collective sales of residential

redevelopment sites in 2006. CB Richard Ellis reckons the sites could yield

about 3,700 new high-rise homes. But what they will cost is harder to

predict. "How the prices of forthcoming high-end projects in the core

Central Region move depends on the strength of the economy and the support

from high net-worth individuals," says CBRE director (residential).

Here's where the 39 collective sales sites are:

SINGAPORE

BUSINESS TIMES 2007 Feb 26

SINGAPORE

BUSINESS TIMES 2007 Feb 26

The Orchard Residences sets record

price

Singaporean pays over $4,080 psf for

53rd level penthouse

2007 March 21:

Singaporean businessman is said to have paid

a benchmark price of over $4,080 per square foot, working out to over $17

million, for a 53rd level penthouse at The Orchard Residences earlier this

week. This beats the previous record of $3,450 psf set in December last year

for a penthouse at the Marina Bay Residences, which also has a 99-year

leasehold tenure.

2007 March 21:

Singaporean businessman is said to have paid

a benchmark price of over $4,080 per square foot, working out to over $17

million, for a 53rd level penthouse at The Orchard Residences earlier this

week. This beats the previous record of $3,450 psf set in December last year

for a penthouse at the Marina Bay Residences, which also has a 99-year

leasehold tenure.

In the case of Orchard Residences, which

will rise above Orchard MRT Station, the $4,000 psf mark has been crossed

not just for the penthouse deal, but also for several other apartments on

the upper floors.

'We're extremely pleased to have achieved

a record price of over $4,000 psf for several units at The Orchard

Residences in Singapore. Units above the 30th floor have also attained

prices of over $3,200 psf,' said CapitaLand Group's president and chief

executive officer Liew Mun Leong. The property company is developing the

project jointly with Hong Kong's Sun Hung Kai Properties.

The duo is understood to have sold over

40 units in the development since Monday to a mix of Singaporean, Middle

Eastern, European and Asian buyers. About half of the 175 units in the

condo, spread across low, mid and high floors, are being released under the

initial phase, which is for sale by invitation.

The lowest price achieved in the condo is

said to be close to $2,600 psf.

Sun Hung Kai Properties vice-chairman and

managing director Raymond Kwok said that 'more than 50 per cent of the units

sold under Phase 1 are through internal referrals from business associates

and partners'.

The developers seem to have screened

potential buyers to give preference to genuine home buyers and investors

rather than property speculators.

'We have received very strong response

from Singapore, Asia and international genuine home buyers who wish to stay

in the most prime spot on Orchard Road and have purchased

The Orchard Residences with a view for

long-term investment,' Mr Kwok said.

Meanwhile, Keppel Corp yesterday revealed

that the super penthouse at its upcoming Reflections at Keppel Bay condo

launch will be 13,300 sq ft in size, spread across the top three levels of

the 41-storey project. The project is slated for release early next month.

And over in District 11, UOL has sold 40

per cent of its 180-unit condo, Pavilion 11, at Minbu Road.

It began previewing the freehold project

last weekend and has achieved an average price of about $900 psf.

- by Kalpana Rashiwala SINGAPORE

BUISNESS TIMES 22 March 2007

Orchard Turn to Launch Soon

Many

foreigners indicating interest before March/April opening

2007

Feb 6: CapitaLand

and Hong Kong's Sun Hung Kai Properties plan to launch The Orchard

Residences - their upcoming residential project on the prime Orchard Turn

site above Orchard MRT - sometime in March or April, but the project has

already attracted a lot of interest, the developers said yesterday.

‘Our

project has drawn a lot of interest and attention,’ said Soon Su Lin,

chief executive of joint venture company Orchard Turn Developments. ‘We

have received a lot of interest from foreigners, even though we have not

even started any advertising.’

Because of this, the 99-year leasehold,

175-unit project will be launched first in Singapore, said Ms Soon. ‘Given

that the foreigners who are interested are fully aware of our project, we

are likely to launch it in Singapore,’ she said. ‘As for later launches,

we may consider taking it overseas if we need to.’

Sun Hung Kai Properties’ executive

director Victor Lai echoed her, saying that particulars of interested buyers

from Hong Kong have already been passed on to the Singaporean side, which

will then contact them when the project is launched.

Ms Soon said that there has been interest

from private funds to acquire large chunks of the project, but the developer

has instead decided to sell the apartments through a regular launch.

While Ms Soon declined to say what prices

the apartments will go for, The Orchard Residences has been dubbed

’super-luxury’, and CapitaLand Residential Singapore’s chief executive

Patricia Chia recently told reporters that average prices in the

’super-luxury’ segment could rise to $3,000 per square foot (psf) by the

end of this year.

The Orchard Residences is scheduled for

completion in late-2009, and Ms Soon said that the recent price hike and

tightened supply of ready-mixed concrete will not affect the completion

date. The price of ready-mixed concrete has shot up by about 50 per cent

here since Indonesia banned the export of sand last month.

Most of the units in the 218-metre,

56-storey The Orchard Residences will be three and four-bedroom apartments

ranging from 1,800 sq ft to 2,900 sq ft. The development will also have

seven ‘garden units’ and penthouses ranging from 4,300 sq ft to 6,500 sq

ft. The building will be the district’s tallest when completed and

apartments will offer unobstructed panoramic views of Singapore, Ms Soon

said. Residents will also have exclusive access to a 75,000 sq ft high-rise

garden. - SINGAPORE

BUSINESS TIMES 06 Feb 2007

Uma Shankari

太太's good friend effected this joint venture

with Singapore and Hong Kong property giants!

CapitaLand, partner to sink $2b

into Orchard Turn project

Ambition is to open mall component by Christmas 2008

CapitaLand and Sun Hung Kai Properties (SHKP)

will, in all, invest about $2 billion developing a mall and luxury condo on

the Orchard Turn site.

The outlay will include land and construction

costs.

'My ambition is to open the mall by Christmas

2008,' CapitaLand Group president and CEO Liew Mun Leong said at a briefing

yesterday.

'It should not be a big challenge' achieving

average prices of $1,800 to $2,000 per square foot for the 100-odd luxury

apartments of about 2,000-3,000 sq ft each when the group is ready to market

them in Q2 2007, he said.

Market watchers say the residential component

could be launch-ready as early as Q3 next year.

The apartments will rise up to 51 storeys.

CapitaLand officials refuted market talk that CapitaLand and SHKP overpaid

by forking out $1.38 billion or $1,020 psf per plot ratio for the 99-year

leasehold site above Orchard MRT Station.

They said the land will be worth $200 million more

than this if the $18-19 psf gross average monthly rental they assumed for

the mall in their model is surpassed by 10 per cent. The $18-19 psf rental

range is deemed conservative since it is already being achieved at some

Orchard Road malls if anchor spaces are excluded.

Using this rental figure, the net yield for the

Orchard Turn mall would work out to 7 to 7.5 per cent based on its estimated

breakeven cost of $2,500 to $2,550 psf of net lettable area.

Mr Liew sees huge upside for the mall. 'Asia is

growing. The cities are pulsating. The travel industry is growing,' he said.

'The theme is very much about global consumption. And one of the main

branches is retail. We think the retail sector in the real estate industry

will be the fastest growing in Asia.'

Singapore has less retail space per head of

population than Hong Kong, Japan, the UK, Australia and the US, Mr Liew

said. And this leaves room for more retail space here. He reckons Hong Kong

and Singapore - for their prevalent use of English and Mandarin - and

Shanghai will be Asia's major shopping cities in the next 10 years.

He also believes the Singapore Tourism Board's

projection that annual visitor arrivals will double to 17 million by 2015

will be surpassed with the pulling power of two integrated resorts and the

revamp of Orchard Road.

International tourists coming to Singapore will

gravitate towards Orchard Road, and the strategically located Orchard Turn

site will be the 'centre of gravity', Mr Liew said.

Pointing out that Orchard Road rents are now only

19 per cent of those in New York's 5th Avenue, he said there is plenty of

room for growth.

CapitaLand Retail CEO Pua Seck Guan said gross

monthly rentals of $18-19 psf are already being comfortably achieved at

Paragon and Ngee Ann City excluding anchor spaces. Bigger shop units

generally pay less rent psf, and Mr Pua does not plan to have anchor size

tenants at the Orchard Turn mall. Instead, there will be several mini-anchor

tenants occupying 3,000 to 5,000 sq ft each. Most of the units in the mall

will be 800 to 1,000 sq ft, with the smallest just 200-300 sq ft each.

The mall will be spread across six to eight

levels, including three basement levels.

The mall will take up 70-75 per cent of the

Orchard Turn project's 1.35 million sq ft gross floor area. It will be

linked to Orchard MRT Station at Basement 2. And there will be connections

to Wisma Atria next door at B2 and Level 4.

'The void of the mall will be big, like Raffles

City. And the layout will allow you to see every shop from the ground floor

atrium,' Mr Pua said. 'We could also put a long escalator from the ground

level to the fourth floor to improve the accessibility of shops on the upper

floors.'

As for tenants, he said the mall will be pitched

as the showcase of choice for big international brands, but CapitaLand and

SHKP also want high-energy tenants to draw shoppers and create high

foot-traffic. Second-tier international brands, local brands and family

restaurants will be among the other tenants. There will also be a branded

restaurant on the fourth level, at the lift entrance to an observation deck

on the top two levels, on the 52nd and 53rd floors.

Mr Pua also revealed that the group is exploring

the possibility of building a direct underground link running diagonally

from the Orchard Turn site to Shaw House across the road. -

by Kalpana Rashawala SINGAPORE

BUSINESS TIMES 17 Dec 2005

Top Orchard Turn bidder to go heavy on

retail component

URA Tender

Information

URA Tender

Information

Plum property: Most market watchers expect

the top bids for the 99-year leasehold site to come in above $1 billion.

It's just a matter of how much above $1 billion

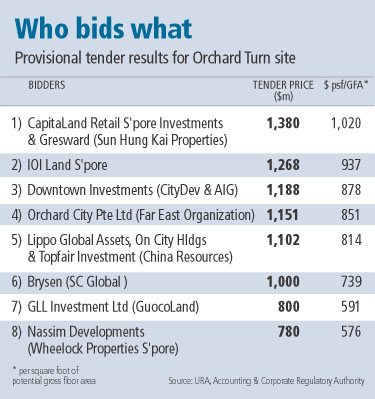

The partnership that put in the bullish top bid of

$1.38 billion for the plum Orchard Turn site yesterday is planning to go big

on the retail component of its project.

CapitaLand group, Singapore's biggest mall owner,

and Sun Hung Kai Properties (SHKP), Hong Kong's premier developer, are

planning to set aside 70 per cent or more of the gross floor area (GFA) in

their project for retail use.

This is much more than the mandatory minimum 40

per cent retail component in the project stipulated by the authorities. This

probably also explains how the partnership is supporting its bid.

Analysts say retail is the best use of space on

the 99-year leasehold site above the Orchard MRT Station, and dedicating a

higher percentage of GFA to a mall will allow the developers to maximise

land value.

A maximum GFA of 1.35 million sq ft can be built

on the site, which comprises 1.8 hectares of land above the MRT station and

an adjoining underground area of 0.3 ha below Paterson Road to be developed

into an underground pedestrian mall linked to Wheelock Place.

The CapitaLand bid, which works out to $1,020 psf

of potential gross floor area, is considered bullish by most market watchers

and could spark an upward revaluation of property in the area.

The bid was also 8.8 per cent higher than the next

highest offer of $1.27 billion by Malaysia's IOI group. In all, yesterday's

tender by the Urban Redevelopment Authority drew eight bids.

CapitaLand Group president & CEO Liew Mun

Leong said that his group and SHKP have dedicated 'substantial effort to

design a mixed retail and residential development that maximises the

potential of the site and delivers our target level of return'.

The partners are committed to building an iconic

mall on the last prime site on Orchard Road that will will drastically

change the local retail scene, he said.

And as to how the future mall on the site will

fare against new attractions from the integrated resorts at Marina Bay -

which will have a significant retail component - and at Sentosa, Mr Liew has

this to say: 'The Orchard Turn project will complement the two IRs and

together, they will contribute significantly to the growth of tourist

arrivals and tourism receipts to Singapore'.

CapitaLand is vying for both IR sites.

CapitaLand Retail CEO Pua Seck Guan told BT that

the plan is to set aside 70 per cent or more of GFA at the Orchard Turn

project for retail use. The efficiency ratio - the ratio of net lettable

area to GFA - will also be high at about 68-70 per cent. This will result in

net lettable retail area of about 660,000 sq ft, making it the second

biggest mall on Orchard Road after Ngee Ann City. 'To maximise on its prime

location, a mall on the Orchard Turn site must have significant size. In

addition, we'll have good layout. All the shops will be prime units,' he

said.

There will be exits for pedestrians on three

levels - at basement two connected to Orchard MRT station, and on levels one

and two on Orchard Road and Orchard Boulevard, respectively. This will boost

space with high shopper traffic.

The mall could be spread over six to eight levels,

while the residential component will have a separate private entrance, most

likely on Orchard Boulevard. The project is expected to be over 50 storeys -

the tallest in the location.

Property consultants estimate a breakeven cost of

about $1,400 psf for the residential component. Developer sales of luxury

freehold condos like The Grange, The Boulevard Residences and The Arc @

Draycott have lately been at above $1,600 psf, said CB Richard Ellis

executive director Soon Su Lin.

Overall prices in the luxury market have risen

11.5 per cent quarter on quarter to average $1,500 psf in Q3, Ms Soon noted.

As for Orchard Turn's retail component, BT

understands that the breakeven cost could be $2,500-$2,800 psf and

CapitaLand and SHKP could be planning for net yields of 7 to 8 per cent.

This translates to a gross monthly average rent of about $17 to $22 psf for

the entire mall. This is considered high, as some swanky shopping centres in

the area are achieving $10-12 psf in average rent.

But Mr Pua of CapitaLand Retail is confident of

achieving the desired yields at the Orchard Turn mall through efficient

layout and by having mini-anchor tenants instead of big anchors.

Generally, bigger shop units pay a lower psf rent.

'Between us and SHKP, we have the retail tenancy base and network to get the

required tenants,' he said. - by Kalpana Rashiwala

SINGAPORE

BUSINESS TIMES 9 Dec 2005

Tender for Orchard Turn site: a

billion dollar question

Thirteen years ago, when the Urban Redevelopment

Authority offered a plum site above Orchard MRT Station, there was not a

single bidder. This time around, the outcome is likely to be markedly

different.

The latest Orchard Turn tender is expected to

attract 10 bids, or even more, market watchers say. Local players like

CapitaLand, City Developments, Wing Tai, Far East Organization, GuocoLand,

Wheelock Properties (Singapore), SC Global Developments, as well as foreign

parties like Indonesia's Lippo Group and even some companies which have

never before bid for a government site here, could turn up at the tender,

the observers say.

Japanese groups Mitsubishi Estate and Kajima, Shui

On group from Hong Kong and China Resources are also said to be looking at

participating in the tender, most likely in partnership with other bidders.

The big question is: what will be the top bid?

When the reserve-list site was launched for tender

in September, the minimum price was revealed as being $600 million or $443

per square foot per plot ratio.

Within days, as developer after developer declared

its interest in the plot, market watchers upped their price expectations for

the site to about $1 billion, or about $740 psf per plot ratio.

On the back of strong investment sentiment in the

Singapore property market especially among foreign investors, price

expectations for the site have continued to escalate.

Most market watchers now expect the top bids for

the 99-year leasehold site to come in above $1 billion. It's just a matter

of how much above $1 billion.

A few weeks ago, a price tag of $1.5 billion,

which works out to $1,111 psf per plot ratio, was being suggested. At this

price, the breakeven cost for the retail mall component on this site could

be about $2,900 psf.

Some analysts could argue this is still viable,

considering that Macquarie MEAG Prime Reit has valued its retail space at

Wisma Atria next to Orchard Turn at $4,810 psf. However, seasoned retail

players say the two sites are not quite comparable. For one, the retail

component at Orchard Turn will be much larger. It has to be at least 40 per

cent of the 1.35 million sq ft maximum gross floor area. This works out to

net lettable retail space of about 350,000 sq ft - almost three times

Macquarie MEAG Prime Reit's 121,181 sq ft retail space at Wisma.

As well, the Reit's Wisma property does not

include Isetan's department store in the building, and this exclusion has

also boosted the average per square foot monthly retail rent from the

property for the Reit. Anchor tenants like department stores usually pay

lower per square foot rents than smaller specialty shop units.

The $25-27 psf gross monthly average retail rent

from Wisma indicated in the Reit's prospectus issued earlier this year works

out to a net yield of at least 5 per cent based on the $4,810 psf valuation.

But a new investor in the Orchard Turn is likely

to demand at least 8 per cent net yield for the retail space, factoring in

its profit, according to seasoned retail players. Using the $2,900 psf

retail breakeven cost for Orchard Turn based on a $1,111 psf ppr or $1.5

billion land bid, the gross monthly rent will have to be about $22 psf. On

an entire-mall basis, especially for a much bigger mall, this may be too

high even after factoring in steady rental increases in the next few years,

say observers.

Of course, developers bidding for the Orchard Turn

site are eyeing not only the retail component, but also what they intend to

do with the rest of the space - which can be put to office, hotel or

residential uses.

Most of the bidders are looking at residential use

besides the mandatory retail component, given the resilience of the luxury

residential sector, fuelled by strong foreign interest.

Indeed those waiting to launch upmarket condos in

the Orchard belt, most notably CityDev for St Regis Residences, will clearly

be looking at the top bid for tomorrow's tender. The higher the top bid for

Orchard Turn, the higher the price at which they can peg values for their

own condo projects.

The same applies to other big property owners in

the area. That should give them some comfort if they bid but fail to clinch

the Orchard Turn plot. - by Kalpana Rashiwala

SINGAPORE

BUSINESS TIMES 7 December 2005

Orchard Turn could yield $545m profit

Merrill Lynch estimates would mean $272m gain for

CapitaLand and SHKP

Capitaland stands to gain $272 million in

development profits, or $0.10 a share, after winning a joint bid for the

prized Orchard Turn site last week, according to a recent report from

Merrill Lynch.

|

| New on the block: The Orchard

Turn site will be developed into a shopping mall and 127 high-end

residential condominiums |

CapitaLand's 50:50 joint venture with Hong Kong's

Sun Hung Kai Properties paid $1.38 billion for the site, or $1,020 per

square foot of permitted gross floor area, 10 per cent higher than the next

highest bidder.

The pair will develop the mixed-use property to

include a shopping mall with about 680,000 square feet of retail space as

well as 127 high-end residential condominiums of about 2,500 sq ft each.

Merrill's report estimated the total cost of the

project, including the cost of the land, development and interest, to be

$2.18 billion.

It estimated the capital value of the completed

project to be $2.86 billion, the average of a high estimate of $3.08 billion

and a low estimate of $2.64 billion.

The average post-tax profit on the project is

estimated at $545 million, with CapitaLand taking a 50 per cent share.

Merrill believes the shopping centre will be ready

by end 2008 and the residential tower by 2009.

The CapitaMall Trust could potentially be used as

the vehicle to own the shopping mall in 2009, it said.

Merrill raised its 12-month price objective for

CapitaLand stock to $3.58 per share, up from $3.50 and a premium to its

revalued net asset value (RNAV) of $3.08 per share.

Separately, another Merrill report released

yesterday noted that City Development's 15 per cent equity stake in Las

Vegas Sands' bid for the Marina Bay integrated resorts tender might be worth

$0.21 per share, if their bid was successful.

The report on CityDev upgraded the stock from a

'sell' to a 'neutral', arguing that the partnership with Sands represented a

key near-term catalyst for the stock that had been absent before.

Merrill ranked the Sands-CityDev bid as

the front runner for the tender, due to its experience in developing

resorts, the casino business and the meetings, incentives, conventions and

exhibitions (MICE) industry, as well as CityDev's knowledge of Singapore.

Before the partnership, Sands was viewed

as a strong contender but lacking a local partner to provide political

advantage.

CapitaLand's stock closed at a high of

$3.42 yesterday, while City Development's stock closed at $8.75, the same as

last Friday's close. - by

Matthew Phang SINGAPORE

BUSINESS TIMES 20 Dec 2005 - by Kalpana Rashiwala

SINGAPORE

BUSINESS TIMES 28 Oct 2004

Orchard Rd's tallest condo ready to

move

Owners of Orchard Boulevard's tallest up-market

condominium, The Boulevard Residence, are about to start living the high

life. Tomorrow, the owners of 46 units will be able to move into their new

homes in the Cuscaden Walk development.

The Boulevard Residence is a joint venture between

GuocoLand Group and niche market developer SC Global Developments. Its

apartments range from three-bedroom standard units to super-penthouses.

Touted as one of Singapore's most expensive

developments when it was launched in 2003, the apartments are priced at an

average of $1,500 per square foot. Prices for the 42 standard units of about

2,000 sq ft each start from $2.81 million.

The 36-storey building features four penthouses,

two of which are super-penthouses. It is understood that these could go for

at least $10 million each.

Facilities include swimming and wading pools, a

barbeque area and function rooms. Each residence carries with it lifetime

membership at The Club at Four Seasons.

Elsewhere, The Mountbatten Regency, a 13-unit

apartment, is being launched tomorrow.

Prices for the three-bedroom units and three

penthouses start from $450 per square foot. Foreigners are permitted to buy.

Construction of the Katong block, which will

include a swimming pool and barbeque pit, starts next month and is intended

to be completed in early 2007. - Published 15 Apr 2005

SINGAPORE

BUSINESS TIMES

HISTORICAL

Orchard/Scotts properties need more

incentives to redevelop

2004: Building owners in the

prime Orchard/Scotts roads shopping belt on the whole could generate only

about 7 per cent additional gross floor area (GFA) if they were to tap the

maximum development potential allowed under the current Master Plan for their

sites, Jones Lang LaSalle estimates in a recent study.

This doesn't provide sufficient incentive for

building owners in the area to redevelop their properties and could have

implications for plans to rejuvenate Singapore's prime shopping belt - said to

be spearheaded by Urban Redevelopment Authority and Singapore Tourism Board -

to help the area keep up with the rise of shopping Meccas in the region.

JLL studied more than 40 properties on Orchard Road

and part of the adjoining Scotts Road - up to Far East Plaza and the Thong

Teck Building. It excluded the Thai Embassy site, which is sovereign Thai soil

and plans for which have yet to be firmed up.

To build the additional space, developers would most

likely have to redevelop their properties, especially in the case of older

buildings, or do additions and alterations.

However, an enhancement potential of about 7 per

cent may not provide enough incentive for most building owners to consider

redeveloping their properties, says JLL Singapore managing director Yu Lai

Boon.

Building owners may need to be offered sweeteners

including exemption from paying development charges (DC) to spur them to

redevelop their properties, Dr Yu suggests.

'It's an inescapable fact that the single most

important factor in driving private-sector redevelopment is still economic

gains, especially in view of the huge capital outlay required,' he said.

'Based on our potential GFA enhancement calculations

and the existing ownership structure in some cases - some are strata-titled

properties with many owners - most building owners in the Orchard/Scotts roads

area currently don't have a strong enough economic inducement to undergo

redevelopment.'

A major developer agrees. 'Some buildings on Orchard

Road have either reached or are very close to the maximum permissible gross

floor area.

In some cases, existing GFA already exceeds what's

allowed under the current Master Plan,' the developer said.

'In a best-case scenario, URA will allow you to keep

your existing GFA if you redevelop. So there's not much incentive from that

perspective,' he added.

Another developer pointed also to other constraints

that property owners face.

Many properties on Orchard Road are safeguarded for

hotel use and cannot be redeveloped to other uses their owners might find more

profitable, he said.

And a further problem is that many properties are

strata-titled with fragmented ownership, making redevelopment a tough

proposition as it will require the consent of many parties.

Among the incentives that JLL's Dr Yu suggests to

spur a rejuvenation of Singapore's key shopping belt are raising plot ratios

and giving owners concessions such as exemptions or rebates on property tax

during the development period.

But he acknowledged the downside of an

across-the-board increase in plot ratios. This could spur redevelopment that

could trigger a supply deluge on Orchard Road causing an 'over-shopped'

situation again as in the 1990s, brought about by the opening of huge projects

like Ngee Ann City and Shaw House.

A developer said: 'The authorities are already very

concerned about the traffic volume on Orchard Road. Intensifying plot ratios

will worsen the problem.'

Instead of providing incentives to spur

redevelopment throughout Orchard/Scotts roads, the authorities could provide

sweeteners for specific buildings - perhaps the older ones - to induce their

owners to redevelop.

Ultimately, what sort of incentives the government

dishes out will depend on how important the rejuvenation of Orchard Road is as

a national objective, market watchers say.

Property market watchers note that back in the

1990s, when URA wanted to transform the old industrial sites in the Hillview/Upper

Bukit Timah area into a residential belt, it awarded bonus plot ratios to

landowners of the industrial sites to convert their properties to residential

use without having to pay DC - provided the industrial activities on the sites

were stopped by stipulated deadlines.

When contacted, a URA spokeswoman said that in

meetings with Orchard Road's business community to seek their feedback and

ideas on plans for the area, 'the business community has given us their

feedback and various redevelopment incentives for consideration'.

'We will take these feedback and suggestions into

consideration in our review with other agencies,' she said.

'We are currently in a preliminary stage of

discussion with these agencies, including STB, and will provide the details

when they are finalised.' - by Kalpana Rashiwala

SINGAPORE

BUSINESS TIMES 28 Oct 2004