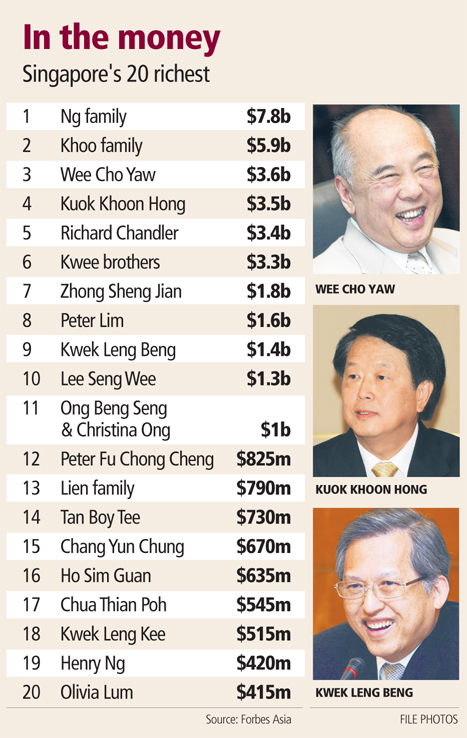

Singapore's richest get 17% wealthier

this year

The Republic's wealthiest are enjoying

better fortunes this year, in tandem with the local economy's improving

performance, according to data collected by Forbes Asia.

The

publication, which tracks the wealth of Singapore's 40 richest people, said

their total net worth this year is US$45.7 billion (S$62.4 billion) - up 17

per cent from last year's US$39 billion.

Of the lot, 26 tycoons saw their wealth

increase this year, while seven suffered declines.

The family of the late Ng Teng Fong - who

died in February - topped the list with a combined net worth of US$7.8

billion.

Still, they were among the few whose

wealth declined - from US$8 billion the year before, as the value of their

shareholding in Hong Kong developer Tsim Sha Tsui Properties fell 18 per

cent over the past year, on fears of a slowdown in China. Forbes Asia said

the biggest chunk of the family's wealth continues to come from its

privately held Singapore property development company Far East Organization.

Meanwhile, the family of the late Khoo

Teck Puat (who died in 2004) is second, with a total net worth of US$5.9

billion, up from US$5.5 billion in 2009. The family - the 14 children who

inherited the fortune - sold its stake in Standard Chartered Bank to Temasek

for US$4 billion in 2004. Its main asset is the Goodwood Group of hotels and

a minor stake in the Ng family's Orchard Parade Holdings.

United Overseas Bank chairman Wee Cho Yaw

moves up to third from fifth place last year, adding US$500 million to his

wealth. Wilmar International's chairman Kuok Khoon Hong holds steady in

fourth place with a net worth of US$3.5 billion. He's expected to add more

to his fortunes, however, with the recently inked US$1.5 billion deal to buy

Sucrogen (the largest raw sugar producer in Australia and maker of fuel

ethanol) expected to be completed by September.

There were also some notable entrants to

the list this year. Making a debut, at No 5, is New Zealand- born social

entrepreneur Richard Chandler, who became a Singapore resident in 2008. The

52-year-old heads RF Chandler (a fund which invests in emerging markets) and

has also set aside US$100 million for educational causes in the developing

world.

The other newcomers to the top-40 list

this year are Otto Marine's Yaw Chee Siew, who comes in at No 22, with a

total net worth of US$385 million, and ARA Asset Management's John Lim at No

38, with US$202 million.

And returning to the list, after a

two-year absence, is Osim International's Ron Sim. He re-enters at No 28,

with a net worth of US$301 million, after having written off his investment

in loss-making Brookstone in 2008.

Hotelier Ong Beng Seng and his wife

Christina Ong are also first-time billionaires - with a combined wealth of

US$1 billion, up from US$700 million last year, thanks to the better

performance of their hotel and retailing empire. Between them, they control

Hotel Properties, UK fashion house Mulberry, the Club 21 retail chain and

the Como Group.

Meanwhile, among those suffering a

decline in fortunes is Yanlord Land Group's Zhong Sheng Jian, who made his

fortune from China's property boom over the last two decades, and was named

'Businessman of the Year' at BT's Singapore Business Awards 2010. His net

worth fell 10 per cent from the year before, to US$1.8 billion this year, as

Yanlord's stock price fell due to worries about the Chinese government's

efforts to curb real estate prices.

The full list of Singapore's richest can

be found in the August issue of Forbes Asia.

The magazine said it compiled the list by

calculating the individuals' public net worth using share prices and

exchange rates as at July 14. For privately held wealth, it estimated what

they would be worth if they were public.

The publication also said that this

ranking, unlike the Forbes billionaire list, includes numerous family assets

shared by individuals and their children, grandchildren and siblings. Where

family assets are held by extended families, such as the Kwek cousins (that

is, Kwek Leng Beng, Kwek Leng Kee and Kwek Leng Peck), Forbes Asia split

them into separate entries. - 2010

July 30 BUSINESS

TIMES

Millionaire Households on the Rise

Singapore stands out, with such households rising by 35% last year

The rebound in

asset markets last year has buoyed the global wealth market by 11.5 per cent

to US$111.5 trillion, with Singapore making its mark yet again as the market

with the highest growth in millionaire households.

Singapore's millionaire households rose

35 per cent in 2009, says the Boston Consulting Group (BCG) in its latest

Global Wealth Report. Singapore also had the highest concentration of

millionaire households at 11.4 per cent, followed by Hong Kong at 8.8 per

cent.

These comprise households with at least

US$1 million in assets under management (AUM). BCG's data cover liquid

assets and exclude property.

But while asset growth may look robust,

there are sobering aspects to the business. Wealth managers' average

profitability fell to 22 basis points, from 27 basis points in 2008.

The survey of 114 wealth-management

institutions worldwide found that revenues fell despite the fact that assets

under management of the firms surveyed increased by an average of 14.3 per

cent. Revenue margins - measured by return on assets - slipped by an average

12 basis points to 83 basis points. While managers' costs fell, it was not

enough to offset the fall in revenues. Cost-to-income ratio hence rose to

74.4 per cent from 72.3 per cent previously.

BCG says in its report: 'The recovery in

AUM masks significant and lasting challenges to the industry's

profitability. In most regions, wealth managers face the prospect of

persistently low revenues and revenue margins, along with stubbornly high

costs.'

It adds: 'Wealth managers must not allow

the surge of global wealth to lead to a sense of complacency or a lack of

urgency when it comes to addressing (the) challenges. They must focus on

quality, precision and service delivery - as well as on truly understanding

the client.'

The average cost-to-income ratio in Asia

actually rose 24 percentage points between 2007 and 2009. This is a greater

magnitude than the global average increase of five percentage points in the

same period.

What's more, global assets in 2009

remained in a state of flux. This was driven, says BCG, by a couple of

trends: Clients moved assets out of global institutions, spreading them

among multiple banks. And, regulatory pressure led to a repatriation of

assets from offshore centres to clients' home markets.

Still, net new assets - the difference

between asset inflows and outflows excluding market performance - rose by an

average of just 1.5 per cent globally. Asia-Pacific saw net new money of 6.2

per cent.

The outlook for Asia and the emerging

markets, however, remains bright. BCG expects global wealth to grow at an

annual clip of nearly 6 per cent from end-2009 to 2014. Asia's growth is

expected to be nearly twice the global rate.

BCG partner Tjun Tang, who also

co-authored the report, said: 'There is no doubt that wealth will continue

to grow faster in emerging markets, fuelled by strong economic growth. We

expect Asia-Pacific, including Japan, to grow at nearly twice the global

rate, raising its share of global wealth from 15 per cent in 2009 to almost

20 per cent in 2014.'

Switzerland remained the largest offshore

wealth centre with US$2 trillion or 27 per cent of global offshore wealth.

BCG lists Singapore and Hong Kong's combined share at US$700 billion or

about 9.4 per cent of total offshore AUM of US$7.4 trillion.

In Asia and Europe, market values and

increased savings played an equal part in the AUM rise. In the United

States, market values accounted for 70 per cent of the rise in AUM. While

Europe remained the largest wealth region with US$37 trillion in AUM, the

largest absolute gain in wealth was seen in North America. Asia registered

the greatest percentage gain in wealth of 22 per cent to US$3.1 trillion.

Clients' asset allocation remained fairly

conservative in 2009. Globally, allocations to cash rose declined from 51

per cent in 2008 to 48 per cent last year. But the latter is still higher

than the 2007 cash allocation of 44 per cent.

Equities' share was 30 per cent. Here

lies part of the reason for wealth managers' lower margins as clients still

preferred simpler products. This is in addition to the pressure of fewer

transactions and tougher price negotiations.

Tongjai Thanachanan, a core member of

BCG's South-east Asia asset and wealth management practice, said: 'Investors

have started moving assets out of safe havens, but they still have a lot of

wealth parked in basic, low-margin products.

'Their asset allocations tend to be more

conservative than their actual risk profiles. In addition, the use of

discretionary mandates is down, as investors remain wary of signing over

control of their wealth.' -

2010 June 12

BUSINESS TIMES

Two new faces in Singapore billionaire list

Singapore now has seven US-dollar

billionaires, up from five last year, according to the latest list of the 40

richest people here published by Forbes.

But the combined net worth of Singapore's

40 most affluent people stayed unchanged at US$32 billion, as some real

estate tycoons here saw their fortunes dwindle with falling property stocks.

Both new entrants to the billionaire

league are shareholders of Singapore-listed palm oil giant Wilmar

International. As the share price of Wilmar soared 30 per cent over the past

year, their fortunes skyrocketed.

A stronger Sing dollar also helped. Over

the year since the previous list was compiled, the Sing dollar gained 9.1

per cent against the US dollar.

Kuok Khoon Hong, 59, Wilmar's chairman

and chief executive, saw his net worth rise to US$1.3 billion from US$960

million a year ago, propelling him into fifth place on this year's Singapore

rich list, up from No 6 last year.

He overtook Kwek Leng Beng, executive

chairman of property group City Developments, who together with his family

is estimated to be worth US$1.2 billion, up from US$1.1 billion last year.

Former remisier Peter Lim, 55, who owns

just under 5 per cent of Wilmar, according to Forbes Asia magazine, stayed

at No 7 on the list, but his wealth shot up to US$1.1 billion from US$830

million a year earlier.

Property magnate Ng Teng Fong, 80, and

his family, who control the privately held Far East Organization, emerged as

Singapore's richest family for the second year running. They have an

estimated combined net worth of US$7 billion, up from US$6.7 billion last

year - the result of 'a more in-depth valuation of their real estate

holdings', said Forbes.

The family of late banker Khoo Teck Puat,

who died in 2004, stayed in second place. Together, they control some US$6.1

billion, including an estimated US$4 billion from the sale of their stake in

Standard Chartered Bank in 2006.

Veteran banker Wee Cho Yaw, 79-year-old

chairman of United Overseas Bank group, and his family remained in third

position, with an estimated net worth of US$3.6 billion, up from US$3.3

billion last year.

Zhong Sheng Jian - founder, chairman and

chief executive of China-based property developer Yanlord Land Group - saw

his net worth tumble US$700 million over the past year as the group's share

price fell, but still managed to retain his spot as the fourth richest

person in Singapore with US$1.8 billion to his name.

Of this year's top 40, four were new

entrants, including Wong Fong Fui, chairman of Boustead Singapore, an

engineering and infrastructure firm, at No 37. His wealth is valued at

US$135 million.

Vivian Chandran, the widow of Robert

Chandran - founder of marine fuel company Chemoil, who died in a helicopter

crash in January - also entered the list for the first time at No 23, with

an estimated net worth of US$240 million.

The net worth of each of the top 40 was

calculated using stock prices and exchange rates as at Aug 7, for public

holdings. The value of privately held assets were estimated based on what

they would be worth if public. Last year's estimates were based on prices

and exchange rates as at Aug 10, 2007.

- 2008 August 22 BUSINESS

TIMES

S'pore's wealthy ahead in

investible assets: report

They allocate

36% of funds to property, next to Korea, say Merrill, Capgemini

The average high net worth individual (HNWI)

in Singapore has US$4.9 million of investible assets, slightly more than the

regional and global average, the Merrill Lynch-Capgemini Asia Pacific Wealth

Report has found.

Globally, HNWIs have investible assets of

about US$3.9 million, while the regional average at end-2006 was US$3.3

million.

Singapore's wealthy allocated most of

their investible funds - 36 per cent - to real estate. This was second only

to South Korea, where the wealthy invested 42 per cent in property.

Other allocations by Singaporeans were 18

per cent cash and 26 per cent equities.

On real estate, Merrill Lynch

Asia-Pacific investment strategist Stephen Corry told reporters yesterday

the region's property cycle is 'closer to the bottom than to the top'.

A recent report by the firm found the

boom is still in its early stages and said prices do not appear excessive

relative to income. Asian property prices have also lagged global prices.

But Mr Corry said there are two

exceptions: 'High-end Hong Kong and Singapore properties are looking

expensive. I actually see good value in the mass residential side. The price

gap between high-end and lower-end property has reached unprecedented

levels.'

The Merrill Lynch-Capgemini Asia-Pacific

wealth report aims to give a detailed profile of the region's HNWIs and

their investment preferences.

The report found that Singapore has about

928 ultra HNWIs, comprising 1.39 per cent of the population.

These are people whose investible assets

exceed US$30 million, as opposed to 'ordinary' HNWIs whose qualifying

threshold is US$1 million.

The number of ultra HNWIs in the region

grew 12.2 per cent to 17,500 at end-2006, said Gregory Smith, Capgemini

Australia's vice-president for wealth management.

'We are seeing a sharp rise in the number

of ultra HNWIs,' he said. 'This is particularly evident in China, where that

country's phenomenal economic growth is reflected in a high concentration of

ultra HNWIs.'

The study found that more than 28 per

cent of the region's ultra HNWIs are in China.

In terms of the sources of Singaporeans'

wealth, 36 per cent was derived from businesses and 22 per cent inherited.

In total, wealthy Singaporeans' assets are estimated at US$320 billion,

giving them a 4 per cent share of the Asia-Pacific's total wealth pie.

About 43 per cent of HNWIs in Singapore

are aged 41 to 55 and 39 per cent aged 56 to 70. Merrill Lynch market

managing director (South Asia) Kong Eng Huat said: '(Singapore) individuals

tend to be more active investors and are continuing to build their wealth.

They are also actively planning or in the process of transferring wealth to

their beneficiaries and children.'

'Those with inherited wealth tend to have

a more complex portfolio structure and restrictions. They tend to focus on

capital preservation.'

The Merrill Lynch-Capgemini report

expects the wealthy in the region to diversify into fixed-income and

alternative investments and to increase their international exposure. At the

moment, 51 per cent of their assets are invested in the Asia-Pacific.

- 2007 October 19 SINGAPORE

BUSINESS TIMES

Ng

Teng Fong tops Singapore rich list

Elite group gets wealthier; 12 new

members break into top 40

The property boom, while churning out millionaires by the dozen, has also

sprinkled its gold-dust on the billionaires driving the market.

Riding

the wave, property tycoon Ng Teng Fong, with an estimated net worth of

US$6.7 billion, has topped the Forbes Asia 2007 Singapore Rich List, nudging

the Khoo family down to second place.

The Khoo family's fortune swelled 14 per cent to US$5.7 billion, but this

was nowhere near enough to keep pace with Mr Ng, who controls Far East

Organization and Yeo Hiap Seng. From an estimated wealth of US$4.9 billion

last year, his fortune grew a staggering 36 per cent, placing him firmly at

the top of the table.

United Overseas Bank's Wee Cho Yaw and his family came in third with an

estimated wealth of US$3.3 billion - a drop from last year's US$3.4 billion.

Occupying fourth spot was China-born property developer Zhong Sheng Jian -

now a Singapore citizen - whose wealth was estimated at US$2.5 billion.

Kwek Leng Beng of Hong Leong Group is at number five since Forbes Asia

divided up his extended family's holdings - an exercise that enabled his

cousins Kwek Leng Kee and Kwek Leng Peck, who also have stakes in the group,

to make this year's list.

The collective net worth of Singapore's 40 wealthiest increased about 14

per cent to US$32 billion. The top 10 on the list alone have a combined

worth of nearly US$23 billion, constituting an impressive 72 per cent of the

US$32 billion that the wealthiest 40 are said to possess. According to

Forbes Asia, the net collective wealth of Singapore's 40 richest could

easily dwarf that of their other South-east Asian counterparts.

The 2007 list was dominated by those in real estate, shipping and palm

oil - a clear reflection of Singapore's booming industries - while those in

the banking sector saw a slight decrease in fortune in the wake of the

recent worldwide downturn in mortgages.

The list also boasted a significant number of entrepreneurs. 'If you read

through the list, you'll see there are a lot of very highly qualified and

successful entrepreneurs here. All these individuals have been very

entrepreneurial in finding ways to make money in different industries,' said

Mr Justin Doebele, contributing editor of Forbes Asia and project editor,

Forbes Asia Rich Lists.

Some 19 of the top 40 saw a growth in their net worth this year, while

eight saw a dip in fortunes and one was unchanged. Twelve on the list were

newcomers. Among them is fourth-placed Mr Zhong, who has a 71.4 per cent

stake in Yanlord Land Group. He attributed his substantial fortune to being

able to 'understand the phase that the economy is in at any particular

time'.

Founder and CEO of main-board listed Chemoil Corporation, an established

supplier of marine bunker fuels, Robert Chandran has a net worth of US$490

million, which placed him at number 14. The Mumbai native, who pursued his

masters degree in Manila and made his first fortune in the United States,

moved to Singapore recently where he opted for citizenship. He, too, was not

on the list last year.

Another new addition to the list, at number 36, is Christina Ong, wife of

Malaysian tycoon Ong Beng Seng. Ms Ong is the managing director of Club 21,

which owns Ishop and a share in luxury brand Mulberry.

The two other women on the list are Olivia Lum, founder of water

treatment firm Hyflux, and Margaret Lien, who inherited wealth from late

banker husband Lien Ying Chow.

Forbes calculated various fortunes using stock prices and exchange rates

as at August 10, 2007. Privately-held wealth was 'estimated'. Mr Doebele

said that the spillover effects of the sub-prime mortgage crisis in the US

wouldn't change the order of the listings. 'We're looking over a 12-month

period so if they drop 10 per cent less over two weeks, that's not going to

wipe out the entire gains they've made,' he said.

The cut off for the 2007 list was also

upped to US$100 million, nearly double last year's minimum net worth of

US$55 million. Still, number 40, chairman and CEO of Creative Technology Sim

Wong Hoo, whose wealth was estimated at US$105 million, made the cut with a

cool US$5 million to spare. - SINGAPORE

BUSINESS TIMES 2007

August 24

2006 Singapore's

Richest

The richest Singaporeans are the heirs of the late Khoo Teck

Puat,

followed closely by Ng Teng Fong - both of whom made their fortunes mainly

away from the public eye. Film maker Eric Khoo, 41, youngest son of the late

Mr Khoo - who died in 2004 - is also the youngest on the list of 40 richest

Singaporeans compiled by Forbes

Asia.

One third of the people on the list amassed their

fortunes from real estate or banking, according to Forbes' first-ever

listing of the richest Singaporeans. The ranking is in US dollar terms.

Excluding Eric Khoo's sisters, there are only two

women on the list: Margaret Lien, widow of banker Lien Ying Chow, and Olivia

Lum, founder of the publicly listed water-technology company Hyflux.

Only one - Mustaq Ahmad of Mustafa Centre - made

all his money in Singapore.

Forbes said Singapore's 40 richest have a

collective net worth of US$28 billion, which is US$2 billion more than their

Malaysian counterparts and US$8 billion higher than the 40 richest Thais.

Singapore has a population of 4.3 million, while Malaysia has 25 million,

and there are almost 65 million Thais.

Forbes compiled the list by looking at

shareholdings in publicly listed companies as well as in private company

filings. A minimum net worth of US$55 million (S$86.4 million) was needed to

make the list.

The 14 Khoo children ranked first on the list with

a fortune estimated at US$5 billion after they sold a 12 per cent stake in

Standard Chartered bank in March this year for an estimated US$4 billion to

Temasek Holdings.

According to Forbes, the Khoos still have about

US$1 billion in real estate ventures including the prominent Goodwood Park

Hotel, which was delisted in 2004. Mr Khoo's daughters Mavis and Elizabeth

are involved in the hotel business.

Coming a close second on the list with US$4.9

billion is property magnate Ng Teng Fong, 78, whose Far East Organization is

the biggest private developer in Singapore. Mr Ng, who is married, with two

sons and six daughters, is seen as Singapore's most low-profile billionaire.

Ranked sixth on the list is the only

non-Singaporean, shipping magnate Chang Yun Chung, 88, who kept his Chinese

citizenship. In 1967 he founded Pacific International Lines, now the world's

19th largest shipping line. PIL is ranked No 1 among privately owned

companies in Singapore, in terms of revenue from overseas operations. Also

known in business circles by his dialect name Teo Woon Tiong, he is regarded

as the doyen of Singapore's shipping industry.

Mustaq Ahmad, who hit the headlines this week when

mentioned by the prime minister as one of the many immigrants made good in

Singapore, ranked 27th on the list with US$165 million.

India-born Mr Ahmad, whose Mustafa Centre employs

about 1,000 people to sell some 150,000 inexpensive items ranging from

spices to motor cars, told BT the ranking 'means nothing to me'. He said: 'A

person with some income who can support his family, with a reasonable place

to stay, who doesn't owe anything - to me, he's already a rich man.' Many of

the richest made their millions by exporting. The three Phua brothers, whose

US$130 million ranks them 34th, founded listed HTL International to sell

their furniture to more than 40 countries.

Youngest brother Yong Tat said 'our main asset is

HTL . . . the performance depends on the share price. I can't really say I

am very rich.' - SINGAPORE BUSINESS TIMES

August

24, 2006

Singapore's Four Richest

Singapore's four richest men - Ng Teng

Fong, Kwek Leng Beng, Lee Seng Wee and Wee Cho Yaw - have held on to their

spots in the Forbes 2006 Billionaires List. And Mittal Steel boss Lakshmi

Mittal continues his reign as the richest man in Asia.

Mr Mittal is also the world's

fifth-richest man, with a fortune estimated at US$23.5 billion - far ahead

of Singapore's richest man Ng Teng Fong with US$3.8 billion.

Other than Mr Mittal, the only Asian to

make the top Forbes top 20 worldwide is Hong Kong tycoon Li Ka-shing, who

jumped 12 places from 2005 to 10th position with US$18.8 billion.

Singapore's Mr Ng came in 174th worldwide. And he took the top spot locally

from Kwek Leng Beng, who was ranked Singapore's richest man last year.

Mr Kwek, who controls the Hong Leong

Group, including City Developments and London-listed Millennium &

Copthorne, came in second locally, with his wealth falling to US$3.6 billion

this year, from US$4 billion in 2005.

Mr Ng, who also made his fortune in

property, was worth US$2.6 billion last year. He runs the privately-held Far

East Organization, which includes listed Yeo Hiap Seng, Orchard Parade

Holdings and Hong Kong-based Sino Group. Singapore bankers Lee Seng Wee of

OCBC and Wee Cho Yaw of United Overseas Bank are said by Forbes to be worth

US$3 billion and US$2.4 billion respectively, giving them third and fourth

place locally.

The Asia Pacific is home to 115

billionaires with a collective worth of US$364 billion. Japan has the most

billionaires in the region at 27, although their net worth slid 11 per cent

from 2005. India has 23 billionaires.

Meanwhile, the sleeping giant that is

China twitched a little to increase its presence on the list from two to

eight, led by Larry Rong Zhijian, head of the Citi Pacific conglomerate,

with a fortune of US$1.7 billion.

Worldwide, Microsoft tycoon Bill Gates

remains the richest man for the 12th year running, with a personal fortune

of US$50 billion. Investor Warren Buffett again ranked second, though his

fortune fell US$2 billion to US$42 billion.

The total number of billionaires

worldwide rose by 102 to a record 793 over the past year, and their combined

wealth grew 18 per cent to US$2.6 trillion.

- by Uma Shankari SINGAPORE

BUSINESS TIMES 11 March 2006

Singapore's millionaire ranks swell to

almost 50,000

The number of

millionaires in Singapore has swelled to almost 50,000 - and we're counting

in greenbacks here.

What's

even more interesting than the 48,500 figure recorded for the Republic last

year is the increase.

According to a survey of wealthy people in 68

markets by Merrill Lynch and Capgemini for their World Wealth Report 2005,

Singapore posted the biggest worldwide jump in the number of millionaires

last year - at 22.4 per cent. The figure for the past two years was a

whopping 56 per cent. Just over one per cent of the population are now

millionaires.

The report defined the millionaires as high

net-worth individuals with financial assets of over US$1 million, excluding

their primary residential property.

The increased wealth comes courtesy of greater

trade and integration with China and high market returns, which strengthened

the local economy, the report said.

'Singapore will continue to be well positioned as

a major financial centre in the region as growth in the number of wealthy

people and their total wealth are outpacing other markets,' said Andrew

Chan, Merrill Lynch's head of global private sales in Europe, the Middle

East, Africa and the Pacific Rim. 'Singapore's robust private consumption

growth, the Government's commitment to reduce costs for businesses and

integration with China's economy remain the key economic drivers.'

Singapore was not the only beneficiary of China's

economic might. The report said that five of the top 10 places with the

highest growth in the number of high net worth individuals are in Asia or

the Asia-Pacific region. Besides Singapore, they are Hong Kong, Australia,

India and South Korea. Japan still has the highest absolute number of

prosperous people, more than 1.3 million.

The money controlled by the world's high net-worth

individuals also recorded robust growth in 2004, for a second consecutive

year, powered by GDP growth and the increase in market capitalisation.

Globally, the number of high net-worth individuals

rose 7.3 per cent to 8.3 million, with their combined wealth climbing 8.2

per cent to US$30.8 trillion.

North America has the highest number, growing by

about 10 per cent to 2.7 million. That beats Europe's 2.6 million.

Asia-Pacific still lags behind these regions in

absolute numbers, but its growth rate of 8.2 per cent - to 2.3 million

well-off individuals - was twice that of Europe's.

The report also highlighted a more elite club -

ultra-high net worth individuals - or those with at least US$30 million in

financial assets. There are 77,500 of them in the world, with 6,300 joining

their ranks last year, an 8.9 per cent increase over 2003.

On the downside, the report expects the value of

financial assets to be affected after 2004, as last year marked the highest

worldwide GDP growth in 20 years. Factors including rising inflation and

interest rates are expected to slow global growth and curb the value of

financial assets this year. Still, the report projects global high net worth

wealth growing at a compound annual rate of 6.5 per cent over the next five

years, reaching US$42.2 trillion by 2009. Asia is forecast to score a 6.9

per cent increase.

Produced annually, the World Wealth Report covers

68 countries, which account for over 98 per cent of global gross national

income and 99 per cent of the world's stock market capitalisation.-

by Alexandra Ho SINGAPORE

BUSINESS TIMES 11 June 2005

S'pore's rich forecast

to grow by over 100, 000

A

new report from independent market analyst Datamonitor has shown that the

number of wealthy individuals in Singapore has grown by over a quarter over

the last five years.

Singapore is now home to over 415,000

individuals with more than S$86,000 in onshore liquid assets.

Their investible wealth grew from $150b

in 1998 to $193b in 2003.

'Growth in Singaporean affluent wealth

has not been as marked as in some of the other Asia-Pacific countries.

However, the country continues on its way to a full economic recovery after

the global economic slowdown and the Asian economic crisis and future growth

for affluent wealth looks strong,' comments Alan Shields, Financial Analyst

at Datamonitor and author of the report.

Singapore's wealthy population is

forecast to grow by a further 29 per cent to just fewer 538,000 in 2008, and

their liquid assets are forecast to increase at a faster rate, registering a

total rise of 39 per cent over the period.

Singapore's affluents who have seen their

wealth increase in the last five years have not been immune to the global

economic slowdown.

While the amount of liquid wealth owned

by the high net worth population increased in total over the 1998-2003

period, it fluctuated significantly during this period.

In 1998, affluent individuals owned 77.5

per cent of total assets, and then peaked in 2000, when they accounted for

81.1 per cent of total retail liquid assets.

During 2003, affluent individual's wealth

increased as a proportion of total liquid wealth to 78.8 per cent as the

stock market performed better, indicating the level of affluent investors'

exposure to direct equity investment.

The fastest level of asset growth

throughout the 2003-2008 period will be amongst the richest individuals;

those with 510,307.42 or more.

These high net worth individuals are set

to get richer, with average assets increasing from $1.6m in 2003 to just

over $1.7m in 2008.

The wealth of these high net worth

individuals is set to grow at a rate of 7.7 per cent compounded annually

over the 2003-2008 period, versus 5.3 per cent for the mass affluent

segment; those with between $86,000 and $516,000. -

SINGAPORE

BUSINESS TIMES 10 Sept 2004

S'pore

millionaires have US$300b combined wealth

Their

numbers rise 3% thanks to strong equity markets

There were about 31,000 millionaires in Singapore last year, each worth

US$1 million or more. Their combined wealth of US$300 billion - up 3.4 per

cent from a year ago - is about three times the size of Singapore's GDP in

2003.

According to the 2004 World Wealth Report published this week by Merrill

Lynch and Capgemini, the number of high net worth individuals (HNWIs) in

Singapore grew 3.3 per cent from 2002, thanks to the strengthening of the

local currency and equity markets.

'After the decline in 2002, Singapore bounced back in both the number of

wealthy people and their total wealth,' said Eng Huat Kong, Merrill Lynch

Global Private Clients Market managing director for South Asia.

'The Singapore equity index was up 30 per cent in US dollar terms last

year as a result of decent market performance and a stronger Singapore

dollar.'

HNWIs are defined by Merrill Lynch as people with financial assets of at

least US$1 million, but this excludes home real estate, a market that has

also been booming in past years.

The estimates were based on information culled from various sources,

including Capgemini in-house analyses and reports, Merrill Lynch surveys and

studies and statistics pulled from global indices.

But despite a healthy recovery, Singapore lagged its Asian counterparts

in terms of growth in high net worth.

Hong Kong saw a 30 per cent leap in the number of HNWIs, while the number

of US dollar millionaires in India and China swelled 22 per cent and almost

12 per cent respectively.

China and Hong Kong's wealthy were reported to be worth US$969 billion,

with Hong Kong accounting for almost half of that wealth.

Asia's growth in wealth was the second highest globally with the region's

overall number of HNWIs jumping 8.4 per cent last year, and the region's

combined wealth increasing 10 per cent to US$6.5 trillion.

This is equal to 22.5 per cent of the global wealth of the richest.

Capgemini predicted that Asia's wealth will increase by 7.4 per cent per

annum to US$9.3 trillion by 2008, while global wealth is slated to rise to

US$41 trillion by the same year.

The report also highlighted the greater use of sophisticated

diversification strategies by HNWIs, especially in Singapore and Hong Kong,

to create more dynamic asset allocations both by asset class and geographic

allocation.

'Unsurprisingly, HNWIs in Hong Kong and Singapore made the most

geographically diverse investments, spreading their assets across the globe

from Japan to Kazakhstan to the United States,' it said.

Diversification has also led to the increased popularity of

non-correlated alternative investment assets, such as hedge funds, according

to the report.

Private clients who increased their allocation to hedge funds and

structured products received an average return of 19 per cent, the report

said.

Alternative investments aim to make money for investors regardless of

what markets are doing. Some hedge funds, for example, use short selling as

a tool when markets are falling.

Such a trend towards alternative investments has been reflected in the

Singapore hedge fund industry.

Last month, the Monetary Authority of Singapore said total hedge fund

assets under management in Singapore now exceed US$2.5 billion, with the

number of hedge funds here more than doubling since 2002.

Meanwhile, a study published earlier this month by Citibank said wealth

in Singapore has been growing for the past 10 years at an annual rate of 8

per cent.

The report, which estimated wealth here had doubled in 10 years to over

$200 billion, said that household financial assets of the Asia Four -

Singapore, Hong Kong, Taiwan and Korea - grew at a 10-year compounded annual

rate of 8.2 per cent to US$2.3 trillion.

Singaporeans are also increasingly parking their wealth with professional

institutions.

The Citibank report found that last year they handed over 46 per cent of

their wealth to professional managers, up from 37 per cent 10 years earlier.

- By Taila

Krishnakumar SINGAPORE

BUSINESS TIMES

17 June 2004

A Dow

Jones newswires in the Wall Street Journal on 30 June 2004 mentions that

Singapore's partially protected banking sector has S$204.37 billion in

deposits.

Private banking to grow 20 to 30% annually in

Asia: Citigroup

SINGAPORE : Private banking in Asia is expected to

rake in revenue growth of 10 percent a year on average, according to a

recent Pricewaterhouse Coopers survey.

But some private banks are confident of beating

the average by a wide margin.

Citigroup, for one, is looking at 20 to 30 percent

expansion annually.

Private banking is feeding on the immense wealth

generated in this region, as well as wealth outside the region flowing here.

Henk R de Glint, Deputy Managing Director,

MeesPierson, said: "I think indeed Asians are getting richer. It is

globally estimated that around one-fifth of wealth is in Asia. And I think

other things that are moving is money from the rest of the world to Asia

especially to Singapore and Hong Kong. That is an indication that the

industry is growing."

Patricia Enslow, Head of Marketing Communications,

Citigroup Private Banking, said: "Industry forecast has indicated a

growth rate of 10 percent in the region for private wealth management. We

think the industry is more likely to grow 20-30 percent well into the

foreseeable future. Our private banking business in the region has been

growing at a 20-30 percent each year for the last 5 years. It is one of the

fastest growing businesses in Citigroup."

The rapid growth in private banking is leading to

a scramble for talent.

Mr Henk R de Glint said: "We are looking

globally for 300 people, so in Asia that will be quite a number as well. We

have started our campaigns already and we continue to look for these people.

We are looking to add to the workforce."

Ms Enslow said: "Just in Singapore alone, we

have recruited 25 management associates."

The hiring got a boost recently when the Monetary

Authority set aside S$2.5 million over two years for the Financial Sector

Manpower Conversion Scheme to train people to switch into growth areas like

private banking. - CNA YAHOO!

25 June 2004

Spending Power

Singaporeans spend only about 20 per cent of their

disposable income on retail items, compared with 35 per cent for England and

30 per cent for Hong Kong.

The figure is also a few points below Malaysia's.

Disposable income is defined as household income after the deduction of

taxes and the addition of benefits.

Adding to an already bleak outlook for Singapore's

retail industry, receipts from tourists are also on the decline.

These findings were revealed at the Singapore

Retail Industry Conference 2002 yesterday in a presentation by Steve Wyatt,

South-east Asia head of the Monitor group, which does advisory business.

The findings were part of a retail industry

cluster study commissioned by Spring Singapore, the Singapore Retailers

Association (SRA) and the Singapore Tourism Board.

Pointing out that the low spending in relation to

disposable income was anomalous, Mr Wyatt said: 'Normally, after people have

attained their houses and cars, spending on retail increases. In Singapore,

it seems that retail items seem much less attractive.'

Jannie Tay, managing director of The Hour Glass

and president of SRA, said Singaporeans' spending patterns may be different

from other countries because they have a greater variety of choices. They

may prefer to spend on holidays or invest their money in equities.

But economists polled by BT said part of the

explanation could lie in the relatively high cost of housing here.

'When we consider that Singapore is a city and

that land is scarce, the figures are not absurd,' said David Cohen, an

economist with MMS International.

Agreeing, Mrs Tay said this is fuelled by

government policies that 'emphasise home ownership so that people feel they

have a stake in the country'.

However, Mr Wyatt pointed out that cities like

Hong Kong also have high property prices and yet Hongkongers spend a full 10

percentage points more of their disposable income on retail items.

His findings also revealed that the quality of

retailers here is worse than in places like Hong Kong.

The study suggested Singapore retailers could do a

lot more to improve their competitiveness. These included differentiating

strategies, beefing up market sophistication, and improving the quality of

trained retail workers.

Tharman Shanmugaratnam, Senior Minister of State

(Trade and Industry, and Education), who opened the seminar, said: 'Low

productivity is the achilles heel of the retail sector. The productivity of

our retail work force has lagged behind economies like UK, US and Hong Kong.

'Compared with US retailers, we are almost 60 per cent less productive.'

Retailers were also worried about the decline in

tourist spending. Mrs Tay said tourist arrivals were strong up until the

1980s and 'some of us could look forward to 70-80 per cent of our sales

coming from tourists'. Now, tourists only bring in about 20-30 per cent of

business, she added.

The study noted that the luxury and branded goods

retailers who relied heavily on Japanese tourists needed to reorientate

their products to suit changing visitor patterns.

More tourists are now arriving from China and

India. Noted Mr Tharman: 'Their spending habits are different from other

tourists, with greater expenditure on jewellery and electronic goods.'

The bleak retail outlook has already had some

high-profile casualties.

As Mrs Tay noted in her address: 'By 1996, CK Tang

posted a loss of $28 million. Takashimaya chalked up a net loss of $33.4

million, Seiyu experienced a net loss of $7.8 million, Yaohan Department

Store saw losses of $4.5 million and later exited the market as did Lane

Crawford which experienced a loss of $36.4 million at the end of December

1995.'

Despite these developments, retail shop space has,

in fact, increased.

Terry O'Connor, managing director of Courts, noted

'an oversupply of retail space but an undersupply of quality retail space'.

This, he said, was unproductive.

But steps are being taken to reform the retail

industry. Mr Wyatt said 22 initiatives will be implemented to improve such

areas as market knowledge and availability of consumer credit.

- by Grace Tan Singapore

Business Times 15 May 2002