|

Hong Kong

Celebrities buying in Singapore

Hong Kong movie superstar Jackie Chan and

his good friend singer/song writer Wakin Chau have again picked up a few

apartments - this time in Overseas Union Enterprise's Twin Peaks condo at

Leonie Hill Road.

Residents of Twin Peaks, at the corner of

Grange and Leonie Hill roads, will have the option of engaging hospitality

and housekeeping services from the Mandarin Orchard Singapore, which is also

part of the OUE group. Business Times understands that the

units bought by Mr Chan and Mr Chau will have views of Grange Road/ Orchard

Road.

In March last year, the duo picked up

four apartments in the freehold Centennia Suites at Kim Seng Road worth over

$10 million. In that deal, Mr Chan acquired three units - two, three and

four bedders making up an entire floor - while Mr Chau purchased a three

bedder.

The average price in the project then was

reported at about $2,000-2,100 psf. Centennia Suites is being

developed by a privately held entity of Lippo Group. The Indonesian group

also controls OUE, which is listed in Singapore.

Mr Chan also bought the former Jinriksha

Station at 1 Neil Road in late 2007 for $11 million.

Twin Peaks comprises two identical

35-storey towers with a total of 462 units, offering a mix of one, two and

three-bedroom apartments. OUE began selling units in the project in July

last year and to date more than 50 units have been sold. The highest price

achieved in the development is $3,170 psf.

The project is on a 99-year lease and

average price in the project was $2,850 per sq ft. and will be

completed around early 2014.

-- 2011 June 15 BUSINESS

TIMES

Hong Kong movie superstar Jackie Chan and his good friend

singer/songwriter Emil Chau, who were in Singapore in March 2010 for Thong

Chai Charity Night, and picked up some properties in Singapore.

The duo bought four apartments at Lippo Group’s freehold Centennia

Suites worth over $10 million.

|

CENTENNIA SUITES

Location:

100 Kim Seng Road

(District 9)

Tenure: Freehold

Expected Completion: Dec 2015

Total Units: 97

Unit Types:

2 bedroom ~ 1238 sqft

3 bedroom ~ 1755 – 1819 sq ft

4 bedroom ~ 2217 – 2303 sq ft

Penthouse ~ 3315 – 4004 sq ft

|

The four units are on the mid- to high

floors of the 36-storey condominium project, which is being built on the

former Kim Seng Plaza site, opposite Great World City and facing the

Singapore River.

Mr Chan is said to have picked up three units – two, three, and

four-bedroom apartments – making up an entire floor.

Mr Chau, who is now known as Wakin, purchased a three-bedder. The two men

visited the Centennia Suites showflat on Friday last week.

The 97-unit District 9 development, which is expected to be completed in

2013, is now almost half sold.

The average price is about $2,000-2,100 per square foot. The range of

prices achieved is $1,900 psf to nearly $2,200 psf. Lippo began selling the

project last month.

Mr Chan is no stranger to the Singapore property market. In late 2007, he

bought the former Jinriksha Station at Neil Road for $11 million.

Lippo and Mr Chan have also had business dealings before. Mr Chan used to

own a unit at Grangeford Apartments, which was sold through an en bloc sale

to Lippo’s listed arm Overseas Union Enterprise a few years ago.

Mr Chau was born in Hong Kong but lives and works in Taiwan. The singer

has a loyal fan base in Singapore. He has also acted in a few of Mr Chan’s

films, such as Mr Nice Guy and Gorgeous.

Last year, international action star Jet Li bought a Good Class Bungalow

at Binjai Rise for $19.8 million. The property has a freehold land area of

about 22,700 sq ft.

- 2010 March 25 BUSINESS

TIMES

As a result, Guess Who is

Looking for Sites?

Note:

Justin Chiu at Cheung Kong is ex Ming Pao so he knows those stars!

Cheung Kong on lookout for land sites

Hong Kong developer Cheung Kong Holdings is on the lookout for more residential

and commercial sites to buy in Singapore, says executive director Justin

Chiu.

'We are looking at a few pieces of land,' said Mr Chiu. 'The whole market

(in Singapore) is moving. I am optimistic about the future.'

Although land prices are high, Cheung Kong will 'keep looking for new

land' as it is an 'investment in (Singapore's) future', he said. He expects

private home prices here to continue climbing over the next few years.

The group, which is controlled by Hong Kong tycoon Li Ka-shing, launched

its 99-year-leasehold The Vision condo in the West Coast area earlier this

month. It has since sold 210 of the 295 homes at the project at benchmark

prices for the area.

Cheung Kong now has one yet to be launched residential project, at Upper

Thomson Road, in its portfolio.

It also has a one-third stake in the upmarket Marina Bay Suites, which is

part of the Marina Bay Financial Centre complex. During phase one, 90 units

released for sale at the 221-unit condominium were snapped up at $2,200 to

$2,500 per square feet (psf). Phase two is slated to be launched this year.

The official public launch of The Vision takes place this Friday, after

most of the units were through private previews. Discounts of 2-3 per cent

were given during these previews, said Mr Chiu. From Friday, the discount

will no longer be available.

Two- to four-bedroom units, which make up the bulk of the project, are

selling for $1,000-1,200 psf, while most of the 14 strata terrace units have

been sold for $3-3.2 million apiece.

Up next is the 99-year leasehold condo plot in Upper Thomson Road. Cheung

Kong won the plum site in November 2009 with a top bid of about $251

million, which works out to $533 psf of potential gross floor area - above

most expectations. Mr Chiu said then that the breakeven cost for the project

would be about $850 to $900 psf.

Yesterday, he said that Cheung Kong will make the best use of the site's

location opposite Singapore Island Country Club's Island Golf Course.

Planning permission is yet to be received, but Mr Chiu said that the units

will definitely be large. - 2010 March 24

BUSINESS

TIMES

NATHAN

SUITES (District 9)

Developers continue to roll out new

residential projects. TID Pte Ltd – a joint venture between Hong Leong

Group Singapore and Japan’s Mitsui Fudosan – is expected to preview the

65-unit Nathan Suites at Nathan Road, opposite the Malaysian High

Commission, within the next two weeks.

The 24-storey freehold development is

expected to be priced at about $2,100 per square foot on average. The

units, which comprise two, three and four-bedroom apartments as well as

penthouses, range from about 915 sq ft to 4,800 sq ft.

2010 March 23 BUSINESS TIMES

Location: Nathan Road

(District 9)

Tenure: Freehold

Total Units: 65

Unit Types:

2 bedroom ~ approx 900 sqft

3 bedroom ~ approx 1400 – 1800 sq ft

4 bedroom ~ approx 2000 sq ft

Penthouse ~ approx 4800 sq ft

Located at Nathan Road,

near the exclusive neighbourhood of Bishopgate, Nathan Suites comprises of

only 65 exclusive units ranging from 2 to 4 bedroom apartments.

24 storeys high with

landscape deck, basement carparks, swimming pool and communal facilities.

Designed by

internationally acclaimed Japanese architect Jun Mitsui & Associates,

Nathan Suites is located just within walking distance to the Good Class

Bungalow Zone of Bishopgate.

All Units are efficiently

designed and are skilfully orientated to overlook the verdant greenery of

Bishopgate. Each apartment will also be fitted with luxury

brand names such as Poggenpohl, Gaggenau, Laufen, etc, and are laid with

the finest quality imported marble pieces that are 600mm by 900mm sizes,

which is very rare in the market.

Home sales will continue to sizzle

Economic recovery and better job prospects will sustain demand: Experts

With first-quarter home sales rocketing to a higher-than-expected 4,446

units, property experts say that the strong sales momentum will probably

spill over into the second quarter as developers plan more sizeable

launches.

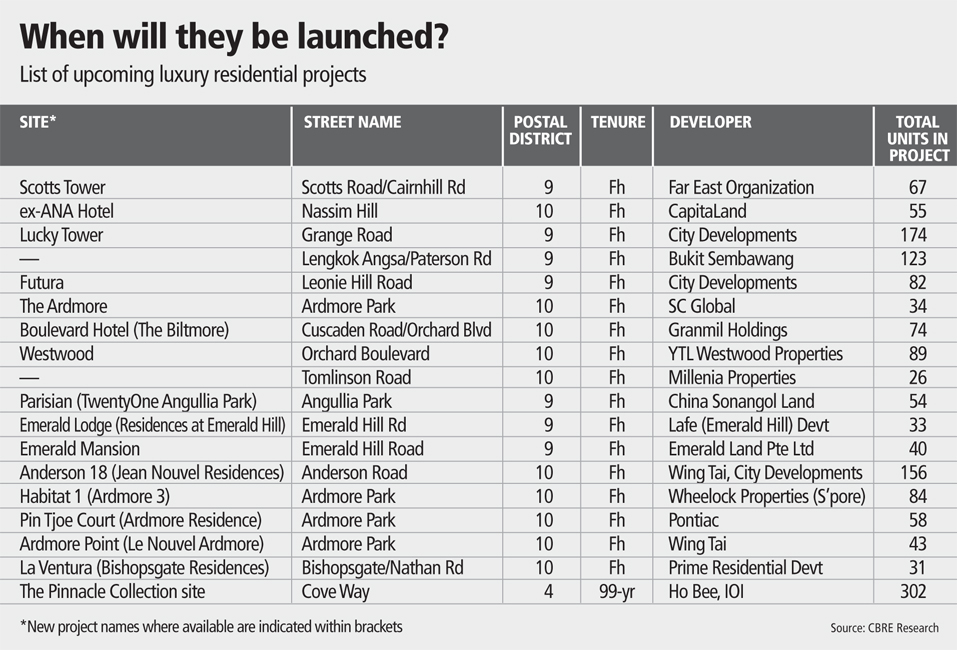

In fact, at least 12 developments have been identified by property

consultants as possible launches this quarter.

These include Far East Organization’s 361-unit Waterfront Gold at

Bedok Reservoir Road, Wing Tai Holdings’ 43-unit Le Nouvel Ardmore at

Ardmore Park and KSH Holdings’ 250-unit Cityscape@ Farrer Park.

The strong economic recovery and better employment prospects will

continue to sustain demand, Knight Frank manager of consultancy and

research Ong Kah Seng said.

This is especially so after the latest government announcement of

stellar first-quarter 13.1 per cent growth for the economy year-on-year

and its upward revision of full-year gross domestic product growth to 7

per cent to 9 per cent from the previous 4.5 per cent to 6.5 per cent,

further contributing to positive market sentiments.

CB Richard Ellis (CBRE) residential executive director Joseph Tan added

that with the coming months seeing more sizeable project launches in

varying locations, there will be enough choices to continue drawing the

interest of potential buyers.

Sales in the first quarter were dominated by units in the core central

region, where prime and higher-end properties such as those in Cairnhill

and Holland Road, or Sentosa, are located. They made up 44 per cent of

total sales, according to CBRE.

The second quarter is also likely to see similar posh launches

following a laggard performance of high-end residential properties in the

past two years, experts say.

‘The launch and sales activity outside the central region (OCR) was

buoyant in 2009 and a number of mass-market projects were launched last

year. Hence fewer sites will be launched in the OCR area,’ Mr Ong said.

However, buyers can still expect to see mid-tier and mass-market

launches this quarter, such as The Minton in Hougang Street 11 and UOL

Group’s Terrene condominium.

CBRE’s Mr Tan noted that more than 500 units of UOL Group’s

616-unit Waterbank at Dakota had been sold in the two weeks since its

preview early this month.

Ms Christine Sun, Savills Singapore’s senior manager of research and

consultancy, pointed out that buying interest had remained strong despite

recent anti-speculation measures.

‘The residential market is likely to perform as well moving forward,

especially over the next few months as developers push out new launches to

ride on the current sentiment and buyers race to lock in the lower

borrowing rates ahead of the expected interest rate revision by the second

half of this year,’ she added.

Home sales of 4,446 units in the first quarter were more than double

the 1,860 units sold in the previous quarter and 67 per cent more than

sales in the same period last year.

If the pace continues throughout the year, total sales of new homes

could be comparable to last year’s volume of 14,688 units, property

experts say.

Home hunters, however, will be pleased to note that with the

Government’s close monitoring, most experts do not expect prices to

spiral upwards rapidly.

Although Knight Frank’s Mr Ong expects to see high-end residential

properties receiving strong buying interest and enjoying a higher price

increase, any rise is likely to be ‘incremental and sustainable’.

He said: ‘The overall interest for high-end residential properties

will be underpinned by sound economic fundamentals and buyers who

carefully evaluated the investment potential of high-end residential

properties.

‘The integrated resorts can enhance the international exposure and

familiarity of Singapore, and provide further opportunities for owners and

sellers of high-end residential properties.’

Savills’ Ms Sun said prices are likely to see moderate rises only.

She expects a 10 per cent to 15 per cent increase in the high-end

market and a 5 per cent to 10 per cent increase in prices for the mid-tier

and mass markets after their strong run last year. -- Source: Sunday

Times, 25 Apr 2010

Upscale releases kick up average home

transaction to $1.78m

As

developers released more upmarket projects, the average transaction value of

private homes sold in the primary market in the first two months of this

year rose to $1.78 million per unit, a study by CB Richard Ellis shows.

This

is 37 per cent higher than the $1.3 million average price of homes sold by

developers for the whole of last year.

But

the figure for January and February 2010 is still shy of the $1.97 million

average price in the bull year of 2007, according to CBRE's analysis of URA

Realis caveats data on March 5.

Reflecting

the pattern of developers migrating to releasing higher-end projects towards

the end of last year - after kicking off the year with mass-market launches

- the priciest home in absolute dollar terms sold in the primary market

since January 2007 was transacted in November last year - a $33.41 million

junior penthouse at Far East Organization's Boulevard Vue project. The price

of the 8,051 sq ft unit works out to $4,150 psf. The unit, which occupies

the 30th and 31st levels of the 33-storey block, is believed to have been

bought by Nippecraft non-executive chairwoman Linda Wijaya Limantara and her

family. Nippecraft is part of the Asia Pulp & Paper group.

The

unit's absolute price surpassed that of the most expensive unit transacted

in the primary market in 2007, when a 19th floor unit at The Marq on

Paterson Hill sold for $31.4 million in July that year. That price equated

to $5,100 psf.

As

for last year, another high-priced primary market deal was a bungalow at

Kasara The Lake, located at Ocean Drive in Sentosa Cove, which fetched

almost $14.43 million.

In

January this year, the most expensive unit transacted in the primary market

was a fourth-floor condo unit at Marina Collection on Sentosa Cove, at $10.3

million (or about $2,200 psf). February's priciest sale was a 16th floor

unit at Urban Suites in the Cairnhill area - $10.43 million or $2,213 psf.

CBRE

executive director Li Hiaw Ho reckons it is likely that the average dollar

value of primary market transactions for the whole of this year will

generally be above last year's figure as more high-end projects are slated

for launch this year.

Agreeing,

Knight Frank chairman Tan Tiong Cheng reckons bigger units may gain appeal

again as developers roll out high-end projects this year, a trend seen

during the 2007 bull market.

'However,

a lot will depend on how rentals fare for large units,' he said.

High-end

projects primed for release this year include Seascape and The Residences at

W, both at Sentosa Cove, phase 2 of Marina Bay Suites and a project at 76

Shenton Way in the downtown area, says CBRE. In the Orchard Road area,

Ardmore III and projects on the sites of the former Anderson 18, Parisian,

Grangeford and Beverly Mai are among expected launches.

Mr

Tan also points to 'the other end of the spectrum - shoebox units could be

launched, which could drag down slightly the average absolute price per

unit' this year. However, their impact will not be significant as the number

of such units, compared with total units launched by developers, is likely

to be relatively small, he believes.

The

lowest absolute price for a unit sold by a developer in the first two months

of this year was $437,880 for a fourth-floor apartment at Suites @

Kovan in Upper Serangoon Road. The price for the 366 sq ft unit works out to

$1,196 psf.

For

the whole of last year, the smallest primary market deal was $305,860,

involving a 441 sq ft unit on the second storey of Ventura View at Rambutan

Road, off Still Road. It was sold in August last year.

Mr

Li offers another reason that the average value of homes sold by developers

this year is likely to surpass last year's figure - more 99-year leasehold

projects on recently sold Government Land Sale sites will be launched at

higher prices because of their higher land costs and location attributes

such as proximity to MRT stations.

CBRE's

study also shows that on a monthly basis, the highest average price in

dollar terms achieved by developers since January 2007 was in March 2008, at

$3.87 million. The lowest monthly figure was $761,082, in February last

year. That was around the time that developers began testing the market with

mass-market launches at attractive prices, after emerging from the darkest

days of the global financial crisis.

By

December last year, the average transaction price had risen to $2.16

million. It eased to $1.65 million in January this year before rising again

to $2.08 million last month. However, the latest numbers may change as more

caveats are lodged, analysts say.

- 2010 March 10 BUSINESS

TIMES

Prices of new luxury homes surge

Launch of prices

of new luxury residential projects in Singapore rose about 20-25 per cent

last year and could appreciate a further 10-15 per cent this year, says CB

Richard Ellis.

Rentals of completed luxury homes,

which slid 10.5 per cent in 2009, could increase 5-10 per cent this year,

according to the property consulting group.

Already, in the first two months of

this year, prices have been climbing steadily, CBRE said, citing sales of

88 units at Urban Suites at $2,500 psf on average and about 35 units at

The Laurels at $2,500-2,900 psf, although the latter features smaller

units. Both projects are in the Cairnhill area.

Other luxury projects that will be

marketed in the first half of 2010 include Ardmore 3, Nassim 8 and those

on the sites of Grangeford and Parisian, CBRE said.

The Singapore residential property

launch meanwhile continues to teem with activity in various market

segments.

At Meyer Road, Hong Leong Holdings is

releasing this week close to 60 upper-floor units at Aalto, a 27-storey

freehold condo with a total of 196 units. Prices will start from $2,000

psf.

'Absolute pricing ranges from $3.1

million for a 1,442 sq ft three-bedder on the 18th floor to $5.3 million

for a 24th level four-bedroom apartment of 1,959 sq ft,' the company said

in a statement yesterday. A handful of lower-floor units are also

available, from $1,500 psf.

The project was first launched in early 2008 and as at end-January this

year, 118 units had been sold. Aalto comprises three and four bedroom

apartments and penthouses. It is expected to receive Temporary Occupation

Permit in September this year.

Hiap Hoe is also doing an official launch of its 200-unit Waterscape At

Cavenagh this week. So far, it has sold 96 units. The average selling

price is about $1,880 psf. The seven-storey freehold condo comprises

one-to-four-bedroom apartments, and penthouses.

Later this month, Hong Leong Group could release a 202-unit project on

the former Ong Building site at 76 Shenton Way. TID Pte Ltd - a joint

venture between Hong Leong and Mitsui Fudosan - is also expected to

preview in a few weeks Nathan Suites, a 24-storey project at Nathan Road,

opposite the Malaysian High Commission. The project's 65 units comprise

two, three and four-bedroom apartments as well as penthouses.

CBRE, in its release on the luxury residential market, said that recent

sales activities point to the start of a revival in this market segment.

'It is likely that this interest in luxury homes is sustainable given the

low interest rates and improving economic environment,' the firm's

executive director, Li Hiaw Ho, said.

However, he predicts that 'we are unlikely to see runaway prices the

way we did in 2007 as homebuyers will be less impulsive and more

discerning following the latest government measures' to cool the market.

Back then, average launch prices of new luxe projects jumped from

$1,800-2,600 psf in 2006 to $2,000-4,000 psf in 2007.

Overseas buyers returned at upmarket property launches in Singapore in

Q4, as seen at Marina Bay Suites, Urban Suites, and Kasara the Lake, a

plush villa development at Sentosa Cove. This bodes well for the market

segment.

Elsewhere in Asia, prices of luxury homes in the secondary market edged

up in Beijing, Shanghai, Guangzhou and Hong Kong by 6-10 per cent in Q4

2009 over the preceding quarter while remaining largely stable in other

markets.

Singapore saw a 2.7 per cent quarter-on-quarter gain in average prime

residential price in the secondary market to $2,260 psf in the fourth

quarter. Despite strong sales, leasing demand for luxury homes remained

rather fragile in some cities, with Beijing, Guangzhou, KL and Ho Chi Minh

City posting a modest rental drop in Q4.

Leasing markets in Hong Kong, Shanghai and Bangkok began to gradually

recover, with rents for luxury homes rising by increments ranging from one

per cent in Bangkok to 6 per cent in Hong Kong.

Looking ahead, CBRE forecasts that end-users and investors may adopt a

more cautious approach in the next couple of months following the

introduction of measures that tighten lending for property in certain

markets.

- 2010 March 4 BUSINESS

TIMES

Seller's stamp duty and tighter loan limits

reintroduced in bid to discourage speculation

It

was announced that a seller's stamp duty (SSD) will be levied on those who

buy a residential property from today and sell it within a year. This is

aimed at curbing short-term speculation. Also, the Loan-to-Value (LTV) limit

on housing loans will be lowered from 90 per cent to 80 per cent.

The

SSD applies to all residential properties and residential lands, except for

HDB flats. The date of purchase for the purpose of computing the one-year

holding period shall be the option exercise date. This raises the

possibility that some speculators who have been granted options to purchase

residential properties recently but have yet to exercise them may allow

their options to lapse - and lose typically 1.25 per cent of the purchase

price - rather than face the rule change.

'True-blue

speculators or flippers may fall out and return their options to

developers,' said a market watcher. 'But specuvestors with the means of

raising funding to make progress payments and who see prospects beyond a

one-year horizon will likely continue with the purchase,' he added.

Currently,

stamp duty is levied only for the purchase of property, not its sale. SSD

will be applied at the same rate as the buyer's stamp duty - one per cent

for the first $180,000 of the consideration, 2 per cent for the next

$180,000 and 3 per cent for the balance.

The

Inland Revenue Authority of Singapore released an e-tax guide, listing more

details including exceptions on the payment of SSD - for instance housing

developers when they sell residential properties within a year of purchase,

or for an estate of a deceased person when interest in residential property

is passed to the beneficiary.

The

Real Estate Developers' Association of Singapore (Redas) said: 'The

introduction of the SSD should not impact adversely activities in the

property market. The reduced mortgage cap is also unlikely to have

significant impact on genuine buyers and investors. Lending institutions

have already been more prudent especially in the aftermath of the global

financial crisis.'

The

lower LTV ratio on housing loans applies to home buyers granted options to

purchase from today and covers all housing loans given by financial

institutions for private homes, executive condos, HUDC flats and HDB flats.

However, loans granted by the Housing Board for HDB flats will still have a

90 per cent cap as such flats are already subject to other criteria to

prevent speculation and encourage financial prudence, the government said.

-2010 February 20 BUSINESS

TIMES

2010: The year of luxury homes

Data from CB Richard Ellis (CBRE) shows

that of the 7,975 landed and non-landed homes that are likely to be launched

in 2010, more than 40 per cent of them are in Singapore's core central

region (CCR), which includes the prime Districts 9 and 10, the financial

district and Sentosa

Cove.

A total of 3,469 homes will be in the CCR.

Another 3,071 units are in the outside central region, which is a proxy for

suburban mass-market locations. The remaining 1,435 homes are in the

mid-tier rest of central region.

In contrast, most private home launches

in 2009 were in the mass market.

Another analyst commented 'The growing

acceptance of Singapore as a choice destination to live and work will fuel

prices further because property prices in Singapore are still significantly

lower than those of key gateway cites of Monaco, London, New York, Hong

Kong, Tokyo and Moscow.'

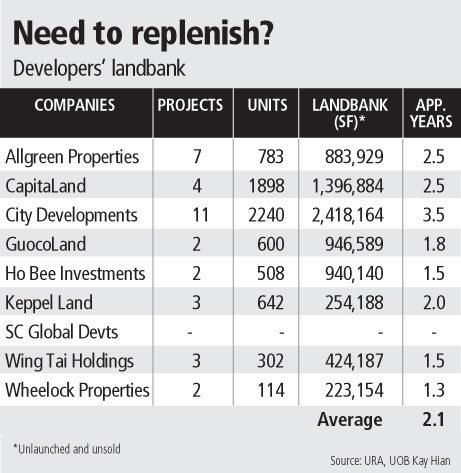

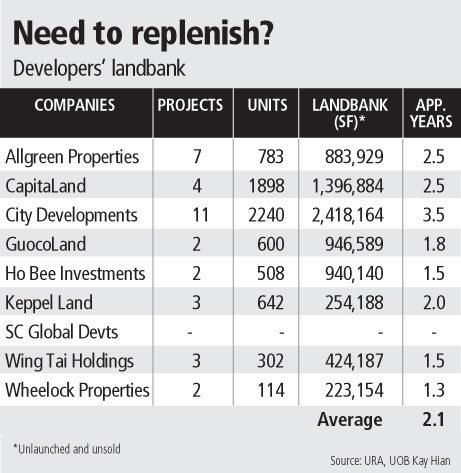

There is also a lot of speculation on the

ground about how developers will replenish their landbanks once they start

selling luxury and high-end homes once again. In 2006 and 2007, a scramble

for prime residential sites led to a booming collective sales market.

- 2010 January 14 BUSINESS

TIMES

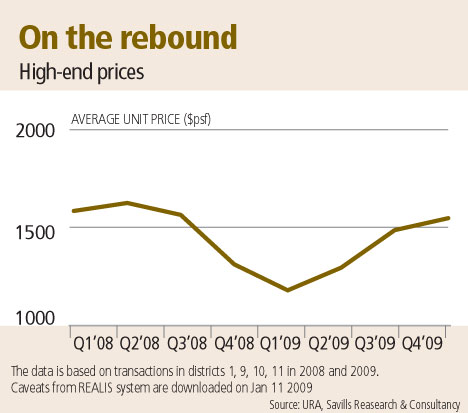

Data from Savills Singapore shows that

the prices of high-end homes on the mainland in Districts 1, 9,

10 and 11 (which include Shenton Way, Orchard, Holland, Newton and Bukit

Timah) have been climbing since Q2 2009.

The average unit price of high-end homes

fell from $1,621 per square foot (psf) in Q2 2008 to $1,174 in Q1 2009, the

property firm said. But prices have since rebounded and the average unit

price of high-end homes was $1,543 psf in Q4 2009.

Goldman Sachs yesterday raised its

forecasts for high-end property prices, and now expects high-end prices to

rise 10-15 per cent. The bank's research shows that by segments, luxury home

prices are 19 per cent below their 2007 peak, while prime and mass-market

home prices are respectively 8 per cent and 4 per cent lower than their

previous peaks.

'We expect the high-end to lead for the

better part of 2010; there is still positive carry in rental yields, as

rents hold steady even as consensus braces for a 10 per cent decline,' said

analysts Paul Lian and Rishab Bengani. And as the volume of total home sales

falls, the high-end and luxury markets are expected to make up a larger

piece of the pie.

On a yearly basis, 2009 saw the second

highest number of new private home sold. Developers sold around 14,500 new

homes last year - second only to the record take-up of 14,811 units in 2007.

But in spite of the high volume of new

sales last year, caveats lodged show that the total value of the homes sold

is only around 60 per cent of that in 2007. The lower quantum was attributed

to the dominance of mass-market and mid-tier homes that were sold in 2009,

compared to 2007 when high-end homes stole the limelight.

This is expected to change in 2010.

Analysts reckon that the take-up in 2010 will moderate to 8,000-10,000

units. But the activity is expected to move into the high-end and luxury

segments. Mr Ng estimates that the volume of high-end and luxury home sales

could climb by 50 per cent.

The year began well last week, with

property giant CapitaLand reporting that it has sold 60 apartments in the

165-unit Urban Suites condominium in the Cairnhill area, at prices ranging

from $2,400 to $2,700 psf.

FAST

FACTS:

Urban

Suites in Cairnhill

|

|

| CapitaLand

has sold 60 apartments in the 165-unit Urban Suites condominium in

the Cairnhill area, at prices ranging from $2,400 to $2,700 psf.

CapitaLand started preview sales

in Singapore for phase one of Urban Suites - on the former Char Yong

Gardens site in Hullet Road - just before Christmas. Sixty units

were released in phase one and sold to buyers prepared to purchase

more than one.

CapitaLand, which is developing

the project with Wachovia Development Corporation, plans to launch

the second phase, comprising about 50 units, in Jakarta during

mid-January 2010.

At Urban Suites,

about two-thirds of the buyers are foreigners from countries

including China, Australia and Canada. Most buyers bought two units,

CapitaLand said.

It gave a one per

cent discount to buyers who picked up more than one unit. Buyers

have a choice of two, three and four-bedroom apartments as well as

duplex and triplex penthouses. The units range from 1,044 sq ft to

4,715 sq ft.

Analysts say

CapitaLand can be expected to raise prices for subsequent phases. |

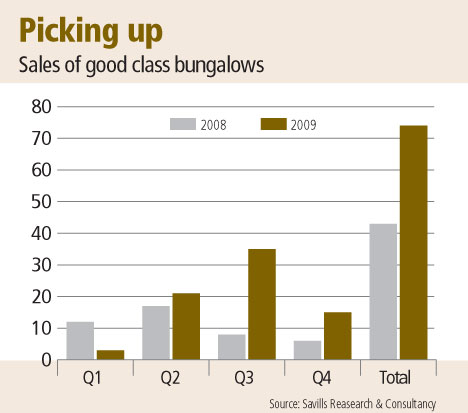

In line with the rising interest in

luxury homes, sales of good class bungalows (GCBs) also picked up in 2009.

According to CB Richard Ellis, the

average price on a psf basis reached a high of $826 last year, up from $820

in 2008 and $681 in 2007.

And transaction volumes have also started

picking up.

Data from Savills Singapore shows that 74

GCBs worth a total of $1.3 billion changed hands in 2009. This was a up from

43 GCBs and $745.7 million in 2008.

Most of the transactions last year took

place in the second half of the year - 35 GCBs were sold in Q3 and another

15 were sold in Q4 2009.

'A lot of people jumped into the GCB

bandwagon from April last year,' said Savills Singapore's director of

investment sales and prestige homes Steven Ming. 'People sidelined

themselves from the GCB market in 2008 in anticipation of a further slowdown

in the economy. So there was a backlog of demand.'

Sales were also boosted by a low interest

rate environment.

For 2010, Mr Ming expects a slight drop

in the number of GCB transactions, and estimates that 60-80 bungalows will

be sold: 'We are expecting volumes to slow in 2010 because those investors

who wanted to buy in the last two years would have bought last year.'

As for prices, no big surges are expected

either, with Mr Ming predicting at most a 5-10 per cent climb for the GCB

market in 2010. - 2010 January 14 BUSINESS

TIMES

Singapore's Top Developers

Leong Group, Far East Organization and

Frasers Centrepoint have been the most active companies on the local

property scene this year, making their mark in the number and value of homes

sold.

Together, the three developers are likely

to have raked in more than $6 billion from selling more than 5,000 private

homes - mostly from mass-market and mid-tier sites.

The data comes from a quick poll of

several developers. To highlight, not all figures are exact - there is

double-counting of sales in some cases because of joint venture projects.

Nevertheless, Hong Leong, Far East and

Frasers Centrepoint emerged clear leaders. As at Tuesday this week, entities

linked to Hong Leong - City Developments (CDL), Hong Leong Holdings and TID

- had sold 2,122 units, valued at $2.39 billion.

CDL alone moved 1,500 homes worth $1.86

billion, from launches including The Arte, Livia and Hundred Trees. Hong

Leong Holdings sold 325 units, while TID sold 297. Sales from a joint

venture project The Gale are included in figures for both CDL and Hong Leong

Holdings.

Far East commanded a sizeable share of

the market with 1,932 homes sold, valued at more than $2.34 billion. The

developer launched 11 projects this year, and the five that brought in the

highest revenue are Mi Casa, Vista Residences, Cyan, Waterfront Waves and

Silversea.

But included in figures from Far East are

sales from tie-ups with Orchard Parade Holdings and Wing Tai (111 units from

Floridian) and with Frasers Centrepoint (225 units from Waterfront Key and

222 units from Waterfront Waves).

Frasers Centrepoint itself has also been

a big winner, moving 1,852 units worth $2.17 billion. These came from

projects such as Martin Place Residences, Caspian, 8@Woodleigh and

Woodsville 28.

Figures from Frasers Centrepoint also

take into account sales from Waterfront Key and Waterfront Waves.

Coming behind Hong Leong, Far East and

Frasers Centrepoint is UOL, which sold a respectable 1,009 homes for $1.2

billion, from Breeze by the East, Meadows@Peirce, Nassim Park Residences and

Double Bay Residences.

CapitaLand sold 535 homes in Singapore

valued at close to $1 billion. Keppel Land sold close to 380 homes, also for

close to $1 billion. -

2009 December 18 BUSINESS

TIMES

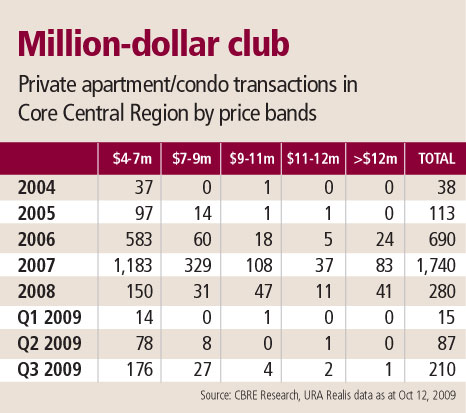

Luxury apartment sector feels the rush

Luxury apartment deals picked up in the second and third quarters of this

year as a more cheerful mood spread to the upper realms of the private

residential market.

CBRE studied caveats data for condo and

apartment deals in the Core Central Region, which includes the prime

districts 9, 10 and 11; the financial district; and the HarbourFront and

Sentosa Cove locations. The transactions include both primary and secondary

market transactions but exclude collective sales.

Developers report a pick-up in sales of

luxury apartments to both Singaporeans and foreigners.

Wheelock Properties (Singapore) CEO

David Lawrence says: 'A lot of foreigners talk to us about buying quality

property assets in Singapore. They include high-net-worth (HNW) Indians

and Chinese who are thinking of becoming Singapore permanent residents and

wish to move their families here.'

Savills Singapore managing director also says the Republic has been a beneficiary of wealthy Asians

from places like China, Malaysia and India coming out again to buy luxury

properties with renewed confidence upon sensing that the worst is over in

the overall global economy.

'A lot of them see Singapore as a safe

place to park their family and money,' he added.

The thinking in property circles is

that foreign buying will strengthen further when Singapore's two

integrated resorts (IRs) open next year. And this should translate to

stronger demand for luxury apartments.

CBRE's data showed that about 86 per

cent or 268 of the 312 units sold at above $4 million in the first nine

months of 2009 were in the 'above $4 million to $7 million range'.

They included developer sales in

projects like Volari at Balmoral Road, Residences@Killiney, One

Devonshire, Latitude at Jalan Mutiara, Madison Residences in Bukit Timah,

and The Orchard Residences. This segment saw the biggest recovery in

transaction volume over full-year 2008.

A total of 35 caveats were lodged for

properties that cost between $7 million and $9 million in the first nine

months of this year. The transactions, which were mostly in Q3, include

The Hamilton Scotts and The Orchard Residences in the primary market

(developer sales), and Ardmore Park, St Regis Residences and Scotts

Highpark in the secondary market.

There was a caveat lodged for a unit at

Nassim Park Residences that cost nearly $13.3 million in July and two in

August (at about $9.6 million and $9.8 million), based on URA Realis

caveats data as at Oct 12.

However, Business Times understands

that since then, two more units were sold in the development in September,

followed by a further two so far this month.

The four units were sold at prices

ranging from $9.6 million to $14 million, or from about $2,850 per square

foot to $3,480 psf.

Business Times understands there have

been close to a dozen transactions at Nassim Park Residences since

mid-year. However, buyers of some units have yet to lodge caveats.

- 2009 October 15 BUSINESS

TIMES

High-end properties feel the buzz too

Prices breach $3,000 psf, speculators

on the prowl; analysts advise restraint

The high-end property market is starting

to soak up the sunshine again.

Developers of some luxury residential

projects have reported a slight pick-up in sales since May. The Orchard

Residences, The Hamilton Scotts and Boulevard Vue have seen units sold at

above $2,500 psf; in the case of The Orchard Residences, there have been a

few units transacted at more than $3,000 psf.

In the secondary market, a unit at

Ardmore Park is said to have changed hands for around $2,500 psf recently.

Prices have also breached the $2,000 psf

mark again for The Sail @ Marina Bay, where transacted prices are said to

have appreciated by $100 psf a week in the past three weeks.

The speculators are back, too. 'We hear

of people trading options again in some secondary market projects like The

Sail and Rivergate. That is, someone buys a unit and before the two-week

option exercise period is over, sells it to another person,' a market

watcher said.

In the primary market, five units have

been sold at The Orchard Residences in the past few weeks. A spokeswoman for

Orchard Turn Developments, which is building the 99-year leasehold condo,

confirmed this when contacted by BT. 'We've recently sold units at prices

ranging from $2,700 psf for a 10th floor unit to $3,300 psf for an apartment

on level 33. We've seen interest from both locals and foreigners at prices

similar to what we sold when we first began to sell around March/April

2007,' she said.

A stone's throw away at Cuscaden Walk,

Far East Organization sold an apartment last month at Boulevard Vue for

$2,600 psf or nearly $12 million. The eighth-floor unit was acquired by a

Singapore permanent resident on normal progress payment scheme. Far East's

chief operating officer of property sales Chia Boon Kuah told BT the unit

would have been priced around $3,800 psf in first-half last year when the

group first started selling the posh 33-storey freehold project.

Added Mr Chia: 'We're seeing more

inquiries across the full range of our products, including landed homes,

over the past few weeks. In terms of volume of transactions, we're now

seeing 3-5 times the level in the December/January period. So in a typical

week - without new launches - we're now selling about 40 units compared with

10 in December/January,' he added.

This weekend, Far East is launching its

ad campaign for Miro, comprising freehold loft units at Lincoln Road. Prices

range from $1,400 to $1,600 psf. The group has also been selling Dalla Vale,

a freehold cluster semi-detached and bungalow project at Springleaf Avenue

priced from $650 psf.

At Scotts Road, Hayden Properties this

week sold a 2,756 sq ft apartment at Hamilton Scotts for $2,600 psf or about

$7 million to a Singaporean buyer on normal progress payment terms. The

price is about 20 per cent lower than the $3,200 psf the unit would have

cost in August last year, when Hayden sold the initial five units in the

project, says the company's director Leny Suparman.

'We started getting more inquiries from

April and therefore we were more inclined to revise our prices. Buyers have

become more confident about the market lately because of the stockmarket

rally and positive news from all fronts. People don't want to miss out on

good opportunities,' she added.

In the secondary market too, a couple of

two-bedroom units at The Sail @ Marina Bay were

transacted recently at above $2,000 psf. A bay-facing unit above the 50th

level fetched $2,400 psf while another unit slightly above the 15th level

sold for $2,200 psf. Also, a one-bedder on the 20th floor changed hands at

$1,700 psf.

Knight Frank director Nicholas Mak

pointed out that the last time the market saw transactions above $3,000 psf

was late last year. 'Across Asia, the stockmarket rally has improved

investors' confidence and this has spilled over to the property market.

However, there are factors that could potentially cut away the legs of this

rally. Falling rents is one of them.'

DTZ executive director Ong Choon Fah

noted that the latest price gains come after substantial declines. By Q1

this year, luxury home prices had fallen about 30-40 per cent from the 2007

peak levels.

'Many perceive the worst is over and the

downside risk is manageable. There's also been a subtle change in attitude

towards real estate. People now realise that property is more lasting. At

least you can live in it, hold it out for the long term and pass it to your

children; it won't vanish, unlike some financial products,' Mrs Ong said.

'However, we would rather the market

exercise some restraint. At the end of the day, any sustainable recovery

will have to be supported by fundamentals. The leasing market is still going

through a challenging period. Given the recession, can we support such a

sharp V-shaped recovery in property prices?' she asked.

- 2009 June 12

BUSINESS TIMES

Investors warm to cooling condo prices

Sharp 40% drop in luxury Orchard Rd

condo prices from peak in H2 2007 is making some investors sit up and take

notice

The sharp slide in high-end residential

property prices is beginning to show up on the radars of serious investors.

From their peaks in the second half of

2007 to the first quarter this year, transacted prices of luxury condos in

the prime Orchard Road belt have fallen by about 40 per cent.

This is the steepest islandwide decline

in condo prices and the potential buying opportunities that this is opening

up are not lost on investors keen on buying multiple units.

Credo Real Estate's analysis of URA

Realis' caveats shows the average price transacted at St Regis Residences

has fallen 38 per cent from $3,411 per square foot in H2 2007 to $2,099 psf

in Q1 this year.

At Ardmore II, the average transacted

price has slipped 43 per cent, from $3,073 psf in H2 2007 to $1,761 psf in

Q1 2009.

Over the same period, Cairnhill Crest's

average price declined 36 per cent to $1,430 psf in Q1 2009.

'The projects we selected were those that

we believed stood as good proxies for their respective locations, and

ideally have some history (that is, not launched recently),' said Credo's

managing director Karam- jit Singh.

'Transaction volumes were thin in Q1 this

year; there were only three luxury projects in the Orchard Road belt with at

least two transactions each in the first three months of this year. It's not

an ideal situation, where we would want to pick from a larger basket of

transactions. But this study still serves to point towards where the market

has been heading,' he said.

Credo's analysis also showed that, on

average, condo prices in Sentosa Cove in Q1 2009 were about 30 per cent

below H2 2007. In the city centre, the average price decline in the same

period ranged from 22 per cent (for Icon) to 34 per cent (for The Sail @

Marina Bay).

In what Credo dubs the 'mid-prime

segment' - covering River Valley, Bukit Timah, Novena/Thomson and Katong -

it said average price declines generally ranged from about 20 to 30 per

cent. Suburban condo prices generally fell less than 10 per cent.

'The analysis shows the greater price

volatility in the prime districts, which also presents opportunity for

greater upside when recovery sets in, compared with suburban condo prices,

which tend to move in a more subdued fashion,' said Mr Singh.

The bigger price drops in the Orchard

area have led to a narrowing price gap between the high-end and low-end

segments. 'At some point, not too far from now, buyers will start upgrading

from one tier to the upper tier,' Mr Singh reckons.

'What the price convergence illustrates

is the buying potential of prime properties. It will pay - whether at this

point in time or not very far off from now - to bet on prime,' he added.

The price declines have surfaced on the

radars of potential investors - individuals, families and some property

funds - who are studying top-notch prime- district projects, with a

medium-term investment horizon. 'Some have capacity to take about 10 units,

some 20 units. Some have budgets of more than $100 million,' according to Mr

Singh.

CB Richard Ellis executive director

Jeremy Lake said high-net-worth individuals here as well as in a three-hour

flight radius from Singapore are among the key players actively looking for

property investments here. 'Some are keen on investing in offices; some in

residential - most would go for the high-end, where prices have corrected

the most,' he added.

Mr Singh said acquisitions would be

funded largely with equity. 'Right now, they're monitoring the big picture -

homing in on a good time to make a swoop, which projects, at which prices,'

he added.

Mr Lake adds: 'Some investors are willing

to commit sooner rather than later, compared with a few months ago when

everybody wanted to wait and found pricing to be unattractive. Now, some

investors think pricing is good enough to go.'

Market watchers say the likelihood of

deals being struck will also depend on the threshold of sellers, who could

include individuals who are stretched from holding multiple condo units as

well as developers of projects with low-cost land or who just want to clear

unsold units.

DTZ senior director Shaun Poh says some

private bankers are trying to arrange consortiums for high-net-worth clients

and are sourcing for property investments of about $20-50 million per

consortium. 'Their main target would be high-end condos; some may also be

interested in commercial properties. The banks will also provide financing

for the acquisition.The mandate given to these private bankers is to look

for opportunities priced 20-30 per cent below current values,' he said.

However, Mr Singh's advice is: 'It's

close enough to the bottom that it makes sense to buy at this stage, rather

than buy when it has turned the corner - by which time the number of

competing buyers will be greater.' - 2009

April 09 BUSINESS

TIMES

Many high-end condos

unsold

Fifty-five per cent of about 2,200 units

in luxury projects launched by developers between 2006 and 2008 remained

unsold in November 2008, according to CB Richard Ellis (CBRE).

And the property consultancy firm is

tipping a 10-15 per cent fall this year in the price of luxury

apartments/condos, which slid to about $2,000 to $2,400 psf of strata area

in Q4 last year from $2,000-3,300 psf a year earlier.

The figures refer to existing luxury

developments such as Ardmore Park, Four Seasons Park and Grange Residences.

As for new luxury condos/apartments, the

average launch price fell to $2,000 to $2,600 psf in Q4 2008 from $2,000 to

$4,000 psf in Q4 2007, says CBRE.

Caveats for only 1,096 luxury

apartments/condos in prime districts 9 and 10 were lodged in 2008 based on

filings by Jan 7, 2009 - a mere 19 per cent and 32 per cent of sales in 2007

and 2006 respectively.

The number of apartments sold for more

than $10 million dropped to 82 last year from 143 in 2007. Still, the 2008

figure was above the 22 units sold in 2006.

Most luxury projects launched in 2006 and

early 2007 are fully sold, such as Ardmore II and Tate Residences.

But several projects, particularly those

released during or after second-half 2007, remain on the market. 'By then,

news of the sub-prime crisis had caused the market to pull the brakes,' CBRE

said.

In the landed housing segment, the firm

predicts a drop of about 10 per cent this year in the price of Good Class

Bungalows (GCBs).

Last year, the average price of GCBs rose

20.7 per cent to a record $822 per sq ft (psf) of land area.

'GCB prices recorded very strong growth

in 2006-7,' said CBRE director (luxury homes) Douglas Wong. 'This upswing in

prices spilled over into the first half of last year. Right up to July 2008,

average GCB prices continued to raise the benchmark.

'Also, the capacity of owners to hold

prices added to the resilience in this segment in the second half of 2008.'

The highest psf price in a GCB

transaction last year was $1,303 for a property in Leedon Road with only

21,097 sq ft of land. In absolute price terms, it fetched $27.5 million.

The all-time record price for a GCB in

Singapore is $1,899 psf, set in October 2007 when 32H Nassim Road was sold

for $25.5 million.

While the average price of GCBs rose last

year, the number and value of transactions fell.

Forty-nine GCBs changed hands for a total

of $785 million in 2008, down from 87 worth $1.15 billion in 2007 and 119

worth $1.23 billion in 2006.

CBRE said: 'Going forward, we expect the

activity in the luxury residential market to be lukewarm, similar to the

pace in H2 2008. Hence, the number of GCBs and luxury apartments transacted

will be small.' - 2009 January

9 BUSINESS

TIMES

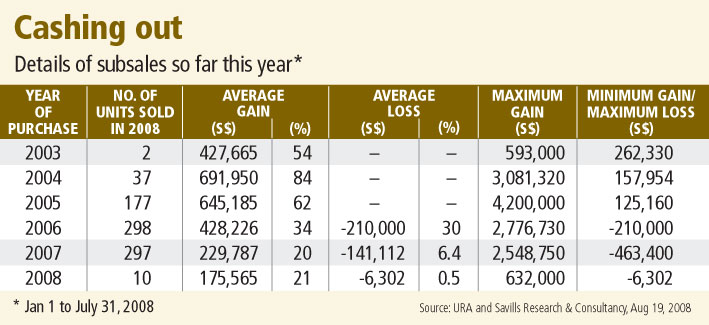

Property subsales - who wins and who

loses

For those who sold in the

first seven months of this year, close to 97% came out ahead

Sentiment in the Singapore property market

is now far from bullish, but data shows that nearly 97 per cent of those who

have sold private apartments and condos in the subsale market in the first

seven months of this year have made profits.

Only 3 per cent incurred losses, an

analysis of caveats by Savills Singapore shows.

For those who turned a profit, the

average gain per unit came to $417,563 or 36.5 per cent. Generally, the

longer the holding period, the bigger the gain.

Subsale deals are seen as a proxy for the

level of speculative activity in the market. On average, those who had

bought their units in 2004 and sold them in the subsale market this year

made the biggest gain, averaging nearly $692,000, or an 84 per cent profit.

They are followed by those who had picked up units in 2005, who recorded an

average gain of about $645,200 or 62 per cent from selling their homes in

the subsale market this year.

In absolute dollar terms, the smallest

average gain of around $175,600 was by those who bought their units this

year, reflecting a holding period of just a few months.

The profit or loss in the calculation is

the difference between sale and purchase prices and does not take into

account stamp duty and other expenses.

'The fact is that longer holding periods

allow for larger gains, shorter holding periods for smaller gains. This is

consistent with the fact that real estate is a long-term investment.

Investors with short exit time frames should look for alternative

instruments,' said Savills Singapore's director of marketing and business

development Ku Swee Yong.

Savills' analysis was based on 1,040

caveats for subsale transactions from Jan 1 to July 31 this year captured by

Urban Redevelopment Authority's Realis system as at Aug 19. Of these, 821

had previous caveat records dating back to 2003 and Savills compared the

latest subsale price of each unit with the earlier price paid by the seller

to work out the profit or loss.

Citylights, Varsity Park Condo and The

Sail @ Marina Bay had the most subsales in

the first seven months of this year - 63, 47 and 45 respectively. The Sea

View and City Square Residences had 30-plus subsales each. Park Infinia at

Wee Nam, The Calrose, Icon and The Raintree each had 20-odd subsales.

Subsales, often seen as a gauge of

speculative activity, refer to secondary market deals in projects that have

yet to receive their Certificates of Statutory Completion. This may be

anywhere from three to 12 months after the project receives its Temporary

Occupation Permit (TOP).

Market watchers note that many of the

projects topping the subsale chart this year had either received TOP or are

close to receiving TOP. Some of the units that changed hands in the subsale

market could have been purchased on deferred payment schemes from developers

in the past. Typically, such schemes run out when the projects get their TOP

and that is when buyers have to pay the chunk of the purchase price to

developers.

The deferred payment scheme was scrapped

in October last year to discourage speculative buying.

Of the 25 loss cases for subsale deals

done this year, sellers of about half the units had themselves bought theirs

in the subsale market, while the other half had made direct purchases from

developers. For instance, the four units sold in the subsale market at a

loss this year at City Square Residences had all been picked up in the

subsale market last year.Looking ahead, Savills' Mr Ku expects subsales to

maintain at current levels, that is, about 150 units a month. Those who want

to sell now will have to expect lower profits, he said.

'Whether in good or bad times, there will

still be subsale losses from people being forced to make untimely sales due

to corporate liquidation, bankruptcy, divorce,' Mr Ku added.

In cases where investors are sitting on

potential losses, Jones Lang LaSalle Singapore's head of residential,

Jacqueline Wong, said: 'My advice to my clients, who are usually foreigners,

have bought in prime districts and are well off, would be, 'If you can, hang

on. It will be just a temporary paper loss. Singapore has a lot of things

going for it in the mid term'.'

Another seasoned property consultant

said: 'A lot will depend on your entry price vis-a-vis other owners,

especially in a big development. If a lot of them bought at say $1,000 psf

from the developer and you got your unit later for $1,800 psf in the subsale

market from an earlier buyer, you're in a disadvantageous position. If the

market dives, the earlier buyers could offload their units at much lower

prices than your cost price.

'On the other hand, everybody may be in

the same boat. Say, if you've bought into a small project of 30 units and

everyone's bought at about the same price, and if there's not much

competition from surrounding projects, chances of prices going down

substantially may be lower because everyone's locked in at the same

threshold.' - 2008 August

26 BUSINESS

TIMES

Developers ponder tricky math before new

launches

Apart from

pricing, a host of factors are critical in their launch decision

The recent spurt of purchases at projects

like Nassim Park Residences, Dakota Residences and Clover By The Park, has

got many industry players preparing for possible launches to ride the

current buying wave.

The decision on whether to launch a

project now is a tricky one. A host of factors have to be weighed - not just

pricing, location and the product, but assessing the depth of demand in the

particular neighbourhood or micro-market where a condo is located, how many

projects have been launched in the area over the past few years, and even

the buyer profile in earlier projects.

The ability to price projects

attractively - from 7 to 25 per cent lower than market expectations 12

months ago - has been a critical factor in drawing buyers at recent

launches.

An increasingly important factor is the

prices at which earlier projects in the area had been sold in the past

couple of years. Given the run-up in prices, some buyers in earlier projects

may unload their units at prices below what the developer of the latest

project in the area may be gunning for.

In fact, in at least one project in the

Newton area, the developer is said to have started facing competition from

earlier buyers in the same condo seeking to unload their units.

Keppel Land is still marketing the

remaining units at Park Infinia at Wee Nam and its asking price is

understood to be $1,400 to $1,800 psf. Earlier buyers in the same project

are offering their units just a tad lower. KepLand first released the

project in 2005 at prices well below $1,000 psf on average. So when the

project received Temporary Occupation Permit a few months ago, earlier

buyers were in a position to undercut the current price and still reap a

nice profit.

So studying the extent of competition

from secondary market deals is a vital part of the homework developers and

agents have to do before deciding on any launch. 'Supposing you're a

developer and your upcoming condo launch will be the fourth project to have

been released in a particular location in the past two years and buyers in

the earlier projects bought their units for, say, $800 psf average and your

breakeven cost is around $900 psf, you could be in a difficult position if

you need to launch today,' a seasoned industry player says.

'If a substantial number of buyers in the

earlier projects bought for investment rather than owner occupation, they

may consider leasing the units when the project is completed - and rental

yields could be pretty attractive today based on the investors' purchase

price - or they may decide to cash in their units for a profit. That could

spell competition for the developer launching a new project in the area,' he

added.

Frasers Centrepoint Homes chief operating

officer Cheang Kok Kheong says: 'The supply-demand pattern in the particular

micro-market must be suitable for the project a developer is targeting to

launch.'

'There may be pent-up demand in a

location that has not seen any new projects launched in the past few years,'

he adds.

A case in point would be Sim Lian's

Clover by The Park condo in the popular Bishan area, near Catholic High

School, which has sold over 200 units since it was released on June 25 at an

average price of $750 psf. By some agents' reckoning, a project like that

could have been priced at $800-850 psf on average about 12 months ago.

While many in the industry have lauded

Clover's 'success', Credit Suisse's property analyst Tricia Song finds the

response wanting. 'Given that the pricing is relatively attractive for a

popular suburb that has not seen any new projects in years, we think the

take-up is disappointing and is reflective of the cautious sentiment even

among upgraders,' she said in a June 30 research note. 'If we exclude the

100 units that were sold during a private preview (on June 25) take-up has

visibly slowed...'

Perhaps this reflects a smaller demand

pool these days, in the absence of speculators and fewer foreign buyers.

As Knight Frank managing director Tan

Tiong Cheng says: 'I think everybody's very cautious about whether they

should or should not launch - and at what price levels. You don't want to

start something that will run out of steam because it's priced too high or

the demand pool just isn't big enough.'

DTZ executive director Ong Choon Fah

notes that the recent home-buying spurt was created by developers releasing

new projects in attractive locations at lower prices than initially

expected. 'However, once a developer has started selling a project at a

certain price, it becomes trickier to reduce the price as this then creates

a problem of dealing with earlier buyers who paid the higher price.' The

stakes are indeed high for developers to get the timing and price right for

their launch. - 2008 July

7 THE

BUSINESS TIMES

Singapore's property boom cooling:

analysts

Singapore's booming residential property

sector is finally showing signs of cooling but projects including two casino

developments should underpin long-term prices, analysts say.

The market was described by real estate

giant Jones Lang LaSalle as the world's hottest in 2007, when the

city-state's property prices surged 31 percent overall.

But this year the sector has not escaped

wider concerns over a US-led global economic slowdown and inflationary

pressures.

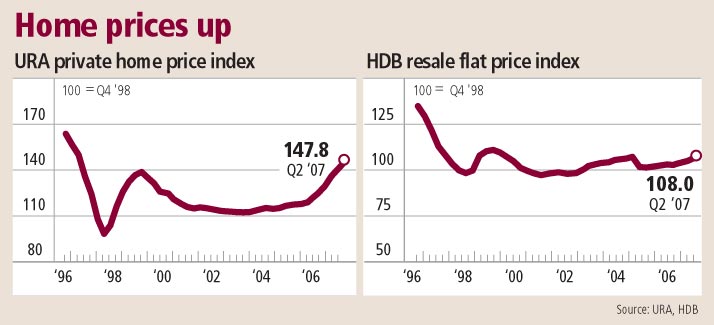

Private home prices rose 0.4 percent in

the second quarter, the slowest increase in four years, the government's

preliminary figures showed last week.

The second-quarter rise was also much

slower than the 3.7 percent increase recorded in the previous three months

but prospective buyers waiting for huge bargains may be disappointed.

Property analysts say prices are likely

to fall further in the third quarter but experts rule out massive declines

because of the multiplier effect from two multi-billion-dollar gaming

resorts now under construction.

Housing demand is expected to pick up

when the first of the two casinos opens next year, employing thousands, said

Chua Yang Liang, head of Southeast Asia research with Jones Lang LaSalle.

Some of the workforce for the resorts

will likely come from foreign countries, creating possible demand for

housing, he said.

"To staff these people, you need

housing so there will be a potential effect," Chua told AFP.

Foreigners currently make up more than 20

percent of Singapore's 4.6 million population.

The Marina Bay Financial Centre, a new

financial district under construction which will also feature luxury

apartments, should also underpin the market in the longer term, analysts

said.

Tan Huey Ying, director for research with

Colliers International real estate consultants, said prices are not about to

spiral downwards even though second quarter figures indicate the residential

property market may have peaked.

"Singapore's positive mid-term

prospects on the back of the completion of the two integrated resorts and

the Marina Bay Financial Centre will help to prop prices up," said Tan.

Values may hold, or decline by no more

than three percent, in the third quarter but overall for 2008 home prices

could still rise four to eight percent, said Tan.

Analysts from DTZ real estate consultancy

said buyers are still interested in project launches.

"Some residential projects are

enjoying sell-out status while others are being well received," said

Margaret Thean, DTZ's executive director for residential.

Government approval for the two gaming

resorts in 2005 was one of the major factors behind the revival of

Singapore's property market, which had been stuck in a rut stemming from the

1997 Asian financial crisis.

Efforts to woo wealthy foreigners to take

up residence in Singapore, along with an all-out bid to attract skilled

foreign migrants, also drove the property market revival, analysts said.

The rebound left many expatriates

struggling to cope with soaring rents which in some cases doubled over the

past year. - 2008 July

6 Yahoo!

Mass market stays buoyant as buyers find

price is right

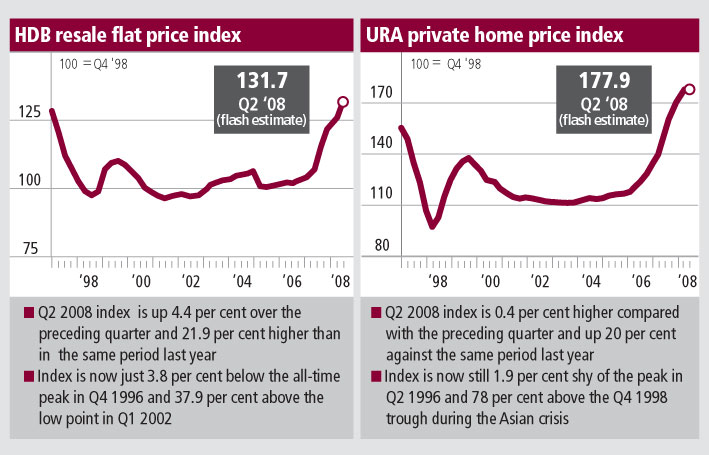

Flash estimates for property price indices

are in with numbers suggesting that price-sensitive buyers are bargain

hunting or scaling down their expectations altogether.

The Urban

Redevelopment Authority (URA) released estimates for the Q2 2008 price

index for private residential property yesterday with prices rising just 0.4

per cent - a mere crawl compared to the 3.7 per cent increase in the

previous quarter.

While this represents the slowest growth

in four years, Jones Lang LaSalle's local director and head of research

(South East Asia) Chua Yang Liang also notes that it is the, 'steepest'

quarterly rate of change since Q3 2000.

Much of the activity was in the mid and

mass-market as reflected by URA's index for three geographical regions.

Prices of non-landed private residential properties increased by just 0.2

per cent in Core Central Region (CCR) and 0.7 per cent in Rest of Central

Region (RCR), but climbed a more robust 1.3 per cent in Outside Central

Region (OCR).

Dr Chua added that demand remained

favourable in the OCR supported by average nominal wage increases in the Q1

2008 and 'dislodged residents of collective sale sites'.

Also robust was the Housing and

Development Board's (HDB) resale market with estimates for the quarter

revealing that the HDB Resale Price Index increased by 4.4 per cent over the

previous quarter, and higher than the 3.7 per cent increase in Q1 2008.

Knight Frank director (research and

consultancy) Nicholas Mak said that the mass market is 'influenced' by HDB's

resale market and added that, 'the resale market has been steady'.

Indeed, while HDB resale volume did fall

to 6,360 units in Q1 2008, a 6 per cent drop compared to Q4 2007, it

actually increased by one per cent on a year-on-year (y-o-y) basis.

By comparison, secondary market private

property transactions of 2,304 units in Q1 2008 was a fall of about 40 per

cent, quarter-on-quarter (q-o-q) and a fall of 57 per cent, y-o-y, while

primary market transactions of about 762 units was a fall of about 48 per

cent in Q1 2008 q-o-q, and a fall of 84 per cent y-o-y.

ERA Realty Network assistant

vice-president Eugene Lim also believes that a buoyant HDB resale market

could boost HDB upgrader sentiment, but he pointed out that the strength of

the HDB resale market can be attributed to 'upgraders, downgraders and

permanent residents'. On the last group, Mr Lim estimates that based on

in-house data, permanent residents account for about 20 per cent of the

buyers in the HDB resale market.

And attention is likely to continue to be

diverted away from high-end products.

'The market is not short of buyers and

many astute investors have been shopping around, looking to scoop up value

buys,' added Mr Lim.

CBRE Research executive director Li Hiaw

Ho noted that in the private property market, most of the transactions were

mid and mass-market projects with the majority of transactions in the

$750-$1,000 psf price bracket.

As such, Mr Li expects sales volume of

new launches to rise to between 1,200-1,400 units in Q2 2008, compared to

just 762 units in Q1 2008.

Property consultants have so far been

careful to not use the 'F' word to describe home prices. Most believe prices

have 'plateaued' or 'softened', but not 'fallen'.

Colliers International director (research

and advisory) Tay Huey Ying even believes that home prices have, 'remained

stubbornly resilient to the extent that they continue to post a y-o-y

increase of 20.4 per cent'.

Ms Tay also added that for the first six

months of the year, home prices rose by 4.2 per cent. '(Developer's) current

pricing strategy can be described as competitive, that is either similar to

current market prices or marginally lower than competitors,' she added.

Ms Tay believes that home prices will

continue to resist 'downward pressure' and expects prices to hold steady or

decline marginally by not more than 3 per cent in Q3 2008.

Saying that mass-market prices have

generally not been 'chased up' or preyed upon by the 'speculative element',

Ms Tay believes this sector could be the best performing for the rest of the

year.

This however needs to be put in context.

Knight Frank's Mr Mak does point out that

prime property prices have increased by 52.4 per cent over the last two

years. 'On this basis, it is not surprising that this market segment will

lead the slowdown in price growth,' he added.

0 2008 July 2 THE

BUSINESS TIMES

Central, prime condo take-up rates

outpace other areas

Softening condo and private apartment prices

in the first six months of this year in the prime and central districts -

the latter of which covers the financial district, Harbourfront area and

Sentosa Cove - have been accompanied by a push in demand in these locations.

This, according to a study by Jones Lang

LaSalle, has been reflected in the higher primary market take-up rates for

properties in these locations.

'This suggests the presence of a strong

latent market where potential buyers are waiting at the sidelines, eagerly

buying up properties when the price is right,' Jones Lang LaSalle's head of

research (Southeast Asia) Chua Yang Liang says.

JLL measured the take-up rate as the

ratio of the number of non-landed private homes sold by developers to such

homes launched by developers. It then compared these take-up rates against

the average resale prices in four locations on the island - prime (districts

9, 10 and 11), central (districts 1-4), east coast (15 and 16) and mass

market (all other districts).

The prime and central districts achieved

relatively higher take-up rates of 87 per cent and 250 per cent respectively

during H1 2008 compared with take-up rates of 67 per cent for east coast and

66 per cent for mass-market during the same period.

The prime and central districts also saw

weaker price movement. The average resale price for prime districts in H1

2008 was 12 per cent higher than in H1 2007 but down 3 per cent from the

figure for full-year 2007. In the central districts, the H1 2008 average

resale price represented an improvement of 9 per cent year-on-year but was

flat against the full-year 2007 figure.

In the east coast, the H1 2008 average

resale price raced 20 per cent ahead against a year ago while mass-market

locations topped the chart with a 25 per cent year-on-year price gain.

'The conservative attitude of buyers

coupled with cautious outlook by developers will continue to moderate market

performance in terms of take-up rates. Buyers are generally sensitive and

cautious about prices.

'Developers are more likely to discount

prices to maintain the demand, either through direct discounts of between 5

and 10 per cent on selling prices as we're already seeing, or absorption of

other costs like stamp duty and furnishing vouchers,' Dr Chua reckons.

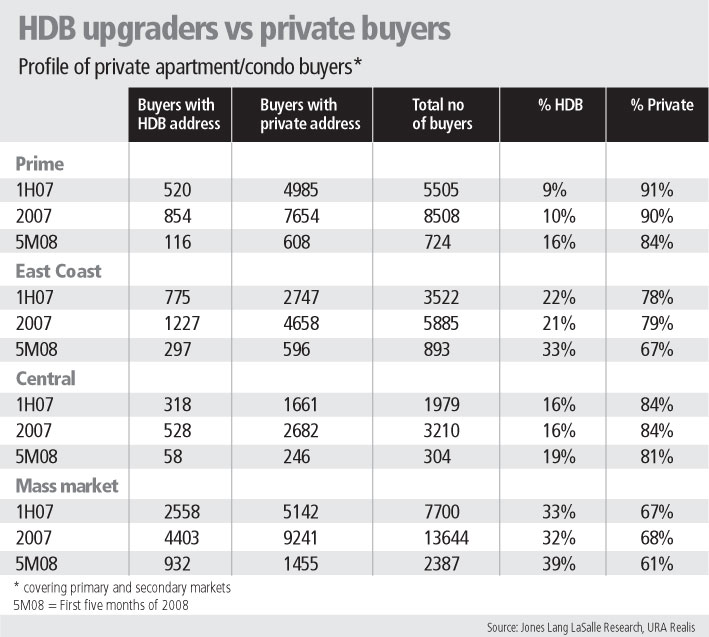

JLL's study also showed that amidst the

overall quieter market the number of non-landed private homes bought by

those living in HDB flats as well as those with private addresses fell in

the first five months of this year.

However, there was an increase in HDB

upgraders' share of total non-landed private homes bought (in both primary

and secondary markets) during the first five months of this year in all

locations.

This was the case even in the prime

districts, where buyers with HDB addresses made up 16 per cent share of

total private apartments/condos bought in January to May 2008. This was

higher than a 10 per cent share for the whole of last year in this location.

Most of the HDB upgraders who bought a

prime district property in the first five months of 2008 picked up a unit in

District 9, mainly at new project launches like Wilkie 80 and Mount Sophia

Suites, according to JLL.

HDB upgraders accounted for 33 per cent

of non-landed homes sold in the east coast in the first five months of 2008,

up significantly from a 21 per cent share in full-year 2007.

In the mass-market districts - the

traditional haunt of upgraders buying private property - their share was 39

per cent in Jan-May 2008, up from 32 per cent in 2007. In the central

districts, the upgrader share edged up from 16 per cent last year to 19 per

cent in the first five months.

'Although prices in 2007 have moved past

the average-income buyers' affordability, the current softer prices as well

as stronger economic performance in 2007 have provided the impetus for many

HDB upgraders in all locations,' Dr Chua notes.

'As HDB resale flat prices are likely to

remain strong given limited supply, upgraders who benefit from the gain in

the resale market are likely to enter into the private market. We reckon the

percentage of upgraders is likely to grow by year-end if developers and

sellers keep prices at realistic levels,' he added.

- 2008 July 1 THE

BUSINESS TIMES

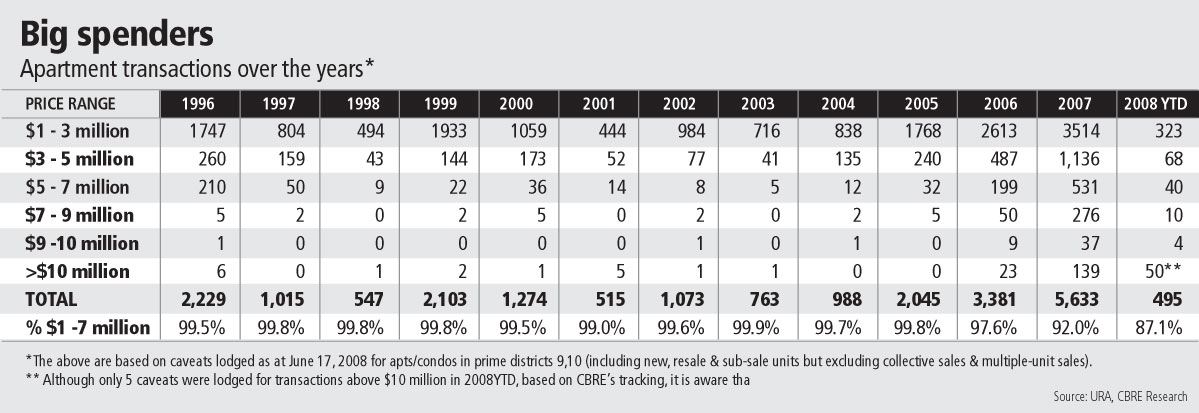

Apartments above $10m still

shine in dull market

In the landed

sector, demand for GCBs remains strong

The high-end residential sector has been

largely subdued in 2008, but at least 50 luxury apartments costing above $10

million each have been sold so far this year. And the tally for the full

year, according to property consultant CB Richard Ellis (CBRE), is expected

to come in at about 70 to 100 units.

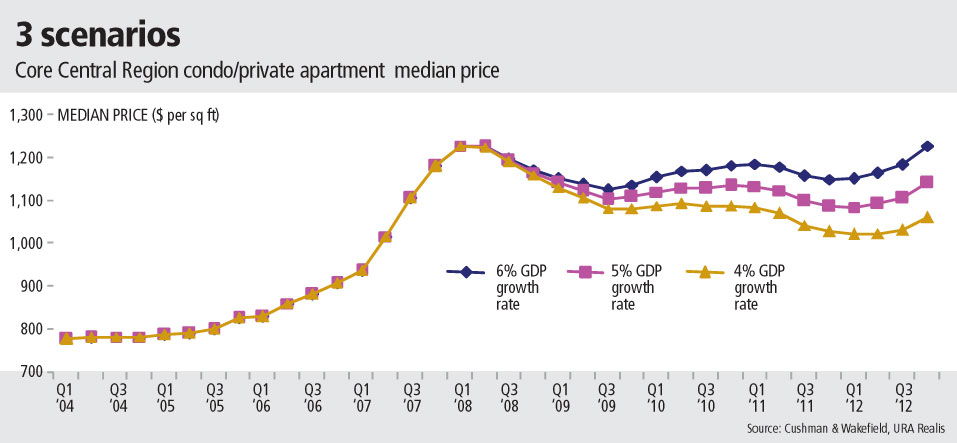

The prices

of condos and private apartments in the Core Central Region (CCR) will inch

downwards and are unlikely to touch their recent peaks for almost the next

four years, a model developed by Cushman & Wakefield (C&W) shows.

The extent of the fall will depend on how slowly the Singapore economy

grows, but C&W expects these median prices to drop between 8 per cent

and 17 per cent from their peak of Q1 2008, before recovering by some time

in 2012.

This will be lower than the 139 such

units sold for the whole of 2007, but still significantly higher than the

2006 full-year figure of 23 units, CBRE's research shows.

Putting things in perspective, CBRE

Singapore's managing director Pauline Goh says: 'One point to note is that

luxury home prices in 2006 were lower than in 2007. Hence, fewer units would

have touched the $10 million mark back in 2006. There was also a smaller

supply of upscale developments with big units back then compared with 2007

and H1 2008.'

The 50-odd luxury apartments costing

above $10 million each sold so far this year are the tally at June 17 and

include not just units sold at Nassim Park Residences, which was previewed

in May, but also a unit each transacted at Cliveden at Grange, The

Tomlinson, The Grange and The Orange Grove condos.

BT understands that the highest-priced

transaction so far this year is a $19.7 million ground-floor unit sold at

Nassim Park Residences.

In the landed sector, a total of 23 Good

Class Bungalows (GCBs) have changed hands so far this year for a total of

$380 million.

'We're quite confident that at least 50

to 60 GCBs will be sold for the whole of 2008. Demand will continue to be

strong from Singaporeans as well as PRs, but deals are limited by

availability of GCB stock,' Ms Goh predicts.

Last year, a total of 87 GCB deals

totalling $1.15 billion were sealed, against the record 119 transactions

worth $1.23 billion in 2006.

As for the outlook for luxury apartment

sales, Ms Goh says: 'Singapore has a lot going for it; the government has

put in so much effort to build Singapore into a global city. We'll have the

integrated resorts, special events like Youth Olympic Games and F1 night

race. Singapore is on the radar screens of a lot of international investors.

However, the flow of bad news from the US has to stabilise before confidence

returns.

'On the other hand, as Nassim Park

Residences shows, if the product is right, there can be very, very strong

demand. The project is in a very niche location; arguably the best luxury

location in Singapore.'