|

Bungalow - buying foreigners buying in

Sentosa

They are buying fewer bungalows in

other prized locations in the rest of the city - but more at Sentosa Cove.

Foreigners (including Singapore

permanent residents) have seen their share of bungalow purchases in

Districts 10, 11 and 21 - home to many Good Class Bungalow areas - fall

last year from the preceding year.

In absolute numbers too the number of

detached houses bought by foreigners in these three districts in the past

couple of years was generally much smaller than in 2006/2007 - the peak

years of foreign buying of Singapore property.

However, in District 4 (which includes

Sentosa Cove), both the percentage share of bungalows bought by foreigners

as well as the absolute number of bungalows they purchased scaled fresh

highs last year, according to a caveats analysis of bungalow transactions

by CB Richard Ellis.

Knight Frank chairman Tan Tiong Cheng

attributes the divergent trends in foreign buying of upmarket bungalows on

mainland Singapore versus Sentosa Cove to the fact that fewer were granted

PR status last year compared with 2009.

Last year, the government granted only

29,265 permanent resident passes, fewer than half of the 59,460 passes

given out the year before. This number was the lowest PR intake in at

least the last five years.

'One of the criteria for a foreigner to

be granted approval to buy a landed home on mainland Singapore is that he

or she has to be a Singapore PR (making adequate contribution to

Singapore's economy). And even those who are PRs may have faced stricter

criteria in getting approval to buy landed homes last year,' suggests Mr

Tan.

'On the other hand, for Sentosa Cove a

foreigner does not have to be a PR to get approval to own a landed home.

So it's easier for foreigners to buy bungalows there.'

A spokesperson for Singapore Land

Authority said: 'The government has been and will continue to be strict in

granting approval for non-Singaporeans to purchase landed residential

properties in Singapore. We assess very carefully the merits of each

application. Permanent Residents today own less than 4 per cent of landed

residential properties in Singapore. We intend to continue with the strict

approach we have taken.'

'The number of applications received

(from non-Singaporeans to buy landed homes) generally reflects the

prevailing property market sentiment and is not reflective of the number

of (landed) properties eventually bought by non-Singaporeans as some may

not proceed further to purchase the property after getting approval.'

According to Newsman Realty managing

director KH Tan, in the past, the SLA's Land Dealings (Approval) Unit had

in some instances allowed PRs to buy GCBs with land areas slightly larger

than the 15,000 sq ft maximum size set for foreigners buying landed homes.

'However, since late-2009, LDAU has turned down applications by PRs

seeking to buy bungalows with over 15,000 sq ft in land area,' he said.

Most GCBs would be in this category and

this could account for the decline in foreigners' share of bungalow

purchases in Districts 10, 11 and 21.

He also said that he has come across

some PR clients from the West who were previously looking at buying a GCB

in Singapore but last year decided there was more value in overseas

property markets like New York and London.

On the other hand, at Sentosa Cove,

foreign buying continued to strengthen because it is the only place in

Singapore where foreigners who are not PRs may own a landed home. And

cash-rich mainland Chinese prepared to pay the high asking prices are

fuelling foreign buying, says Mr Tan.

CBRE's analysis of URA Realis caveats

data shows that the percentage of bungalows in District 4 (including

Sentosa Cove) bought by foreigners swelled to a record 49.3 per cent last

year - from 37.3 per cent in 2009. The number of such homes they purchased

also surged from 9 in 2006 and 23 in 2007 to 33 last year.

District 10 - which includes GCB areas

like Nassim Road, Cluny Park, Chatsworth Park, Queen Astrid Park and

Leedon Park - saw the percentage of bungalows picked up by foreigners fall

from 13.3 per cent in 2009 to 10.4 per cent in 2010. In absolute numbers,

the number of bungalows foreigners have bought in this district has

declined from 25 in 2006 and 20 in 2007 to 15 in 2009 and 14 in 2010.

It was a similar trend in District 11 -

which covers GCB areas like Swiss Club Road, Raffles Park, Eng Neo Avenue,

Camden Park, Chee Hoon Avenue and Caldecott Hill Estate. The foreign

buying share slipped from 4.7 per cent in 2009 to 3.9 per cent in 2010; it

used to be 18.5 per cent in 2006. The number of foreign buyers has also

dwindled from 17 in 2006 and 16 in 2007 to 3 each in 2009 and 2010.

Over in District 21 - home to GCB areas

like King Albert Park, Kilburn Estate and Binjai Park - the number of

foreigners acquiring bungalows has slid from eight in 2006 to three each

in 2009 and 2010. Foreigners made up 10 per cent of bungalow buyers last

year, down from 11.5 per cent in 2009 and 17.8 per cent back in 2006.

Foreigners need LDAU's approval before

they can own landed property in Singapore. On mainland Singapore, the main

criteria are that they are Singapore PRs and that they make an adequate

economic contribution. Typically it takes LDAU about four weeks to process

an application.

Foreigners buying landed homes on

Sentosa Cove have traditionally enjoyed a 48-hour expedited approval

channel from LDAU for their applications. While this is still available,

SLA said: 'Some applications may require more time, especially where more

information is needed for assessment.'

--- 2011 March 31 SINGAPORE

BUSINESS TIMES

Sentosa Island is one of the jewels of

Singapore we first visited over fifteen years ago but it has taken this

long to get significant momentum going on this major masterplan

opportunity. Now the

Americans are looking to be part of the Integrated Resort

as they 'spread their wings' into Asia. The 'feng shui'

though is questioned by some Asians because they are superstitious because

the locale used to be a pirate's den!

However many do not practise feng shui and now there is a track record to

demonstrate liquidity. This area is also the only location where

Expatriates can buy without special permissions so the waterfront setting on

an urban island has a lot of appeal. The community keeps

expanding with new concepts and investors and is thriving.

Foreigners again look to buy homes on the

island as the economy improves

After a muted 2008, property sales at

Sentosa Cove picked up again in 2009 as buyer interest returned to the

high-end and luxury segments of Singapore's property market.

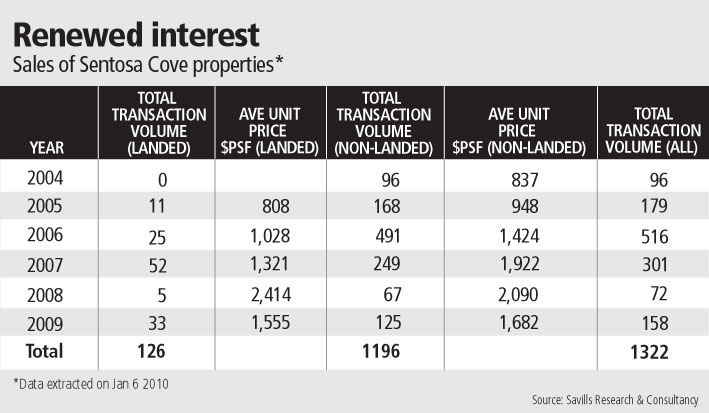

According to data compiled by

Savills Singapore (above chart),

125 non-landed and 33 landed homes were sold on the island in 2009, up from

67 non-landed units and just five landed homes in 2008.

And more homes worth more than $10

million apiece were also sold on the island last year. Savills' data shows

that 30 homes worth $10 million and more were sold at Sentosa Cove in 2009,

compared to just one such property in 2008 and 15 during the height of the

property boom in 2007.

FAST

FACTS:

|

|

| Unique lifestyle:

Malaysia-based YTL

Corporation has sold six of the 13 villas at its Kasara project at

Sentosa Cove, at prices ranging from $14 million to $22 million.

This works out to about $1,600 per sq ft on average.

YTL sold the

six villas in November and December through private previews. It

will officially launch the remaining seven villas were marketed in

January 2010.

At Kasara, selling prices will be bumped up slightly with the

official launch. The villas, which range from 9,000 sq ft to more

than 14,000 sq ft, will now be sold for an average $1,700 psf.

They were designed by DP Architects and aim to combine Asian

architectural style with European interiors and fittings.

YTL said the six homes sold so far have been bought by

Singaporeans and foreigners from the Asia-Pacific and Europe.

|

Developers and analysts say that with the

global economy picking up, foreigners are once again looking to buy

properties on the island.

Sentosa Cove is the

only place in Singapore where foreigners can own landed

property without

special permission.

'Sentosa

Cove with its unique lifestyle offerings has already attracted a strong

following of high net-worth individuals from around the globe,' said DTZ

managing director Margaret Thean.

She noted that the recent sales of

Malaysia-based YTL Corporation's Kasara project at Sentosa Cove demonstrates

the optimism of market sentiment and confidence in Singapore's luxury

property market, which is expected to be further strengthened with the

completion of the developments around the Marina Bay Financial Centre and

the two upcoming integrated resorts.

YTL said last week that it has sold six

of the 13 villas at Kasara at prices ranging from $14 million to $22

million. This works out to about $1,600 per square foot on average. Buyers

included foreigners from Asia-Pacific and Europe.

The improved sentiment means that

potential buyers can expect project launches on the island soon. City

Developments is expected to launch its 228-unit luxury project The Quayside

Collection soon.

The property group last year announced

that it will delay launching the project due to the subdued property market

and global economic uncertainty but will proceed with construction.

And Ho Bee Investment could also launch

its two remaining Sentosa Cove projects later this year. The group has the

151-unit Seascape as well as Pinnacle Collection, which has some 280

apartments in all, left in its portfolio.

2010 January 8 BUSINESS

TIMES

Sentosa's tenants get 15% rent rebate

SDC

joins other govt agencies in channelling savings from property tax rebates

Sentosa Development Corporation said

yesterday it will give its tenants a 15 per cent rent rebate.

The move - backdated to Jan 1 and

effective until the end of this year - will benefit 47 tenants who run

attractions, beach pubs, food and beverage and retail outlets, and other

businesses such as bicycle hire kiosks.

They will get monthly rent rebates of

between $180 and $3,000. About 80 per cent of tenants on the island will

benefit. The other 20 per cent, who pay property tax direct to the

government, will not be eligible as they will benefit from the government's

property tax rebate.

In January, the government said owners of

industrial and commercial property will get a 40 per cent tax rebate this

year.

Similar measures to help tenants were put

in place during the last economic recession in 1997-98 and the Sars outbreak

in 2003, Sentosa said.

It joins other government agencies - such

as the Housing and Development Board, Singapore Land Authority, JTC

Corporation and National Environment Agency - in giving tenants 15 per cent

rent rebates.

'Sentosa is channelling the savings we

will get from the government's property tax rebates back to our island

partners,' said Mike Barclay, chief executive of Sentosa Development

Corporation.

'These rebates are consistent with our

wider objective of working with our island partners to create irresistible

value for all guests visiting Sentosa.'

In the coming months, Sentosa will also

spearhead several sales and marketing campaigns on behalf of its tenants.

- 2009 March 18 BUSINESS

TIMES

Rentals

making gentle waves at Sentosa Cove

They could hold firm despite gloom elsewhere and offer decent yields

Close to 300 homes at Sentosa Cove,

including 200 condominium units, have received Temporary Occupation Permit

(TOP) and the exclusive enclave is starting to bustle.

DTZ Debenham Tie Leung, which is the

property manager of the 200-unit The Berth by the Cove says that the

development is now about 70 per cent tenanted.

It added that the remaining units of the

fully-sold development are owner-occupied, some of which are weekend homes

or holiday homes for foreigners.

Other developments that have received TOP

include The Berthside, Ocean 8, The Villas @ Sentosa Cove, Coral Island and

North Cove.

Expected to come onto the leasing market

next is the 116-unit The Azure, which is also fully sold.

And the popularity of The Berth by the

Cove with the leasing market bodes well for the remaining 2,200 homes that

are still being constructed.

DTZ senior director (research) Chua Chor

Hoon said that the supply of new homes in Sentosa Cove is still 'limited'

compared to the rest of Singapore and the units have 'the unique feature of

close proximity to the sea'.

Saying that the limited supply of units

in Sentosa Cove will limit any downward pressure on rentals, Ms Chua added:

'Rental prospects are likely to be better.'

This upbeat outlook for Sentosa Cove is

particularly pertinent at a time when new housing supply is expected to

flood the rental market by next year.

In a recent report, DTZ noted that in

general, rentals would come under pressure between 2009 and 2011, not just

from new supply but from the sub-sale market as well as it is unlikely that

speculators will want to hold units for low rental income.

DTZ said that based on its basket of

non-landed properties in the prime district (excluding luxury properties)

average monthly rents are currently still holding steady at $4.90 psf per

month.

While DTZ did not reveal rentals at The

Berth by the Cove, a check with SISV-Realink shows that the rental for a

unit there contracted for $19,500 per month in May.

Colliers International also said it

believes median rentals could be around $6 psf per month.

Colliers director (research and advisory)

Tay Huey Ying added that based on the average launch price of The Berth by

the Cove of about $860 psf in 2004/2005, investors who bought units at this

price could now be enjoying a net rental yield of about 5.5 per cent.

Those that bought units from the

secondary market later when the price rose to about $1,500 psf will be

looking at a net rental yield of 3.5 per cent.

'Nevertheless, these investors would

still be enjoying a higher net rental return compared to those who invested

in a freehold luxury apartment on the main island of Singapore in recent

times since the latter are generating average net rental returns estimated

to be in the region of 2.3 per cent,' added Ms Tay.

In time over 1,700 condominiums will be

completed. Savills Singapore director (marketing and business development)

Ku Swee Yong believes that buyers for most of these units will be investors,

suggesting that a majority will be put up for lease.

Still, he said that there is a niche

market for this type of waterfront home. 'We had an expat client who was

looking to rent and after showing him a few options, he chose The Berth

because he already has a yacht,' reveals Mr Ku.

Interestingly, Mr Ku says the advent of

the integrated resort on Sentosa may not necessarily guarantee a pool of

tenants. 'Not everyone will want to live so close to work,' he added.

What he does believe is crucial to the

success of Sentosa Cove as an exclusive enclave is the provision of high end

amenities. He added: 'Once these are completed, we believe Sentosa Cove

rents could demand a premium over Orchard Road.'

- 2008 July 3 THE

BUSINESS TIMES

Staking a claim in the new Singapore

When the master developer of Sentosa

Cove, an exclusive oceanfront residential community here, started selling

land to individual builders in 2003, the first plot went for 350 Singapore

dollars per square foot. In July, during the most recent land auction for a

condominium site, the price was 1,799 dollars a square foot.

"Back in 2003, it was an untested

market and the sale came right after SARS," recalled Nicholas Chua, the

business development and marketing manager at Ho Bee Group, which paid the

equivalent of $203 a square foot at the time. "The confidence level in

the property market wasn't that great." Now, Ho Bee owns six

development sites there.

The luxury development's success partly

reflects the underlying strength of Singapore's property market, which is

expected to increase by as much as 30 percent this year, estimated Tay Huey

Ying, director of research and consultancy at Colliers International real

estate in Singapore. It also has benefited from the government's 48-hour

fast-track approval program for foreigners who want to buy homes or land in

the development as well as plans to build a resort featuring a casino and

Universal Studios theme park nearby.

"The product wasn't a success at the

beginning because it didn't look interesting to the market, especially after

the Dubai Palm and The World were launched in Dubai," said Ku Swee

Yong, director of marketing and business development at Savills Singapore.

"It was after mid-2005, when the casino was announced, that buyers

become more confident in the Cove's prospects."

"Solid marketing has also

helped," Ku said. "Developers will do well to take a leaf from the

books of Sentosa Cove. The packaging has been so successful that investors

who failed to secure a plot of land there still aspire to live there.

"I hope they will continue to sustain the brand name years after the

Sentosa integrated resort has been completed and packed in with

tourists," he said.

In the space of a few years, Sentosa Cove, the only residential

development on Sentosa Island, has become one of Southeast Asia's most

exclusive and expensive addresses, with three-bedroom condominiums selling

for 5 million dollars and free-standing properties selling for 15 million.

The Cove has been marketed as "the world's most desirable

address" — a poster child for the "new" Singapore, which is

trying to reinvent itself. In recent years, the city-state of 4.5 million

has polished up its image as a dull place by developing a vibrant nightlife

and art scene, announcing plans for two integrated resorts with casinos

(including a family resort on Sentosa), and scheduling its first Formula One

Grand Prix on Sept. 28.

On the economic front, the country also has become an important financial

hub for private banking and hedge fund management, luring hordes of

well-heeled bankers that splash out on high-end properties.

Sentosa Cove is divided into two gated communities, covering 117

hectares, or 290 acres, 60 percent of which has been reclaimed from the sea.

It has a members-only marina with a few berths for mega yachts and a

320-room W Hotel is being planned.

When completed in 2010, the community of oceanfront, waterway-facing and

fairway-flanking properties is to total 2,500 homes, including 400

free-standing structures, and 2,100 condominium units. So far, only around

275 homes have been completed.

At this point, more than half of the Cove's buyers are foreigners,

developers say.

Sentosa Cove was inspired by Port Grimaud, the 40-year-old lagoon

development in the south of France designed by the late François Spoerry.

"Our vision was to create one of the most desirable oceanfront

residential communities," explained Kemmy Tan, general manager of

Sentosa Cove Pte, the project's master planner and developer. "But we

also realized we needed to adapt Port Grimaud's concept to a tropical

setting."

So far, the company has sold more than 3 billion dollars in land to

individual developers; buyers get only 99-year leaseholds on land.

The Cove's property prices have moved up faster than the rest of

Singapore's because the overall development started from a lower base, Chua

said. Units in Ho Bee's first condominium, The Berth by the Cove, sold for

800 dollars per square foot when they were first offered for sale in 2004.

Today, the apartments resell for about 1,800 dollars per square foot.

Meanwhile, a unit at the uncompleted Oceanfront condominium re-sold

recently for 2,550 dollars per square foot. The seller initially bought the

unit in September 2006 for 1,750 dollars per square foot; the resale

produced a profit of more than 2 million dollars.

Since the start in September of sales of its latest condominium, The

Turquoise, Ho Bee has sold 40 of the 55 available units, with prices

averaging 5.2 million dollars for a three-bedroom condo and 6 million for a

four bedroom.

"People have many reasons for buying on Sentosa. Some love the sea

and have a boat they can moor there, others buy because they want to be

close to two championship golf courses, and it is 15 minutes away from the

financial district," Chua noted.

Jenny Chua, chairwoman of Sentosa Cove Pte, adds that the gated

communities offer greater privacy to home buyers. "Obviously this is

not a security issue here, but more of a lifestyle decision," she

added.

Attention now is focused on the land tender for The Pinnacle Collection,

a planned 20-story condominium structure that will be the tallest building

on the island and will offer panoramic vistas of the South China Sea, the

Southern Islands and the city skyline. The tender closed Dec. 12 and the

result should be announced this month.

"The Pinnacle Collection is the last condominium parcel at Sentosa

Cove and can categorically be classified as the best. It is anticipated that

this will be the most coveted parcel of all, due to its strategic location

at the entrance of the marina leading into Sentosa Cove," said Li Hiaw

Ho, executive director at CBRE Research in Singapore. Li believes that bids

for the undeveloped site will exceed 2,000 dollars per square foot.

All of the buildable land on Sentosa Island will be sold by the end of

2008 but would-be home buyers will still have plenty of opportunities. Ho

Bee is planning to sell a 150-unit condo, the Seaview, in the second

quarter, while Lippo Group will start selling the Marina Collection and City

Development will sell apartments in the Quayside Collection.

Also, sometime this year Elevation Developments will sell apartments in

the Cove's only development facing the Sentosa Golf Club's Tanjong Course.

The company is considering hiring the renowned architect Zaha Hadid for the

project, which should have 20 units of about 6,000 square feet each, each

with its own pool, said Satinder Garcha, chief executive of Elevation

Developments. At current market prices, Garcha estimates each will sell for

about 9 million dollars to 10 million dollars.

The reputation of the Italian architect Claudio Silvestrin probably has

made the 18-villa development on Sandy Island, one of the manmade islands in

the Cove, one of the area's most anticipated projects.

Silvestrin designs Giorgio Armani's stores; the landscaping will be done

by Jamie Durie, an Australian who occasionally appears as a garden

consultant on Oprah Winfrey's show.

The villas will range in size from about 6,500 square feet to 12,000

square feet and each will come with a boat berth and private pool.

Genesis-Alliance (YTL Companies) will offer them for sale sometime during

the first quarter of the year.

- 2008 January 4 INTERNATIONAL

HERAL TRIBUNE

Ho Bee tops bid for Sentosa condo plot:

sources

Price said to be over $1,350 psf ppr, setting new record for area

Seaview Collection: The 157,108 sq ft condo site

boasts a prime location, with unobstructed sea views and facing the Southern

Islands. It can be built into an eight-storey condo with about 200 units in

total

March 2007 -

Ho

Bee Investments is said to have cast a top bid of over $1,350 psf per plot

ratio (psf ppr) yesterday for a 99-year leasehold condominium site dubbed

The Seaview Collection at Sentosa Cove.

This is a new record for condominium land

in the upscale housing precinct and surpasses the previous high of $919 psf

ppr that Ho Bee itself paid for The Waterfront Collection condominium plot

in November last year.

The tender for The Seaview Collection

site attracted five bids in total, all above $1,000 psf ppr.

Sentosa Cove Pte Ltd - master planner and

developer of the upscale waterfront residential precinct - did not identify

the bidders. However, these bidders are believed to be Ho Bee, Lippo Group,

City Developments, Frasers Centrepoint and CapitaLand.

SCPL had said at the time that the tender

for the Seaview Collection was launched in January that the award will be

based solely on price.

Both the Seaview and Watefront collection

condominium sites are in Sentosa Cove's Southern Residential Precinct

although the Seaview Collection is in a more choice location, next to the

sea and facing the Southern Islands.

The plot is the second of only four

condominium plots in the Southern Precinct. This means only two more condo

plots are left for the whole of Sentosa Cove, and this scarcity value is set

to continue pushing up land values barring unforeseen circumstances, say

property market watchers.

The Seaview Collection is next to an even

more coveted site, designated for a 15-storey condominium at the entrance to

Sentosa Cove's marina basin, set to be offered later this year.

As the Seaview Collection has a land area

of 157,108 sq ft and a 2.15 plot ratio - the ratio of maximum potential

gross floor area to land area - the top bid works out to a lumpsum amount of

about $460 million, reckon market watchers. The parcel can be developed into

an eight-storey condo with about 200 units.

Ho Bee's top bid will result in a

breakeven cost of about $1,800 psf or possibly even lower, assuming the

developer uses up the maximum 10 per cent additional gross floor area

allowed for balconies, and factoring in saleable private enclosed areas and

roof terraces, analysts estimate.

Assuming Ho Bee is awarded the latest

plot, this will be the listed property group's seventh project on Sentosa

Cove. - by Kalpana Rashiwala SINGAPORE

BUSINESS TIMES March 7, 2007

Six bungalow plots awarded, with new

benchmark price set at $1,308 psf

2007 - The

latest condo site being offered by Sentosa Cove Pte Ltd (SCPL) could fetch

as much as $1,100 to $1,200 per square foot of potential gross floor area,

market watchers say.

And a spokesman for SCPL revealed

yesterday that an expression of interest for six sea-fronting 99-year

leasehold bungalow plots that closed in November last year saw a new

benchmark price set for bungalow land - $1,308 psf of land area, surpassing

previous high of $1,130 psf achieved in October last year.

A new record for condo land in the

upscale waterfront housing precinct is expected to be set for the latest

condo plot offered yesterday, dubbed The Seaview Collection. It is being

offered through a tender that closes on March 6.

Based on the $1,100 to $1,200 psf per

plot ratio top bids predicted for the plot by some observers, the breakeven

cost for a new project on the site is estimated at $1,600 to $1,750 psf.

Market watchers reckon a new 99-year

leasehold condo on the plum site boasting sea views could fetch about $1,800

psf on average if marketed today.

Assuming current bullish sentiment in the

luxury housing market continues to prevail, there will be further price

upside in the location - which suggests potential bidders could still make a

decent profit if they bag land for $1,100 to $1,200 psf per plot ratio.

The 157,108 sq ft plot is the second of

four condo plots in Sentosa Cove's Southern Residential Precinct and can be

built into an eight-storey condo with about 200 units in total.

The site has a 2.15 plot ratio - the

ratio of maximum potential gross floor area to land area. The award will be

based solely on price, SCPL said in a statement yesterday.

The last condo site sold at Sentosa Cove

- the Waterfront Collection, also in the Southern Precinct - was awarded to

Ho Bee late last year for about $919 psf ppr. That can be developed into a

six-storey condo.

Seaview Collection boasts a more prime

location, with unobstructed sea views and facing Southern Islands. It is

next to an even more coveted site designated for a 15-storey condo at the

entrance to Sentosa Cove's marina basin. This is expected to be offered

later this year.

Knight Frank director Nicholas Mak

reckons the winning bid for The Seaview Collection will exceed $1,000 psf

ppr. 'The bidding for this site will add more fuel to the already hot market

on Sentosa Cove,' he said.

A spokesman for SCPL also revealed

yesterday that after an expression of interest exercise that closed in

November last year, six seafront bungalow parcels offered on an individual

basis have been awarded to the respective top bidders at prices ranging from

$927 psf to $1,308 psf of land area, or absolute sums of $8.1 million to

$17.2 million.

Singaporeans picked up four of the plots,

with a Malaysian and an Indian buying one each.

A tender for the en bloc sale of two

man-made islands - Pearl & Sandy in the Southern Precinct - also closed

in November. Bids have been evaluated but an award is still pending approval

from SCPL's parent ministry, the Ministry of Trade and Industry.

SCPL has sold all the land parcels in

Sentosa Cove's Northern Residential Precinct - for a total of 1,528 homes.

The Southern Precinct will have 145

bungalow plots - of which 33 have been sold. The four condo plots in

Southern Precinct are for development into 762 homes in total.

- By Kalpana Rashiwala SINGAPORE

BUSINESS TIMES Jan 9 2007

Monorail coming to Sentosa to link to

Mainland

2006: - Sentosa

is seeing a surge in interest from companies looking to develop projects on

the island, Sentosa Leisure Group's chief executive Darrell Metzger said

yesterday.

Rather than being intimidated by

competition from the upcoming Sentosa integrated resort (IR), more companies

are hoping to bring up their own attractions on the island as they look

forward to a surge in visitor numbers once the resort is there, Mr Metzger

said.

Sentosa is in talks with some of these

interested parties, he added.

Mr Metzger was speaking to reporters at

the preview of the new $140-million Sentosa Express, a monorail system

linking the mainland and Sentosa.

Once the monorail starts operations in January, it

will boost Sentosa's bid to become a premium resort island for the region,

the Sentosa Leisure Group believes.

To begin with, the train will stop at three

stations - the VivoCity mega-mall on the mainland, and two more stops on the

island.

Another station - Waterfront, which will be in the

heart of the IR - will be open only in 2010 when the resort development is

completed.

Minister of State for Trade and Industry S Iswaran,

who was the guest-of-honour at the handover ceremony of the monorail system

from manufacturer Hitachi Asia to Sentosa yesterday afternoon, said that the

completion of the monorail marked a milestone in Sentosa's $12 billion

masterplan to redevelop and rejuvenate the island resort.

Launched in 2002, the 10-year plan proposes to

refresh many of Sentosa's offerings and upgrade existing facilities,

enhancing its attractiveness and competitiveness. The masterplan is

progressing well, Mr Iswaran said.

Sentosa, which had originally looked to receiving

more than eight million visitors a year by 2012, now expects to pass the

target by 2010 - when most of the planned attractions on the island,

including the IR, are completed.

At present, the island attracts more than five

million visitors annually, with a record high of 5.2 million in the latest

financial year. - by Uma Shankari SINGAPORE

BUSINESS TIMES December 5, 2006

Sentosa Cove condo plot draws record

$919 psf

Ho Bee's bid price of $181.2m was the highest of five offers for the

119,508.4 sq ft site

A new record has been set for 99-year condominium land on Sentosa Cove,

with Ho Bee Investments offering the top bid of $919 psf of potential gross

floor area for a tender which closed yesterday.

In absolute price terms, its bid price was $181.2 million, and was the

highest of five offers for the 119,508.4 sq ft site, which can be developed

into a six-storey condo.

The plot has a 1.65 plot ratio (ratio of potential maximum gross floor

area to land area).

The $919 per square foot per plot ratio (psf ppr) unit land price for the

latest Sentosa

Cove condo plot is 12 per cent higher than the $818 psf ppr that a Lippo-led

consortium paid two months ago for the Marina Collection site in Sentosa

Cove's Northern Residential Precinct.

Lippo's site, next to the One Degree 15 Marina Club, can be developed

into a four-storey condo.

Ho Bee's breakeven cost for a six-storey condo on the Waterfront

Collection site could be about $1,250 psf, reckon market watchers. It is

expected to be eyeing an average selling price of around $2,000 psf or even

more by the time it is ready to launch the project, say, in next September.

Its 249-unit The Coast condo on Sentosa Cove released early last month is

about 90 per cent sold, at an average price of about $1,600 psf.

Yesterday's provisional tender result cements Ho Bee's position as the

leading developer in the upscale waterfront housing district, where it has

been buying land since master developer Sentosa Cove Pte Ltd began selling

land parcels in the location in late 2003.

Assuming it is awarded the latest Waterfront Collection site, Ho Bee

would have spent about $724 million buying slightly more than one million sq

ft of land on Sentosa Cove - which it is developing into over 600 homes.

This is about a quarter of the total 2,446 homes planned for Sentosa Cove.

The Waterfront Collection site is the first of four condo plots in

Sentosa Cove's Southern Residential Precinct.

With fewer and fewer sites left in the location, the scarcity value is

expected to continue driving up property prices on Sentosa Cove.

Ho Bee clinched its maiden condo plot (which it has developed into The

Berth By The Cove, and received Temporary Occupation Permit recently) in

late 2003 for $351 psf ppr. The group has achieved an average selling price

of about $900 psf for the 200-unit condo, which is fully sold.

Ho Bee's other projects in the location include eight terrace houses (The

Berthside) which are all sold, and two man-made islands with luxury villas.

To date, Ho Bee has sold 20 of the 21 bungalows on Coral Island at prices

between $5.3 million and $14 million each.

On average, the price works out to about $800 psf of land area. Ho Bee is

getting ready to release 29 bungalows on Paradise Island early next year.

Bidders at yesterday's tender for the Waterfront Collection site -

besides Ho Bee - are said to have included City Developments, CapitaLand and

Frasers Centrepoint. The site will be awarded based solely on price.

While up to 117 homes can be built on the plot, Ho Bee is expected to

build about 100 to 110 units as it opts for mostly large units - three and

four-bedroom units and penthouses given current strong demand for bigger

apartments.

Units on the third storey and upwards will be able to enjoy views of

Tanjong Golf Course.

Ho Bee will have 21 berths in the development.

In fact, all of Ho Bee's condo developments at Sentosa Cove will have

berthing facilities. - by Kalpana Rashiwala

SINGAPORE

BUSINESS TIMES 30 Nov 2006

Lippo condo draws OCBC, RZB, Marina

developer

Lippo Group has drawn together an

interesting array of partners for its first condo development at Sentosa

Cove, BT understands.

Two banks - Singapore's OCBC and a European bank -

as well as the developer of ONE 15 Marina Club, right next to Lippo's site,

are all taking equity interests in the 99-year leasehold condo project.

OCBC is also expected to provide Lippo the loan

for the development, in addition to taking a 10 per cent equity stake in it.

The European bank - said to be Austria's RZB - is expected to take a bigger

stake, possibly around 25 per cent. Interestingly, the developer of ONE 15

Marina Club, SUTL Group, took part in the tender for the condo site when it

closed in September.

Market watchers expect SUTL and Lippo to explore

synergies between the adjacent developments. 'The two could be packaged such

that buyers at the condo get free membership of ONE 15 Marina Club. This

would enable condo residents to use the marina's facilities,' one market

watcher suggests.

Lippo is expected to participate in the

development through its Hong Kong-listed unit Hongkong Chinese Ltd and will

retain a majority stake of about 50 per cent in the project. The 170-unit

condo will be four storeys high and is slated for launch in the second half

of 2007. Lippo was the highest bidder for the site, at $234.7 million or

$818 per square foot (psf) per plot ratio. Analysts say its breakeven cost

could be around $1,200 psf.

Property consultants reckon Lippo aims to surpass

the $1,600 psf average selling price that Ho Bee is now getting for The

Coast on Sentosa Cove. Ho Bee has sold about 80 per cent of its 249-unit

project. Lippo is understood to have appointed Australia's Philip Cox as

design consultant for its project and to have tasked Architects 61 with

creating 'a bungalow in a condo'. Market watchers say OCBC's 10 per cent

interest in the project marks the second time the bank is known to have

taken a stake in a property development here in recent months.

OCBC earlier took a 10 per cent interest in the

Orchard Central mall project by Far East Organization. That was seen as a

strategic investment to pave the way for closer cooperation between Far East

and OCBC, which owns the next-door Specialists' Shopping Centre which it

plans to redevelop.

Contacted yesterday, OCBC spokeswoman Koh Ching

Ching declined to comment on the bank's participation in the Lippo condo

project. However, she noted that the Banking Act allows OCBC to take a stake

of up to 10 per cent in any company without prior approval from the Monetary

Authority of Singapore. And the bank is allowed to hold properties not for

its own use, so long as their aggregate net book value does not exceed 20

per cent of the bank's total capital funds.

- SINGAPORE

BUSINESS TIMES November 4, 2006

Developers bet big on Sentosa Cove condos

Up to 40% margins possible with prices

at prime values

Sentosa will be home to Singapore's second integrated resort with casino

by 2010 - but the gambling has already started.

Betting on huge profit margins at Sentosa

Cove, Lippo Realty recently bid 130 per cent more than the price paid for

the first condominium site in December 2003; while Ho Bee Group - which

launched the first condo there - will soon launch The Coast at around $1,400

psf, 75 per cent more than an apartment cost there less than three years

ago.

The odds are in favour of even higher

prices. Last month, Lippo bid a new benchmark price of $234.7 million for

the 240,000 sq ft, 99-year leasehold site. Based on data compiled by CB

Richard Ellis (CBRE), the price works out to be $818 psf per plot ratio, 28

per cent more than the price for the most recent site sold about a year ago.

Joseph Tan, director (residential) at

CBRE, also noted that Lippo's bid price matches those of recent freehold

sites sold in District 9. He even believes that Sentosa Cove could become a

'pace-setter' in the movement of prime prices in the residential market.

Lippo has not been awarded the site yet

but BT estimates that based on its bid price, the new condo could be

launched at around $1,600 psf. When Ho Bee Group launched the first condo

The Berth by the Cove in November 2004, average price was just $800 psf.

When The Azure by Frasers Centrepoint was launched in September 2005, prices

had risen by as much as 25 per cent. By July, City Developments' The

Oceanfront @ Sentosa Cove was selling for

$1,300-$1,350 psf, about 60 per cent more than The Berth.

Ho Bee should not be too sore, though. A

financial analyst who did not want to be named projected a profit of about

$173 million for the group from proceeds of The Coast. She is not too

concerned about rising land prices at Sentosa either: 'In the near term, we

do not foresee any risks.'

Based on estimated construction costs and

building efficiency, Ho Bee's project could have a profit margin of between

35 and 40 per cent. Indeed, BT estimates the margins for the previous two

developments were also in this region while The Berth enjoyed a margin of

around 25 per cent.

Ho Bee is said to have been outbid by

Lippo for the latest Marina Collection site by 7 per cent but Lippo will not

be expected to take a haircut.

Colin Tan, head of research and

consultancy at Chesterton International, said: 'Given the way the market is

moving, I would not even rule out prices hitting the $2,000 psf mark.

'Developers would normally factor at

least a 25 per cent profit margin in their planning but depending on how the

market pans out or takes off, returns of 50 per cent or more would not be

surprising.'

This could explain Lippo's bullish bid

for the Marina Collection site.

'In the case of Sentosa, developers

probably see this site as being less risky - although the price is many

times higher - than say a suburban site in an off-location, given the

lukewarm conditions in that segment of the market presently,' he added.

A property consultant who did not want to

be named agreed. 'Sentosa has not reached its full potential yet. Even in

the prime districts, you don't see this potential because it has already

been capitalised,' she said. Outside Sentosa, developers generally work with

a 10-15 per cent margin, she said.

There are several more residential sites

at Sentosa Cove to be released at strategically timed intervals in the

future, and two developments are unlikely to ever be launched together.

'Who will Lippo's competitor be?' asks

Nicholas Mak, director of research and consultancy at Knight Frank,

highlighting that it is very much a sellers' market. Still, buyers will be

gambling too. Says Mr Mak: 'The higher the purchase price, the higher the

risks for investors. - by

Arthur Sim SINGAPORE

BUSINESS TIMES October 4, 2006

Sentosa Cove's last northern condo

site up for grabs

Land price of the site expected to be $550-$600 psf ppr

Sentosa

Cove Pte Ltd (SCPL) is putting up

for sale the last major site in the Northern Residential Precinct of the

upscale waterfront residential enclave

The Marina Collection comprises two plots

for condo development next to the One 15 Marina Club.

The plots totalling 239,198 square feet

of land area are being sold on 99-year leasehold tenure for four-storey

condo development with up to 170 units. The plot ratio (ratio of potential

maximum gross floor area to land area) will be 1.2.

Developers may build luxury waterfront

residences, service apartments or vacation homes on the two plots which are

being offered as a single parcel through a tender closing on Sept 13.

The award will be based solely on price,

SCPL told BT.

A property consultant familiar with

Sentosa Cove said: 'The developer of the condo on Marina Collection site

could be looking at breaking even at about $900-$950 per square foot (psf).

Working backwards, that reflects a land price of about $550-$600 psf per

plot ratio (ppr) or an absolute sum of about $158 million to $172 million.'

The latest condominium project launched

on Sentosa Cove - CityDev's and TID's 15-storey development called The

Oceanfront @ Sentosa Cove - is currently commanding an average price

slightly above $1,300 psf.

While the Marina Collection has a much

lower height limit and does not face the sea directly, a condo project on

the site should still be able to ride on strong demand for homes on Sentosa

Cove, reckons the property consultant.

Owners of yachts berthed at the One 15

Marina Club should find it convenient to zip in and out of their weekend or

holiday condo at the Marina Collection site.

The four-storey height limit is the

shortest for all the condo plots sold so far on Sentosa Cove and that is in

keeping with the low-rise character around the pier.

The earlier condo plots sold in the

Northern Precinct, or North Cove, can be built up to at least six storeys.

Prices of condo plots on North Cove have risen about 80 per cent over a

two-year period from $351 psf of potential gross floor area in late 2003,

when SCPL began selling land parcels in the location, to $639 psf per plot

ratio in January this year. The latter site price was achieved for The

Baywater Collection parcel sold to Ho Bee. It comprises three plots - two

can be built up to eight storeys and the third up to six storeys.

Just last week, SCPL awarded the Quayside

Collection site to City Developments for $255 million or $355 psf ppr but

this comprises a mix of hotel, commercial and condo plots, making the latest

sale difficult to use as a benchmark for other land sales on Sentosa Cove.

SCPL has moved on to selling land in

Sentosa Cove's Southern Precinct. The maiden sale of 12 bungalow plots will

be through an auction on Aug 25.

In all, Sentosa Cove will eventually have

about 2,500 homes, about 60 per cent of which will be in North Cove. The

Marina Collection parcel is linked along the waterfront promenade to Sentosa

Cove's Integrated Arrival Plaza and the recently awarded Quayside Collection

site which will offer an array of specialty retail shops, restaurants, small

office home office (Soho) suites as well as the Westin Hotel.

- by Kalpana Rashiwala SINGAPORE

BUSINESS TIMES 1 August 2006

Ho Bee puts in top bid for Sentosa

condo site

It offers benchmark price of $640 psf ppr: sources

A tender for a 99-year leasehold condominium

Sentosa Cove yesterday drew seven bids and market talk is that Ho Bee group

put in the top bid of about $325 million.

This works out to nearly $640 per square foot of

potential gross floor area - a new benchmark in the upscale housing

district.

But Ho Bee was not alone in its bullish take on

the 276,467 sq ft plot, dubbed The Baywater Collection and which actually

comprises three land parcels.

The next highest bid, understood to be from

Centrepoint Properties, is said to be within 5 per cent of Ho Bee's bid.

Before yesterday's tender close, the highest price

fetched for a 99-year leasehold condo site at Sentosa Cove was $485 psf per

plot ratio (psf ppr). That price was notched in May when the landmark plot

next door gracing the entrance to Sentosa Cove's marina basin was sold to a

City Developments-TID Pte Ltd consortium.

Property market watchers say the bullish top bids

for the Baywater Collection site was not altogether a surprise, as the site

has an elongated double frontage of both the sea and waterway. In other

words, all the 262 or so units in the condominium will have both ocean and

waterway views.

In addition, there are not that many prime

waterfront condo sites on Sentosa Cove remaining. And given the efforts of

Sentosa Cove Pte Ltd (SCPL) - the master developer of Sentosa Cove - to

position the upscale waterfront housing district as a desirable address for

Asia's rich and famous, residential prices there can be expected to escalate

further.

Ho Bee's top bid of $640 psf ppr works out to a

breakeven cost of about $1,000 psf - not far off from the average price at

which Centrepoint's The Azure fetched in October.

A total of 41 berthing facilities will be provided

for the condominium on the Baywater Collection site, which should further

increase its attraction among the jet set.

Besides Ho Bee and Centrepoint, the other bidders

at yesterday's tender close are said to be Wing Tai, SC Global, City

Developments, Far East Organization, and a joint venture between CapitaLand

and Lippo Group.

The Baywater Collection site is the fourth and

largest condo site that SCPL has offered since it began selling housing

plots in the upscale residential district in late 2003.

SCPL decided to offer three parcels with separate

land titles as a single site to provide the winning bidder the flexibility

to amalgamate all three land parcels to build a single condominium

development, or to build two or three standalone projects on the three

parcels.

Originally, the maximum height for all three plots

was set at six storeys, but SCPL later offered a higher eight-storey maximum

height for two of the plots.

This will be subject to SCPL getting approval from

the planning authorities for the increase in height.

Yesterday's tender required bidders to place their

bids based on two scenarios. One assumes that the building height remains at

six storeys maximum while the other allows for a two-storey increase in

height to eight storeys for two of the three plots.

BT understands that Ho Bee bid close to $640 psf

ppr for the latter and a lower price of about $620 psf ppr for the former.

On both counts, its bid was the highest, say sources.

That bids crossing $600 psf ppr have been offered

for the latest site may surprise some, considering that the maximum height

will be only eight storeys, while the plot next door sold to CDL and TID can

be built up to 15 storeys high.

But as some seasoned market watchers observed, all

condo units in the latest site can face the sea - unlike the earlier plot.

'And once your development is right along the

seafront, and nothing else is blocking your view, frankly it may not matter

much whether it's eight storeys or 15 storeys, the view's pretty much the

same,' said a property source.

In any case, sentiment in Singapore's luxury

residential sector has improved by leaps and bounds over the past six

months.

This has been fuelled by foreign investors

attracted to the growth story that the integrated resorts will bring to the

Republic and its property market, which has been lagging those in other

parts of Asia. - by Kalpana Rashiwala SINGAPORE

BUSINESS TIMES 22 Dec 2005

Sentosa Cove to

sell Treasure isle piecemeal

It says demand is high from buyers who want to build own bungalows

SENTOSA

Cove Pte Ltd (SCPL), which yesterday awarded Paradise Island to

Ho Bee, says it may sell individual bungalow lots on Treasure Island next

door, instead of selling it en bloc like Paradise and Coral islands.

Apart from Paradise and Coral islands, all the other bungalow sites at

Sentosa Cove have been sold individually and demand has been high.

'Hence, we are considering the release of individual bungalow plots on

Treasure Island - instead of doing an en bloc sale - to cater to this strong

demand by home owners seeking to build their designer bungalows on an island

within Sentosa Cove itself,' an SPCL spokesman said yesterday.

Ho Bee has clinched both islands sold so far.

Treasure Island, which can house 19 bungalows, is the last of three

islands at North Cove, where SCPL has been selling land parcels since late

2003.

So far, the master developer of the upmarket waterfront housing precinct

has sold land for about 791 homes, making up half of the 1,567 residential

units slated for North Cove.

The other 1,000-odd homes planned for Sentosa Cove will be at South Cove,

which will include two islands.

When completed, the precinct will have a total of 2,600 homes comprising

condo units, bungalows and terraced houses.

Ho Bee's purchase of the 99-year leasehold Paradise Island for $64.44

million works out to about $260 per square foot of the land area of 247,846

sq ft.

This is 26 per cent higher than the $206 psf it paid for Coral Island

late last year.

Ho Bee will develop 21 bungalows on Coral Island and the project is

slated for launch next month.

Each bungalow will have two storeys and an attic, and its own swimming

pool and private berth.

As for its latest catch, Ho Bee can develop up to 33 bungalows on

Paradise Island.

While Coral Island was sold by tender - Ho Bee was the sole bidder at $38

million - Paradise Island was sold by an expression-of-interest exercise.

'We're extremely pleased with the level of interest in Paradise Island by

very eminent developers, resulting in healthy competition for a very

attractive site on Sentosa Cove,' said SCPL chairman Jennie Chua.

Besides Ho Bee, two other parties made submissions for Paradise Island.

They are understood to be CapitaLand and Wing Tai.

- by Kalpana Rashiwala SINGAPORE

BUSINESS TIMES 11 Aug 2005

Well-heeled snap

up Sentosa property

Within hours, 14 waterfront bungalow plots at

Sentosa Cove were snapped up on Friday for between $2.48 million and $3

million in special private treaty sales that do away with the usual tender

process and allow buyers to make a decision on the spot.

With cheque books in hand, the 50 or so

well-heeled investors crossed the causeway to the island, some in their

Mercedes-Benzs, BMWs and Jaguars, from as early as 9 am to make their pick

of the 19 plots on offer.

After a quick look at the map ands model at the

site office for the upmarket resort-style development on the island's

eastern coast, the investors hopped on to a jeep, mini-bus or a boat to view

the sites.

Of the 14 plots sold yesterday, the smallest at

7,427.1 sq ft fetched $334 psf while the largest at 9,579.88 sq ft was sold

for $325 psf.

Seven of the buyers were Singaporeans and the

others were an American, a New Zealander, two Indonesians and three

Malaysians. -

4 March 2005 SINGAPORE

STRAITS TIMES

Sentosa Cove buyers may get PR deal

The appeal of Sentosa Cove to wealthy foreign

property buyers could get a boost soon - if an extension to a permanent

residence scheme to woo high net worth investors takes effect.

Under the proposed extension, up to $2 million of

the $5 million minimum investment required for the Financial Investor Scheme

for Permanent Residence can be invested in a bungalow on Sentosa Cove. The

remaining sum of at least $3 million must still be placed in financial

assets, however.

The changes are still being finalised.

According to the existing scheme, which took

effect late last year, applicants must place at least $5 million in

financial assets with financial institutions regulated by the Monetary

Authority of Singapore (MAS). Applicants must also have minimum net personal

assets of $20 million.

An MAS spokesman yesterday confirmed that details

are being finalised for a variation of the scheme to allow a bungalow

purchase on Sentosa Cove to form part of the qualifying assets. 'We are

working out the details with the Ministry of Trade and Industry,' said the

MAS spokesman.

MTI is the parent ministry of Sentosa Development

Corporation. The latter, in turn, is the parent of Sentosa Cove Pte Ltd, the

master developer that has been selling land in the upmarket waterfront

housing district since October 2003.

However, some developers and property market

watchers are wondering why bungalows on Sentosa Cove are the only qualifying

property assets allowed under the proposed variation of the Financial

Investor Scheme.

Market watchers reckoned the authorities' thinking

could be similar to the rationale given last year when fast-track approval

within 48 hours was introduced for foreigners (including PRs) buying land

and landed homes on Sentosa Cove: 'The strategic objective of Sentosa Cove

is to attract international talent and high net worth personalities to have

a stake in Singapore.'

Elsewhere in Singapore, foreigners including PRs,

can only buy such restricted residential property if they have the

permission of the Land Dealings (Approval) Unit. Approval is usually granted

in about three to five weeks to PRs and foreigners deemed to bring some

economic benefit to Singapore. However, under a special channel set up for

Sentosa Cove, the approval time has been reduced to two working days.

On learning about the proposed change to the

Financial Investor Scheme for PRs which will allow bungalows on Sentosa Cove

as a qualifying asset for the minimum $5 million investment, a developer

said yesterday: 'I guess they have to start somewhere, and Sentosa Cove is a

good starting point. But we hope that the qualifying assets can be extended

in the near future to cover terrace houses and condos on Sentosa Cove, as

well as to residential properties in the rest of Singapore.'

Another restriction that developers have been

lobbying to remove is a measure introduced as part of the May 1996

anti-speculation package - that residential property purchases can no longer

form part of the $1.5 million investment that PRs make under the Economic

Development Board's Permanent Residents for Investors' Scheme.

That restriction remains, an EDB spokesman

confirmed yesterday.

Under the variation to the Financial Investor

Scheme for PRs, the Sentosa Cove bungalow purchase can be for land bought

directly from SCPL or a completed property bought from developers or

subsequently in the resale market.

The minimum five-year holding period under the

original scheme announced in November also applies to bungalow purchase on

Sentosa Cove. However, applicants granted Singapore citizenship during the

five-year retention period will no longer need to comply with the terms and

conditions of the scheme.

SCPL began selling land on Sentosa Cove in October

2003. To date, it has sold through tenders two condo plots, four sites for

terrace housing, 24 bungalow lots as well as Coral Island, which will be

developed into 21 bungalows.

From today, SCPL is selling bungalow plots through

private-treaty to broaden its reach to individual investors. When fully

developed, Sentosa Cove will have about 300 bungalows, 200 terrace homes and

2,100 condo units. - by Kalpana Rashiwala

SINGAPORE

BUSINESS TIMES 4 March 2005

The latest land tender for a condominium development

at the upmarket residential enclave of Sentosa Cove will be awarded based

not only on price, but also on the bidder's architectural design proposal.

Sentosa Cove to sell land in Private

Deals

Sentosa Cove Pte Ltd is stepping up its

marketing of land parcels in its namesake waterfront housing district on

Singapore's resort island.

It will soon begin selling individual bungalow

lots through negotiation on a private treaty basis, in addition to the

tender method it has been using since it began selling 99-year leasehold

land parcels in late 2003.

And Sentosa Cove is extending the geographical

reach of its marketing campaign further afield to places like Japan, China,

Taiwan, Australia, the Middle East and Europe.

'The world is our oyster,' said Sentosa Cove

chairwoman Jennie Chua in a recent interview with BT.

She also confirmed that private treaty sales will

kick off this year, starting with individual bungalow parcels. 'This will

open up a new marketplace for us,' she said.

Private treaty deals will speed up land sales on

Sentosa Cove as they are typically a faster method of selling property

compared with the the more troublesome tender method, say property

consultants.

Sales of bigger parcels for terrace housing and

condominiums to developers through private treaty is 'not on our radar

screen at this point in time', Ms Chua said.

'People who don't want to tender and are not used

to the tender system are usually the individuals,' she reasons. 'So the

negotiation or private treaty method is for these people. Developers, on the

other hand, are comfortable with buying land through tenders.'

However, some analysts say it will only be a

natural progression for Sentosa Cove to later extend private treaty deals to

larger sites once it has successfully tried and tested the method on smaller

plots.

While Sentosa Cove will soon introduce private

treaty sales for individual bungalow parcels, it is not abandoning the

tender method. The two will operate in parallel fashion, say Sentosa Cove

officials.

The tender method serves as a benchmark to

establish land values for the various locations on Sentosa Cove. For

instance, earlier tenders have helped to establish prices for waterway and

seafronting bungalow plots. These will be used as a price guide for the sale

of similar, nearby parcels on a private treaty basis in the near future.

Similarly, when Sentosa Cove decides to begin

sales of bungalow plots which face the nearby golf courses, the tender

method is likely to be used initially to benchmark the value of these sites,

while later releases of nearby sites could be negotiated through private

treaty.

Sentosa Cove will eventually comprise 2,600 homes

that will be built on a 117-hectare stretch of mostly reclaimed land on the

eastern coast of Sentosa Island.

To date, about 9 per cent of this land has been

sold through tender exercises, the first of which was launched in October

2003. The sites sold to date can generate about 400 homes, comprising

condominium units, bungalows and terrace homes.

Initially, Sentosa Cove had concentrated its

marketing efforts mainly in Singapore and the region, including Indonesia,

Malaysia and Hong Kong.

Recently, it has started to cast its net wider, to

places like Japan, Taiwan, Shanghai, Dubai and the Gulf area. Also on the

list are Sydney, Melbourne, the UK and Scandinavia.

Sentosa Cove general manager Margaret Goh said DTZ

and CB Richard Ellis have been appointed principal agents for some of these

markets. 'But it doesn't preclude us talking to other agents,' she added.

Sentosa Cove also showcased its plans earlier this

month at the Dubai Property Show, and will be taking part in the MIPIM

international real estate fair in Cannes next month. - by

Kalpana Rashiwala SINGAPORE

BUSINESS TIMES

22 Feb 2005

Sentosa terrace houses set price

record

BERTH BY THE COVE

Developer Ho Bee has set a record price for Singapore

terrace homes with its Sentosa Cove development. The Berthside, comprising

eight terrace homes on Sentosa Island, is going for between $2.2 million and

$2.85 million per unit - and buyers have already signed up for seven of them

since sales started on Jan 21.

Four of the buyers are foreigners and permanent

residents.

There are several good reasons why buyers are

paying such prices.

For one, the project is the first of its kind

here. There are currently no waterfront-facing terrace homes in mainland

Singapore, say property consultants.

In fact, Ho Bee's project marks the first time

landed homes are being offered on Sentosa Cove, an upmarket residential

district coming up on the eastern coast of Sentosa.

Each of the 99-year leasehold terrace houses at

The Berthside comes with a private berth for owners to park their boats.

Secondly, Ho Bee's units are much larger than

typical terrace homes on the mainland, said Ho Bee Investment's general

manager Chong Hock Chang.

Intermediate terrace units at The Berthside have

land areas of 2,300-2,700 sq ft each, compared with typical plot sizes on

the mainland of 1,600 to 1,800 sq ft. Built-up areas for Ho Bee's units

range from 4,200 to 5,000 sq ft - again larger than the usual 3,000-3,500 sq

ft elsewhere in Singapore.

Similarly, corner units at Ho Bee's project come

with land areas ranging from 3,200 sq ft to 3,800 sq ft and built-up space

of 4,300-5,200 sq ft - surpassing those on the mainland, which usually have

a land area of 2,200 to 2,400 sq ft and built-up areas of 3,000 to 3,500 sq

ft.

Intermediate units at The Berthside cost $2.2

million to $2.4 million each, while the corner homes are priced between

$2.65 million and $2.85 million, said Mr Chong.

Property consultants say the most expensive

terrace homes on mainland Singapore available from developers are Far East

Organization's freehold homes at The Greenwood, with intermediate terrace

units priced at around $2.1 million.

In the 99-year leasehold segment, the

highest-priced transaction for a terrace house since 2003 has been at about

$1.3 million.

Another strong selling point for Ho Bee's project

is that foreigners receive fast-tracked approval, within 48 hours, from the

Singapore Land Authority's Land Dealings (Approval) Unit to buy landed

properties on Sentosa Cove.

Foreigners, including permanent residents, may buy

landed housing, vacant land and apartments in a building of less than six

storeys only if they have the LDU's approval.

This approval is usually granted in about three to

five weeks to PRs and foreigners deemed to bring some economic benefit to

Singapore.

The two foreigners who've bought terrace homes at

The Berthside are from Hong Kong and India while the two PR buyers are

Malaysians.

Ho Bee has three projects at Sentosa Cove. It is

developing a 200-unit condo, The Berth, which it began selling in late

November. It has to date sold more than 70 per cent of the project, whose

average price has moved from $785 psf to just above $800 psf over the past

few months.

The group has also bagged Coral Island, which is

one of five islands created at Sentosa Cove. On it, Ho Bee plans to develop

21 bungalows with plot areas ranging anywhere from 6,200 sq ft to 14,000 sq

ft.

The luxury homes will have built-up areas of

between 5,000 sq ft and 10,000 sq ft.

Prices are expected to start from $4.5 million.

Ho Bee has engaged high-profile Singaporean

architect Tan Hock Beng's Maps Design Studio as architect for the project.

It has also roped in internationally-renowned

landscape consultant Bill Bensley to do the landscaping for Coral Island's

common areas as well as for individual bungalows. The myriad projects which

Mr Bensley, an American based in Bangkok, has worked on all over the world

include the Four Seasons Hawaii, Sheraton Lagoon Bali, Oberoi Mauritius and

Grand Hyatt Istanbul.

Mr Tan has designed a whole portfolio of projects

in Singapore and overseas. He bagged awards last year for designing a condo

named Casa Grande in Marbella, Spain, and 17 upscale bungalows at Palauea

Bay, Hawaii. - 1 Feb 2004 SINGAPORE

BUSINESS TIMES

Sentosa's first condo goes on

sale today

Ho Bee releases 100 units at Berth by the Cove at average price

of $785 psf

Sales of Sentosa's first condominium start today,

with the initial release of 100 homes priced at an average of $785 per

square foot (psf).

This is expected to rise to above $800 psf when

the second phase of the 200-unit project, The Berth by the Cove, is released

early next year, said Chua Thian Poh, chairman of developer Ho Bee Group.

He said at a media briefing at a showflat

yesterday that the group expects foreigners to take up 30-40 per cent of the

waterfront development, gauging from international feedback.

'For the preview, we have set it at a lower price

for those who have registered interest,' Mr Chua said, adding that a casino

on the island won't affect the condo's target market, partly because any

such plan is understood to be part of a high-end resort.

'The second phase should be out at the beginning

of next year,' he said. 'And maybe there won't be an official launch, but

the average price should rise to above $800 psf.'

Between 10 and 20 potential buyers have already

dropped off deposits, he told reporters on the sidelines of the briefing.

Ho Bee paid $110 million last year for the 174,000

sq ft site at Sentosa Cove, the first residential enclave on the tourist

isle. Breakeven for the project, which is aimed at upper-end buyers, has

been estimated at $640 psf.

Only 2,600 homes, comprising landed and condo

units, are allowed at the 117-ha Sentosa Cove development. And according to

Ho Bee executive director Ong Chong Hua, this 'scarcity' means The Berth

will retain investment value.

Willy Shee, managing director of CB Richard Ellis,

one of the marketing agents of the project, reckons The Berth could fetch an

above-average rental yield of 4-4.5 per cent.

'The two-bedroom units could fetch $3,000-$4,000

per month, three-bedrooms could go for $4,000-$5,500 while the four-bedroom

ones could be about $7,000,' he said.

Going forward, Mr Chua said Ho Bee could release

its Mount Sinai project - which has potential for 110 mid-size apartments -

next year, while continuing to look out for land in Singapore.

Ho Bee also develops homes in London and Shanghai.

- By Vince Chong SINGAPORE

BUSINESS TIMES 24 Nov 2004

Market estimates $200-220 psf bid for

bungalow plot

The latest tender on Sentosa Cove closed yesterday

with Ho Bee understood to have emerged as the sole bidder for the en bloc

sale of an island plot that can be subdivided into 24 bungalow lots.

Sentosa Cove Pte Ltd did not make any announcement

on the outcome of the tender for Coral Island, but market watchers estimated

Ho Bee's bid could have been $200-220 per square foot of land area.

This factors in a bulk or en bloc discount of 15

to 20 per cent using a base price of $260 psf.

This was the lower end of the range of prices at

which Sentosa Cove has previously awarded 99-year leasehold waterway-facing

bungalow plots that were sold individually.

The earlier plots are believed to have been sold

primarily to end users.

Analysts pointed out that in formulating its bid,

Ho Bee would also have considered the risks involved in developing a

high-end product, plus its profit margin.

A bid of $200-220 psf works out to $36.9 million

to $40.6 million for the 184,634 sq ft total land area. Assuming Ho Bee

develops the maximum 24 bungalows, its average land cost per bungalow would

work out to about $1.6 million.

Add to this construction costs of about $1

million to $1.2 million per unit, the breakeven cost could be about $2.6

million to $2.8 million for a bungalow.

A veteran property consultant estimated a selling

price of about $3.25 million to $4 million for a new 99-year bungalow on

Sentosa Cove with about 4,500-5,000 sq ft built-up area.

All the bungalows on Coral Island will face the

waterway and can have their own private berths for yachts.

Although Sentosa Cove has held a few land tenders

for condo, terrace and bungalow parcels, this is the first time Sentosa Cove

is offering an entire island for sale.

Coral Island comprises 24 subdivided bungalow

lots, although its successful developer may propose a new parcellation

scheme - but subject to a maximum of 24 bungalows.

For instance, if there's demand from end-buyers

for bungalows set on bigger plots of land to allow more outdoor garden area,

the developer could build fewer bungalows.

Market watchers are waiting to see whether Sentosa

Cove will award Coral Island to Ho Bee, which is developing a 200-unit condo

and eight terrace homes on two parcels that it clinched in a maiden tender

at Sentosa Cove which closed last December.

Sentosa Cove expects to make an award within the

next two weeks for yesterday's Coral Island tender as well as for 11

bungalow sites in an earlier tender that closed about a month ago, said a

spokesman for Sentosa Cove.

Last month's tender also included two terrace

plots and a condo site, which have since been awarded.

Sentosa Cove, which will eventually have 2,558

homes, is being pitched as an upscale housing district that will rank

internationally alongside Sanctuary Cove on Australia's Gold Coast and Palm

Islands Resort in Dubai as prestigious housing districts for high net-worth

foreigners.

In August, Sentosa Cove eased rules to attract

foreigners to buy landed properties, as well as to draw foreign developers

to participate in developing the housing resort. -

by Kalpana Rashiwala SINGAPORE

BUSINESS TIMES 27 Oct 2004

Bid for Sentosa Cove condo site

tops $400 psf/plot ratio

Foreign parties from M'sia, China, HK submit

tenders for landed sites

The second sale of 99-year

residential land parcels in Sentosa Cove has attracted a top bid for a condo

plot exceeding $400 psf per plot ratio, according to sources.

This surpasses the $351 psf ppr for the first

condo plot sold earlier under last year's maiden tender in the waterfront

housing district.

Among the contenders for the latest condo plot -

which can be developed into a maximum of 138 homes - are Ho Bee (which

bagged the earlier condo parcel), Centrepoint Properties and Sim Lian Group.

Property market watchers did not rule out a bid from property giant Far East

Organization.

Besides the 117,612 sq ft condo plot, two terrace

plots (each of which can be developed into a maximum of eight houses) and 11

bungalow parcels were on offer at the tender which closed at noon yesterday.

The terrace plots are understood to have attracted

bids from local developers Ho Bee and Wah Khiaw. The latter had bid

unsuccessfully for bungalow and terrace plots in the maiden tender.

Also competing yesterday for both terrace parcels

was Malaysian developer IJM Properties, a subsidiary of listed IJM

Corporation. The company's executive director Teh Kean Ming told BT this was

the company's first attempt at bidding for land in Singapore. 'Sentosa Cove

is very unique,' he added. - by Kalpana Rashiwala

SINGAPORE

BUSINESS TIMES 29 Sept 2004

World-class facility on Sentosa

for mega-yachts by 2005

Owners of multi-million-dollar mega-yachts here will soon have a world-class

facility to moor their vessels.

Toasting the deal to build Singapore's first sheltered marina are SUTL