|

Chinese now comprise largest buying group of Bungalows

Foreigner's share of bungalow deals hit 11.7% in 2010, up from 9.1%

in 2009

The Chinese picked up 15 bungalows in District 4 last year, nearly double

the eight properties they acquired in the area in 2009.

Mainland Chinese

replaced Malaysians as the biggest foreign buyers (including permanent

residents) of bungalows across Singapore last year, shows a caveats analysis

by CB Richard Ellis.

China nationals

picked up 19 properties in 2010, giving them a 3.3 per cent share of the

total 571 caveats lodged for bungalows last year.

HK

citizens were in second place, with 11 deals or 1.9 per cent share, followed

by Malaysians, who picked up eight bungalows (1.4 per cent share).

In 2009, Malaysians

were the number one buyers, followed by UK citizens and mainland Chinese.

Foreigners'

(including PRs') share of bungalow purchases across Singapore rose from 9.1

per cent in 2009 to 11.7 per cent in 2010, surpassing their 11 per cent

share in 2007.

Companies' share of purchases rose from 10.8 per cent in 2009

to 12.3 per cent last year. Singaporeans remained

the predominant buyers of bungalows, accounting for 434 deals (76 per cent

of all bungalow purchases) last year.

However, this is

lower than their 80.1 per cent share in 2009.

Throughout Singapore,

a total 571 caveats were lodged for bungalow purchases last year, up 6.3 per

cent from 2009 but still 29.7 per cent lower than the high of 812 deals in

2007.

The Chinese were

most active in District 4 (which includes Sentosa Cove) where they picked up

15 bungalows last year, nearly double the eight properties they acquired in

the area in 2009.

They were the

biggest foreign buyers in the district for both years.

Singaporeans,

however, bought even more bungalows in the district - 15 in 2009 and 23 in

2010.

After the Chinese, Indonesians were

the next biggest foreign buyers of bungalows in District 4 with six deals,

followed by Malaysians (three deals) last year.

District 10 - a high-end bungalow location on mainland Singapore - last

year saw three purchases each by Australians and Malaysians, and two

purchases each by Chinese and UK citizens. --2011

SINGAPORE BUSINESS TIMES

Landed homes : Lure of scarcity

When private home prices made their

sterling recovery in the second half of 2009, landed homes didn't miss out

on the action. The Urban Redevelopment Authority (URA) price indices for

detached, semi-detached and terrace houses recovered by 22-26 per cent in

2H 2009, after falling some 18-21 per cent from the market peak in the

second quarter of 2008 to Q2 2009.

This upward trend is likely to continue

because of the scarcity of landed homes in Singapore. Out of a total

housing stock of 1.14 million units, only 69,500 or 6.1 per cent are

landed homes.

While new landed projects are limited,

home buyers are always willing to buy older properties in the resale

market. On average, 380 new landed homes and 2,800 resale landed homes

changed hands annually between 2004 and 2009.

Moreover, there is also a certain

degree of speculative activity in the landed market. An analysis of the

caveats lodged for subsales of new landed properties in the past year

shows a gain of 5.5 to 34 per cent from their original prices two to three

years ago.

Landed properties offer a certain

prestige to homeowners in the middle to high-income groups. Nowadays,

well-heeled homebuyers in their mid-30s are especially attracted to entry

level bungalows with a land area of 4,000-5,000 sq ft and costing $4-$5

million. Some of these can be found in Lynwood Grove and Cotswold Close.

Equally popular are strata bungalows

like Goodman Crest and Bellaville which have the same built-up area as the

average bungalow but cost less - around $2.5-$3.5 million - because of the

shared ownership of land and communal facilities like swimming pool and

landscaped garden.

Similarly, cluster terrace houses are

seen as value for money as opposed to condominiums because of their

generous built-up areas of over 3,000 sq ft. These also come with communal

facilities which appeal to families with young children.

However, the downside of cluster

terrace developments is the rather crowded conditions within the compound

and the higher volume of vehicular traffic they generate in the

neighbourhood.

At the top of the Singapore housing

pyramid are the good class bungalows (GCBs) which are the most prestigious

and expensive type of housing. In just the first two months of 2010, some

14 GCBs were transacted, compared with just three in the first quarter of

2009.

Among the 14, the most expensive GCB

was a Swettenham Road house, which sold for $31.5 million in January. It

has a land area of 29,569 sq ft.

In 2009, the highest priced GCB was

sold in October at $38.67 million. It is located in Victoria Park Road and

has a land area of 32,077 sq ft.

Over at Sentosa Cove, Kasara villas,

which range from 9,000 sq ft to over 14,000 sq ft, were sold at $14-$22

million in November 2009. These villas come with designer finishes and top

quality fittings.

The reason why leasehold landed homes

in Sentosa Cove can fetch prices equivalent to, if not higher than, their

freehold counterparts on the mainland is because of the resort island

status, foreigners' eligibility to buy and above all, limited supply of

around 400 units. Foreigners are not allowed to buy landed properties on

the mainland and even permanent residents need special approval from the

authorities to buy one.

In 2009, a landed project in Seletar

Hills estate called Luxus Hills was launched. The first phase of 78

terrace houses was sold within a few weeks. In the second phase, another

30 units sold quickly at a similar price range. The terrace houses fetched

$1.7-$2 million while the semi-detached houses fetched $2-$2.2 million.

Estrivillas, a cluster housing project

in Jalan Lim Tai See comprising 38 semi-detached and one detached house,

was launched in November 2009. By January this year, 24 of the 39 units

had been sold at $3.5-$3.8 million.

In the resale market, transactions in

January and February this year show that the median price of semi-detached

and terrace houses was $2.5 million and $1.5 million respectively. A year

ago, the corresponding median prices were $1.76 million and $1.16 million.

Developers marketing landed properties

should emphasise the limited land resources and hence, the value of landed

properties in the long-term. Secondly, owners do not have to pay

maintenance fees for houses, unlike condominiums. Unless a house is very

old, the upkeep is generally inexpensive. Spending money on one's own

property beats contributing $3,000 to $4,000 a year to a condo management

or sinking fund.

Landed homes are also attractive as

investments as they can fetch good rentals. Proximity to premier schools,

international schools and embassies is definitely an advantage.

At the top, GCBs in Bukit Timah can be

leased out at $18,000 to $25,000 a month while standard detached houses

can fetch $12,000 to $18,000, depending on their size and condition.

Semi-detached houses can command a monthly rent of $8,000 to $12,000 while

terrace houses can achieve $3,000 to $7,000.

Limited supply results in the

relatively inelastic prices of landed homes, and increasingly, those who

hold such properties will find them a boon as more often than not these

are assets that appreciate in value over time.

--2010 March 25 BUSINESS

TIMES

Bungalow prices to hold steady

Landed property enjoyed a fantastic

year in 2010. Good Class Bungalows in the prime districts of 9, 10 and 11

did particularly well in terms of sales. But good performance was seen for

all types of bungalows in the prime districts, and the eastern districts

of 15 and 16. Total sales value of bungalows in these three categories

alone amounted to $3.3 billion last year, 46 per cent higher than the

sales done in 2009.

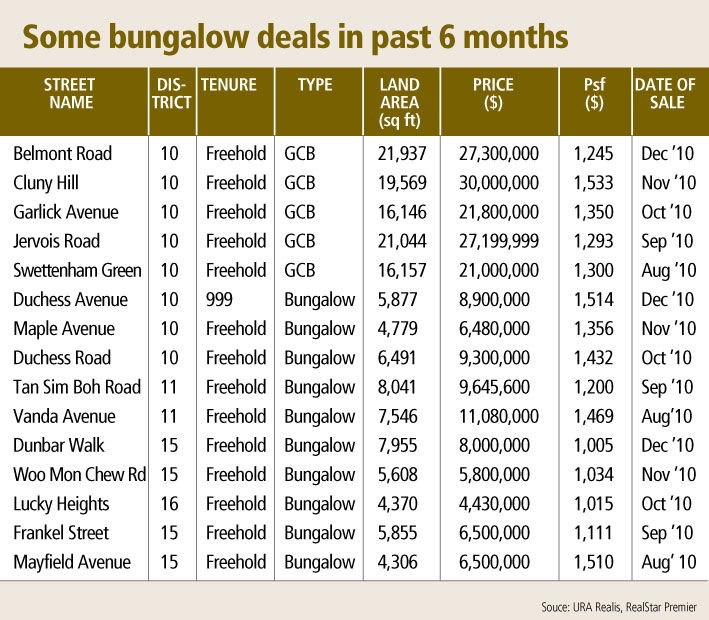

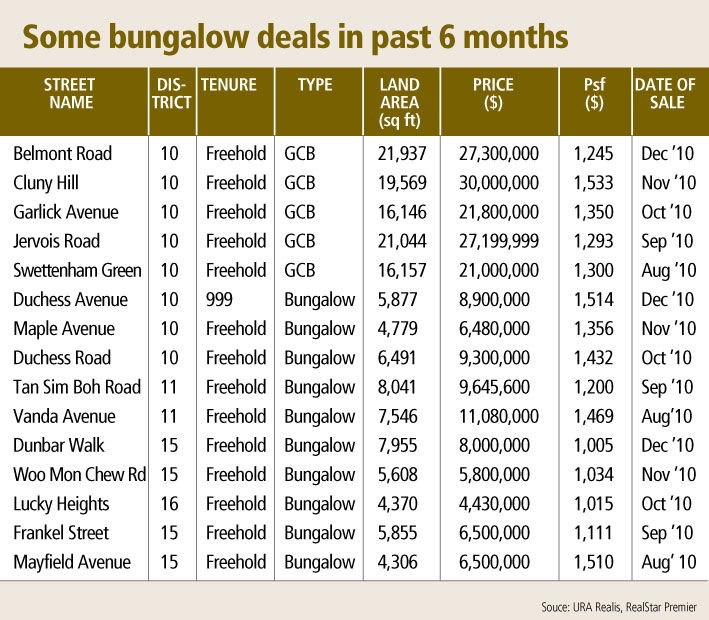

A total of 88 Good Class Bungalows

(GCBs) in districts 9, 10 and 11 changed hands in 2010, compared to 84 in

2009, an increase of about 5 per cent. These bungalows, located in

designated GCB Areas, are sought after by ultra-high-net-worth individuals

(UHNIs). Median prices for GCBs also saw the highest percentage growth

among all bungalow segments last year. The median price for GCBs in 2010

was $1,129 per square foot, up 31 per cent from $865 psf in 2009.

In fact, most owners who bought their

GCBs five years ago would have enjoyed close to a 300 per cent

appreciation in property values. These bungalows in the exclusive enclaves

of Nassim, Tanglin, Dalvey and Cluny Park are in high demand as elite

homeowners in these areas tend to hold on to such prized assets, making

supply scarce.

Besides GCBs, other bungalows in the

prime districts have also experienced phenomenal growth both in terms of

transaction volumes and price. A total of 95 bungalows changed hands in

2010 compared to 75 in 2009.

The median price per square foot has

also gone up from $1,018 psf in 2009 to $1,207 psf in 2010. It is getting

more pricey to own a bungalow in the prime districts these days as most of

them could easily command prices above $7 million. Demand for bungalows in

Bukit Timah is naturally high due to their proximity to some of

Singapore's prestigious schools, such as Nanyang Primary School,

Anglo-Chinese School (Barker Road) and Raffles Girls' Primary School.

Another popular bungalow market is in

the eastern part of Singapore - in district 15 (which includes Katong and

East Coast) and 16 (including Upper East Coast and Bedok). A total of 93

bungalows were sold in these two districts last year, 24 per cent more

than the 75 transactions in 2009. The median price has also risen 28 per

cent from $732 psf in 2009 to $937 psf in 2010.

As prime district bungalows get

pricier, some buyers have switched their search to the east where prices

could be 10-30 per cent lower.

Bungalows in Katong are in greater

demand. Easy access to food amenities, the short drive via East Coast

Parkway to the Central Business District and the presence of top schools

in the vicinity are key reasons for the high demand for bungalows here.

The Singapore bungalow market was

poised for a superb bull run this year, with prices expected to soar by

another 10-20 per cent until the government came out with its Jan 13

cooling measures.

Impact of new measures

However, the new rules should have a

limited impact on the bungalow segment due to the short supply and strong

holding power of the owners.

The lower loan-to-value limit on new

private home purchases for those already servicing a housing loan should

not pose a major problem to most bungalow buyers. In fact, most of these

well-heeled buyers do not make use of the maximum financing.

As well, owners of these bungalows,

especially GCB owners, tend to hold on to their properties for many years.

It is also the norm for them to own a few such properties to keep for the

next generation.

Despite the cooling measures, there are

still many buyers searching for their dream bungalows. The only negative

impact of the measures we have seen so far is a standoff between sellers

and buyers. Sellers are unwilling to lower their prices while buyers are

expecting price declines. This situation has created a price gap, which

means fewer bungalow transactions are likely in the months ahead.

There are still many offers coming in

from buyers but these are generally lower than what sellers expect. In

fact, we are seeing some sellers withdrawing their properties from the

market, with a view to relaunching them six to 12 months later. Some have

opted to lease out their bungalows instead of selling them, for the time

being.

Trend in 2011

Going forward, we expect the sales

volume of bungalows to drop by about 20 per cent for the year. First

quarter sales are likely to fall more steeply, by 30 per cent or more,

before picking up again from the second quarter. The Chinese New Year

festivities in February, coupled with the introduction of the cooling

measures in January, are the main reasons for the big drop expected in Q1

sales.

Short-term investors or speculators who

usually look for a 10-20 per cent profit margin within one to two years

are effectively driven out of the market by the punitive seller's stamp

duty in the Jan 13 cooling package. Bungalows with redevelopment potential

may also lose some of their appeal. Before the measures, developers or

investors would pay a high premium to own such bungalows.

However, they now have to be prudent as

their margins will shrink due to the higher stamp duty they will have to

pay when selling the redeveloped properties. On the other hand, bungalows

with existing tenancies seem to be the star attraction for investors.

Despite a slowdown in bungalow

transactions this year, prices on the whole are likely to remain stable,

with a gradual increase of 5 per cent from 2010.

With the economy doing well, bungalow

sales should be relatively healthy even if they may not match the vibrancy

of 2010. Overall household wealth has risen over the years and owning a

bungalow is a growing status symbol.

The upside potential for bungalows

remains promising given that the price of a brand-new bungalow in a prime

district would generally be below $2,000 per sq ft of built-up area. This

compares well with a new condominium in the same vicinity which would be

priced above $3,000 psf of strata area.

Furthermore, we are seeing a steady

increase in the number of ultra-rich Singapore permanent residents taking

up citizenship here. This means they no longer face restrictions on the

number of bungalows they can own in Singapore.

All in all, demand for bungalows will

remain strong, as long as interest rates do not rise dramatically, and

there are no further cooling measures.

Bungalow hunt

For those still searching for a

bungalow, here are a few tips on what to look for:

- Location: As with any property

investment, location is the most important criterion in selecting a

bungalow. When the market picks up, bungalows in prime locations will

appreciate faster than those elsewhere.

For example, many bungalows in the

prime districts have tripled in value over the past five years. Those

in the eastern districts have doubled over the same period. It is also

easier to resell a bungalow in a prime district as there is a bigger

pool of buyers.

- Shape and gradient of land: The best

choice is a regular-shaped plot with a broad frontage as it allows the

house to have an imposing entrance. And the land should be flat rather

than undulating. Better still would be a plot on elevated ground,

especially if it comes with a panoramic view, which is hard to come

by.

- Zoning: There are various kinds of

zoning for bungalow land - such as Good Class Bungalow Area (GCBA),

bungalow and mixed landed.

Only GCBs, which are governed by

stringent planning requirements, are allowed to be built in a GCBA.

For a plot zoned for mixed landed use, terrace and semi-detached homes

as well as bungalows are allowed.

Hence, zoning has a bearing on the

prestige of the neighbourhood. Bungalows built on sites zoned

specifically for bungalows tend to fetch higher values as there will

only be bungalows in that area instead of a mixture of terrace,

semi-detached houses and bungalows.

- Redevelopment potential: Due to

their plot ratio and site specifications (such as road frontage and

depth of plot), some bungalows have huge redevelopment potential, and

these properties are much sought after by developers.

-- 2011 March 3 BUSINESS

TIMES The

writer is managing director, RealStar Premier Property Pte Ltd

- - -

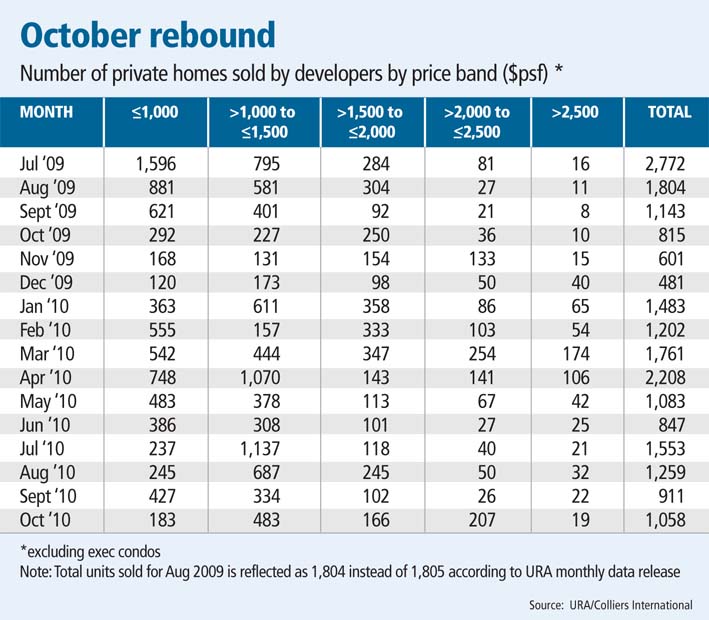

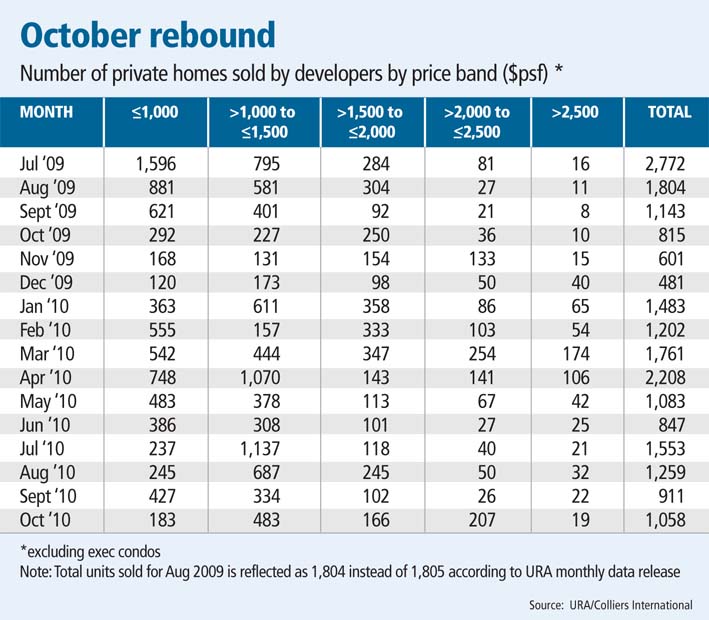

Developers' sales of private homes

surged 82 per cent month on month to 1,544 units in July from the low of

847 units in June, according to latest official figures. This reflects a

resumption in home buying, which had taken a breather during the school

holidays and World Cup.

However, sales are expected to slip to

around 800-1,000 units again in August, on the back of slower launches

during the Hungry Ghost Month, say some property agents. After this ends

on September 7, both launches and sales will pick up again, they reckon.

In the first seven months of this year,

developers have sold 9,957 private homes (excluding executive condos),

after last year's strong sales of 14,688 units.

CB Richard Ellis expects the full-year

figure will be about 14,000 units. Jones Lang LaSalle's estimate is

13,000-14,000 while DTZ's SE Asia research head Chua Chor Hoon puts the

number at 13,000-15,000 units.

'The outlook still remains positive

against the backdrop of Singapore's economic growth and the low interest

rate environment but buyers will be more selective given that so many

Government Land Sale sites are being sold; this will translate to greater

choice of new projects.

'Prices have also been on the rise, so

potential buyers will be more discerning in picking properties that have

better potential for rental income or capital appreciation,' Ms Chua

added. DTZ's data shows that secondary market prices of completed private

homes appreciated about 6-8 per cent in the first half of this year; her

full-year forecast is an 8-13 per cent increase.

CB Richard Ellis executive director

(residential) Joseph Tan reckons that developers are unlikely to test new

price benchmarks when they resume launches next month. But prices are

unlikely to fall below current levels either, as land prices remain high,

he adds.

On the other hand, signs of buyer price

resistance continue to prevail. Colliers International's analysis of

official developer monthly sales data released by Urban Redevelopment

Authority shows that the proportion of private homes sold by developers

priced at $1,500 psf and below was at its highest level in 10 months in

July, at 88 per cent.

The Outside Central Region, where

mass-market properties are typically located, accounted for 42.8 per cent

of the total 1,544 units sold by developers in July, while the Core

Central Region, where the most expensive homes in Singapore are found, had

a 17.9 per cent share.

Nonetheless, a handful of buyers picked

up properties at top-line prices in July, notes CB Richard Ellis executive

director Li Hiaw Ho. The most expensive apartment/condominium unit (in

terms of $ per square foot) sold by a developer in July was a unit at

Boulevard Vue which fetched $4,600 per square foot. BT understands that

Far East Organization sold the high-floor unit of 4,456 sq ft for $20.5

million.

URA's data shows that other high-end

deals last month included a unit at The Orchard Residences which sold at

$4,099 psf and another at Skyline @ Orchard Boulevard at $3,719 psf.

The least expensive non-landed home was

a unit at The Minton in Hougang which was transacted at $612 psf.

July's surge in primary market sales

came on the back of three major launches - 368 Thomson, Terrene at Bukit

Timah and The Scala at Serangoon Avenue 3. Together, they made up 46.6 per

cent of the total 1,544 units developers sold in July.

The top-selling project was The Scala,

with 400 units transacted at a median price of $1,173 psf.

Also helping to boost last month's

sales were sell-out launches for three projects that comprised mostly one-bedders

- the 51-unit Centra Studios at Lorong 25 Geylang, 99-unit Haig 162 and

Leicester Suites (46 of its 47 units were sold last month). 'Their success

could be attributed to the affordably-priced small-format units they

offered,' says CBRE's Mr Li.

Developers launched 1,335 private homes

in July, up from 1,010 units in June.

Projects expected to be released after

Ghosts Month include NV Residences in Pasir Ris, Twin Peaks on the

Grangeford site, Cityscape in Mergui Road and Killiney 118.

Two executive condo projects - the

573-unit Esparina Residences at Compassvale Bow in Sengkang and Chinese

developer MCC Land's 406-unit The Canopy in Yishun - are slated for

release in October, say market watchers.

--2010 August 17 BUSINESS

TIMES

Landed homes' capital values rise faster

than apartments, condos

Average cap value of prime resale freehold landed homes up 5.1% in Q4

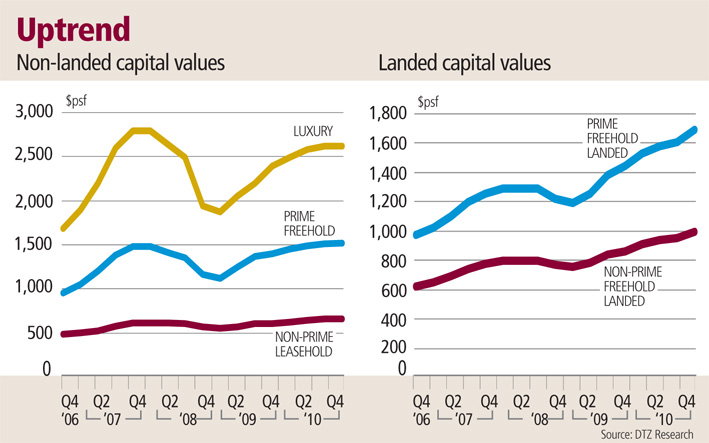

Average cap values of landed homes in

Singapore have risen at a faster clip than those of private

apartments/condos in the fourth quarter as well as the whole of 2010

DTZ's analysis referred only to resale landed and non-landed homes,

that is, properties that had already obtained Certificate of Statutory

Completion.

'The limited stock of landed homes has made them prized assets,

especially those in the prime districts. Landed homes currently account

for about 26 per cent of Singapore's total private housing stock

(including executive condos), with very limited supply in the pipeline. In

contrast, the supply of non-landed private homes is injected at a faster

pace via the Government Land Sales programme and collective sales,' says

DTZ's Southeast Asia research head Chua Chor Hoon.

The average capital value of prime resale freehold landed homes stood

at $1,693 per square foot (psf) on land area in Q4 2010, up 5.1 per cent

from the previous quarter, taking the full-year increase to 17 per cent.

For suburban freehold landed houses, the average capital value increased

4.3 per cent quarter on quarter to $993 psf in Q4, resulting in a

full-year appreciation of 15.5 per cent.

In the non-landed segment, the average cap value for 99-year suburban condos

remained unchanged at $660 psf on strata area in Q4 2010, taking the

appreciation for the whole of 2010 to 8 per cent. The average price of prime

freehold condos increased 0.4 per cent quarter on quarter to $1,520 psf in

Q4, also reflecting an 8 per cent full-year price

DTZ said prices in these two segments are hitting resistance, having risen by about 18 per cent and 36 per cent since their respective Q1

2009 troughs following the global financial crisis. The latest cap values are also above the respective Q4 2007 peak levels, it noted.

'Greater prudence is also being exercised on buyers' part following

the latest property cooling measures introduced on Aug 30. Buyers are

more selective and prefer projects with good location attributes such as

proximity to MRT stations, schools or the central business district,'

DTZ said.

On the other hand, the Q4 2010 average cap value of freehold luxury

condos (above 2,500 sq ft) in the prime districts was $2,630 psf, about

6 per cent shy of the Q4 2007 peak of $2,800 psf. The latest Q4 figure

was unchanged from the preceding three months while the full-year 2010

increase was 9.6 per cent.

'With a limited pool of buyers being able to afford these luxurious

units which require a large quantum sum, this segment has seen more

subdued purchasing activity,' DTZ said.

The firm's executive director (residential) Margaret Thean said:

'Although there's less activity in the high-end segment, we're still

seeing strong interest from Chinese and Indian nationals, and

increasingly from institutional investors such as funds. They have

confidence in future price growth due to Singapore's strong economic

fundamentals. As for individual foreigners buying for owner occupation,

completed developments near renowned schools particularly interest

them.'

Ms Chua predicts that resale prices of 99-year suburban condos are

likely to remain flattish next year while those of prime freehold condos

could rise by up to 5 per cent if there is more buying from foreigners

due to the clampdown on property purchases in their home countries.

She expects prices of landed homes to continue to outperform those of

apartments and condos due to their relative scarcity appeal.

- 2010 December 23 SINGAPORE

BUSINESS TIME

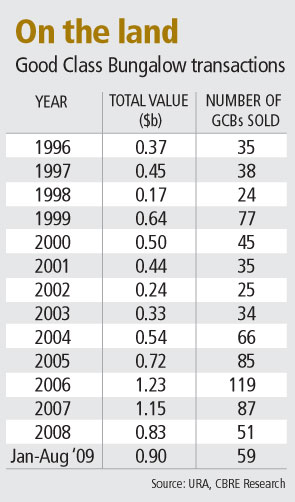

Record

year in the offing for good class bungalow sales

Good times continue to roll for the Good

Class Bungalow (GCB) market, with some high-profile business personalities

involved in the latest transactions. They include palm oil giant Wilmar

International's chairman and CEO, Kuok Khoon Hong, and Prima Group boss

Bernard Cheng.

The latest deals have boosted the volume

of GCB transactions between January and August this year to about 60 deals

with a total value of around $900 million, surpassing the $830 million

transacted in the whole of last year, latest figures from CB Richard Ellis (CBRE)

show. The actual year-to-date numbers could be higher if caveats for some

deals done in August have still not been lodged, suggest property market

watchers.

CBRE's director, luxury homes, Douglas

Wong is now predicting record GCB sales totalling $1.2 billion to $1.4

billion for the whole of this year, encompassing 80-90 transactions - up

from his earlier forecast of around $1.1 billion-$1.2 billion made just

three weeks ago. Up to now, the highest full-year value of GCB transactions

was achieved in 2006 - involving $1.23 billion across 119 deals.

Savills Singapore director of investment

sales & prestige homes Steven Ming said that while the GCB market

remains active, 'buyers continue to approach purchases with measured

optimism and are sensitive to price increases'.

Wilmar's head honcho, Mr Kuok, and his

wife are said to have bought two adjoining GCB properties on Victoria Park

Road last month for a total of about $44.17 million. The couple paid about

$24.5 million for No. 35 Victoria Park, a two-storey bungalow with a

swimming pool; the price works out to $750 per square foot (psf) based on

the land area of 32,688 square feet. The sellers are believed to be members

of the Khoo family linked to Kimly Construction.

Mr Kuok and his wife also picked up the

next-door property at 37 & 39 Victoria Park, an old single-storey

bungalow, for $19.65 million or about $660 psf. The seller is said to be Ng

Cheong Bian, son of the late Ng Bok Eng, dubbed 'king of cloves'.

Both properties - Nos. 35 and 37/39

Victoria Park - have 999-year-leasehold tenure.

Bungalow market watchers say they would

not be surprised if the Kuoks amalgamate the two plots for redevelopment

into a plush new GCB on sprawling grounds of more than 60,000 sq ft.

DTZ is understood to have brokered the

sale of both properties.

Last month, Prima Group boss Bernard

Cheng is believed to have sold his freehold bungalow at Queen Astrid Park

for $24 million or about $877 psf to Zain Fancy. A person bearing the same

name was formerly head of Morgan Stanley Real Estate Investing for Asia

Pacific and who late last year joined Och-Ziff Asia Real Estate as executive

managing director and is based in Singapore. The entity is part of New

York-based fund management giant Och-Ziff Capital Management Group.

Ho Tian Yee, managing director of Pacific

Asset Management, is said to have picked up a bungalow at Astrid Hill in

July for $20.5 million or $654 psf on its land area of about 31,360 sq ft.

Meanwhile, 12 Bishopsgate, with a land area of around 16,550 sq ft, changed

hands last month for slightly more than $19 million or about $1,150 psf.

The year began slowly for the GCB market

with just three deals worth about $27.5 million in the first quarter.

However, things soon gained momentum with around $432 million worth of deals

done in Q2 and about $436 million in July and August.

GCBs are the creme de la creme of

Singapore's housing market, with stringent planning requirements. There are

only about 2,400 such bungalows in Singapore's 39 gazetted GCB Areas.

'Liquidity, cheap financing and the general belief that the worst of the

economic crisis is over are fuelling this run,' says Savills' Mr Ming.

'Furthermore, it appears the wealthy are

allocating a greater proportion of their investments to real estate. GCBs,

being limited in nature but highly desired amongst the rich, become highly

sought after.' - 2009 September

4 BUSINESS

TIMES

Q4 private home price slide is worst in

decade

In its

worst showing since Q4 1998, the official private home price index slid 5.7

per cent in Q4 last year over the preceding quarter. For full-year 2008, the

index fell 4.3 per cent, reversing a 31.2 per cent jump in 2007.

Property consultants are predicting a

further decline of 10-20 per cent this year in the benchmark index, with

upmarket homes continuing to be the worst hit, as in 2008. This sector was

the most overheated during the run-up in 2006 and 2007.

'The bid-ask gap is very high; any buyer

that comes in now wants to make sure he's buying at very attractive prices

to cushion against future risk. As a result, most transacted prices are

quite distressed,' said DTZ executive director Ong Choon Fah.

BT understands buyers are looking at

prices at least 20 per cent below Q3 2008 levels before they are willing to

commit.

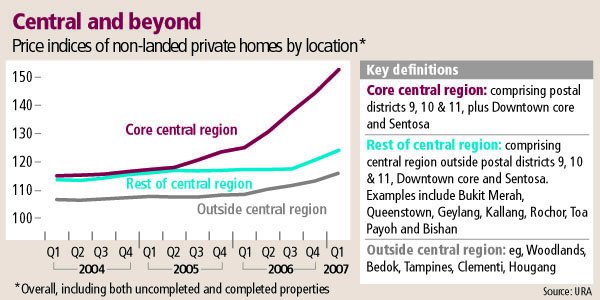

URA's non-landed private home price index

for Core Central Region (CCR) fell 6.3 per cent quarter-on-quarter in Q4, or

a full-year drop of 5.5 per cent. CCR includes the prime districts,

financial district and Sentosa Cove. In the Rest of Central Region, the

price drop was 5.5 per cent for Q4, and 4 per cent for the full year.

Outside Central Region, a proxy for suburban mass-market locations, suffered

the smallest declines, of 4.7 per cent in Q4 and 1.6 per cent for the whole

year.

The declines in URA's indices were far

smaller than the price drops estimated by property consultants. CB Richard

Ellis said that last year, average prices of new luxury homes under

construction fell 30 to 35 per cent for prime districts 9 and 10, while

those in Marina Bay and Sentosa Cove eased 10-13 per cent.

URA's price indices are weighted

according to the moving average mix of transactions for the preceding 12

quarters, and this tends to make changes in the indices more muted during

sharp market swings.

For this year, JP Morgan analyst Chris

Gee said: 'The critical factor that will affect private home prices in 2009

- probably more importantly than the economy and jobs market - will be

banks' financing of property. Banks seem happy to lend to the right type of

buyers, but they're more conservative on valuations and tighter on

loan-to-value.'

As for developers, smaller players have

already started to chop prices. 'Among bigger developers, some are

restructuring their portfolios and re-evaluating their risk positions,'

DTZ's Mrs Ong noted.

A seasoned developer pointed to a

diversity of strategies among developers, according to their financial

strength, profit margin for each project and their view of when the recovery

will take place. 'Some will cut and sell; some will package things that

effectively give more discounts; some will lease instead of selling; some

will just sit it out and wait for better times.

'Projects will be slowed down or delayed,

stretching out the supply coming into the market, which in itself is a

regulating mechanism,' he said.

In the public housing segment, the

Housing & Development Board's (HDB) resale flat price index still inched

up 1.5 per cent quarter-on-quarter in Q4 to scale a new peak. But this was

slower than the 4.2 per cent rise posted in Q3.

ERA Asia Pacific associate director

Eugene Lim said: 'We've been seeing more transactions with decreasing

cash-over-valuations (COVs). The days of transactions with above $50,000

COVs are over.'

He is predicting a sub-1 per cent rise in

the HDB resale flat price index for each of Q1 and Q2 this year. 'If the

recovery takes longer, we may see the price index flatten in H2 2009 before

decreasing, if the situation worsens.'

Knight Frank director Nicholas Mak

predicted a 5 to 10 per cent correction in HDB resale flat prices this year,

as the weakening economic conditions filter into the HDB market.

ERA's Mr Lim noted that 'in uncertain

times, home buyers go for the 'safer' option of HDB flats to ease their

financial burden'. He estimated 30,000 to 31,000 HDB resale transactions

were done in 2008 - surpassing the 29,436 in 2007.

As for the private housing sector, CBRE

predicted developers may sell 5,000-6,000 units in 2009, as falling prices

boost take-up. It put the figure for last year at 4,300 to 4,400 units -

just 30 per cent of 2007's record volume. Sales also slowed in the secondary

market. CBRE estimated about 7,400 to 7,600 resale deals were done last year

- against nearly 21,000 transactions in 2007. The 1,600 to 1,650 subsale

deals it estimated for 2008 were also a far cry from the 2007's figure of

4,863. - 2009 January

3 BUSINESS

TIMES

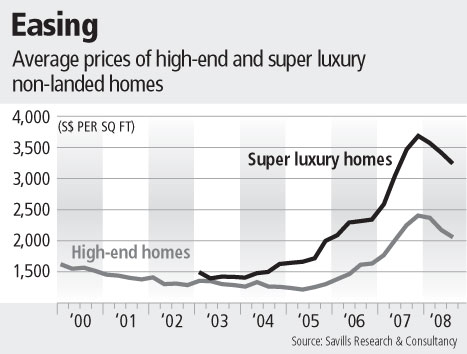

20% drop in luxury home prices

Savills Singapore is predicting price

drops of more than 20 per cent in the next five quarters for high-end and

super-luxury private homes.

This would follow declines of 14.3 per

cent and 12 per cent respectively for these two segments in the first nine

months of 2008 from the peak in Q4 last year.

The forecast is probably the grimmest

announced by a property consultancy here - although some rival firms BT

spoke to yesterday said that privately, they have similar estimates.

Research analysts at stockbroking

houses/banks have already been making downbeat pronouncements, predicting

declines of about 30 per cent or more for luxury home prices byl end-2009.

In its report yesterday, Savills said

that the high-end and super luxury segments are more vulnerable to the

deteriorating global investment climate. The average capital value for

high-end (non-landed) residential homes fell to $2,065 per square foot in Q3

2008, 4.6 per cent lower than the preceding quarter and 14.3 per cent below

the Q4 2007 peak of $2,410 psf.

In the super luxury league, the average

capital value slipped to $3,240.40 psf in Q3, down 5.2 per cent from the

preceding quarter and 12 per cent lower than the Q4 2007 figure.

Savills expects mass- market home prices

to fall 5 to 8 per cent in the next five quarters - arguing that a price

drop in this segment will be cushioned by continued support from HDB

upgraders and other buyers picking up private homes for their own

occupation.

The fundamentals of the mid-tier and

mass-market segments are stronger today than during the Asian Crisis

downturn, partly due to Singapore's more open immigration policy, Savills

said.

Permanent residents have accounted for

14.3 per cent of private home purchases (excluding ECs) in the first nine

months of this year, up from a 12 per cent share in 2004. PRs are likely to

become a strong demand driver in the residential market in the coming

months, Savills reckons.

Foreigners (including PRs) had 24.8 per

cent share of private home purchases (including ECs) in the first nine

months of 2008, down from a 25.9 per cent share for the whole of last year

but still ahead of sub-20 per cent shares between 2000 and 2004.

In Q3 2008, a total of 4,287 caveats were

lodged for private homes (including ECs), covering both primary and

secondary markets - 9 per cent higher than the 3,934 caveats lodged in the

preceding quarter.

However, the total value of private homes

transacted edged up only slightly to $5.68 billion in Q3 from $5.62 billion

in Q2.

'The average value of each unit

transacted decreased, as evidenced by the very successful sales at mass

market projects such as Livia and Clover by the Park. The proportion of

transactions in the luxury and super luxury sectors dropped compared with

mass market, as rich investors were more cautious about big-ticket

purchases,' said Savills' director of marketing and business development Ku

Swee Yong.

The average monthly rental value for

high-end non-landed homes tracked by Savills contracted for the second

consecutive quarter, slipping 3.6 per cent quarter-on-quarter to $5.62 psf

in Q3.

This followed a 1.2 per cent drop in Q2.

'For full- year 2008, we expect prime rents to ease 4 to 6 per cent and fall

a further 7 to 13 per cent in 2009,' Mr Ku said.

Tenants may now seek more competitive

rentals, softening the market.

'So far, the impact on the local rental

market has been limited, despite rents beginning to come off their peaks.

The quarters ahead, however, should see a more entrenched rental decline as

demand weakens in the face of a global economic slowdown,' Mr Ku said.

Savills also said that 10,923 leasing

deals were recorded for private homes (excluding ECs) in the July to

September quarter this year, the highest Q3 figure since 2000.

The leasing volume for Q3 2008 was up

about 20 per cent from the preceding quarter and 25 per cent above the

figure in the same period a year ago.

The strong leasing volume may have been

contributed by a seasonally active Q3 that coincides with the opening

semester of some international schools, as well as displaced tenants from

collective sales completed last year, downgrading from high rental units to

more affordable ones, and completion of new projects with attractive

facilities and competitive rents.

However, Savills expects rental demand

drivers to weaken in coming quarters. Savills' residential leasing head

Patrick Lai says: 'The inflow of expats is expected to slow down, although

we're still seeing an influx of foreign talent into Singapore, particularly

in the healthcare, pharmaceutical, R&D and logistics industries.'

- 2008 November 21 BUSINESS

TIMES

Prime

property districts' prices show 1st fall in 4 years: DTZ

Downward pressure may increase as speculators dispose of units, it says

Property prices in the prime districts of

District 9, 10 and 11 have registered their first fall in four years and DTZ

Debenham Tie Leung believes that this downturn in sentiment could spill over

to the non-prime districts.

In an analysis of resale prices based on

its own basket of properties, DTZ found that prices of private residential

properties in Q2 this year reflected the first correction in the past four

years, led by non-landed residential units in the prime districts.

DTZ's basket of properties for prime

freehold non-landed resale residential homes include Cairnhill Crest, The

Pier at Robertson and Botanic on Lloyd and capital values averaged $1,410

per square foot (psf) in Q2 2008, reflecting a 4.7 per cent

quarter-on-quarter (qoq) decline. Capital values had remained at $1,480 psf

for the two previous quarters.

While it should be pointed out that

luxury home prices have reached new heights in recent years, DTZ said that

it also tracks a separate basket of luxury properties which includes premier

developments like Ardmore Park.

Outside the prime districts, capital

values of freehold and leasehold non-landed resale residential units

remained unchanged, averaging $750 psf and $610 psf respectively, holding

steady at this level for three consecutive quarters after both sectors

registered 7 per cent increases in Q4 last year.

And the outlook for rest of the year is likely to be challenging.

DTZ said that with high inflation

compounding the expected economic slowdown globally, prices of private

residential properties are set for further corrections.

'Besides smaller developers, some of the

bigger developers are also likely to reduce selling prices to move sales

especially for developments that have been on the market for some time.'

'In addition, the sub-sale market is

expected to be active with speculators disposing their units, especially

those who have purchased multiple units on Deferred Payment Schemes and are

most likely to dispose some or all units to avoid stretching their financial

limits,' it added.

While some speculators may feel that

renting remains an option for them, DTZ said that as rentals come under

pressure in 2009-2011 due to the surge in new home completions, it is

unlikely that speculators will want to hold on to their units for rental

income.

DTZ does believe that there was

significant wealth creation in the run-up to the recent 'economic boom' of

2006 and last year, and there is 'pent-up demand' from many who have been

waiting for an opportune time to buy. 'Take-up will eventually pick up when

the market senses that prices have bottomed,' it added.

On the pick-up in sales towards the end

of Q2 2008 for 'attractively located and reasonably-priced projects', DTZ's

executive director (Residential) Margaret Thean said: 'At the end of the

second quarter, we began to witness the return of market confidence and an

improved buying sentiment. Some residential projects are enjoying sell-out

status while others are being are well-received. This is clearly indicated

by the sell-out status of projects such as Suites 123 while Nassim Park,

Parc Sophia, Dakota Residences and Clover by the Park received encouraging

response. - 2008

July 2 THE

BUSINESS TIMES

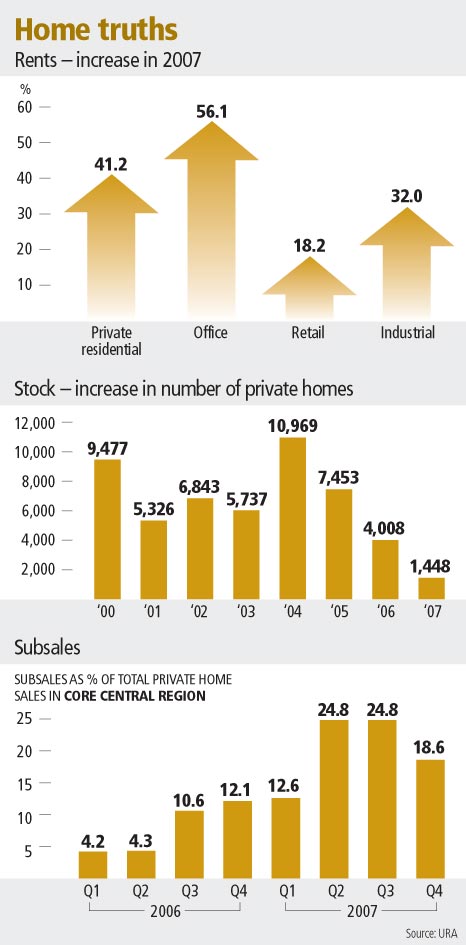

Private

homes losing speculative froth

Subsale

activity slowed in Q4; rising rents defined 2007

The

level of speculative activity in the private property market, as measured by

the extent of subsales, slowed considerably in Q4 last year, especially in

the Core Central Region (CCR), according to the latest official data.

Islandwide, subsales as a percentage of

total private housing sales fell from 14.4 per cent in Q3 last year to 10.7

per cent in Q4, while in the CCR, the hotbed of speculation, the subsale

percentage fell from 24.8 per cent to 18.6 per cent over the same period.

Property consultants attributed the drop to uncertainty about the financial

markets as well as the withdrawal of the deferred payment scheme in October

2007.

Reflecting the current housing shortage,

the stock of completed private homes increased by just 1,448 units last year

- the smallest rise in at least 12 years. The stock had increased by 4,008

units in 2006, 7,453 units in 2005, and 10,969 units in 2004.

Rents of condos and apartments rose

significantly last year - by 42.3 per cent in CCR (comprising the prime

districts 9, 10, 11, Downtown Core and Sentosa), an even higher 47 per cent

in the Rest of Central Region (RCR), and 41.9 per cent in Outside Central

Region (OCR).

'Looking back at 2003/2004, developers

were cautious and there were not many housing starts. So three or four years

down the road, we're seeing a fall in terms of new home completions,' DTZ

executive director Ong Choon Fah explains. 'Of course there have also been a

lot of en-bloc sales in the past two years and some of these properties have

been demolished,' she adds.

'The situation is even more severe in the

prime areas, and we've been seeing a lot of expats fanning out from the

prime districts to RCR, to rent private homes, which probably explains why

the increase in non-landed rents was steeper in RCR compared to the CCR,'

Mrs Ong explains.

With many private residential projects

likely to be completed only in late 2008 and 2009, property consultants

including Knight Frank managing director Tan Tiong Cheng expect rentals for

non-landed properties to increase further this year. The rise could be less

steep - perhaps 20 per cent, or around half the rate of increase for last

year.

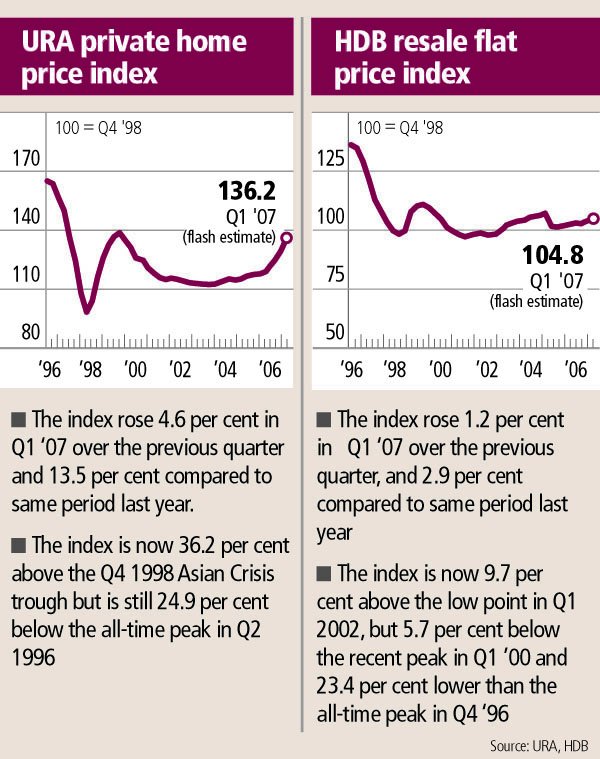

Yesterday's data on the private property

market by Urban Redevelopment Authority showed that the overall price index

for private homes rose 6.8 per cent in Q4 over the preceding quarter, slower

than the 8.3 per cent hike in Q3. For the full year, the index was up 31.2

per cent, three times the 10.2 per cent rise in 2006.

In terms of regions, the price index for

non-landed private homes in CCR rose 7.5 per cent in Q4, more measured than

the 8.3 per cent gain in Q3. Price indices for RCR and OCR advanced 7.7 per

cent and 7 per cent respectively in Q4, slightly more modestly than in Q3.

For the whole of last year, the

non-landed home price index for CCR rose 32.7 per cent, while RCR and OCR

indices were up 30.4 per cent and 26.4 per cent respectively.

Developers sold a record 14,811 private

homes last year, surpassing the previous high in 2006 by 32.9 per cent. They

launched a total of 14,016 units in 2007, 26.6 per cent above the 2006

figure and also a new high.

Knight Frank director (research and

consultancy) Nicholas Mak predicts that URA's overall private residential

property price index will rise at a more sluggish pace - around 10-15 per

cent - this year, as buyers become more prudent.

Colliers International director (research

and consultancy) Tay Huey Ying reckons that subsales as a percentage of

total private homes sales islandwide will continue trending down in the

coming months, to average about 8 per cent for the whole year, as the market

moves to a 'healthier and more sustainable set of fundamentals'.

Less speculation could also slow the hike

in home prices, she says. 'As a result, developers are less likely to bid

aggressively for development sites and this will affect the success rates of

collective sales,' she adds.

Some seasoned market players are

predicting that home prices in CCR could take a hit of up to 10 per cent

this year; those in RCR will be flat, perhaps rising slightly; while OCR

will post the biggest gains of about 10-15 per cent.

'There's significant supply of projects

for launch in CCR, and that will weigh down on prices. Foreign buying will

thin because of the financial market turmoil which is hitting high-net-worth

bankers and others,' a veteran industry observer suggests.

BT learnt yesterday that the release of

the high-profile Marina Bay Suites, which was initially slated for the end

of this month, has been delayed till after the Chinese New Year festivities

- by which time the Budget should also be announced and hopefully lift

sentiment. - 2008 January

26 SINGAPORE

BUSINESS TIMES

Singapore's

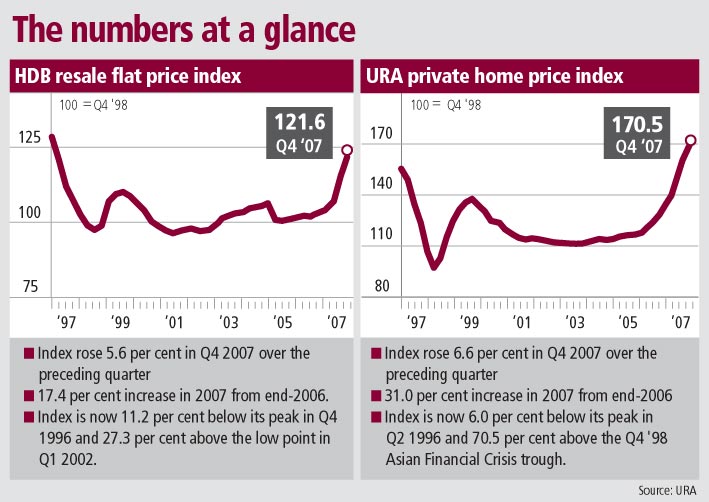

private home prices rose 6.6% in Q4 08 Singapore

private home prices rose at a slower quarterly pace of 6.6 per cent in the

last three months of 2007, according to government figures released on

Wednesday.

The Urban

Redevelopment Authority's price index for private residential property

rose 6.6 per cent in the final three months of 2007, slowing from the 8.3

per cent rise in July-September.

In the whole of 2007, private home prices

rose 31 per cent.

The Singapore government said in October

that developers could no longer sell uncompleted property on a deferred

payment scheme in a bid to reduce speculation in the real estate market.

Other recent measures taken by

authorities include raising development charges to make it more expensive

for companies such as CapitaLand and City Developments to buy out existing

condominiums for redevelopment into larger apartment blocks with more units.

A separate index compiled by the Housing

Development Board showed resale prices of government-built HDB apartments

rose 5.6 per cent in the fourth quarter, slower than the 6.6 per cent

quarterly gain in July-September. --

2008 January 2 REUTERS

Home prices feel pull of gravity

after 31% rise Private

home prices rose 31.0 per cent in 2007 - the biggest year-on-year jump since

1999 - despite a slowdown in the fourth quarter caused by the withdrawal of

the Deferred Payment Scheme (DPS) and sub-prime woes, flash estimates show.

HDB resale prices also climbed some 17.4

per cent last year - the fastest growth seen since 1996 - as private home

price gains filtered down. But HDB resale prices also saw a slowdown in

growth in the fourth quarter.

At a doorstop yesterday, Minister for

National Development Mah Bow Tan said that over the last few months, the

government had taken several steps to try and cool down speculative activity

in the property market. However, the market is also being affected by

external factors beyond the authorities' control, he said.

'For Singapore, we are optimistic that we

will continue to do well but there are many things beyond our control,' Mr

Mah said. 'It is up to us to keep a close eye on the market and be able to

tweak those policy levers that we can in order to keep property prices

stable.'

Private home prices rose 6.6 per cent in

the fourth quarter - down from the 8.3 per cent growth seen in the third

quarter.

Similarly, HDB resale prices grew 5.6 per

cent in the fourth quarter of 2007 - down from the 6.6 per cent rise for the

previous quarter.

Experts said that the slowdown was

brought on by both poor global market conditions as well as the removal of

the DPS scheme.

Knight Frank managing director Tan Tiong

Cheng said that the fourth-quarter slowdown was not surprising considering

the sub-prime crisis in the United States.

'People are still waiting for signs as to

how bad the sub-prime situation will turn out,' Mr Tan said. 'It affects the

whole outlook; people are uncertain.'

Demand could also be muted as lending by

banks in the US, UK and Europe has been tremendously curtailed since the

crisis, he said.

On the other hand, OCBC Investment

Research analyst Winston Liew believes that the bigger culprit is the

withdrawal of the DPS. 'After the DPS was withdrawn, the whole market went

down - the resale market, new launches and the stock market,' he said. He

has a 'neutral' rating on the Singapore property sector.

For the HDB resale market, the slowdown

could also be attributed to buyers holding back in the face of rapidly

increasing asking prices, said ERA assistant vice-president Eugene Lim.

'The slowdown in price increase was

largely expected as the market hit resistance level in the light of

unrealistic sellers demanding for high cash-over-valuation (COV)

transactions - particularly for the five-room and executive flat-types,'

said Mr Lim.

The slowdown in price growth, experts

said, will continue in the first quarter of this year.

'It is unlikely that there will be much

activity in January or February,' said Knight Frank's Mr Tan. Agreed OCBC's

Mr Liew: 'I would expect the rate of growth to slow down.'

CB Richard Ellis (CBRE), for example,

expects the take-up of new homes to be between 9,000 and 11,000 units for

2008. By comparison, the property firm estimated that a record 15,000 new

homes were sold in 2007, 34.5 per cent more than the 11,147 new homes sold

in 2006.

This year, the property market will be

driven by mid-end and mass-market homes, experts said. Prices and take-up of

luxury homes are expected to moderate.

In the fourth quarter of 2007, the price

increase was led by non-landed homes in outside central region (OCR) where

the index showed an increase of 7.5 per cent.

The strong showing, CBRE said, could be

attributed to new project launches during the quarter, such as Park Natura

and Hillvista. Prices in the core central region and rest of central region

rose by 7.0 per cent and 7.3 per cent respectively.

For 2008, 'we expect a moderate rise in

overall prices as luxury prices are likely to firm up at current levels

while mid-tier and mass-market prices have the potential to rise by about

10-15 per cent', said Li Hiaw Ho, executive director for research at CBRE.

Others were more bullish about the mass

market. Ku Swee Yong, director of marketing and business development at

Savills Singapore, predicts that mass-market prices will climb by 30-50 per

cent this year.

In response to a question about the

rapidly climbing prices in the mass market, Mr Mah told reporters that the

government is watching the segment closely and will take action if

necessary.

'People who can't afford the central

region to buy or to rent are starting to look outside, which I think is the

sensible thing to do,' he said. 'We will continue to keep an eye. We're

watching it every day. If necessary, we'll do something, if not necessary

we'll just let it be.'

The overall price index for private homes

could climb by anywhere between 10 per cent and 25 per cent this year,

depending on how quickly the market recovers, experts said.

And for the HDB resale market, prices

could climb by between 10 and 15 per cent, they said.

'With the buoyant economy and expected

positive market sentiment in 2008, the HDB property market in Singapore is

likely to enjoy a double-digit growth in the 10-11 per cent range,' said

Mohamed Ismail, chief executive of property agency PropNex.

- 2008 January 3 SINGAPORE

BUSINESS TIMES

Good

class bungalow prices surge 40%

Huge

wealth creation, high networth PRs cited for hike; smaller gains likely next

year

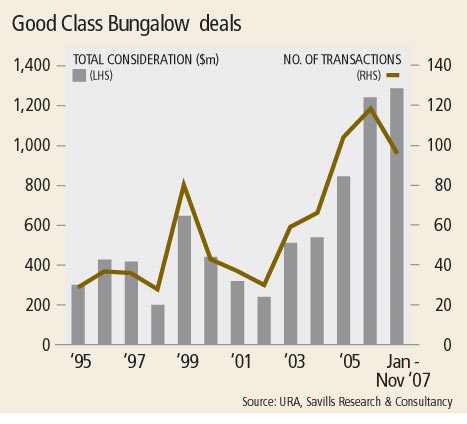

The

demand for gracious bungalow living is chugging along quite nicely.

In fact, average prices of Good Class Bungalows (GCBs) are expected to

appreciate by about 10 to 15 per cent next year. This appears even more

impressive if you consider that this year, they have already climbed by

nearly 40 per cent to $710 per square foot of land area.

The expected appreciation could propel the total value of GCB

transactions to increase slightly in 2008, although the number of

transactions may be slightly lower, Savills Singapore director (Prestige

Homes) Steven Ming predicts.

The first 11 months of this year saw a total of 96 GCB transactions

adding up to $1.28 billion. The value is an all-time record and has

surpassed slightly the $1.24 billion achieved for the whole of last year.

However, the number of GCB transactions from January to November this year

is still shy of the 118 for the whole of 2006, according to an analysis by

Savills Singapore based on caveats data from Urban Redevelopment Authority's

Realis system.

'I don't expect the number of GCB transactions to increase next year,

because prices have gone up quite rapidly in the past 12 to 15 months. The

GCB market is generally restricted to Singaporeans and Permanents Residents

with special approval to buy landed homes.

'Some of these potential buyers may have bought GCBs at much lower prices

in the past and may take time to adjust to higher prevailing prices now. But

having said that, there's been a lot of wealth creation over the past few

years as seen in the reasonable number of record prices being set,' Mr Ming

said.

Credo Real Estate managing director Karamjit Singh, too, predicts

moderate price upside for GCBs for next year, despite forecasting overall

flat property prices. 'GCB values will benefit from the enormous wealth

created from the economic boom, and the influx of high networth individuals

who become permanent residents (PRs), while supply remains scarce,' he adds.

While demand-supply fundamentals remain sound next year for Singapore's

real estate sector as a whole, including GCBs, the crucial factor is how the

currently-shaky sentiment pans out, Mr Singh said.

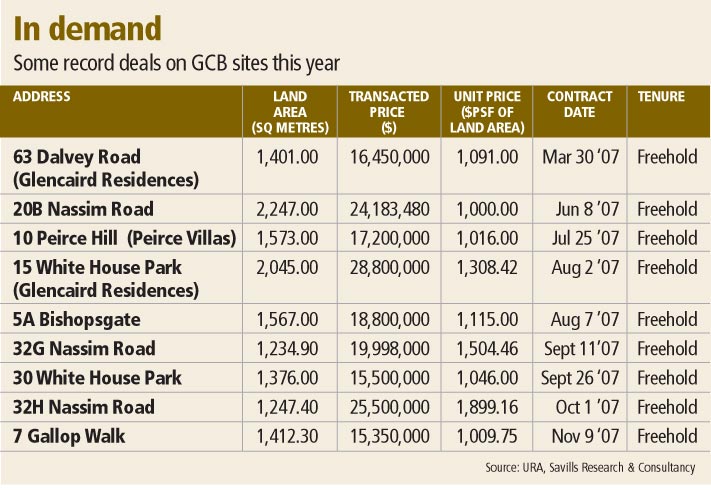

Record prices were set for two adjacent bungalows at Nassim Road in the

past few months - 32G Nassim Road, which was sold for just under $20 million

or $1,504 psf of land in September, followed by 32H Nassim Road in October

at an even higher $1,899 psf.

Raffles Education founder and chairman Chew Hua Seng is believed to have

picked up 32H Nassim Road, for which he paid $25.5 million. Mr Chew is said

to own a few other bungalows nearby.

The prices achieved for 32G and 32H Nassim Road surpassed the previous

record for GCBs, of $1,308 psf set only in August this year, when Hong Kong

group Wharf (Holdings) sold Glencaird, a conservation bungalow at 15 White

House Park, for $28.8 million.

However, market watchers highlight that for the 32G and 32H Nassim Road

transactions, each property's land area is just slightly over 1,200 sq

metres - lower than the minimum 1,400 sq metres (or 15,070 sq ft) plot size

stipulated under Urban Redevelopment Authority guidelines for GCBs. Savills'

Mr Ming argues nonetheless that these two properties will be bound by GCB

regulations if they were to be redeveloped. This means that they cannot be

more than two storeys high, their built-up area is limited to 35 per cent of

the total land area, and the plots cannot be subdivided further.

The year has also seen quite a few GCBs being flipped. 21 Cluny Hill was

bought for $15 million in January and changed hands again for $20.2 million

in June. 46 Mount Echo Park was sold for $10 million in January and again

for $12.8 million in March.

'Some savvy bungalow investors with deep pockets, saw value in investing

in freehold GCBs earlier this year, when their prices were lagging quite a

bit behind those of 99-year bungalows on Sentosa Cove. The gap has since

narrowed and these investors have been able to offload their GCB investment

for a handsome profit,' Mr Ming said.

Over at Sentosa Cove, seafronting bungalow sites have fetched as much as

$1,696 psf this year. These are vacant sites sold by the precinct's master

developer, Sentosa Cove Pte Ltd, to buyers to build their dream homes on

them.

The supply of completed bungalows for sale in the upscale waterfront

housing locale is still limited, but Savills' director of business

development and marketing Ku Swee Yong says that owners are asking for

$1,800 psf to $2,400 psf depending on the direction they face. 'The main

reason for higher bungalow values on Sentosa Cove than in mainland Singapore

is because of expedited approval for foreign buyers of landed property on

Sentosa Cove. This has been a great draw for those who want to be PRs in

Singapore and park a fraction of their wealth here,' Mr Ku said.

- 2007 December 19 SINGAPORE

BUSINESS TIMES

The

ascent of landed housing

Solid

gains await with double-digit price growth and Singapore's scarcity of land The

private residential market has been hogging the headlines in the past 18

months. Overall prices recovered in 2004 and 2005 by 0.9 per cent and 3.9

per cent respectively, and home prices shot up by 10.2 per cent in 2006 and

another 13.5 per cent in the first half of 2007, led mostly by the

condominium segment of the market.

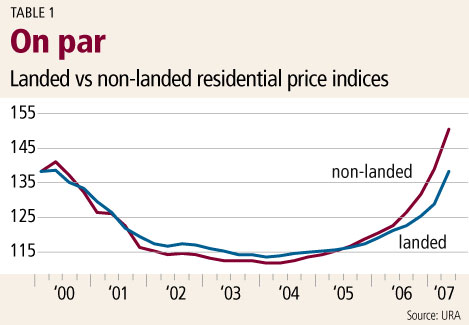

It has been pretty obvious that

non-landed homes have been leading the way in the strengthening residential

market, with prices growing from a marginal 1.1 per cent in 2004 to 4.5 per

cent in 2005, 11.1 per cent in 2006 and 14.2 per cent in the first six

months of 2007 alone, according to numbers from the Urban Redevelopment

Authority (URA).

What of landed properties then? Will

landed properties match their high-rise counterparts in the price spiral?

Prices of landed homes have risen in line

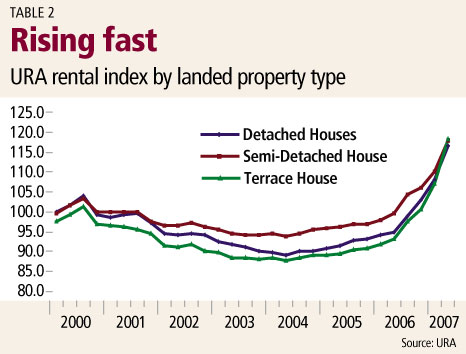

with the rest of the market. (See Table above) From a marginal 0.6 per cent

rise in 2004, prices of landed homes grew by 2.4 per cent in 2005, 6.7 per

cent in 2006 and 10.1 per cent in the first half of 2007.

A breakdown in price of the different

landed property types shows that detached houses have made the most headway

over the past year. According to URA numbers, prices of detached houses rose

by 12.3 per cent in H1 07, after increasing by 8.1 per cent in 2006.

As for semi-detached and terrace houses,

their indices rose by 7.6 per cent and 9.3 per cent respectively in the

first half of 2007, from 5.3 per cent and 5.2 per cent respectively in 2006.

As detached houses comprise Good Class Bungalows (GCB), the price increases

have been more pronounced given the demand for high-end homes.

Based on caveats for GCBs, the average

price has risen by an estimated 30 per cent in 2006 and a further 25 per

cent in the first half of 2007. Not only are prices registering double-digit

growth, it has also been observed that certain GCBs have been sold and

resold within 12 to 18 months.

An example of this trend is a GCB at

Queen Astrid Park that was sold for $12.5 million in April 2006, only to be

resold at $16 million in May and then again in December 2006 for $18

million. This is an increase of 44 per cent in seven months. Another GCB at

Nassim Road was first sold for $9.8 million in February 2005 only to be sold

another three times for $15 million in August 2006, $18.4 million in

December 2006 and $24.2 million in June 2007, an increase of 147 per cent

over some 28 months.

Overall, it appears that there are

several solid reasons for optimism in the landed housing market, especially

in the next 12 months.

As prices of landed property in Singapore

have not risen as steeply as their non-landed counterparts, there would

generally be some better bargains in the landed market compared with luxury

condominiums that have already attained very high benchmarks.

Aside from the GCB market, the

comparatively slower rise in prices for landed properties could be viewed

more favourably vis-a-vis upper and middle-upper income local home buyers

who might have been priced out of the luxury condominium market, especially

in the very prime locations.

Secondly, landed housing will always be

considered a scarce commodity in the Singaporean landscape. With limited

land, landed housing at present comprises 29 per cent of all housing stock

throughout the island as at June 2007, or 68,360 units out of 233,143

private homes. Due to its inherent scarcity, landed housing would always be

the ultimate goal of Singaporeans, especially since foreigners are not

ordinarily allowed to purchase these properties.

With regard to scarcity, landed housing

can be an attractive investment property in the near future as a source of

regular income. As Singapore welcomes more foreign professionals to its

shores, houses for rent could prove to be valuable assets for rental income,

especially so for foreign professionals who might be used to living in

landed properties back home and are not allowed to purchase similar types of

accommodation while working in Singapore.

In the first six months of 2007, URA's

rental indices for all the landed property types improved significantly.

(See Table 2) During this period, rents of detached houses increased by 13

per cent followed by a 11.4 per cent rise for semi-detached houses and a

extraordinary 17.3 per cent jump in rents for terrace houses. Compared with

capital values of landed residences, rents have increased much faster.

Examples of recent rental transactions

where the increases were evident include a detached house at Woodgrove

Estate which was renewed at $15,000 a month, a 25 per cent increase from the

previous rent of $12,000 a month. A detached house at Chancery Lane was

rented at $16,500 a month, while a semi-detached house at Lim Tai See Walk

was rented at $11,000 a month.

From a supply standpoint in the next five

years, 1,872 landed units are under construction with another 2,579 landed

units planned. Compared with the 28,082 non-landed units under construction

and the 35,077 non-landed units that have not started, new supply of landed

homes only account for 6.6 per cent of all new supply expected from the

second half of 2007 to 2011, making it fairly certain that landed

residential homes are going to remain a scarce product for the foreseeable

future.

An increase in landed prices of some 20

per cent for the whole of 2007 might very well be on the cards, given an

accumulation of the above factors. Demand for landed housing should

increase, and prices would follow suit once the home-buying public realises

that there are investment, as well as rental income opportunities in landed

houses, and that prices have also not risen as much compared with

condominiums in the prime areas.

Ultimately though, it will be the

fundamental reality that landed housing will always be a scarce product in

Singapore's urban landscape that bodes well for this type of housing in the

medium to long term.

- 2007 September 27 SINGAPORE

BUSINESS TIMES

Q3

may see slowdown in private home sales

But

new launches may accelerate activity again, say market watchers

Private home sales are expected to slow

this quarter - the result of the twin effects of the US sub-prime woes which

made the headlines in August and the just-ended Hungry Ghost month.

But the pace of activity is expected to

pick up again as developers step up launches and confidence recovers, say

property market watchers.

Fresh price benchmarks may still be set

for projects offering compelling propositions, but developers are likely to

tread carefully before upping prices.

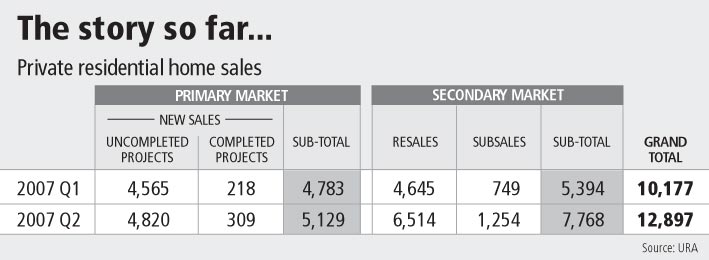

CB Richard Ellis (CBRE) estimates that

the total number of new private homes sold by developers in the primary

market during Q3 will be 3,500-4,000 units including sales from ongoing

projects. This is lower than the 5,129 units sold in Q2 and 4,783 units

transacted in Q1 this year.

Activity also decelerated in the

secondary market in Q3. 'Whereas the first and second quarters saw resale

volumes of 4,645 units and 6,514 units respectively, it is likely that Q3

figures will be lower, probably in the region of 4,000 to 4,500 units,' CBRE

executive director Li Hiaw Ho says.

'Anecdotal evidence suggests that subsale

activities have been muted as investors become more cautious,' Mr Li added.

Subsales as a percentage of total private housing sales are likely to fall

below the 7.4 per cent and 9.7 per cent in Q1 and Q2, he predicts.

Subsales, often used as a gauge of

speculative activity, involve projects that have yet to receive a

Certificate of Statutory Completion, while resales, which are also

secondary-market transactions, cover completed developments.

But the current slowdown in activity is

not such a bad thing, says DTZ Debenham Tie Leung executive director Ong

Choon Fah.

'The market has been going up quite

dramatically. It's good that people step back and evaluate their positions

before moving on. This window also creates an opportunity for people to

enter the market. When the market is so hot, everytime you put in an offer

at the seller's asking price, he raises his price,' she says.

Ong Chong Hua, executive director of Ho

Bee Investment, also describes the current slowdown as 'a healthy

consolidation after a robust period of growth in sales volumes as well as

prices'.

'Activity will start picking up slowly

and I think confidence will come back, as developers start launching more

projects. Buyers will be cautious but underlying demand is still strong. The

share market seems to have consolidated and strong economic fundamentals are

still in place for Singapore and the Asian region,' he said.

Among the projects expected to be

released soon are MCL Land's Hillcrest Villas cluster terrace homes along

Dunearn Road, Ho Bee's Turquoise condo at Sentosa Cove, Bukit Sembawang's

Paterson Suites and SC Global's Hilltops in so said to have Cairnhill.

CapitaLand is albegun selling Latitude at Jalan Mutiara at around $2,800 per

square foot on average.

Projects that are slated for launch in Q4

include Lippo's condo on Sentosa Cove, Ritz-Carlton Residences at Cairnhill,

and the second phase of Marina Bay Financial Centre.

Says DTZ's Mrs Ong: 'Sales activity may

be slow for the next couple of months, but this will depend on the type of

projects launched and their price points. If developers release projects

that are targeted at home owners, demand is still very much there. But if

they're targeting investors or want to set benchmark prices, buyers will

take a longer time to consider.'

Ho Bee's Mr Ong said: 'Developers will

definitely be more cautious in moving up prices and trying to set benchmarks

all the time. They will test the waters.

'But I don't think anybody will cut

prices because fundamentals are still strong. There's still a shortage of

homes, with a lot of those who sold their homes in en bloc sales looking for

replacement properties.'

CBRE's executive director (residential)

Joseph Tan reckons that the market could still see benchmark prices if the

right kind of products are offered, such as branded residences.

Looking to the final quarter of 2007, the

residential market will remain active as the government's projected economic

growth rate of 7 to 8 per cent for 2007 remains on track. 'If developers

sell around 3,000 to 4,000 units in Q4, then the total number of new homes

sold in 2007 will be a new record of 17,000 to 18,000 units,' CBRE's Mr Li

said.

This will be significantly higher than

the 11,147 units sold in the primary market last year.

- 2007 September 12 SINGAPORE

BUSINESS TIMES by Kalpana Rashiwala

The

demand for single family residences seems to be on the increase by

foreigners as multinationals expand their presence in the city.

Foreigner home buys hit record in Q1 07

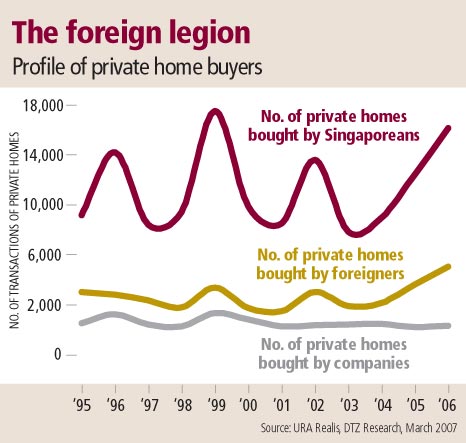

Companies and foreigners upped their share of

caveats lodged for private home purchases in the first quarter of this year,

according to an analysis of caveats by estate agents DTZ Debenham Tie Leung.

Companies accounted for 8 per cent, or 538 of the

total 7,042 caveats lodged for private homes in the first quarter of the

year, up from a 6 per cent share in the preceding quarter.

The 538 homes that companies bought in Q1 this

year is an increase of 15.2 per cent from the preceding quarter and the

highest quarterly figure ever captured by the Urban Redevelopment

Authority's Realis caveats data, which go back to Q1 1995.

During the height of the last major bull run in Q2

1996, companies bought 462 private homes while the figure for Q3 1999, a

year that saw a short-lived property rally, was 413.

Companies include both entities incorporated in

Singapore and overseas and these buyers would include property funds as well

as high-net-worth individuals who set up offshore companies to purchase

properties for tax or confidentiality reasons, suggests DTZ executive

director Ong Choon Fah.

Some of the caveats for private homes lodged by

companies are for collective sale deals.

Among the caveats lodged by companies in the first

quarter were 35 caveats for Amaryllis Ville, 24 for The Fernhill, 12 for

Water Place and 11 for Marina Bay Residences.

Mrs Ong expects corporate buyers like funds to

continue growing in importance as private residential property buyers.

'Traditionally, overseas property funds buy offices in Singapore, but with

opportunities becoming more limited, they will increasingly turn to the

residential sector,' she added.

DTZ's analysis of caveats lodged for private homes

captured by the Realis system also shows that foreigners (including

permanent residents) snapped up 1,938 private homes in the first three

months of this year.

While this is up just marginally from the 1,934

caveats lodged by foreigners in the preceding quarter, it is nonetheless the

highest level of foreign purchases in a quarter ever captured by Realis.

Foreigners also upped their share of private home

purchases to 27 per cent in Q1 this year, a figure that has been previously

surpassed on just one other occasion. That was in Q4 1995, when foreigners

accounted for 32 per cent or 1,534 of the total 4,781 caveats lodged for

private homes.

DTZ also observed that while the number of private

apartments and condos that foreigners bought from developers in the primary

market declined 21 per cent quarter-on-quarter to 540 in Q1 2007, the number

of apartments/condos foreigners picked up in the secondary or resale market

rose 13 per cent to 1,315 over the same period. 'This was the largest number

of resale apartments that foreigners purchased in a quarter. Foreigners

accounted for a 32 per cent share in overall resale condos/apartments

transacted. This trailed only Q4 1995, when the share was 48 per cent,' DTZ

said.

'Unlike new projects, private homes in the

secondary market are usually ready for lease. This therefore attracts

foreign investors who wish to have a share in the current buoyant leasing

market. Similarly, resale properties are valued by foreigners who are new in

Singapore and require immediate accommodation. There are also some who have

received permanent residence and are keen to own residential properties,

partly as rents have been rising,' DTZ observed.

Projects that saw a high percentage of caveats

lodged by foreign buyers in the secondary market in Q1 included Costa del

Sol, Caribbean at Keppel Bay, The Nexus, Cuscaden Residences, Pebble Bay and

Leonie Gardens. Districts 10, 9 and 15 were the three most popular locations

for foreigners who bought condos and private apartments in the secondary

market in Q1.

As for foreigners who purchased condos/apartments

directly from developers in the primary market, the three most sought-after

districts in Q1 were 9, 10 and 11, followed by 15 and 1.

Tribeca, Residences

@ Evelyn, RiverGate, St Regis Residences, Waterfall Gardens and

Marina Bay Residences were among the projects that saw a high proportion of

foreign buying in the primary market in Q1.

The 540 condos/apartments that foreign buyers

purchased from developers in Q1 accounted for 28 per cent of developer sales

of non-landed homes during the period.

Indonesians and Malaysians continued to be the

largest groups of foreign buyers of overall private homes in Q1 this year,

accounting for 21 per cent and 19 per cent respectively of caveats, followed

by buyers from India, with a 14 per cent share. Indian nationals picked up

275 private homes in Q1 this year, an increase of 13 per cent from Q4 last

year.

Buyers from the United Kingdom were the

fourth-largest home buying market in Q1 (9 per cent share) followed by

mainland China (5 per cent). Australians lodged caveats for 100 private

homes in Q1, up 15 per cent from the preceding quarter. Koreans also