Wee Cho Yaw looking for a Successor

UOB Chair willing to hand over chairmanship to a suitable candidate from outside his fami

Wee Cho Yaw, United Overseas Bank (UOB)

chairman is looking for his successor - which means that for the first time in

its history, the 75-year- old bank could have a chairman from outside its

first family.

Mr Wee, 81, disclosed his succession plan

during an interview with BT last month in connection with the Singapore

Business Awards. Ideally, he wants a Singaporean to take over the chairmanship

from him.

'Since the family (members) cannot be the

chairman and CEO at the same time, I have to plan ahead. If I find a suitable

guy to take over the chairmanship, I'll pass it to him. That's the succession

plan. I have to do it, whether in two or three years, I don't know, it

depends,' he said.

The Monetary Authority of Singapore had in

March proposed that financial institutions be barred from appointing an

immediate family member of the chief executive officer (CEO) as board

chairman. But this would not affect existing chairmen who do not meet this

requirement, such as at UOB where Mr Wee is the father of CEO Wee Ee Cheong.

The interview was to mark yesterday's 25th

anniversary of the Singapore Business Awards. Mr Wee, whose name is synonymous

with UOB, has won the Businessman of the Year Award, its most prestigious

award - twice. He is only one of two businessmen to do so in its 25 year

history, the other being Creative boss Sim Wong Hoo.

Mr Wee said it won't be easy to get the

right candidate but it has to be done as a succession plan is important for

the organisation.

'Certainly, we're looking for suitable,

reputable people to take over from me. I cannot be permanent. It's not easy

but I will definitely try very hard,' said Mr Wee.

His father, Kuching-born Wee Kheng Chiang

founded the United Chinese Bank (UCB) together with six other Chinese

businessmen in 1935. UCB changed its name to UOB in 1965.

Mr Wee joined the bank in 1958 and took

over the day-to-day operations in 1960. He became chairman and CEO in 1974 and

gave up his position as CEO in 2007.

The Wee family own 17.39 per cent of UOB,

according to the 2009 annual report.

Mr Wee said the next UOB chairman should

ideally be a Singaporean given that it is a local bank.

'I think we should get a Singaporean as

this is a Singapore bank. It would be ideal to get a Singaporean to be CEO, to

be chairman. Unless you cannot find one, then we have no choice but to go into

the region,' he said.

Mr Wee also said that after he steps down

as chairman he might not even remain as a director on the bank as positions

are not important to him. But he intends to continue playing a role in the

bank as either honorary chairman or adviser.

In Singapore's other family controlled

bank, OCBC Bank, two members of the Lee clan remain as directors on the board.

'Positions are not important to me because

everybody recognises me, I have contributed to this bank. I can be honorary

chairman or adviser to the bank, I still can monitor the operations of this

bank. I still can give advice to the management, that is good enough for me,'

said Mr Wee.

In the hour long interview, he also said

UOB is not done with acquisitions and that he saw potential in Indonesia.

'I'm still looking into expansion but it

must be good risk. In any acquisition there is a risk, so you must know your

limitation and your appetite.

'Indonesia, I think, there's a lot of

potential but they are all very small banks. But they are good banks, worth

acquiring, and we should look into them.'

- 201 June 1 SINGAPORE

BUSINESS TIMES

Wee Cho Yaw's grip on UOL looks secure

Wee Cho Yaw's control of

United

Overseas Land (UOL) appears to be in no risk of being weakened by

the conversion of bonds issued by the property group.

With less than three weeks to go to the next

important corporate date - the expiry of an exchangeable bond issue - a

complex scheme which some believe will help ensure UOL remain in the control

of the family of Mr Wee looks pretty secure. For all its complexity, the

scheme complies with the rules that govern crossholdings by banks and their

affiliates.

At UOB's current price of $14.40, it is unlikely

that a central feature of the scheme, the nine-month $506 million bonds

exchangeable into 33 million UOB shares issued by UOL, will be exercised.

The bonds will expire on Sept 22 with an exercise

price of $15.34 a share, a price UOB has never reached since December 2004,

when UOL announced that it had sold its 4.2 per cent stake in UOB, the crown

jewel that Temasek failed to wrest earlier last year. UOL made the sale in two steps: first an outright

sale of 33 million UOB shares, and then the successful placement of the $506

million exchangeable bonds.

Unless UOB's share price climbs above the exercise

price of $15.34 each, bond holders will not convert into bank stock. UOL

therefore gets to retain its 2.1 per cent stake.

It will be easy for UOL to sell off the 0.1 per

cent stake in UOB needed to comply with the crossholding rules, which say an

affiliate of the bank cannot hold more than 2 per cent of the parent.

As well, UOL does not have to return the entire

$506 million - on which it would have earned an estimated $7 million based

on 2 per cent bank annual interest for nine months. UOL has only to return

the redemption amount, which is at 98.32 per cent of $506 million. It gets

to keep the difference as profit.

Citigroup analyst Lim Jit Soon said there is still

time to restructure another exchangeable note, or the UOB shares could be

simply placed out. If there are fears of a possible overhang, UOB has in

place a $500 million share buyback mandate of which it has yet to make use.

The unwinding of cross holdings must be tackled by

July 2006.

The next, and arguably final, piece to fall into

place comes on Jan 12 next year, with the expiry of the $276.25 million

notes exchangeable into 121.7 million UOL shares issued by UOB. With the

current share price of $2.33 per UOL share above the conversion price of

$2.26, the notes representing 15.35 per cent stake of UOL are likely to be

exchanged into UOL shares.

Assuming the bonds are converted, UOB would have

reduced its holdings in UOL to 10 per cent, fulfilling the unwinding of the

cross holding rules - that the bank has to divest its holdings to own not

more than 10 per cent in its affiliates.

Mr Wee, who is UOB chairman, and his family would

then end up with an estimated 18 per cent in UOL, including Haw Par's 5.2

per cent stake. The Wee family holds a controlling 23.8 per cent stake in

Haw Par. Combined with UOB's 10 per cent stake, Mr Wee's influence on UOL

would appear secure, said Citigroup's Mr Lim. -

2005

September 6 SINGAPORE

BUSINESS TIMES

A win-win for UOB and UOL

Who would

have guessed in May this year that the heated tussle for United Overseas

Land (UOL) between parent United Overseas Bank (UOB) and Temasek Holdings

would end up in a win-win situation for the managements of UOB and UOL,

leaving raiders out in the cold for now?

In a series of subtle moves over recent months,

veteran banker Wee Cho Yaw has done it again - this time by tightening even

further his control over UOB, Singapore's second largest bank by market

value, while making a tidy sum from the transactions at the same time.

Yesterday, UOL said it had sold all its 4.2 per

cent stake in UOB - the crown jewel that was widely speculated to have

caught the eye of Temasek earlier this year. The sale was effected in two

parts. First, via an outright sale of about 33 million shares in the open

market for $449.43 million or $13.685 each. This was followed by a

successful placement of $506 million worth of 9-month exchangeable bonds,

which when fully exercised will entitle bondholders to 33 million, or 2.1

per cent, of UOB shares. These bonds effectively priced UOB shares at $15.34

each, the highest level seen since 2000.

The sale of UOL's entire stake in UOB removes the

market's nagging concerns over the overhang of UOB shares. While the share

prices of rival banks have risen over the last six months, UOB shares have

been trading within a narrow $12.80-13.80 band despite its sound

fundamentals. UOB shares ended at $13.80 yesterday, up 10 cents.

Also, the manner of disposal is praise-worthy. It

minimises the selling pressure on UOL shares following the sale of its crown

jewel. UOL ended up 7 cents yesterday, at $2.37.

Moreover, had a share placement been chosen,

instead of the bond issue, the UOB shares would probably have had to be sold

at a 5-6 per cent discount to the open market sale price of $13.685 a share.

Unfounded fears

With the bonds, if they are fully converted, UOL

gets to keep the $506 million raised and shareholders - including UOB, which

owns close to 45 per cent of UOL - can expect to enjoy a further windfall

via some special dividend payout.

However, in the event that UOB shares do not hit

$15.34 and the bonds are not converted, UOL still retains its 2.1 per cent

stake but it does not have to return the entire $506 million. It only has to

return the redemption amount which is at 98.32 per cent of $506 million and

gets to keep the difference as profit.

As for fears that the open market sale of the 2.1

per cent stake in UOB would weaken Mr Wee's control over the bank, they are

unfounded. Over the past months, UOB had been buying back its shares in the

open market with the $500 million it had set aside for this purpose. Until

Wednesday, UOB has spent close to $400 million in share buyback - that's a

stake of about 2 per cent.

What's clear is that without UOB, UOL is now a

less convoluted play and more of a property play, with assets including $1.6

billion of investment properties; a 75.8 per cent stake in Hotel Plaza,

which owns 13 hotels in the Asia-Pacific; and 11.9 per cent of United

Industrial Corporation, which owns about 70 per cent of Singapore Land - one

of the largest landlords in the city's financial district.

But it is no longer the easy prey it was earlier

this year when its shares were trading below $2 each or at 50-60 per cent

discount to its revalued net asset value (RNAV). The shares have since risen

and with a RNAV of $3.00-$3.30 a share, the profit margin for potential

raiders has become less enticing.

Going forward, the key question remains: how is

UOB going to divest that stake to meet the Monetary Authority of Singapore's

July 2006 deadline for banks to get rid of non-core investments?

- 2004 December 3 SINGAPORE

BUSINESS TIMES

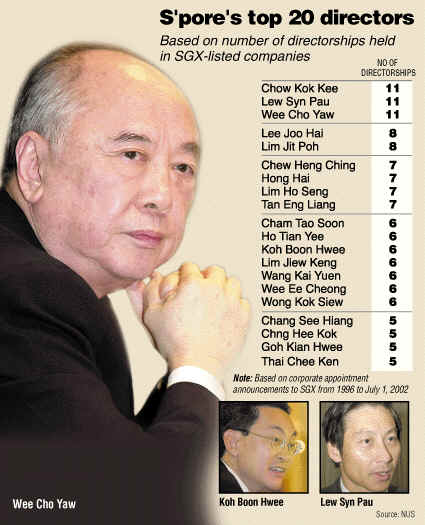

Singapore's Busiest Directors

Singapore Airlines' high-profile chairman Koh Boon

Hwee is often assumed to be the busiest director in Singapore, but an

ongoing NUS Business School study has put three other names ahead of him in

the directorship stakes.

They are United Overseas Bank (UOB) chairman Wee

Cho Yaw, Singapore Food Industries director Chow Kok Kee, and former

politician Lew Syn Pau. Each of them is a director in 11 listed companies

here.

Apart from UOB and its stable of companies, Mr Wee

is also director of Singapore Press Holdings. Mr Chow is also a director at

Meiban Group and other companies, including Thai Village Holdings, Chosen

Holdings, Tuan Sing Holdings, and TMC International (See table). Mr Lew's

directorships in 11 companies include Asia Food & Properties, Golden

Agri-Resources, and Poh Tiong Choon Logistics.

The information is collated from corporate

announcements of new director appointments (excluding CEO, CFO, and

chairman) to the Singapore Exchange between 1996 and July 1, 2002 for a

study undertaken by Associate Professor Mak Yuen Teen, Dr John Sequeira, and

Yeo Mei Chyi. The study aims to examine how the market reacts to the

appointment of directors, and whether this reaction is dependent on factors

such as the number of directorships a director already holds.

Mr Wee is closely followed by Lim Jit Poh,

chairman of Comfort Group and deputy managing director of LC Development. He

is a director in eight listed companies here. Similarly, IPC Corp's Lee Joo

Hai also has eight directorships.

Occupying the next few spots are former

politicians including Hong Hai and Tan Eng Liang, as well as Member of

Parliament Chew Heng Ching, each with directorships in seven listed

companies. UOB's president Wee Ee Cheong takes the 10th spot, with

directorships in six listed entities.

Interestingly, Mr Koh Boon Hwee also holds

directorships in six listed companies, including Singapore

Telecommunications, MediaRing.com as well as Omni Industries where he is

chairman.

But when directorships of non-listed companies are

also taken into account, QAF group managing director Tan Kong King wins

hands down. Mr Tan, who made Gardenia bread a household name, is a director

in a staggering 117 companies.

Of these, three are in locally listed companies

and the remaining 114 are in unlisted foreign and local ones.

A close second is property group City Developments

managing director Kwek Leng Joo who holds a total of 114 directorships -

five locally listed companies, including Hong Leong Asia, Pacific Century

Regional Development, and Republic Hotels & Resorts, as well as 109

unlisted local and foreign ones. But here it is important to note that the

latter comprises largely property and investment firms, most of which are

set up primarily to limit liability of property developments.

A close third is Provision Suppliers Corp

executive director Chan Yeuk Wai who is a director in only one Singapore

listed company but is kept busy with directorships in 104 unlisted foreign

and local firms.

By taking both listed and unlisted companies into

consideration, Mr Koh ranks 18th, with a total of 56 directorships. Kwek

Leng Beng, Wee Cho Yaw, Michael Fam, and Michael Wong Pakshong were not

among the top 20.

While the senior Wee did not make it to the top 20

list based on both listed and unlisted companies, his sons Ee Cheong and Ee

Lim did. Ee Cheong ranks 10th with a total of 73 directorships and Ee Lim is

19th, with 56 directorships.

The number of directorships an individual should

hold remains a hot topic as sceptics question a director's ability to

contribute if he or she is over-stretched. Late August, David Gerald of the

Securities Investors Association of Singapore (Sias) has called for the

number of directorships an individual can hold in listed companies to be

capped at four. Mr Gerald had then told BT that 'ideally, directors should

concentrate on two to four companies'.

Other concerns include the cosy bond shared by

some directors in Singapore that could threaten good corporate governance.

- 2002

October 18 Singapore

Business Times

Tightens hold on UOB with Haw Par move

Ee Lim:

started out as Haw Par marketing executive in 1986

It's all coming together for Wee Cho Yaw. Youngest

son Ee Lim, 41, will soon take charge of Haw Par Corp, seen by many as a key

element of the elder Wee's grand scheme of keeping control of the United

Overseas Bank group.

Second son Ee Chao already heads UOB-Kay Hian

Holdings, the brokerage arm of UOB, while eldest son Ee Cheong is

heir-apparent at the bank.

Eldest daughter Wei Ling is involved in the

family's spa and lifestyle-related business while Wei Chi is said to be

helping out at the family's private vehicle, Kheng Leong.

Haw Par yesterday announced the appointment of Mr

Wee Ee Lim as acting president and chief executive officer, with effect from

April 1. In July last year, it said that president and CEO Hong Hai would

retire in March this year, but would stay as a non-executive director of the

group.

Mr Wee Ee Lim joined Haw Par in 1986 as a

marketing executive and became a director in 1994. He took on the deputy

president job in 2000. So his elevation to the top job at the healthcare and

leisure group is not unexpected.

But the significance of the appointment is

unlikely to escape the market. With just a 10.4 per cent stake in UOB, Mr

Wee Cho Yaw has relied on three listed companies within the group - Haw Par,

United Overseas Land and Overseas Union Enterprise - to strengthen his hold

on the bank.

These companies hold a total of 11.3 per cent of

the bank, with Haw Par holding 4 per cent.

But Monetary Authority of Singapore directives

requiring banks to divest non-core assets by the middle of next year (2004)

means that UOB has to unwind its stakes in Haw Par as well as UOL and OUE.

UOB divested most of its stake in Haw Par through

a distribution in specie to the bank's shareholders last year. But this also

raised Mr Wee Cho Yaw's direct stake in Haw Par through shares he received

as a UOB shareholder, which together with open market purchases helped push

his stake in Haw Par past 20 per cent and boost his interest in UOB.

The bank also continues to hold a 10 per cent

stake in Haw Par as an investment, which is within the MAS limits. It has

yet to announce plans to divest its stakes in UOL and OUE.

- 2003 February 27 Singapore

Business Times

8 Feb 2003 - This is the

year Wee Cho Yaw will try to tighten his grip on United Overseas Bank. But

first he must overcome a major stumbling block - the valuation of UOB shares

A man used to having his own way, Mr Wee will soon

come up against two deadlines he can neither avoid nor get around. Both

deadlines will come up in 2004.

In that year he will turn 75, an age when bank

chairmanship in Singapore is subject to veto by the Monetary Authority of

Singapore, which seems to favour younger men at the helm.

And 2004 is also the last year when Singapore's

three local banks must, in accordance with an MAS directive, dispose of

their non-core assets according to stipulated levels. This explains why Mr

Wee has launched into a flurry of activity to make sure control of the bank

remains in his hands.

This is a job tougher than his spectacular

takeover of smaller Overseas Union Bank back in 2001.

To snatch OUB from DBS, which already had a bid in

place, all Mr Wee needed was to convince three people to sell: OUB's ageing

founder Lien Ying Chow, his wife Margaret, and his number two Lee Hee Seng.

This Mr Wee did, beautifully, through a personal visit to Mr Lien in which

he proposed a 'merger' of the two banks, a polite term for what everyone

knew was a takeover.

But now, to get his restructuring through, Mr Wee

would need to get minority shareholders of up to six listed companies to go

along with it.

The companies are UOB, the two 'non-core'

companies of United Overseas Land and Overseas Union Enterprise, United

Industrial Corporation and its subsidiary Singapore Land, and Haw Par, the

control of which was recently transferred from UOB to Wee Investments, Mr

Wee's private vehicle.

When Mr Wee took over from his father more than 30

years ago, UOB was a small bank. Today it is the largest in Singapore by

many measures. This tremendous growth is fuelled by half a dozen

acquisitions, starting with the Chung Khiaw Bank of the Aw family in the

1970s and ending with OUB two years ago. Each acquisition dilutes Mr Wee's

stake in an enlarged UOB, so that today his holding has been whittled down

to about 10.4 per cent.

A 10.4 per cent stake in a bank with a market

value of more than $16 billion is a lot of money ($1.7 billion), but not

enough to ensure firm control. Even with support from his siblings (whose

total holding is said to be between 3 and 5 per cent), Mr Wee would still be

in a vulnerable position.

This is not a unique problem. It is faced by many

family firms controlling large listed entities, such as the Keswick family

of Jardine and the ruling families of Japan's huge general trading houses,

the sogo shoshas. Invariably, every one tackles the problem in the same way:

they spread control through a complicated interlocking corporate structure

in which members of the group hold each other's shares, thus making it

difficult for outsiders to gain enough votes to go against the controlling

shareholder.

For UOB, three listed companies in its group hold

a total of 11.3 per cent of the bank: UOL (4.2 per cent), Haw Par (4 per

cent) and OUE (3.1 per cent). Combine that with holdings of the extended Wee

family, Mr Wee will be able to call on 27 per cent of the vote, a much

stronger position.

But not for long. The MAS directive requires banks

to hold no more than 10 per cent of 'non-core' assets, which means UOL and

OUE will soon follow Haw Par out from under the UOB umbrella.

Together, UOL, OUE and Haw Par have a market value

of $2.8 billion. This means anyone willing to spend $1.4 billion will gain

control of the three companies, and, through them, 11.3 per cent of UOB -

enough to challenge Mr Wee. To prevent this, Mr Wee must be the one doing

the takeover. He has done so with Haw Par, and is working on the other two.

Getting Haw Par was cheap - a combination of open

and off-market purchases and distribution in specie of shares by UOB has

cost Mr Wee perhaps no more than $50 million for a 21 per cent stake. UOL

and OUE are bigger and more expensive. To secure outright control, the Wee

family will need to spend up to $1 billion. But it can be made cheaper, if

Mr Wee brings in UIC and merge SingLand, the premier office landlord, with

UOL and OUE.

Each company has a market value of around $1

billion. A three-way merger will create a $3 billion property giant, on a

par with the two leaders City Developments ($3.1 billion) and CapitaLand

($2.6 billion). This should go down well with minority shareholders.

Based on market value, UOB will end up with 30 per

cent, and UIC 23 per cent, of the merged entity. As MAS's rule requires UOB

to keep only 10 per cent of the stake, the bank may sell the balance 20 per

cent to Haw Par at cost. This will cost Haw Par only $600 million, easily

affordable from cash reserves and borrowings.

Under this arrangement, control is split three

ways between Wee Investments, UIC and UOB, all under Mr Wee's control. And

it will not cost Mr Wee a single cent personally.

But there is a snag. Both Haw Par and UOL carry

their UOB shares at historical cost, thus creating a gap of hundreds of

million dollars between book and market value of the companies. This

practice raised some eyebrows late in 2001 when UOL sold its Haw Par stake

to Mr Wee based on Haw Par's market price, which reflected its book ($3 a

share), rather than $6 if the UOB shares were marked to market.

Precedent

In any merger involving UOL, the same issue will

come up. To get the best price, UOL shareholders will insist that the UOB

shares be fully valued. But this will not be agreeable to shareholders of

Singland and OUE as it will work to their disadvantage.

And they have a strong case for going against it.

UOL has set a precedent of not revaluing UOB shares when it sold the Haw Par

stake to Mr Wee, a practice its director said was 'fair and reasonable'.

Having taken such a stand, UOL directors will find it difficult to change

their mind now.

This, then, is the hurdle facing Mr Wee should he

decide to merge UOL, OUE and SingLand: how to convince UOL shareholders not

to revalue the UOB shares. Unless a solution is found, no merger can take

place. And time is fast running out. Unless MAS extends the 2004 deadline,

Mr Wee has a maximum of 12 to 16 months to pull off the deal. It will be

interesting to see how he manages it. -

2003

February 8 Singapore

Straits Times

|