|

-

10

Retail Trends

-

Fast

Retailing

-

Ad

Space

-

Metro

to expand in Eastern Europe, Asia

Germany's

Metro, the world's No. 4 retailer, is planning to ramp up expansion in

Asia and Eastern Europe, but not in the U.S. "The United States is

currently not on our top-priority list," said Metro CEO Thomas

Unger. "We see great opportunities and challenges in Asia over the

next 10 years." -

August 17, 2009 Reuters

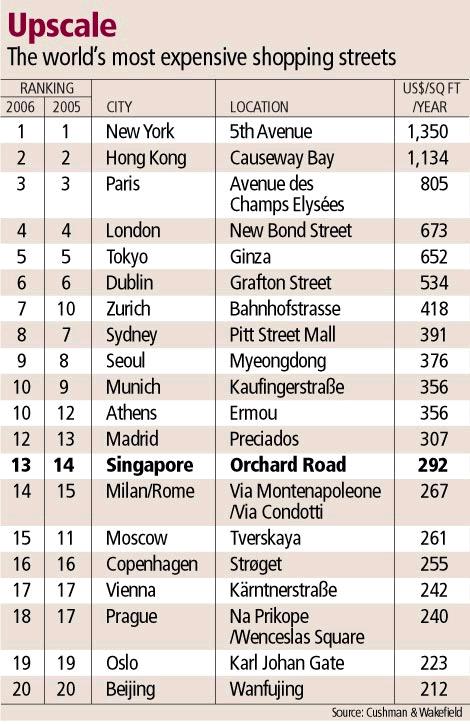

The World's Most Expensive Shopping

Streets

Orchard Road prime rents have hit US$325

psf per year, making it the world's 14th most expensive area for

shopkeepers. By contrast, annual prime rents for sites on New

York's Fifth Avenue are US$1,500 psf, or US$922 for sites on the Avenue des

Champs Elysees, in Paris.

Orchard Road is also the fourth most

expensive shopping location in this region - after those in Hong Kong

(Causeway Bay - US$1,213 psf/year), Tokyo (Ginza - US$683 psf/year) and

Seoul (Gangnam Station - US$431 psf/year).

A report by Cushman & Wakefield

(C&W) shows that Singapore's busiest shopping street did slip one place

from its previous 13th position last year but attributed this to the

strength of the euro over the Singapore dollar.

C&W's report tracks retail rents in

the world's top 231 shopping locations across 44 countries. Its data show

that annual prime rents increased by 11.3 per cent for Orchard Road while in

the top three most expensive locations in New York's Fifth Avenue, Hong

Kong's Causeway Bay and Paris's Avenue des Champs Elysees, rents increased

by 11.1, 6.97 and 14.5 per cent respectively.

At the fourth and fifth most expensive

locations - London's New Bond Street (US$814 psf/year) and Tokyo's Ginza -

annual rents increased by 20.95 and 4.8 per cent respectively.

Although C&W expects retail rents in

Singapore to continue their upward trend, it noted that rents in other

cities have increased faster, notably in India. It believes that this will

help make Singapore more competitive and maintain its attractiveness as a

retail destination in the region.

Rental growth across Asia as a whole

increased by 23.8 per cent. C&W head of retail services (Asia Pacific)

Sebastian Skiff said: 'Of particular note is the robust performance in Tokyo

driven largely by lack of supply. India saw particularly strong growth, with

rents nationally up 53.5 per cent.'

He also noted that Australia, Korea,

Singapore¬ and Hong Kong saw solid growth from already relatively high

bases.

On the demand for prime retail space,

C&W's global head of retail, John Strachan, said: 'We are seeing the

emergence of a line-up of global shopping destinations, whether Fifth Avenue

in New York, Causeway Bay in Hong Kong or Avenue des Champs Elysees in

Paris, where retailers are using flagship stores in prestige locations to

leverage the value of their brands.'

Globally, Chicago's Oak Street was the

location with the biggest rental increases in local currency. Rents for

prime properties doubled in one year.

This was followed by rents in New Delhi's

Ansal Plaza and Connaught Place which saw annual increases of 87.5 per cent

while rents in St Petersburg's Nevsky Prospekt increase by 81.8 per cent.

- 2007 November 20 SINGAPORE

BUISNESS TIMES

|