|

Masterplan

opportunities are few and far between. Timing is everything as

illustrated by Canary Wharf development in London; or the Expo site in

Vancouver, Canada. In Singapore we've saved articles which

document the development of this development.

The tender for the 3.55-hectare waterfront site - about 6 1/2 times the

size of a football field - closes on June 21 and six groups are expected to

submit bids for the land, which is valued at $778 million.

An unlisted company controlled by the

Kwok family, which heads Sun Hung Kai Properties, is in a joint bid with

South-east Asia's largest developer, CapitaLand Ltd, industry sources said.

Both companies denied involvement.

Sun Hung Kai Properties said that it had

'no plan to invest in Singapore at the moment' while a CapitaLand spokesman

said that it was 'not in partnership with Sun Hung Kai'.

'I'm surprised they are still denying

this at this stage,' said one industry source.

Hong Kong-listed Lippo, controlled by

Indonesia's Riady family, said that it was leading a consortium to bid in

Singapore's first government land sale for commercial use in three years.

'We are putting together a consortium,

which we will lead,' said a Lippo spokesman.

Adjacent to one of Singapore's planned

casino resorts, the development will yield a total gross floor area of

438,000 square metres, adding at least 10 per cent to the current office

supply in the central business district.

The reclaimed land, which has a 99-year

lease, will also contain residential apartments and shops.

Hong Kong's Cheung Kong (Holdings) Ltd,

controlled by Asia's richest man, Li Ka-shing, has said that it would work

on a bid with Hongkong Land and Keppel Land.

City Developments and office landlord

Singapore Land are said to be weighing bids as well.

CityDev is reported to have been in talks

to sell $500 million in assets to a listed property trust controlled by Mr

Li to raise money to back its bid.

The tender was triggered in March by

Guocoland Ltd which offered an initial bid of $1,776 per square metre -

lower than many analysts had expected.

The site was on a government reserve

list, created in 2001, which replaced regularly scheduled land sales. The

government assigns secret minimum bid prices for plots on the list. When a

bid level is breached, an auction is triggered.

Winners of the bid will have a 'pretty

tight grip on the prime office space market in the next 5-6 years' as no

other major office development is in sight, said Moray Armstrong of property

consultancy CB Richard Ellis.

The tender is not expected to revitalise

Singapore's property market, which is recovering tepidly.

'Given the risks of a mega-site like

this, I do not expect the bids to be excessively high,' said Yu Lai Boon,

managing director of Jones Lang LaSalle Singapore. Singapore office rents

have climbed 11 per cent since October 2003 while those in rival financial

centre Hong Kong have more than doubled in the same period, he said.

Though office vacancy rates fell one

percentage point in the first three months this year from the previous

quarter, Singapore is fighting to retain multinational firms from being

lured to cheaper regional business centres.

'Unlike Hong Kong, Singapore doesn't have

proximity to China as leverage,' said Ong Wah Foon, head of research at

property consultant DTZ Debenham Tie Leung.

The last government land sale in the same

area went to CityDev in 2002 for $1.07 billion, 38 per cent more than the

initial bid. -

Reuteurs 11 June 2005

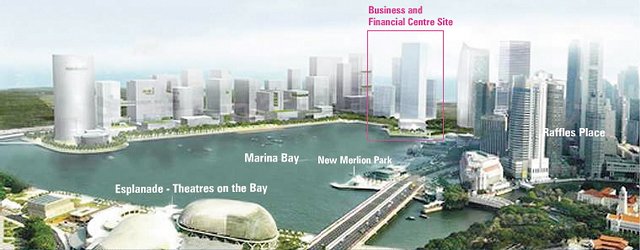

Masterplan for Downtown Singapore

A massive construction site for

Singapore's new waterfront financial and business centre looks set to go on

sale next year - to a single master developer.

The successful bidder, as

master developer, will have greater leeway to decide what types of buildings

it wants to put up on the land.

And the Government will

consider a radical progressive payment scheme to offer flexibility to the

company or consortium which takes on the project which will yield a built-up

floor area of some 4.3 million sq ft.

The proposed new downtown

sits on 372 ha of reclaimed land around Marina Bay, next to the existing

Central Business District, and is intended to meet office-space demand for

the next 50 years.

And if the appointed

marketing consultant - Temasek Holdings' property arm Mapletree Investment -

has its way, the site for sale might come with anchor tenants with their own

design-and-build needs all ready to go.

A progressive payment

approach, rather than the usual full payment upfront for other government

land sales, is just part of the flexible approach to developing this site,

Minister of National Development Mah Bow Tan said at a press conference

yesterday.

Flexibility is needed

because of the sheer size and, thus, the potential financial risk of

developing the site, he said.

So the developer may be

allowed to pay just the land price of the first phase after award of the

site, and an option fee for subsequent phases. If it does not exercise the

option within the period, it will forfeit the option fee. It needs to pay

the full land price for each phase only when it takes up that phase.

The strategy to secure

commitments from anchor tenants before tendering out the site is another way

to hedge the risk of developing the site.

Other things being

considered by the various ministries and agencies involved in marketing the

site include:

Allowing the master

developer a longer project completion period of possibly up to 15 years,

rather than the usual eight to 10 years, and to develop the site in phases;

- Getting the Government

to share the financial risk, perhaps by taking a stake; and,

- Relaxing the degree to

which other building uses could be blended into what is meant to be

primarily a business and financial hub - such as retail, food and

beverage, and residential components.

The exact size and

location of the site, to be tendered out in the first half of next year

'barring adverse economic shocks', will be decided on at the end of the

year when the Urban Redevelopment Authority completes its review of the

area's master plan.

The National

Development Ministry said that it will be a while before the first

buildings are ready for occupation. Also, because of the longer project

completion period allowed, development can be phased to match demand,

allowing the property market to better absorb the supply of floor space.

Flexible payment

The developer may be allowed to pay just

the land price of the first phase after award of the site, and an option fee

for subsequent phases which will be forfeited if not exercised within the

period.

It needs to pay the full land price for

each phase only when it takes up that phase. -

By Soh Wen Lin Singapore

Straits Times 16 August 2002

Bleak future for rents, values at Raffles

Place

It is not exactly Sept 11 all over again,

but the property market is still reeling from National Development Minister

Mah Bow Tan's announcement of a new central business district - the New

Downtown - last week. Since then, hundreds of millions of dollars might have

been wiped off the values of offices in and near the Raffles Place CBD.

Rentals, already hovering near record lows, now threaten to plumb even

greater depths.

And the fledgling REIT (real estate

investment trust) business has been dealt a blow as well. Before Mr Mah's

announcement, at least four large property firms were planning to launch

office REITs. Investors will now demand higher yields - up by at least 100

basis points (a percentage point) - for the higher risk. This might make it

unfeasible for the firms to securitise their properties.

On the face of it, Mr Mah's announcement

is fairly mild. The government, he said, wants to attract more international

financial institutions to Singapore. As these institutions require large,

specially designed offices in pleasant surroundings and as the current CBD

is too crowded, the project will jump-start the development of a new CBD on

reclaimed land next to Raffles Place.

A large plot of land will be sold to

yield more than four million sq ft of space. Various government bodies, such

as the Monetary Authority of Singapore (MAS), would help market the project.

To minimise the impact on an office

market already running desperately short of tenants, the project will be

built over 10 to 15 years, so that an average of only 300,000 sq ft will

come onstream each year. This is the official thinking. But consider the

following factors:

There is expected to be a net shrinkage

of space occupied by financial institutions in Singapore. Even those that

take up more space might do it only temporarily. A good example is United

Overseas Bank, which is hubbing its regional credit card operations in

Singapore, but said it may move to a cheaper location in the future.

- There are already three large office

projects going up in the new CBD: one by a consortium comprising

Hongkong Land, Li Ka-shing and Keppel Land; one by City Developments;

and one by the National Trades Union Congress. With nearly three million

sq ft of space (of which 200,000 sq ft will be taken by NTUC), these

projects should be enough to house all the new financial institutions

coming to Singapore in the next decade.

- As the government is keen to get the

new CBD off the ground to compete with Shanghai and Hong Kong, its mega

project might not be stretched out to 15 years, but just five years.

This could throw more than 800,000 sq ft of space into the office market

each year.

- Given that there are not enough new

tenants to fill the space, poaching of existing tenants will be

inevitable. Rentals in Raffles Place will fall and capital values will

follow.

This is bad news for office landlords

from Singapore Land to CapitaLand and City Developments. There's more.

Raffles Place sets the benchmark for the entire market segment. A fall in

capital values there will ripple throughout Singapore, affecting suburban

landlords from private developers to the Housing & Development Board.

But the contagion may not stop there.

Most of the banks' secured loans are backed by properties. Banks may demand

borrowers to top up their loans to adjust for falling property values. At a

time when cash is tight for everyone, this could be the worst possible news

for office owners. -

By Lee Han Shih Singapore

Business Times 20 August

2002

UPDATE:

If the new business and financial centre

(BFC) is really important to the future of Singapore, should the government

hesitate in pushing the project off the ground?

Last Wednesday, National Development

Minister Mah Bow Tan told developers that the sale of land in the new

downtown - a huge tract adjacent to the existing Raffles Place central

business district outside of Collyer Quay - may not happen in the first half

of next year as announced earlier.

Mr Mah was speaking at the annual dinner

of the Real Estate Developers' Association of Singapore - and his message

was a piece of rare good news for developers in recent times.

The office sector is in the doldrums.

Island-wide, there is a 15 per vacancy rate, with more and more companies

giving up space or cutting down on it. Rents in prime areas have fallen 16

per cent this year and it's hard to say when they will bottom. In the Rafles

Place area alone, there is now five million sq ft of space without tenants.

It was in this doom-and-gloom atmosphere

that the government shocked the property market in August by announcing the

BFC project.

To be built in the new downtown, where

there are already three large office projects under construction, BFC will

be a behemoth of 4.3 million sq ft, or six to seven times the size of City

Developments' top-of-the-line Republic Plaza.

News of the project made developers' jaws

drop - literally. 'It's crazy. We can't even rent out existing space and

(the government) wants to add another four million sq ft to it?,' a

developer lamented at the time.

Knowing the negative market sentiment,

the government took pains to explain that the project is vital to

Singapore's future by providing a new cluster of buildings with large

floor-plates to meet the needs of international financial institutions.

In short, its message was 'no pain, no

gain'. Pain, which could be suffered in the short term by developers losing

tenants to BFC, would be far outweighed by the gain to the nation's

financial industry in the long run.

The message got through, and the BFC

project was pushed in typical Singapore fashion - when something needs to be

done, it will be done, regardless whether it's popular.

BFC, in other words, is like raising the

Goods & Services Tax or the delay in restoring Central Provident Fund

contributions - a large number of people may hate it, but it will still

happen because the government believes it's good for Singapore.

Then last Thursday, Mr Mah said the

government may delay selling land for BFC, hence delaying the project.

Market speculation has it that it might

have to do with the fact that consultant Mapletree Investments (a

government-owned company staffed by former Urban Redevelopment Authority

people) could not get a major commitment from the foreign banks.

But even so, if BFC is indeed vital, then

the government should not lose any time in getting it off the ground. If the

land sale for the project is delayed because of economic conditions, it

could be years before such conditions recover sufficiently for a sale to be

launched - by which time other countries may have taken the lead from

Singapore.

And if the project isn't vital - and the

lack of market response suggests that Singapore may be peddling a product

with no customer - then the government may have to reconsider the whole

project, rather than letting its huge shadow hang over all those who own

offices in the CBD. - By

Lee Han Shih

Singapore

Business Times 19 Nov 2002

|