|

The

third-largest Reit market is Hong Kong with a market capitalisation of

US$8.5 billion

ING officials said recently they expect the fund

to raise at least US$200-US$300 million within the first six to 12 months in

ING Asia Pacific Real Estate Securities Fund in Hong

Kong. Mr Pica, the fund's manager, said some

of its top holdings included Hong Kong-listed China Overseas Land &

Investment Ltd and China Resources Land Ltd, as well as Sun Hung Kai

Properties Ltd and Hang Lung Properties Ltd. - 2008

February 25

HK Reits get a new lease of life

Hong Kong's neglected real estate

investment trust (Reit) market is stirring to life and may finally do what

it's supposed to - give investors stability, a decent yield and, possibly,

clear prospects for growth.

A high-profile acquisition by office

landlord Champion Reit, and the imminent listing of a hotel Reit by

developer Far East Consortium, may help revive investor interest.

The reputation of Hong Kong's Reits has

been sullied by investor perceptions that they were used by wily developers

to offload second-rate assets at inflated prices, and marred by the

byzantine financial engineering that accompanied their deals.

As new Reit markets emerged across Asia,

with investors enjoying fat dividends from rental income and capital gains

from rising property prices, Hong Kong Reits were given the cold shoulder.

'It seems like a lot of Reits are like a

second concubine - it's whatever leftover product you have,' said Far East

Consortium chief executive David Chiu.

'But we're saying to the market that

we're putting all the hotels we have in,' he said about the group's latest

offering, a listing of its hotel Reit. 'You either like it or not, but it's

all of them.'

After a year's lull in new Reit listings,

Far East has lined up an initial public offering (IPO), packaging all seven

of its hotels in the city into the Hong Kong Hotel Trust, and moving away

from complex financial engineering.

Earlier this month, Champion Reit said it

would dismantle the complicated financial structure linked with its IPO, and

also bought a 56-storey block in Hong Kong's Kowloon district.

Hong Kong's biggest developer, Sun Hung

Kai Properties, is also considering resurrecting a planned office trust,

while Swire Pacific wants to spin off its Festival Walk shop and office

complex, bankers say.

Hong Kong's Reit market made an explosive

start in late 2005 when investors flocked to a US$2.4 billion IPO by Link

Reit, drawn by pledges to revamp and squeeze more profit from 151

government-owned malls.

But the city's six other Reits, including

two with mainland Chinese assets, have fared worse on the secondary market,

with their yields pushed up to between 8 and 10 per cent now from 5 to 6 per

cent at their IPOs.

However, their share prices stabilised

despite turbulent markets in the last six months, while Japanese and

Singapore trusts slumped, and they now offer big and steady spreads over the

3.1 per cent yield given by 10-year bonds.

Comparable spreads for Reits in Japan and

Singapore are much lower, at around 3.5 percentage points.

But high yields and cost of capital mean

Hong Kong Reits often struggle to find acquisitions that are 'yield

accretive' - or lift investor returns.

However, by using loans, a convertible

bond issue, and new equity raising, Champion's Reit has managed to buy

Langham Place from the Reit's sponsor, Great Eagle (Holdings), for US$1.6

billion.

The deal is getting a belated thumbs-up

from analysts after initial suspicions the trust was paying too much.

'Don't overreact, this is a positive

deal,' wrote BNP Paribas analyst Andy So, when Champion's share price

slumped 5 per cent a day after the deal was announced.

He said the purchase would lift

distribution per unit, despite dilution from the share sale, and praised the

unwinding of financial engineering that had been unpopular with investors.

The trust had employed interest rate

swaps and a dividend waiver by Great Eagle, that artificially lifted yields

at the time of the IPO.

It now wants to unwind and simplify that

structure.

With Champion embarking on a global

roadshow to raise equity for the deal, a banker who worked on the

transaction predicted it would herald a new beginning for Hong Kong Reits.

-- 2008 February

28 Reuters

Li

and GZI in REIT face-off

Investors will soon face a choice

of betting on the mainland's better, if riskier, growth prospects or the

relative security and stability of Hong Kong as two large real estate

investment trusts vie for their affections in the race to close deals before

the Christmas holidays

Investors will soon face a choice of betting on

the mainland's better, if riskier, growth prospects or the relative security

and stability of Hong Kong as two large real estate investment trusts vie

for their affections in the race to close deals before the Christmas

holidays.

The battle pits Guangzhou Investment, the

Guangdong provincial capital's largest property developer, against Cheung

Kong (Holdings), the flagship company of Hong Kong's richest man, Li

Ka-shing. Together the two initial public offerings could raise as much as

HK$3.4 billion.

Guangzhou Investment plans to raise up to HK$1.6

billion by selling shares in the revenue streams of four mainland

properties. It's offering 583 million units in a trust dubbed GZI REIT that

will be priced to yield not less than 7 percent, a rich payout meant to

compensate for the perceived higher risk of investing in mainland real

estate.

The company plans to buy between 30 percent and 50

percent of the REIT for its own account, a stake typical of REITs in more

developed markets such as Singapore, according to a market source. Guangzhou

Investment begins its roadshow next Thursday, with pricing set for December

15 and trading slated to begin December 21.

Cheung Kong is looking to raise as much as HK$1.9

billion by offering shares in the revenue streams of seven Hong Kong

buildings. The REIT, dubbed Prosperity, will go to market with an indicative

price range of HK$2 to HK$2.16 per unit, yielding a much lower 5.31 percent

to 5.73 percent, according to people familiar with the deal.

Retail orders will be accepted beginning early

next week with pricing scheduled for Thursday. Trading begins on December

16.

Fund managers are attracted to GZI because of

China's long-running economic boom. "There's the growing consumerism of

Guangzhou with the people there seeing a rise in their standards of

living," said Andy Mantel, managing director of Pacific Sun Investment

Management.

When combined with the higher yield, that might

make this seem like a one-horse race. Yet fund managers said GZI's yield

might still not be sweet enough to overcome investor doubts about the wisdom

of investing in mainland securities, especially in a product where many

buyers are looking for predictable yield, not the possibility of quick

capital gains.

"Investors may expect an even higher yield to

compensate," said Phillips Securities director Louis Wong.

REIT investors, since they are buying the rental

income stream, are most concerned with whether a property can maintain high

occupancy rates over the long haul. Though volatility is no stranger to Hong

Kong's property market, Guangzhou has a history of seeing asset prices soar

only to plunge just as precipitiously when returns fail to materialize, fund

mangers said.

Such doubts, and the greater transparency and

stronger market-making mechanisims on offer in Hong Kong, offset a good part

of the fatter yield Guangzhou plans to offer. "Over the course of the

coming year there will be less uncertainty and doubt" here than on the

mainland, Wong said.

Regardless of which deal proves most attractive to

investors, both will get a boost from - and have been timed to coincide with

- the Housing Authority's Link REIT, which rose 15 percent on its debut last

Friday and has climbed another 2 percent since then.

Citigroup, HSBC and DBS are arranging the sale for

GZI while Cheung Kong has hired JPMorgan and Merrill Lynch. -

by Tim Lee Master THE

STANDARD 2 Dec 2005

Li

flagships to take 29pc of Prosperity REIT offer

Cheung Kong

(Holdings) and Hutchison Whampoa will subscribe up to a combined 29 percent

in Prosperity REIT, a portfolio of seven properties worth HK$4 billion that

is expected to become the first real estate investment trust to be listed in

Hong Kong

Cheung Kong (Holdings) and Hutchison Whampoa will

subscribe up to a combined 29 percent in Prosperity REIT, a portfolio of

seven properties worth HK$4 billion that is expected to become the first

real estate investment trust to be listed in Hong Kong

The firms, controlled by Li Ka- shing, are obligated to subscribe for up

to 18.58 percent and 10.42 percent of the total units.

Cheung Kong shareholders have the preferential right to subscribe to one

unit of the trust for every 32 shares of the company, it said Sunday.

Cheung Kong said an application has been lodged with the stock exchange

for the proposed listing of the trust, which will buy the properties from it

and Hutchison for HK$4 billion, a discount of about 11.9 percent to the

valuation appraised by an independent surveyor as of the end of last month.

Cheung Kong, Hong Kong's largest developer by market value, will reap

HK$2.43 billion from the sale, representing about 1.3 percent of its

shareholders' equity as of the end of June.

The properties consist of three office buildings, three industrial and

office premises and an industrial property, with a total gross rentable area

of 1.2 million square feet.

Those include the Metropolis Towers, a 15-story office tower in Hung

Hom;

MLC Millennia Plaza, a 32-story office building in North Point; the

commercial component of the Harbourfront Landmark development in Hung Hom.

Others include Modern Warehouse, a 27-story industrial and office

building in Kwun Tong; the Trendy Centre, a 30-story industrial/office

building in Lai Chi Kok; Prosperity Centre, a 26-story industrial and office

building in Kwun Tong; and New Treasure Centre, a 30-story industrial

building in San Po Kong.

The timetable for Prosperity Trust's listing hasn't been unveiled. Sing

Tao Daily reported earlier that Cheung Kong plans to list its REIT on

November 21, ahead of the Link REIT listing, a portfolio of Housing

Authority shopping centers and parking garages, expected to go public on

November 24.

HSBC Institutional Trust Services (Asia) will act as Prosperity REIT's

trustee.

The manager will be ARA Asset Management, a Cheung Kong 30 percent-held

unit that also manages its two Singapore real estate investment trusts,

Fortune REIT and Suntec REIT.

Analysts say the planned secondary listing of Fortune

REIT, a portfolio

of 11 malls and properties across Hong Kong, is unlikely to beat the Link

REIT and Prosperity REIT to become the first real estate trust listed in

Hong Kong. Under regulatory guidelines, to qualify for a Hong Kong listing,

a REIT should be under local legal jurisdiction. Fortune REIT is domiciled

in Singapore.

Shares of Cheung Kong fell 1.24 percent Friday to close at HK$79.60.

- by Amy Gu and Raymond Wang THE

STANDARD 31 Oct 2005

Global funds poised for return

REITs likely to be the

preferred investment vehicle as foreign buyers show renewed interest in Hong

Kong real estate

International funds are poised to make a push into

the Hong Kong property market, but real-estate experts say the funds are

likely to be very selective and cautious in their investments.

Some of the funds are making their debut in Hong

Kong's real- estate sector, while others are planning to add to their

investments in the industry, the realtors say.

Real Estate Investment Trusts (REITs) are expected to be a popular

investment vehicle for the funds as the new initiatives are launched by

local developers.

REITs are funds that hold a pool of rental

properties with set incomes.

The head of the London-based Royal Institution of

Chartered Surveyors, said international funds were refocusing on Hong Kong

property following the seven-year slump.

He said a half a dozen international investment

funds from Britain, the United States and Australia, with total equity of up

to $5 billion, were planning to make forays into Hong Kong's office,

residential and retail property sectors.

Deka-ImmobilienGlobal, a German fund established

in 2002 by Deka Immobilien Investment, had shown an interest in making its

first raid on Hong Kong's grade-A office and retail space.

Johannes Haug, head of the international

department at Deka Immobilien Investment, said that the fund planned to

invest 30 per cent of its cash pool of €2 billion (about HK$19.34 billion)

in the Asia-Pacific region. Tokyo, Seoul, Singapore and Hong Kong were top

of their preferred investment destinations.

Meanwhile, Australia-based Macquarie Real Estate

Asia views Hong Kong as one of the most lucrative property markets in Asia.

Craig Wallace, managing director of Macquarie Real

Estate Asia, said foreign investors were convinced that Hong Kong's property

market had gone through a cyclical correction and was now on an early upward

cycle.

"Most foreign investors showed no interest in

Hong Kong's property market six month ago, but their views have

changed," Mr Wallace said.

Macquarie Real Estate Asia owns property in Asia

worth US$500 million - about 20 per cent of it in Hong Kong and the

remainder equally distributed in Japan and South Korea.

Mr Wallace said the company was interested in

forming a joint venture with local developers to enter the mass housing

market, where he believes supply will fall short in 2005.

Mr Brooke said most of the funds were likely to

invest in REITs.

The Securities and Futures Commission introduced

rules in July allowing REITs in Hong Kong covering assets such as car parks,

shopping centres, office blocks, hotels, recreation parks and serviced

apartments.

The trusts can also include overseas assets.

"A lot [of them] are getting ready,"

said Mr Brooke, citing as examples the Housing Authority's portfolio, MTR

Corp's property project and the government's office assets.

The Housing Authority plans to sell HK$20 billion

worth of car parks and shopping centres through a REIT-like vehicle before

2005.

Sun Hung Kai Properties has also expressed its

intention to launch REITs.

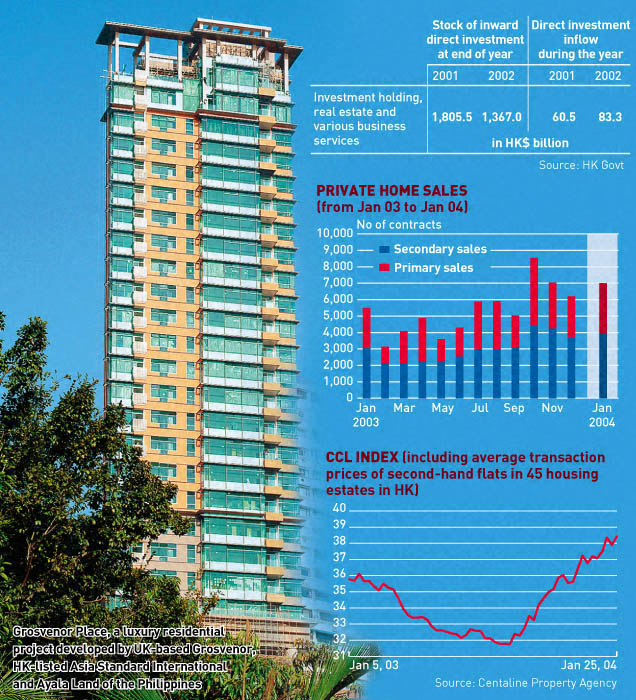

British developer Grosvenor said it planned to

develop luxury projects in Hong Kong in anticipation of the sector's rosy

outlook.

Grosvenor made its investment debut in Hong Kong

with the acquisition of a 15 per cent stake in local medium-sized developer

Asia Standard International for less than $400 million.

It later teamed up with Asia Standard

International and Ayala Land of the Philippines to build the 21-unit luxury

housing block Grosvenor Place in Repulse Bay, which soon will go on sale.

|