|

Temasek,

GIC dominate world's largest SWF deals

The

S'pore units invest a combined US$9.1b, 47% more than a year ago

Temasek Holdings and the Government of

Singapore Investment Corp (GIC) have been involved in five of the 10 biggest

deals involving sovereign wealth funds on record, according to the latest

estimates by Thomson Reuters.

Singapore's two state-owned funds have

poured billions into US and European banks since last year. The sheer size

of their recent investments has surpassed many of the biggest purchases made

by sovereign wealth funds in the past.

GIC's injection of 11 billion Swiss

francs (S$14.24 billion) into Switzerland's biggest bank, UBS, last December

is the single largest investment by a sovereign fund on record, according to

data compiled by Thomson Reuters.

GIC was also part of the consortium led

by Spain's Ferrovial Group that bought UK-listed BAA, the world's biggest

airport operator, for £10.3 billion (S$26.7 billion) in May 2006. That

deal, which also included Canadian pension fund Caisse, still stands as the

largest investment involving sovereign funds on record.

So far this year, both GIC and Temasek

have made a combined US$9.1 billion worth of investments, more than a third

of all deals involving sovereign funds worldwide and a 47 per cent increase

from a year earlier, according to Thomson Reuters estimates.

The bulk of these investments were in the

US, the largest of which was GIC's US$6.88 billion investment in banking

giant Citigroup in January.

That was the single biggest investment by

any sovereign fund this year and the fourth largest on record.

GIC was also one of four investors in the

fifth-largest sovereign fund deal on record - a £2.5 billion takeover of

Associated British Ports, the UK's largest port operator, in March 2006.

GIC invests Singapore's foreign reserves

including pension savings, estimated at over US$300 billion, while Temasek

manages a separate S$185 billion investment portfolio.

Temasek's US$4.4 billion investment in US

investment bank Merrill Lynch last December is the 10th largest sovereign

fund deal on record. In January, two other sovereign funds, the Korea

Investment Corp and the Kuwait Investment Authority, each poured another

US$2 billion into Merrill.

Separately, Temasek invested £975

million in UK banking group Barclays in July last year. It is now likely to

raise its stake in Merrill to as much as 14 per cent from about 9 per cent,

after US regulators gave their approval this week (Aug 26).

Together, GIC and Temasek accounted for

10 of the 22 major deals involving sovereign funds this year, until Aug 28.

Investments by sovereign funds worldwide

rose 65 per cent to US$25.5 billion, from US$15.4 billion for the same

period last year, according to Thomson Reuters. -

2008 September 4 BUSINESS

TIMES

Temasek

warns of lean years as returns dwindle

(SINGAPORE) Temasek

Holdings has warned of a growing danger that global economic growth could

stall as the fallout from the credit crisis spreads around the world, with

possible stagflation posing a severe risk for years to come.

Temasek's own vast

portfolio of investments was buffeted by the turmoil that swept financial

markets since the start of the crisis last year.

By market value, the

total return to Temasek's sole shareholder - the Finance Ministry - for the

year to end-March fell to just 7 per cent, from 27 per cent a year earlier.

Economic profit or

wealth added - which Temasek uses internally to gauge its returns above a

risk-adjusted benchmark - was a negative $6.3 billion, the first time in

five years it fell below the cost-of-capital hurdle. A year earlier, wealth

added was $23.4 billion.

By one measure, the

market risk of Temasek's portfolio rose 67 per cent over the year to

end-March, reflecting the 'severe stress' in global financial markets,

according to its latest annual report.

Group net profit for

Temasek for the year to end-March doubled to a record $18.24 billion from a

year earlier, boosted by strong operating performance at its portfolio

companies and divestment gains from its asset sales.

Under standard

accounting rules, the consolidated net profit includes Temasek's share of

profits from companies in which it has a stake of 20 per cent or more, but

does not directly reflect its share of the profits or losses of firms in

which Temasek has a stake below 20 per cent. Profits from Singapore's DBS

Group, of which Temasek owns 28 per cent, would be included, while profits

from the UK's Standard Chartered Bank, in which Temasek has a 19 per cent

stake, would not.

'The credit crisis

is not over - we expect to see further contagion in the real economy in the

US, Europe and also Asia over the next 24 months,' said Temasek chairman S

Dhanabalan in the 2008 Temasek Review published yesterday.

The fallout from the

credit crisis 'will continue to dampen the global economy' for the next two

years, he added.

The 7 per cent

one-year return to the government - which includes dividends paid by Temasek

to the government net of new capital injections - is the lowest since

Temasek started publishing its annual report in 2004, when the return was 46

per cent.

Temasek's portfolio

performance over longer periods, however, remains strong, with compounded

annual returns of 23 per cent over five years, 9 per cent over 10 years, and

18 per cent since Temasek's inception in 1974.

But Mr Dhanabalan

was cautious on the outlook. 'We are concerned with the emerging risks of

stagflation. This presents huge socio-political as well as economic risks in

the next three to five years,' he said.

Bold policies by

regulators in the US had averted a major systemic failure, but 'the risks of

stagflation have become more apparent with the twin bogeys of high oil and

food prices', he added.

Still, 'there may be

opportunities as imbalances are corrected', although such opportunities may

be limited if stagflation - a period of stagnant economic growth coupled

with high inflation - does set in, he added.

During the year to

end-March, Temasek sold $17 billion worth of assets, including some $12

billion in Asia, 'as we anticipated a massive structural adjustment', said

Mr Dhanabalan.

In April last year,

Temasek also received an injection of new capital from the government, which

boosted its portfolio value by $10 billion, net of dividends paid to the

government. An undisclosed dividend amount is set yearly by the Temasek

board, said Michael Dee, Temasek senior managing director, international, at

a media briefing yesterday. Mr Dee, a former investment banker, recently

joined Temasek from Morgan Stanley. - 2008

August 27 BUSINESS

TIMES

Temasek stable hit by plunging markets

Half its investments in listed companies yield negative FY2008 returns

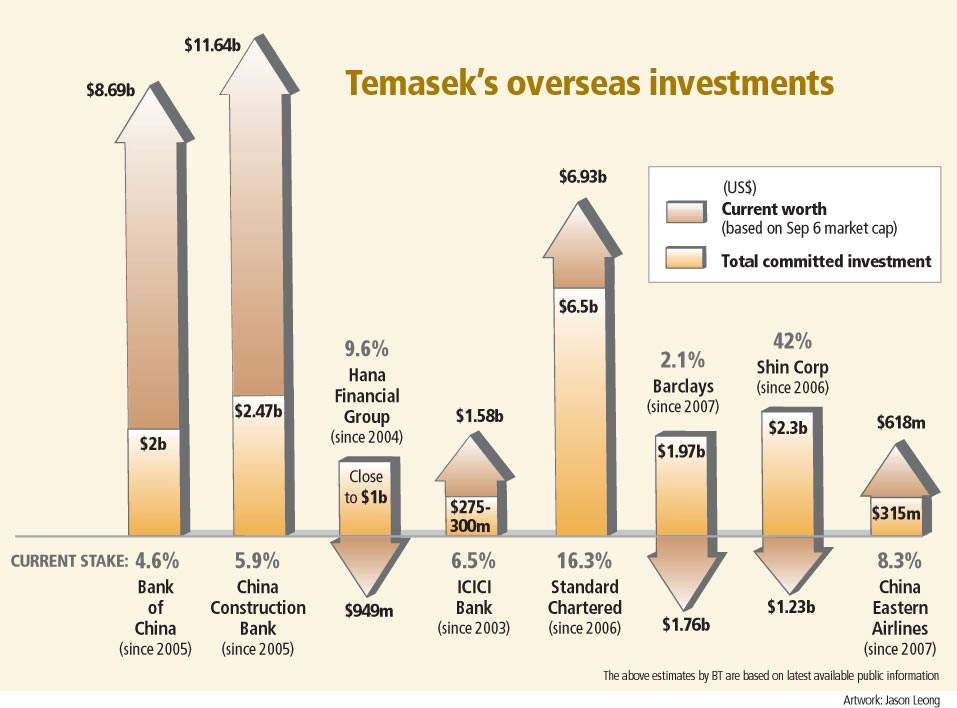

Many of Temasek's investments were poor

performers last year, giving negative returns, in line with plummeting

stockmarkets.

As measured by total shareholder return (TSR),

12 or half of its 24 investments in listed companies reported negative TSR

on a one-year basis.

Not surprisingly, six of the 12 with

negative one-year TSR were financial institutions, including homegrown DBS

Group Holdings which posted a negative TSR of 12.4 per cent.

Temasek's investments in financial

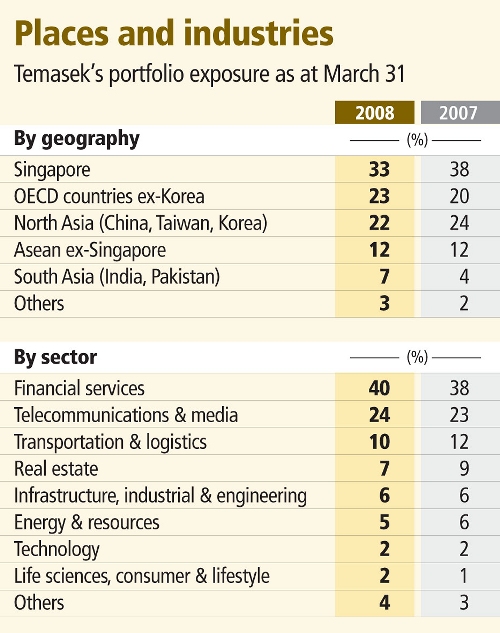

services make up 40 per cent of its total $185 billion portfolio.

Three of the 12 - Barclays plc, Merrill

Lynch and Chartered Semiconductor Manufacturing - had negative TSR on a

three-year basis. According to Bloomberg, Merrill shares have dropped 24 per

cent from the time of Temasek's original investment in December 2007 to

March 31, 2008.

At end-March, Barclays shares had

declined 38 per cent since Temasek and China Development Bank announced

plans to invest in the UK bank on July 23, 2007.

Temasek's investments in eight unlisted

companies fared much better with only one, MediaCorp, posting a negative TSR

of 5.1 per cent.

Temasek's TSR contracted to 7 per cent by

market value, including dividends for the year ended March 31, 2008, from 27

per cent a year ago.

But it wasn't just the banks which

performed poorly.

Non-financials Singapore Airlines,

CapitaLand, Sembcorp Industries, Chartered, STATS ChipPac and Fraser and

Neave also posted negative TSRs.

Other banks which reported negative TSR

included China's third largest bank, Bank of China; South Korea's Hana

Financial Group; and India's ICICI Bank.

Those in positive TSR territory were

Temasek's investments in China Construction Bank, Pakistan's NIB Bank,

Standard Chartered plc and the two Indonesian banks, Bank Danamon and Bank

Internasional Indonesia (BII).

NIB Bank, in which Temasek owns 63 per

cent, delivered the second-highest one-year TSR of 132.7 per cent. Temasek

bought into NIB in May last year. The Pakistani bank in 2007 posted a loss

of 204 million rupees (S$3.8 million).

BII, which Temasek had tried to sell to

Maybank but only to see the deal stall, posted the highest one-year TSR of

146.8 per cent.

Another sterling performer was Singapore

Telecommunications, Temasek's biggest investment with a 55 per cent stake.

SingTel, also Singapore's largest stock by market capitalisation, posted a

one-year TSR of 26 per cent.

Although SingTel's stock price has fallen

this month since it reported a 5.3 per cent drop in first-quarter profit for

the three months ended June 30, to a two-year low of $878 million, it is

still outperforming the market. Year-to-date, SingTel has fallen 13.25 per

cent, compared to the Straits Times Index's 21.9 per cent drop.

- 2008 August 27 BUSINESS

TIMES

Bet on Asia stays, but Temasek sheds

some assets

Temasek Holdings' focus on Asia has

reaped substantial rewards so far, even as it poured billions of dollars

into US and UK banks over the past year.

Investments made since 2002, when Temasek

reshaped its portfolio to boost its exposure to emerging Asia, earned an

annualised return of 32 per cent over the six years to end-March - double

the 16 per cent returns on the rest of its portfolio, said Michael Dee,

Temasek senior managing director, international, at a media briefing

yesterday.

Investments made since March 2002 now

make up 41 per cent of Temasek's $185 billion portfolio, he added.

Over the year to end-March, Temasek

invested just under $17 billion in Asia and another $15 billion outside the

region.

But it also divested more Asian assets

than non- Asian assets during the year - $12 billion compared with $5

billion.

Within Asia, Temasek trimmed its

portfolio exposure to North Asia to 22 per cent from 24 per cent, selling

its stake in China Cosco Holdings. Temasek also pared its stakes in other

major Chinese firms such as China Construction Bank and Bank of China.

But Temasek also boosted its exposure to

South Asia, buying a stake of 4.99 per cent in Indian mobile operator Bharti

Airtel for an estimated US$2 billion last year.

And in March this year, it sold Singapore

power generating company Tuas Power for $4.2 billion. That prompted a fall

in Temasek's portfolio's exposure to Singapore to 33 per cent as at

end-March, from 38 per cent a year earlier.

The large divestments in Asia meant that

for the first time, Temasek's net investments outside Asia exceeded net

investments in Asia, with 68 per cent or $10 billion outside Asia and the

remaining 32 per cent or $5 billion in Asia.

Its major forays outside Asia included a

US$4.9 billion investment into Merrill Lynch in the US and √ā¬£pounds;975

million (S$2.6 billion) in Barclays in the UK, both last year. It also

raised its stake in UK-based Standard Chartered Bank to 19 per cent from 13

per cent.

This contrasts starkly with the previous

five years, during which Temasek's total net investment outside Asia was

just $1 billion, while net investment in Asia was $26 billion.

But Temasek chairman S Dhanabalan said in

the 2008 Temasek Review published yesterday that the firm continues to like

Asia, even as it adds to its investments elsewhere.

'We will continue to broadly focus on

Asia with its long-term trend of growth and development in the next decade

or two.'

Temasek is also looking to increase its

exposure further afield, including new markets such as Russia and Latin

America, said Mr Dhanabalan. 'We are setting up offices in Mexico and Brazil

to deepen and broaden our exposure to Latin America.'

The firm has boosted its staff strength

to 350 over the past year, from 250 previously, and set up a new

international division that will oversee all of Temasek's overseas offices,

said Mr Dee. 'We're expanding our global footprint.'

Its recent investments in US and UK banks

were 'primarily because we saw value', said Manish Kejriwal, Temasek senior

managing director of investment, international and India.

Asked if Temasek was concerned over the

recent declines in the share prices of banks it had stakes in, Lao Tzu Ming,

managing director of risk management, said: 'Unlike short-term traders such

as hedge funds, we are not highly geared - therefore we can ride through the

storms.'

The portfolio remains well-diversified,

said Temasek. Its single largest investment accounts for less than 19 per

cent of its overall portfolio, down from 26 per cent five years earlier.

- 2008 August 27 BUSINESS

TIMES

|