|

ARDMORE

It's not uncommon in Asia for entire blocs of

condominiums to be purchased and demolished for new luxury housing,

especially in the Singapore's most prime Freehold tenured plots.

Ardmore is experiencing a resurgence because of the Orchard

Turn effect.

Ardmore site up for en bloc sale at $471m

Asking price works out to record $1,500 psf per plot

ratio

2006: Anderson 18,

a prime freehold residential site in the Ardmore area,

is up for collective sale to the tune of $470.8 million - or a staggering

$1,500 per square foot per plot ratio (psf ppr).

|

| Anderson 18:

If the asking price is met, the sale could be the largest en bloc

offering in Singapore, both in absolute dollar value terms and in

the price paid per square foot per plot ratio |

If the asking price is met, the sale

could well shape up to be the largest en bloc offering in Singapore, both in

terms of absolute dollar value as well as in the price paid psf ppr, said

Knight Frank, the property consultancy brokering the sale.

The price includes an estimated

development charge (DC) of $43.9 million.

The 10,400 square metre site has a plot

ratio of 2.8 and a maximum building height of 36 storeys. Any successful

developer would be able to build about 149 units with an average size of

2,000 sq ft each, said Knight Frank.

'The recent improvement in take-up rate

for high-end condominium developments on the back of the economic recovery

should increase the site's attractiveness to developers,' said Knight Frank.

'In pricing the apartments, the developer will take the cue from the sale of

similar developments such St Regis, The Tate Residences and Ardmore II.'

Based on this, the owners are asking for

$426.9 million, excluding the DC.

Right now, Anderson 18 is a tower block

of 71 residential apartments.

Owners stand to walk away with between

$5.9 million and $6.1 million a unit, which translates to an en bloc premium

of about 70 per cent.

The tender will close at 3pm on Jan 25.

- by Uma Shankari SINGAPORE

BUSINESS TIMES December 16, 2007

More than 50% of Ardmore II units sold

Wheelock Properties, which

conducted a soft launch of its latest luxury condominium, Ardmore II, on

Tuesday, said yesterday that more than half of the units were snapped up on

the very first day.

|

| Ardmore II offers four-bedroom

luxury apartments at prices between $4.2 million and close to $5.5

million. At a standard 2,023 sq ft a unit, the average price of the

units works out to $2,300 per square foot. |

About 52 per cent of the 118 units at

Ardmore II, located in the prime Ardmore Park area, were sold, said the

company.

Ardmore II offers four-bedroom luxury

apartments at prices between $4.2 million and close to $5.5 million. At a

standard 2,023 square feet a unit, the average price of the units works out

to $2,300 psf.

Even before the soft launch, interest in

the development was high, said Tan Bee Kim, general manager for marketing at

Wheelock Properties. Tuesday's launch was via appointment only, and all

appointment slots were fully booked. Wheelock offered five appointments for

each half hour period.

Ms Tan said the project saw especially

strong interest from buyers of Wheelock's previous developments such as The

Cosmopolitan and Grange Residences. 'We are delighted and encouraged that

our development has attracted such enthusiastic response and definitive

endorsement from our past purchasers,' she said.

'For the soft launch, we are giving a

discount of about 10 per cent, but depending on the response, we will review

the pricing.'

For Ardmore II, most of the buyers (80

per cent) were locals, said Wheelock.

Ms Tan said Wheelock's past projects

usually had a good mix of Singaporean and foreign buyers. For The

Cosmopolitan, Singaporeans account for about half of purchases; for Grange

Residences, locals make up 60 per cent of buyers.

Designed by Architects 61, Ardmore

II's two 36-storey towers sit on 90,000 sq ft of land across from the

Shangri-La Hotel. The development is targeted for completion at end-2009.

- by Kalpana Rashiwala SINGAPORE

BUSINESS TIMES Sept 28, 2006

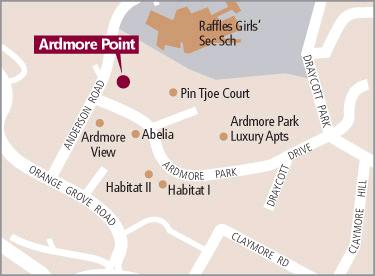

Wing Tai closes in on Ardmore Point

Wing Tai Holdings is said to be close to

buying the freehold Ardmore Point in prime Ardmore Park for around $200

million.

|

| Buying spree: Last October,

Wing Tai clinched Belle Vue in Oxley Walk (next) for $227.3 million

and it may soon pay around $200 million for Ardmore Point (above) |

This works out to a unit land price of

about $1,358 per sq ft of potential gross floor area, including an estimated

development charge (DC) of $31 million.

The unit land price matches the record

set last month for Pin Tjoe Court next door, which was awarded to Pontiac

Land Group for $201 million.

CB Richard Ellis brokered the collective

sale of Pin Tjoe Court and is doing the same at Ardmore Point, which is

being sold through a private treaty.

The tender for Ardmore Point closed on

Aug 8 but there was no sale because potential bidders were said to be

waiting for the outcome of the tender for Pin Tjoe Court site, which closed

on Sept 20.

The thinking was that potential bidders

may have been keen on buying both sites with a view to amalgamating them for

a more substantial condominium project.

But the whopping $1,358 psf per plot

ratio (psf ppr) fetched for Pin Tjoe Court last month caught most market

watchers by surprise, as it was 10.6 per cent higher than the previous

benchmark of $1,228 psf ppr set for Habitat One across the road in July.

Wing Tai can redevelop the 60,533 sq ft

Ardmore Point site into a new condominium with about 95 units averaging

1,800 sq ft. The breakeven cost could be around $1,800 psf or more, analysts

say.

Both Ardmore Point and Pin Tjoe Court are

zoned for residential use with a 2.8 plot ratio - the ratio of potential

gross floor area to land area - and a 36-storey height limit.

The existing 20-storey Ardmore Point has

47 units, according to an earlier report.

Wing Tai recently posted its best

financial results since 1997, achieving a net profit of $128 million for the

year ended June 30, 2006 - up from $24.4 million the year before.

The property group has been buying

prime freehold housing sites through collective sales to

restock its landbank and ride on the luxury

residential boom.

In May this year it snapped up Newton

Meadows through a collective sale for $73 million, or $666 psf per plot

ratio including DC. And in October last year it clinched Belle Vue in Oxley

Walk for $227.3 million or $666 psf ppr. Wing Tai also bought Phoenix

Mansion in Cairnhill Road for $57.9 million or $716 psf ppr in July last

year. - SINGAPORE

BUSINESS TIMES October 11, 2006

A new benchmark could be set if the $220m asking price for the prime

location is met - Ardmore Point - sold to Wing Tai - article above

A new benchmark could be set for the price of freehold

residential land if owners of Ardmore Point are successful in the collective

sale of their homes in the prime Ardmore Park location.

They are asking for $220 million, which translates to a unit land price

of $1,432 psf of potential gross floor area, including an estimated $22.7

million development charge (DC).

Market watchers suggest the actual reserve price set by the owners could

be 5 to 10 per cent lower, at $1,289 to $1,360 psf per plot ratio including

DC.

But even at these levels, if they are achieved, Ardmore Point will still

topple the current record of $1,218 psf ppr set by Eng Lok Mansion in March

this year.

'We're confident that with competition from bidders, we'll be able to

exceed Ardmore Point's reserve price,' says CB Richard Ellis executive

director Jeremy Lake, whose firm is marketing the collective sale. Based on

the asking price of $1,432 psf ppr, the breakeven cost for a new condo

project on the Ardmore Point site could work out to around $1,950 psf. Using

the likely reserve price, the breakeven would be a lower $1,830 psf. That

still leaves a profit margin for its developer going by current pricing

expectations for coming launches in the area.

Across the road, Wheelock Properties (Singapore) will launch in October

its 118-unit condo, Ardmore II, on the amalgamated Ardmore View and Habitat

II site at an average $2,250 psf, Wheelock CEO David Lawrence told BT

yesterday.

The development will comprise of two 36-storey towers and all 118 units

in the project will be four-bedroom apartments of 2,050 sq ft each.

Ardmore Point has a freehold land area of 60,533 sq ft and market

watchers say that whoever bags it is also likely to be eyeing the next door

Pin Tjoe Court, which is expected to be put up for tender soon.

The two sites will have a combined land area of over 120,000 sq ft -

enough to accommodate a new condo with about 165 units averaging 2,000 sq

ft. Both sites are zoned for residential use with a 2.8 plot ratio (ratio of

potential maximum gross floor area to land area) and a maximum height of 36

storeys.

Ardmore Point's tender closes on August 8.

The existing 20-storey Ardmore Point has 47 units.

Based on the $220 million asking price, owners stand to receive sums

ranging from $2.3 million to $7.9 million per unit.

These are about 120 per cent more than what the units would fetch if sold

individually. - by Kalpana Rashiwala SINGAPORE

BUSINESS TIMES July 5, 2006

|

ESSENTIALS |

ARDMORE PARK |

| Street

Address:

|

9

Ardmore Park

|

| District:

|

10

|

| Tenure: |

Freehold |

| Built: |

2001 |

| Total: |

330

units

|

| Facilities:

|

Swimming Pool

Tennis Court

Wading Pool

Barbeque Area

Gymnasium

Fitness Track

Clubhouse

Playground

Putting green

|

| Unit Size: |

4 bedrooms: |

268 sq m |

|

Penthouse: |

812 sq m |

|