|

112 Robinson (formerly known as HB

Robinson) sold

$168m sale price works out to $1,822 per square foot

| 112

Robinson Road, Singapore |

| TRANSACTION

HISTORY |

|

| Asset

Type: |

Office |

| Location: |

112 Robinson Road, Singapore

in CBD |

| Size: |

A 14-storey office tower

with retail outlets on the 1st floor. |

| Net Lettable: |

92,205 s.f. |

| Year of

Completion: |

Constructed in the 80's, a

major renovation program was undertaken in 2004. |

|

| Date |

Purchaser |

Sale

Price |

PSF |

Yield |

| 2010 Dec |

Grace Global |

$168

million |

$1,820 |

3% |

| 2007 |

Credit Suisse Fund |

$119 million |

$1,290 |

|

| 2006 June |

CLSA

Fudo |

$ 80

million |

$ 869 |

7% |

Grace

Global, the Singapore outfit of a low-key Indonesian family, is

buying the property for long term investment. The building's

existing gross floor area of about 115,000 sq ft reflects a plot

ratio (ratio of maximum gross floor area to land area) of nearly

11.8, which exceeds the 11.2 assigned for the 9,780 sq ft site

under Master Plan 2008.

112

Robinson Road is said to be about 90 per cent let. Tenants include

Saxon Financials and India's Jet Airways. The net yield on Grace

Global's purchase price is said to be just over 3 per cent. The

EOI for the office block, which has only five car park lots, is

said to have been hotly contested. '

Grace

Global is familiar with Singapore's CBD office market, being the

owner of 137 Market Street which it bought a few years ago. That

building is being refur`bished and upon completion around the

middle of this year will have total NLA of about 43,000 sq ft.

|

Meanwhile, an expression of interest for Finexis Building at 108

Robinson Road (formerly known as GMG Building) closed on Dec 16

attracting a handful of offers. Owner Robinson Land's asking price is

said to be about $110 million or about $2,042 psf on its strata area of

53,873 sq ft.

Robinson Land - whose shareholders include the Buxani Group of

Singapore - clinched the 12-storey freehold office block in 2006 for $48

million and is said to have refurbished it for about $10 million.

Due diligence is said to be in progress for the Singapore

Technologies Building in the Tanjong Pagar area. The pricing is said to

be close to the seller's asking price of about $1,500 psf or about $148

million.

CBRE figures show that nearly $9 billion of office investment sales

were done last year. BT Weekend reported that NTUC Income is nearing a

deal to buy a 49 per cent stake in 16 Collyer Quay in a deal that values

the office tower at about $2,365 psf on NLA or $661 million.

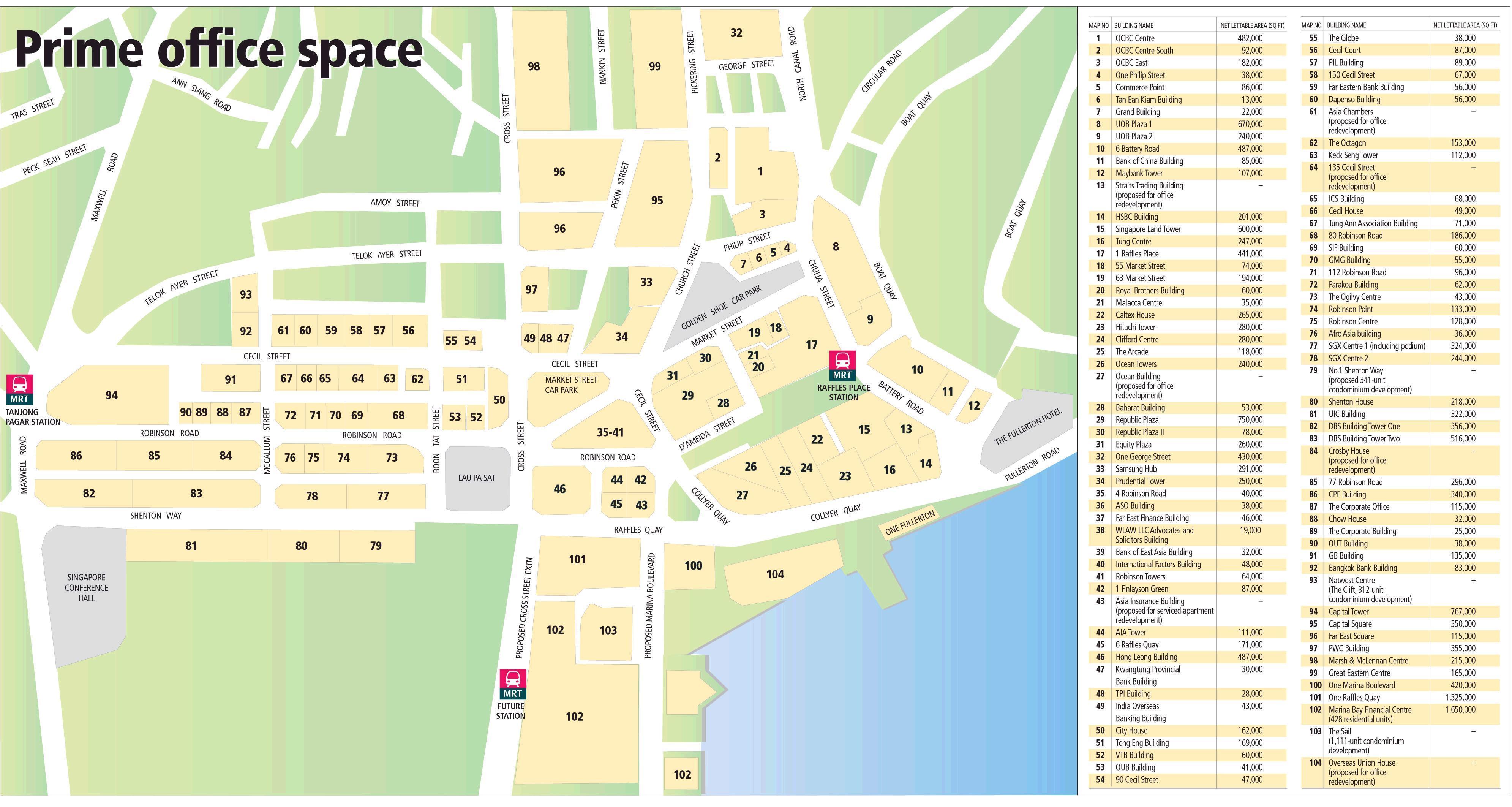

Capital

Square, a Grade A office development at Church Street, is

expected to be put up for sale soon. The vendor, German insurer Ergo, is

said to be eyeing $2,700-2,800 psf on NLA, or crossing the $1 billion

mark. -- 2011 BUSINESS

TIMES

CDL sells The Corporporate

Office for $215 m

Price around $1,956 psf

of net lettable area; buyer led by Oxley Holding

City Developments Ltd (CDL) is said to be

selling a 21-storey freehold office block at the corner of Robinson Road and

McCallum Street for $215 million.

The buyer of The Corporate Office is understood to be a consortium led by

Oxley Holdings group. The price works out to $1,956 per square foot based on

the building's net lettable area of 109,920 sq ft.

The Corporate Office, which is about 25 years old, has 112 carpark lots,

something of a rarity in office towers in that part of the CBD. About 15 per

cent of the building's net lettable area is currently vacant and the lease

for a further 7-8 per cent of space is said to expire early next year. But

that's not necessarily a bad thing for the buyers.

Sources suggest that Oxley - which is headed by Ching Chiat Kwong - is

looking to move its headquarters into The Corporate Office. The group

currently operates out of Singapore Land Tower in Raffles Place and is said

to be gunning for an initial public offer by year end. Oxley has been in the

news lately for developing projects with shoebox apartments, including Suites@Guillemard

and VivaVista in Pasir Panjang.

On the group's purchase of The Corporate Office along Robinson Road,

market watchers suggest that in the medium term, Oxley and its partners may

consider redeveloping the property, which has a land area of 16,032 sq ft,

into a residential project with commercial use on the first storey or into a

commercial-residential development. Under Master Plan 2008, the site is zoned

for commercial use with an 11.2+ plot ratio (ratio of maximum potential gross

floor area to land area). The site can be developed up to 35 storeys high.

The Corporate Office's existing gross floor area is said to reflect a plot

ratio of about 9.27, which points to some unutilised plot ratio.

DTZ is thought to have brokered the sale of The Corporate Office through a

private treaty deal. The property consultancy also brokered the sale of Chow

House next door a couple of months ago for $101 million to a group led by

WyWy Group' founder, YY Wong.

The price for Chow House, a six-storey freehold office block which has

redevelopment potential, is said to work out to about $1,300 per square foot

per plot ratio assuming it is redeveloped into apartments. The site has a

land area of 9,084 sq ft and is zoned for commercial use with an 11.2+ plot

ratio under Master Plan 2008. However, outline planning permission has been

granted to redevelop the Chow House site into residential use with commercial

use on the first storey.

Chow House sits between The Corporate Office and another CDL-owned

property - The Corporate Building.

The property giant's sale of The Corporate Office is its latest divestment

of non-core assets. In recent years, CDL has also sold North Bridge

Commercial Complex (near Bugis Junction), The Office Chamber along Jalan

Besar, Chinatown Point mall, and Commerce Point near Raffles Place MRT

Station. - 2010

October 1

BUSINESS TIMES

Chevron House sold for $547m

Goldman

funds take big loss, sell property to Deka

Chevron House at Raffles Place has been sold for $547 million to a fund managed by

Deka Immobilien of Germany, taking the total value of Singapore office

investment sales deals so far this year to nearly $3 billion.

|

| Changing

hands: The latest transaction price works out to $2,083 psf of net lettable area |

The price for Chevron House works out to

around $2,083 per square foot based on the building's existing net lettable

area (NLA) of 262,650 sq ft, BT understands.

Chevron House, which was formerly known as

Caltex House, is a 33-storey building on a site with a remaining lease of

about 78 years.

The property is being sold by Goldman

Sachs funds, which are walking away with a loss, having paid $730 million or

about $2,780 psf for the property in 2007. That acquisition was funded mostly

by a consortium of lenders headed by Standard Chartered. The latest

transaction is slated for completion by late October, ahead of the expiry of

the financing facility, sources say.

Chevron House is the second Singapore

office property to be sold by Goldman Sachs funds lately following last

month's $870.5 million divestment of DBS Towers One and Two along Shenton Way

to Overseas Union Enterprise. Goldman reaped a profit from that transaction;

it paid $690 million for the office blocks in 2005.

The US bank's funds also bought Hitachi

Tower, behind Chevron House, in early 2008 for $811 million or about $2,900

psf of NLA. The 999-year leasehold office tower, fronting Collyer Quay, is

expected to be put up for sale within the next few months given that the

financing facility on the asset - also extended by a Stanchart-led consortium

- is said to end early next year.

The Singapore office market has seen a steady rental recovery after the

slump in the wake of the global financial crash.

'The fundamentals are attractive. Investors have realised this over the

past three months and investor appetite has increased significantly. Parties

looking to invest include Reits, other property funds and private investors.

Appetites range from $100 million to $500 million-plus,' said a market

watcher.

Deka, which is buying Chevron House, is a unit of DekaBank in Germany. The

deal marks Deka's first major property acquisition in Singapore and is said

to be at close to 4 per cent net yield. Chevron House is currently 98 per

cent let. Major tenants include Chevron and Visa.

The property comprises a four-storey retail podium, 29-storey office tower

and three basement levels. B1 has shops linked directly to the Raffles Place

MRT Station, while B2 and B3 contain 96 carpark lots.

It is thought that the property was marketed through an expression of

interest exercise which closed in the third week of August.

BT understands the exercise was well received and that about six parties

were then shortlisted for due diligence and further negotiations, culminating

in the sale to the Deka-managed fund.

- 2010 September 25 BUSINESS

TIMES

PRESS CLIPPINGS

Chevron House could be the next big office

deal on the cards, say market watchers. This follows the sale of about

$1.9 billion worth of office blocks so far this year. Chevron House was

bought by Goldman Sachs funds in late 2007 for $730 million or about

$2,780 per sq ft of net lettable area and the purchase was mostly funded

by a consortium of lenders led by Standard Chartered. That financing

facility is understood to be expiring in October and the bankers and

Goldman Sachs are said to be weighing their options.

|

CHEVRON

HOUSE

Bought by Goldman Sachs

funds in 2007 for $730m or about $2,780 per sqft of net lettable

area |

BT understands that potential buyers

have been knocking on the doors of Goldman Sachs and the lenders and that

property agents could soon be appointed to conduct a sale process such as

a tender or expression of interest. 'The way I look at it, Goldman could

have about three options - seek refinancing, bring in a joint venture

partner or sell the asset completely,' suggests an industry observer.

Analysts say that the consortium of

banks could have loaned the Goldman funds about 65 per cent of the 2007

purchase price, which would work out to about $1,800 psf of net lettable

area. The loan-to-value covenant on the financing facility would have been

breached sometime ago following the steep slide in office capital values

last year. Interest coverage ratio for Chevron House would also have

fallen on lease renewals in the building; average Grade A office rents in

Singapore today are about $9 psf a month, or 40 per cent lower than the

$15 psf three years ago.

Analysts polled by BT estimate the

property could fetch anything from about $1,900 psf to $2,200 psf (or

about $500 million to $577 million). The most recent benchmark would be

the $2,125 psf that Ho Bee achieved when it sold four office floors at

Samsung Hub at Church Street. While Samsung Hub is a much newer asset and

stands on a site with superior leasehold tenure (999 years) than Chevron

House (which is on a site with 78 years' remaining lease), the latter

boasts a more choice location next to Raffles Place MRT Station.

Goldman Sachs funds also bought Hitachi

Tower, behind Chevron House, in early 2008 for $811 million or about

$2,900 psf of NLA. Stanchart also heads the consortium of lenders for that

purchase; the financing facility is said to end early next year. So a sale

of Hitachi Tower could also be on the cards a little later down the road.

Hitachi Tower would be worth more than

Chevron House, say analysts, citing its superior land tenure (999 years)

and facing (along Collyer Quay). However, one drawback about the asset is

the impending departure of American Express - which is said to occupy

about 70,000 sq ft - to Marina Bay Financial Centre Tower 2.

Last week, Goldman Sachs funds sold DBS

Towers One and Two along Shenton Way for $870.5 million or around $970 psf

of NLA, marking the biggest commercial property deal in Singapore since

mid-2008. Goldman Sachs reaped a profit from that deal, having paid $690

million for the property in 2005.

Some of the blocks sold this year were

'pure office' deals, that is the buyers bought the assets on their

existing office use - such as 1 Finlayson Green and Robinson Point - while

others such as Chow House and StarHub Centre were probably acquired for

their potential for redevelopment into other uses.

Interest from both local and foreign

investors in the Singapore office market has been warming on the back of

recovering office rentals and the easier climate for fund-raising.

- 2010 August

21 BUSINESS

TIMES

Marina House Sold

The $148 million purchase price reflects

about $1,130 per square foot based on the building's existing net lettable

area of about 130,000 sq ft. The building has a few tenants (the most

prominent being Indian Airlines) but is substantially vacant - probably a

deliberate strategy on the part of Hong Leong Group as it weighed various

options, including the possibility of redeveloping the site into

residential use.

- 2010 March

26

STRAITS TIMES

1 Finlayson Green Sold

Headline price is said to be $145 million ($1,630 per sq ft)

The office block that is 1 Finlayson

Green has been sold, BT understands.

The price is said to be about $145

million, or 37 per cent below the $230.88 million the seller had paid for

the property in June 2007.

A unit of UK-based property fund group

Develica is believed to have signed an agreement recently to sell the

19-storey freehold office tower to a foreign-domiciled fund initiated by

low-profile Indonesian investor Norman Winata.

BT understands the sale is being

effected through a sale of shares in the company that owns the asset.

Develica is understood to have borrowed

from National Australia Bank, Hypo Real Estate and Citibank. Market

watchers say the three banks would have consented for the sale to take

place.

1 Finlayson's current net lettable area

(NLA) is said to be about 89,000 square feet. Based on this, the latest

transacted price of $145 million reflects about $1,630 per square foot.

A market watcher described the pricing

as 'about right'. In January, CapitaCommercial Trust sold Robinson Point -

a freehold, 21-storey office building - for $203.3 million or $1,527 psf,

based on its NLA of 133,139 sq ft. 1 Finalyson Green's location is

considered to be superior, being closer to Raffles Place MRT Station.

For 1 Finlayson Green, some market

watchers suggest that there could be some other fees or costs associated

with the transaction which could take its net acquisition price above the

$145 million headline price paid by the buyer.

When Develica bought the property over

two years ago from Singapore's Hong Leong Group, its NLA was reported to

be about 86,500 psf. Develica was later reported to have refurbished the

building for $2 million and increased net lettable area by 7 per cent by

leasing to one tenant per floor. That would have boosted the property's

NLA to about 92,500 sq ft. However, industry observers have been citing

the building's NLA at between 88,200 and 89,000 sq ft recently.

1 Finlayson Green received its

Temporary Occupation Permit in 1994

'However, this is a relatively small asset in the group's office

portfolio and establishing a record price for 1 Finlayson Green would help

to raise the valuations on the rest of its office buildings. So this will

still benefit the group if it decides to go ahead with an office Reit,' as

a seasoned observer put it.

The group's office portfolio in Singapore includes Republic Plaza, City

House, Hong Leong Building, 80 Robinson Road, The Corporate Office,

Commerce Point, and Fuji Xerox Towers.

The record price of $2,200 psf for office space was set in early 1996

when Straits Steamship Land, now Keppel Land, sold seven floors of what is

now known as Prudential Tower in the China Square area to Prudential

Assurance Company Singapore.

Just last week, BT reported the sale of Parakou Building, a spanking

new freehold office block at the corner of Robinson Road and McCallum

Street, for $2,013 psf of NLA, or $128 million. This is the highest per

square foot price achieved in the current office cycle. The buyer was UK

fund manager New Star and the seller, Parakou Shipping Group of Hong Kong.

1 Finlayson Green received its Temporary Occupation Permit in 1994.

Its NLA is around 76,000 sq ft.

- 2010 March 8 BUSINESS

TIMES

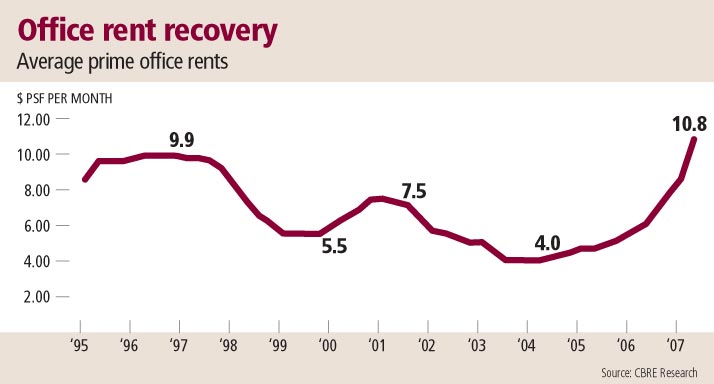

Office rents may end long slide to basement

The Singapore office market has seen its

prospects improve dramatically since a gloomy start this year.

While office rents are still expected to

dip further next year, although at a much slower pace than over the past 15

months, an unexpected flurry of leasing activity recently has led some to

predict a bottoming-out of office rents as early as mid-2010.

'We are currently witnessing a strong

recovery in leasing activity. Some tenants are even starting to look at

expansion,' says CB Richard Ellis executive director (office services) Moray

Armstrong.

Property consultants are predicting a

return to positive office demand to the tune of more than one million sq ft

next year on the back of economic growth. But with over 2.7 million sq ft of

new space slated for completion in 2010, vacancies will continue to rise and

rents dip, albeit at a slower clip than in 2009.

Older buildings suffering a flight of

tenants to new projects still face a challenging year ahead. Still, some

expect the authorities to keep a close watch on the Republic's

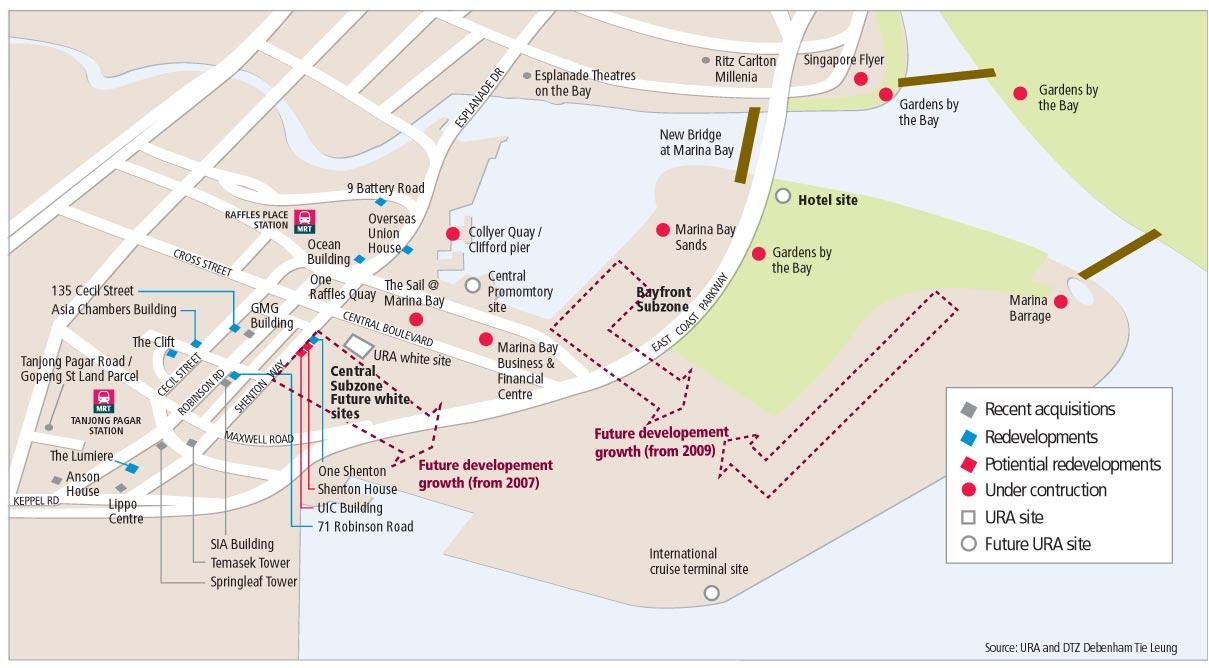

competitiveness in office rents. Mr Armstrong suggests 'it is not

unrealistic to foresee that the government may release a couple of prime

office sites in the Marina Bay area in the second half next year'.

'A lot will hinge on how the office

market performs in the next three months. The government wants to ensure the

supply pipeline is healthy so that businesses feel confident about

Singapore's ability to meet long-term demand for growth from headquarters

and corporates.'

Jones Lang LaSalle's regional director

and head of markets Chris Archibold acknowledges 'some talk in the market

that office supply may become limited in 2013 and 2014 in the CBD Core'.

'The Singapore government is likely to continue monitoring the office market

and inject supply into the market through the reserve list in anticipation

of an upturn to avoid the supply crunch we saw in 2007,' he added.

CBRE data shows gross average monthly

rental value for Grade A office space has slipped 7.95 per cent quarter on

quarter to $8.10 per square foot in Q4 this year. This is the smallest

q-on-q drop since office rents began falling in Q4 last year. The latest Q4

2009 figure reflects declines of 46 per cent for the whole of 2009 and 57

per cent from the peak of $18.80 psf in Q2/Q3 last year. CBRE is projecting

a further contraction of 13.6 per cent next year to reach $7 psf by

end-2010.

Colliers International's average grade A

rental data for various CBD micromarkets show q-on-q dips of 1.9 per cent in

Raffles Place/New Downtown and one per cent in Bugis/ Beach Road in Q4 2009,

with rents unchanged in Shenton Way/Tanjong Pagar, City Hall/Marina Centre

and Orchard Road. For the whole of 2009, the falls ranged from 42 to 53 per

cent, but Colliers predicts rental declines will moderate to 'within 5 per

cent' in the first six months of next year from current levels.

DTZ projects a 15-20 per cent drop in

average monthly rental value for prime office space in Raffles Place next

year, which it says has halved this year to $7.90 psf from $16 psf in Q4

2008.

Mr Armstrong sees rentals stabilising

around mid-2010 particularly for better-quality buildings. DTZ's SE Asia

head of occupational and development markets Angela Tan says rents will

likely bottom in 2011. 'If the economy grows more strongly than expected,

rents could bottom earlier in end-2010.'

The completion of new projects is

creating a two-tier market. Says JLL's Mr Archibold: 'Given the pick-up in

leasing activity, we expect the bottom in rentals for new prime Grade A

office buildings to be as close as H2 2010. However, there's likely to be

longer downward pressure on rentals in existing prime Grade A office

buildings as landlords seek to backfill vacancy caused by tenants relocating

to new developments.'

Mr Archibold points to a 'flight to

quality' by occupiers with leases expiring in older buildings to newer,

higher-quality buildings, riding on lower rents and the larger contiguous

spaces that could enable them to consolidate operations into a single

location.

On a brighter note, CBRE's Mr Armstrong

says he has started seeing some of the resurgence in leasing activity being

driven by expansion and not just replacement needs. This is laying the

foundation for decent positive take-up.

Analysts expect positive demand to

continue this quarter following the modest turnaround in Q3. However, with

some 570,000 sq ft of negative demand in H1 2009, the year will still end in

negative territory. Colliers' executive director (commercial) Calvin Yeo

forecasts positive demand of 1.55 million sq ft in 2010; CBRE predicts

positive take-up of about one million sq ft next year and 2 million sq ft in

2011.

Meanwhile, shadow office space - surplus

stock put up for subletting - has fallen to about 256,000 sq ft from 583,000

sq ft at its peak in June 2009, says Mr Yeo. 'We expect shadow space to

dissipate by H2 2010 as the economy recovers.'

Colliers estimates islandwide office

vacancy rose from 12.2 per cent as at end-Q3 2009 to 12.8 per cent as at

end-2009. On a full-year basis, this is a 4 percentage point rise. Mr Yeo

expects the figure to inch up 1.1 points to 13.9 per cent by end-2010.

- 2009 December 11 BUSINESS TIMES

The vacancy rate in prime Grade A

buildings rose from 1.8% in Q3 2008 to 6.1% in Q2 this year

The office

market here, like many around the world, has seen a fundamental shift in

dynamics over the last nine months, with a marked drop in demand since the

collapse of Lehman Brothers a year ago leading to a drop in rents. While all

markets are cyclical, Singapore's commercial property market has seen rental

fluctuations that are typical of a more volatile market such as Hong Kong.

The reason for this is that many new

developments were cancelled or delayed during the Asian financial crisis/Sars

period in 2002-2004. The typical four-year construction period for a Grade A

office building means that there is a lag in the supply pipeline, which was

adversely affected from 2006-2008.

These were the years which saw a

substantial increase in demand for office space. Much of it came from the

financial services sector, partly as a result of the global growth of this

sector and partly as a result of Singapore's successful repositioning as a

global financial services centre.

Jones Lang LaSalle's research shows that

from the bottoming out of the market in 2004 to the peak in Q3 2008, Grade A

core CBD vacancy shrank from 11.6 per cent to 1.8 per cent and rents surged

by 303 per cent. Post credit crisis, the negative take-up and concerns of

over-supply have led to rents dropping by 48 per cent between Q3 2008 and Q2

2009.

Market sentiment tailed off rapidly

between Q4 2008 and Q1 this year as occupiers began to give up space at the

same time that some of the new developments were completed. The result is

that the vacancy rate in prime Grade A buildings rose from 1.8 per cent in

Q3 2008 to 6.1 per cent in Q2 this year.

A number of occupiers tried to mitigate

part of their outgoings by either subletting or finding replacement tenants

for their space. By June, 'shadow space' - currently leased space that

occupiers are looking to dispose of, including space not available until

2010 - stood at 800,000 sq ft. If shadow space is included, the vacancy

rises by about 30 basis points.

Part of the decline in sentiment has been

caused by concern over future supply. Singapore has a larger than normal

supply pipeline, especially in the core CBD. That said, there is an argument

that in order to attract inward investment, Singapore has to constantly

upgrade its office space offering and the new buildings coming to the market

are, in the main, well specified and offer a significant upgrade to

occupiers.

In the short term, net take-up is

expected to remain low as there has not been any uplift in new office demand

despite a less pessimistic economic outlook. Interestingly, the first two

months of Q3 have seen significantly higher activity in the office market.

There are two main reasons behind this increased activity.

Firstly, activity that is lease expiry

driven. Given that the first wave of the long awaited new supply has now

started to hit the market, there is some vacancy in the market and tenants

now have real options. On the back of this we are seeing a discernible

flight to quality in favour of the new developments ready this year.

The biggest roadblock to relocating today

is a lack of budget for capital expenditure (capex). On the back of this, a

number of active inquiries are focused on fully fitted 'shadow space' that

negates the need for capex spend for fit-out.

Secondly, there are quite a number of

large occupiers (50,000 sq ft plus) in the market who have been sitting on

the sidelines for the last nine months for various reasons. They might not

have been able to accurately predict their future headcount, lacked a capex

budget, or else anticipated a weaker market ahead.

These occupiers are now coming to market

as it has fallen significantly. Also, occupiers of this size would need to

plan a move 12-18 months in advance, and this is close to the completion

periods of new supply.

A significant number of these occupiers,

especially those in the financial services industry, are also looking for

enhanced specifications such as trading floors, enhanced power and

air-conditioning provision and space for their dedicated equipment - back-up

generators and air-conditioning, etc. The ability to supply such needs is

limited and hence the first movers into a building have more chance of

securing the specifications they need.

The increased activity is also being

generated by the desire among some occupiers to secure branding rights

(naming or signage rights) to the building they plan to occupy. The

availability of this in the market is even more limited and hence occupiers

will commit early in order to secure them.

Given the drop in rents and uplift in

market sentiment on the back of both the global stock markets and local

residential market, in the short term we expect to see the office market

continue to be active. However, given the supply scenario, we expect rents

to still face some downward pressure, albeit at a more muted pace, and much

of the activity to be from consolidation or a flight to quality as occupiers

upgrade.

The writer is regional director and

head of markets, Jones Lang LaSalle - published 2009

September 22 BUSINESS

TIMES

Office rents in Singapore fell for the

fourth consecutive quarter in Q3 2009, but the pace of decline has eased on

the back of returning business confidence, said CB Richard Ellis (CBRE).

Data from the firm said that prime office

rents in Singapore averaged $7.50 per square foot (psf) per month in Q3.

This reflected a 12.8 per cent quarter-on-quarter decrease, compared with

the 18.1 per cent decline in Q2 2009 and 18.6 per cent contraction in Q1

2009.

In all, prime rents have fallen 53.4 per

cent in Singapore since their peak in Q3 last year.

As in Singapore, the slower decline in

office rents in Hong Kong is partly attributed to the improving stock

market. - 2009 September

2004 BUSINESS

TIMES

Steepest fall in office occupancy cost

A plunge in Grade A office rents has

raised Singapore's competitive edge somewhat. According to Colliers

International, office occupancy costs here were the fourth-highest among 26

Asia-Pacific cities in Q2 this year - down a notch from a quarter ago.

As rents stay weak while the economy

stabilises, property consultants also expect some companies to take

advantage of the situation to expand.

Colliers noted that monthly gross rents

for Grade A offices in Singapore's central business district (CBD) posted

the sharpest fall in Q2, compared with other major cities in the region.

Rents slid 26.2 per cent quarter-on-quarter, averaging at $6.73 psf per

month in Q2.

As a result, Singapore fell from third to

fourth place in a ranking of office occupancy costs. Tokyo remained the most

expensive place in the Asia-Pacific to rent an office - average Grade A CBD

office rents there were 2.2 times that of Singapore's, up from 1.6 times in

Q1.

Hong Kong also kept its No. 2 spot.

Average Grade A CBD office rents there were 1.4 times that of Singapore's,

growing from 1.2 times in Q1. Ho Chi Minh City rose one notch to replace

Singapore in third place on the list.

Colliers expects office rents in

Singapore to continue falling up till H1 next year, albeit at a slower pace.

This is because demand from most companies is likely to stay subdued, while

supply of shadow space could increase.

This means that Singapore could continue

slipping in the list of the most expensive Asia-Pacific cities to rent an

office, said Colliers research and advisory director Tay Huey Ying.

While most companies may be cautious

about expansion, some may take advantage of lower rents to grow in

anticipation of better times ahead. 'Flight to quality and opportunistic

expansion can be expected to intensify on the back of continued rental

weakness,' Ms Tay said.

Cushman and Wakefield managing director

Donald Han agreed, noting that companies have been more willing to relocate

to larger premises since May or June this year.

'The economy now looks like it's on the

mend' and some companies 'are budgeting for a possible increase in

headcount' by some 10-15 per cent, he said.

Mr Han added that a few quarters ago,

most firms were still watching the rental market and would rather extend

their leases than commit to more space. As rental declines moderate,

'tenants are going to say - how low can it go?'

Colliers cited Dresdner Bank as an

example of companies expanding or upgrading their space requirements as

office rents fall. The bank will be moving from Tung Centre at Collyer Quay

to 71 Robinson Road where it will take up 20,000 sq ft of space

AIG takes 5 floors at new Shenton Way

tower

In one

of the bigger office leasing deals in recent months, AIG is understood to

have leased five floors or about 60,000 square feet at the recently

completed South Tower of 78 Shenton Way. CB Richard Ellis is said to have

brokered the deal.

AIG is understood to be relocating

operations from leased premises at two adjacent buildings on Martin Road in

the Mohamed Sultan Road area to the South Tower.

These operations include the entity

currently known as American Home Assurance Company. BT understands that the

leasing deal involved some 'structuring'. Among other things, 78 Shenton

Way's owner, Germany's Commerz Grundbesitz Investmentgesellschaf (CGI), is

said to have taken over AIG's remaining lease term at Martin Road.

CGI also owns 71 Robinson Road, which it

bought in April last year while still under construction for $743.75

million, reflecting a record price of $3,125 psf of net lettable area. The

seller was a joint venture between Lehman Brothers and Kajima Overseas Asia.

- 2009 September 23 BUSINESS

TIMES

Prime office rents check their slide

The pace of decline in prime office rents

slowed in the first six weeks of the second quarter and the improvement has

been most visible in the key Raffles Place sub-market, going by latest data

from Cushman & Wakefield.

The property consultancy's monthly

average rental value for prime Raffles Place slid 6.6 per cent in the six

weeks since the end of Q1 2009 to $9.44 per square foot as at May 15, a much

smaller decline than the 28.8 per cent quarter-on-quarter drop registered in

Q1 this year. This brings the total year- to-date decline to 33.5 per cent

from $14.20 psf a month at end-2008.

The average Grade A Raffles Place rental

eased 8.7 per cent in mid-Q2 2009, again a more moderate drop than the first

quarter's 27.7 per cent Q-on-Q slump.

The moderation in rental decline was also

seen in the other micromarkets in Cushman's prime office basket - namely,

Shenton, City Hall and Orchard. Cushman's overall prime office vacancy rate

crept up 0.4 percentage point to 5.5 per cent as at May 15, milder than the

2.1-percentage point Q-on-Q hike to 5.1 per cent in Q1 2009.

'The deceleration of rent declines is not

surprising in light of the recent global stock market rally and signs of the

oft-mentioned green shoots starting to emerge in major economies around the

world,' Cushman said in its report. This has caused a mood shift among

landlords - from one of nervousness to a 'more considered and cautious

stance'. 'The continued caution is understandable in light of competition

from the oncoming stream of new office supply,' Cushman added.

CB Richard Ellis executive director

(office services) Moray Armstrong acknowledged that the pace of rent

declines has 'shown signs of easing in the past couple of months' and

expects this trend to continue. 'There's some semblance of confidence

seeping back into the system,' he said.

'Relocation and leasing activity has been

very limited for the past six to nine months. We're looking out for a

restoration of normal level of leasing activity, combined with the

restoration of positive occupier demand. Those will be the signs that we're

emerging out of the office downcycle. We're not there yet,' Mr Armstrong

added.

The office market may be weighed down by

looming new supply - with 9.9 million sq ft net lettable area of offices

slated for completion from 2009 to 2013. This year alone, the new supply is

projected at about 2.56 million sq ft, 83 per cent above last year's 1.4

million sq ft.

Demand-wise, the Singapore office market

has already seen two consecutive quarters of negative take-up: 366,000 sq ft

in Q4 2008 and nearly 323,000 sq ft in Q1 2009, based on official figures.

Cushman's director of research Ang Choon

Beng predicts around 40 per cent full-year contraction in prime office

rents, with a bigger slide expected for Raffles Place.

'While our forecast model predicts that

prime office rents would continue to be weak through 2009, we believe the

market has, in some instances, already priced in 70 per cent of the

anticipated full-year decline. With the significant portion of the rent

declines behind us, we think tenants can start to be more confident of

entering into leases.'

Cushman's figures show that in the

Shenton micromarket (which includes Shenton Way, Robinson Rd and Anson Rd),

the average monthly rental value slipped 6.5 per cent in the first six weeks

of Q2 2009, slower than the 18.7 per cent Q-on-Q contraction in Q1. The City

Hall location - which includes the Marina Centre area - saw an average 9.4

per cent rent reduction in the first six weeks of Q2 from the end-Q1 level,

against a 27.2 per cent Q-on-Q drop in Q1. Similarly, for the Orchard area,

the 9 per cent mid-Q2 drop was smaller than the 15.5 per cent slump in Q1.

Cushman's director of commercial and

industrial agency Kelvin Chiang says that along with an uptick in tenant

inquiries and demand in the first six weeks of this quarter, there wasn't

much sublease (shadow) space being added to the market. Neither does he

foresee any significant supply of additional 'shadow space' - which refers

to excess space that companies try to sublet - in the months ahead.

DTZ executive director (occupier

services) Angela Tan says that while there has been no let-up in the amount

of shadow space in the market, there is healthy interest in such space as it

offers 'good value proposition for short-term use since the space usually

comes fully fitted out and reduces the initial set-up cost for the new

occupier'. - 2009 May

21 BUSINESS

TIMES

To let: 400,000 sq ft shadow

office space

Financial institutions in search of tenants for

space that they pre-committed to

Close to 400,000

square feet of shadow office space is now available as financial

institutions scramble to find replacement tenants for the space that they

pre-committed to in the boom years.

A white paper on the subject by Colliers

International says that the amount of shadow office space in Singapore rose

by a steep 48 per cent over the last two months to hit 370,000 sq ft in May

2009 - up from 250,000 sq ft in March.

This is equivalent to 0.5 per cent of the

islandwide office stock, or about the size of MAS Building at Shenton Way.

Likewise, Jones Lang LaSalle (JLL)

estimates that some 400,000 sq ft of shadow office space is now available.

The bulk of this came onstream from February to May this year, said JLL's

regional director and head of markets, Chris Archibold.

Shadow space is loosely defined as excess

office space that companies have leased but are looking to sublet to a third

party for reasons such as reduction in headcount.

Colliers' white paper, which was released

yesterday, identified the financial industry as the largest contributor of

shadow space. It accounts for 46 per cent of all shadow space currently

being marketed.

'This is hardly surprising,' said

Colliers. After all, the financial services sector experienced explosive

growth of 11.7 per cent in 2006 and 15.7 per cent in 2007. During this

period, many financial institutions - including Citigroup, Credit Suisse,

Deutsche Bank, Merrill Lynch, Prudential Assurance and UBS - embarked on

aggressive expansion plans.

'With the current economic downturn being

fuelled by the collapse of the global financial markets, the reverse is now

true,' Colliers observed.

The white paper also gave a breakdown of

where the available shadow space is located.

Of the 370,000 sq ft of shadow space

available as at May 2009, some 42 per cent is located in the Raffles

Place/New Downtown micro-market.

A further 24 per cent is located in the

Marina/City Hall area, while the Shenton Way/Tanjong Pagar micro-market

accounted for some 14 per cent.

Even more shadow space is likely to

become available over the rest of the year and in 2010, analysts said.

Colliers projects that some 400,000 to

600,000 sq ft of additional shadow space could become available by 2010 from

just financial institutions.

The problem will be worsened when

construction of new major office buildings, in which financial companies

have pre-committed to large amount of spaces, is expected to be completed.

'This will add to the downward pressure

on rents exerted by the potential supply of 9.6 million sq ft from Q1 2009

to Q4 2012, and could keep rents depressed for a prolonged period of time

and delay market recovery until after 2010,' said Colliers.

It projects that Grade A office rents

will decline by up to 60 per cent in 2009 and 20 per cent in 2010.

JLL's Mr Archibold, who similarly

estimates that another 400,000 sq ft of shadow office space could be added

up to 2010, also expects rents to take a hit from the increase in shadow

space.

Colliers' data shows that as at March

2009, grade A office rents in the Raffles Place area have plummeted by some

41 per cent since peaking in Q3 2008.

The intense race for tenants has even

resulted in landlords offering incentives such as rent holidays in addition

to closing rents that are sometimes 25-30 per cent below asking rents in

order to retain or secure new tenants, the firm observed. -

2009 June 11 BUSINESS

TIMES

Office occupancy posts steepest fall

since 1997

The islandwide average office occupancy

rate slid 2.1 percentage points quarter on quarter to 93.6 per cent in Q1

2009, according to DTZ. This is the steepest quarterly fall since Q3 1997,

when a decline of 2.6 percentage points was recorded.

|

| No lack of space: During

the last office slump, shadow space also emerged, and according to CB

Richard Ellis research reports, this amounted to more than one million

sq ft at end-2002 |

The average office occupancy rate at

Raffles Place was 92.9 per cent at end-Q1 2009, translating to the greatest

quarterly decline of 2.7 percentage points since Q4 2004 when the occupancy

rate fell 2.8 percentage points, DTZ said.

'Office occupancies in Anson Road/Tanjong

Pagar and decentralised areas suffered even larger declines of 3.6

percentage points to 93.7 per cent and three percentage points to 95.2 per

cent respectively, due partly to the completion of Murray Terrace and two

transitional office projects - 11 Tampines Concourse and Mountbatten

Square,' the property consultancy group said yesterday. Office vacancies are

expected to rise further and rents will slide.

DTZ executive director Ong Choon Fah

said: 'Office demand has almost collapsed. Substantial new supply is

starting to come on stream from this year, followed by more supply next year

and in 2011. In addition, there is competition from shadow space.'

Shadow space refers to excess space that

companies try to sub-let. There was at least 106,000 sq ft of such space

available for leasing in Q1, according to DTZ. 'This constituted only 2.9

per cent of the total vacant office space, but is expected to grow in the

next few quarters as more companies are likely to return excess space to the

secondary market through cost-cutting measures,' DTZ said. 'In addition,

some companies which have pre-leased space in new projects completing within

these two years are likely to sub-lease excess space as they further

streamline business operations and intensify space usage.'

BT understands that Macquarie is prepared

to sub-let some of the space it has signed up for at Marina Bay Financial

Centre's (MBFC) Tower 2 under the project's first phase, which is slated to

be ready in Q2 2010. Macquarie has taken more than 74,000 sq ft on levels 16

to 18 of the tower.

Market watchers said they would not be

surprised if DBS Group too tries to sub-let part of the 700,000 sq ft it has

leased at MBFC's Tower 3, in the project's second phase, given that it axed

some 900 staff in November.

Elsewhere in Singapore, Citibank is said

to be offering over 100,000 sq ft of shadow space at various locations,

including Capital Square, Marsh & McLennan Centre and Millenia Tower.

DTZ executive director Angela Tan said:

'Shadow space, which usually comes with existing fit-outs and shorter lease

terms, allows tenants to save on initial set-up costs and provides

flexibility.'

Shadow space also emerged during the last

office slump. According to CB Richard Ellis research reports, this amounted

to more than one million sq ft at end-2002.

DTZ said the fall in office rents

gathered momentum in Q1 2009, with an average decline of 18 per cent from

the preceding quarter across the island. Prime office rents in Raffles Place

dived 25 per cent quarter on quarter to an average of $12 psf per month in

Q1.

Average office rents in Tampines Finance

Park fell the most, easing 32 per cent to $5 psf per month amid an increase

in supply emanating from the newly completed 11 Tampines Concourse and the

availability of shadow space at Tampines Plaza. -

2009 April 2 BUSINESS

TIMES

Prime office rentals on fast slide

down

The slide in prime office rents has

continued into the first quarter of this year. CB Richard Ellis estimates

that average Grade A and prime office rental values in Singapore both

slipped about 18 per cent in Q1 this year over the preceding quarter.

CBRE's estimate of the Q1 2009 average

gross monthly rental of Grade A office space was $12.30 per square foot,

down 34.6 per cent from the peak of $18.80 psf in Q2 and Q3 last year.

'We foresee the average monthly rent for

Grade A space to fall to single-digit level during the course of second-half

2009,' CBRE executive director (office services) Moray Armstrong said.

Vacancy for Grade A offices also rose

from 0.9 per cent in end-2008 to 2.9 per cent by end-March 2009.

CBRE predicts that more of the same can

be expected for H1 2009 as demand stays weak. 'Vacancies can be expected to

rise sharply and there will be no arrest in the slide of rents,' Mr

Armstrong reckons.

' I think there's likely to be

higher leasing activity by year-end and certainly going into 2010 - although

the outlook for rents remains bearish,' he added.

He also forecasts that 'the Singapore

office market could see negative take-up for the whole of this year in

excess of one million sq ft, around the levels the market has experienced as

recently as 2002/2003'.

Last year, the market saw a net increase

in office demand of slightly under 200,000 sq ft, not even 10 per cent of

the figure for 2007.

Cushman and Wakefield Singapore managing

director Donald Han said that negative net demand for office space for 2009

could be anywhere from 500,000 sq ft to one million sq ft, depending on how

badly the economy fares.

He estimates that average monthly Raffles

Place rents will slip by about 30 per cent for the whole of this year to

slightly below $10 psf by end-2009. 'About 38 per cent of prime office space

in Singapore is occupied by the financial services sector and this is the

segment that's worst hit this downturn,' Mr Han pointed out.

CBRE's average monthly rental estimate

for Grade A space - which covers the best office space within the firm's

prime office basket - of $12.30 psf as at end-March this year is 18 per cent

lower than the $15 psf as at end-2008.

Its $10.50 psf estimate of monthly

average prime rental value as at end-March 2009 represents an 18.6 per cent

quarter-on-quarter decline from $12.90 psf as at end-2008.

The end-Q1 2009 rental estimates for both

categories of office space represent drops of about 34 per cent from the

same period last year.

CBRE reckons that the Grade A vacancy

rate rose from 0.9 per cent as at end-2008 to 2.9 per cent as at end-March

2009. In the broader Core CBD comprising the micro-markets of Raffles Place,

Marina Bay, Shenton Way and Marina Centre, the vacancy rate increased from

4.6 per cent as at end-2008 to an estimated 6.9 per cent as at end-March

2009. These vacancy figures do not take into account 'shadow space' or

excess space that companies try to sublet.

'Right now, the shadow space is at a

tolerable level, but we haven't seen the full knock-on impact of attrition

and realignment of businesses. In due course, shadow space will grow as

subletting activity rises, and this will serve to further erode rentals,' Mr

Armstrong said.

Pre-lease momentum in new office

developments has stalled in the past two quarters as corporates grapple with

more immediate challenges within their businesses before even looking at

long-term premises planning, CBRE said. But some end users now have a bit

more clarity on their requirements. 'Some of the merging companies will

necessarily need to co-locate and those are the deals starting to emerge,'

Mr Armstrong said.

Towards the later half of 2009, CBRE

expects a few selective office deals to firm up, largely due to the expected

premises consolidation requirements arising from mergers and company

restructuring. - 2009

March 25 BUSINESS

TIMES

Raffles Place Q4 office rents slide

15.8%

Prime office rents in Raffles Place sank

15.8 per cent quarter-on-quarter (qoq) in the final three months of 2008 to

an average of $16 per square foot per month (psf pm), representing the first

decline since Q4 2003, according to DTZ Research.

|

| Ample supply: In

Raffles Place, the average office occupancy fell 1.3 percentage points

qoq to 95.6 per cent in Q4 2008. Island-wide, occupancies slid 0.8 of

a percentage point to 95.6 per cent |

The drop was the biggest among the micro

markets tracked by DTZ. Office rents in the Marina Centre micro market also

fell a hefty 12.9 per cent qoq to $13.50 psf pm.

'While the low level of new office supply

supported rents in the first nine months of 2008, the market began to favour

occupiers in Q4 as demand fell,' DTZ said. 'Landlords have lowered their

asking rents and are offering attractive incentives to retain existing

tenants and attract new ones.'

Office vacancies edged up further in Q4

2008 as demand dwindled. Except for Tampines Finance Park, where occupancy

remained at 96.8 per cent, occupancy in all other micro markets declined.

In Raffles Place, the average office

occupancy fell 1.3 percentage points qoq to 95.6 per cent in Q4 2008.

Island-wide, office occupancies slid 0.8 of a percentage point qoq to 95.6

per cent, as new supply was added and demand weakened as companies shelved

expansions, cut back on space needs or shifted to cheaper locations such as

high-tech industrial space or converted state property.

DTZ said that shadow space is beginning

to surface as occupiers dispose of excess space, although the amount

available for occupation in Q4 2008 was still insignificant, at about one

per cent of total vacant office space island-wide.

In response to falling demand, there has

been a cutback in new office supply - but not enough to ease an impending

glut as most major projects are already under construction, DTZ noted.

Deferred developments totalling about 872,000 sq ft of new office space

include South Beach, office extensions at Tampines Mall and Funan DigitaLife

Mall and the redevelopment of Marina House. DTZ puts potential office supply

from 2009 to 2013 at 11.3 million sq ft, compared with an earlier estimate

of 12.1 million sq ft.

DTZ said that in view of the

deteriorating global financial situation and the large amount of new office

space coming on stream in Singapore this year, occupancy rates and rents are

expected to decline further in 2009.

The firm also noted that sentiment in the

industrial property market has soured, as the manufacturing and office

sectors continue to weaken. Rents for private conventional industrial space

declined in Q4 2008 for the first time since Q3 2003.

Rents for first-storey and upper-storey

private industrial space dipped 2.1 per cent and 2.4 per cent respectively

qoq to $2.30 and $2 psf pm. Rents for hi-tech industrial property slid 4.4

per cent qoq to $4.30 psf pm - the first decline since Q2 2004.

- 2009 January 6 BUSINESS

TIMES

Prime office rentals coming down

Q4 sees them crash by up to

20% in some cases as tenants call the shots

Landlords may be frowning but those

looking for office space have reason to cheer. After climbing steadily for

nearly four years, average Grade A and prime office rental values in

Singapore are estimated to have slipped about 20 per cent in the fourth

quarter of this year over the preceding quarter, according to latest figures

by CB Richard Ellis.

Grade A covers the best office space

within CBRE's prime office space basket.

The Q4 decline means that for the whole

of this year, the estimated fall in rentals is around 13 per cent for Grade

A space and 14 per cent for prime space. 'Modest rental growth featured in

the early part of 2008, but the market had peaked by Q3 2008. It was only in

Q4 that the sheer depth of the financial crisis pitched the office market

into decline,' CBRE executive director Moray Armstrong said.

'We expect further downward pressure on

rents through 2009,' he added without elaborating.

The firm estimates the average monthly

Grade A office rental value at the end of this year at about $15 per square

foot, down from $18.80 psf in Q3. The average prime office rental value in

Q4 is estimated to have eased to $12.90 psf from $16.10 psf in Q3. The Q3

figures were unchanged from the preceding three months.

The latest figures confirm that the

office upcycle which had seen rents galloping over the past two years has

ended.

Office rents nearly doubled last year,

rising 96 per cent for Grade A category and 92 per cent for prime space.

That was on top of respective gains of 53 and 50 per cent posted in 2006.

Putting the latest rental slide in

perspective, Mr Armstrong said: 'The extraordinary pace of rental growth

experienced through the past three years was clearly not sustainable and

would have been arrested by the increased volume of new supply in the

pipeline. We had already anticipated a supply-led softening in the market

from 2010 onwards.

'The rapid deterioration in the economy

and loss of business confidence have accelerated the process as office

demand has dried up.'

Tenant retention is the top priority for

existing landlords. Next year is likely to be a market where lease renewals

outnumber relocations, Mr Armstrong says.

Cushman & Wakefield Singapore

managing director Donald Han predicts Grade A office rents will weaken a

further 10-15 per cent in first-half 2009 from current levels. 'Landlords

are more keen to provide existing tenants with an incentive to retain them,

in terms of rental discounts during lease renewal negotiations; because if

they leave, the landlord will suffer downtime until it finds a replacement

tenant that will also have to be given fitting-out time. This means loss of

rental income.'

The office rental slide reflects a

reversal of the market dynamics to a more demand-led rather than a

supply-led model, Mr Han argues. 'Office rents had surged because of a

shortage of existing office stock; now rents are softening because of

weakening demand,' he explains.

Another seasoned market watcher said

while a 20 per cent drop in Q4 rentals seems alarming, the absolute drop of

about $3.20 to $3.80 psf in monthly rents is not so, given that 'rents were

at artificially high levels' on the back of shortage of existing Grade A and

prime space.

Grade A vacancy rates had been sub-1 per

cent for almost two years before rising to 1.2 per cent in Q3. Some analysts

estimate this will rise further to over 2 per cent by end-2008.

CBRE does not expect to see significant

changes in vacancy levels until sizeable new office developments start to be

completed from 2010.

Tenants, meanwhile, are looking to

contain costs during the economic downturn, Cushman's Mr Han observes.

CBRE's Mr Armstrong says: 'Corporates

will be under severe pressure to contain and indeed reduce costs. (But) the

reality in the Singapore office market is that many tenants with renewals

and rent reviews next year under leases committed three to four years ago

will still be faced with rents that could potentially increase by 75 per

cent to 150 per cent. We expect some fairly robust negotiations.'

He also predicts an increase in

subletting and surrenders of space by tenants if job attrition in the key

financial services sector spirals.

'Take-up in new developments will

inevitably be sluggish until demand improves and tenants are able to secure

capital expenditure approvals to relocate. It will be highly competitive,'

Mr Armstrong says. - 2008

December 11 BUSINESS

TIMES

Lehman's collapse marks

Office Rents peak

The collapse of Lehman

Brothers Holdings Inc may contribute to an easing of demand for prime

office space in Singapore, where commercial rents are already peaking amid

slowing economic growth, property consultants said.

The market turmoil that also this week

forced the sale of Merrill Lynch & Co to Bank of America Corp and a

bailout of American International Group Inc will probably further slow

expansion by international companies in Singapore, said analysts at DTZ

Debenham Tie Leung and Cushman & Wakefield.

‘Rents have peaked and with the

collapse of Lehman and the further shakeout in financial markets, this is

going to accelerate,’ said Ong Choon Fah, Singapore-based regional head of

research at DTZ Debenham, a property consulting firm. ‘Financial companies

are the ones occupying the very prime space and a lot of them are in

survival mode.’

Home prices and office rents in Singapore

have cooled after rising to records last year, and Colliers International

said this month that office-vacancy rates in the US will rise to the highest

in three years as financial-services companies slash jobs after reporting

writedowns of US$515.8 billion.

Gains in Singapore office rents will be

limited as global economic growth slows, the property researchers said.

Singapore’s economy is forecast to grow between 4 per cent and 5 per cent

this year, slowing from 7.7 per cent in 2007, as demand for Asian-made goods

wanes and writedowns mount at banks and securities firms.

Lehman, which this week filed the biggest

Chapter 11 bankruptcy in history, occupies office space in Suntec Real

Estate Investment Trust’s Suntec development. The firm has about 270

employees in Singapore.

Suntec Reit, a property trust partly

owned by Hong Kong billionaire Li Ka-shing, has dropped 26 per cent in

Singapore trading this year. CapitaCommercial Trust, an office landlord run

by South-east Asia’s largest developer, has slumped 36 per cent during the

period.

So-called Grade A office rents will

probably drop to about S$14 a square foot a month in 2009 from S$16 this

year, Merrill Lynch analysts led by Kar Weng Loo estimated in an Aug 26

report.

Rents may fall further to S$10 in 2010,

when the first phase of the 2.6 million-square-foot Marina Bay Financial

Centre is scheduled to be completed, and to S$8 by 2011, the brokerage said.

For the second half of 2008, rents for prime office space will be little

changed after climbing about 7 per cent in the previous six months, said

Donald Han, Singapore-based managing director of Cushman & Wakefield.

Still, supply of prime office space is likely to remain tight until 2010 and

any office space vacated by Lehman will probably be filled quickly, Mr Han

said.

‘The market is still in a very healthy

state and occupancy in Suntec,

where Lehman has its offices, is in excess of 96 per cent,’ Mr Han said.

‘The only issue is that negative

sentiment will creep in, with the fact that such a big investment bank that

has a long history of operating in Singapore is collapsing will shock the

market.’ - 2008 September

18 BUSINESS

TIMES

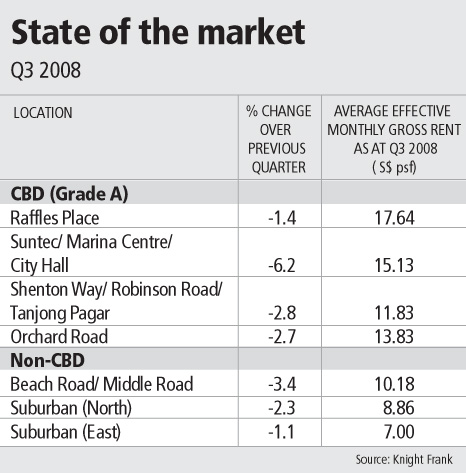

Grade A office rents in CBD slide for first time in

years

Average monthly rent at Raffles

Place slips 1.4% to $17.64 psf in Q3

Grade A office rents in Singapore's

Central Business District (CBD) have declined for the first time since the

office market troughed in 2004.

The average gross monthly Grade A rental

value for the Raffles Place area slipped 1.4 per cent to $17.64 per square

foot (psf) in the third quarter, from $17.89 psf in the preceding quarter,

according to the latest data from Knight Frank.

The Suntec/Marina Centre/City Hall area

led the declines in Grade A office rentals in Q3, with a 6.2 per cent

quarter-on-quarter fall to $15.13 psf. In the Shenton Way/ Robinson Rd/Tanjong

Pagar area, the drop was 2.8 per cent, followed by a 2.7 per cent decline

along Orchard Road.

Knight Frank director (research and

consultancy) Nicholas Mak said that he expects office rentals to continue

declining by 14-19 per cent islandwide in the next 12 months (from current

levels) as the global financial turmoil and possible mergers and

acquisitions contribute to consolidation and reduction in office demand.

Giving her take on weakening office

demand, DTZ executive director Ong Choon Fah said: 'Most companies are in

cost containment mode and would be looking for ways to manage the increase

in their accommodation costs. There has also been quite a lot of leakage of

CBD office demand to business parks and vacant state properties converted to

offices.'

Mrs Ong reckoned that headline office

rents may not come down much but noted that leasing incentives like

rent-free periods have started to reappear. Agreeing, an analyst said:

'Major landlords will try to maintain headline rents, because once rents

come down, it affects their whole portfolio.'

Besides weaker demand for office space

amid the financial turmoil, Knight Frank's Mr Mak attributed the softening

rentals in Q3 to the government's efforts to increase office supply

(including transitional office sites). 'In addition, landlords are more

cognisant of the substantial supply of office space that will be completed

from 2010 and have become more realistic and flexible in their rental

expectation when it comes to lease negotiations; they want to hold on to

their tenants and maintain their buildings' occupancy rates,' Mr Mak said.

The fall in the average Grade A Raffles

Place rental value in Q3 marks the first quarterly decline since Q2 2004.

This incipient weakening follows a rapid escalation in office rentals over

the past two years on the back of tightening supply and strong demand from

occupiers, including global financial institutions expanding their

operations in Singapore. Average Grade A Raffles Place rents surged 82 per

cent last year and that was on top of the 67 per cent gain posted in 2006,

according to Knight Frank.

But it's a different story now. 'Since Q1

2008, there appears to be a crack in the growth momentum for office demand

in the Downtown Core area due to external factors such as the US sub-prime

crisis that began in the second half of last year,' said Mr Mak.

The slowdown in demand in the Downtown

Core area - which includes the key office districts like Raffles

Place/Marina Bay, Shenton Way and Marina Centre - and tapering off in

rentals in Q3 does not come as a surprise, he adds. 'The tenants in this

area are primarily financial institutions, many of which had already

completed their expansion or consolidation plans over the last 24 months and

some are adopting a more cautious approach by putting any further expansion

plans on hold,' Mr Mak observed.

Knight Frank's data showed that Grade B

offices in Singapore also experienced downward pressure on rentals in Q3.

The biggest fall was in the Orchard Road location, where the average rent

decreased 7.8 per cent quarter-on-quarter to $10.70 psf a month in Q3.

Raffles Place and Shenton Way/ Robinson Rd/Tanjong Pagar Grade B offices

were less impacted by easing office rentals and dipped by 1.8 per cent and 2

per cent quarter-on-quarter respectively.

As a whole, offices in non-CBD locations

also mirrored the general slowdown in rental in Q3. Rentals continued to

weaken for the Beach Road/Middle Road area, with a 3.4 per cent

quarter-on-quarter drop. Suburban areas too met a similar fate with

quarter-on-quarter rental decreases ranging from 1-8 per cent.

Looking ahead, Knight Frank said that in

the short term, the beleaguered financial markets are expected to lead to

many firms either postponing their expansion plans or consolidating their

space usage. Restructuring at some organisations could lead to sub-letting

of excess space to ease cashflow problems.

- 2008 September 30 BUSINESS

TIMES

Prime and Grade A office rents

nearly doubled in 2007 but the pace of increase has since eased with gains

of around 7 to 10 per cent in the first-half of this year from end-2007

levels.

Morgan Stanley said last week it expects

Singapore office rents to peak earlier, by end-2008 instead of end-2009, due

to lower expectations for office demand, which will be below upcoming office

supply (including business parks).

CBRE data shows that some 645,000 sq ft

net lettable area of offices would be coming on stream in 2008-2009 from the

five transitional sites awarded so far. Market watchers say that any further

projects on transitional office sites sold today will be completed closer

and closer to 2010, from which point several major office developments are

slated for completion, including Marina Bay Financial Centre (MBFC) and

Mapletree Business City.

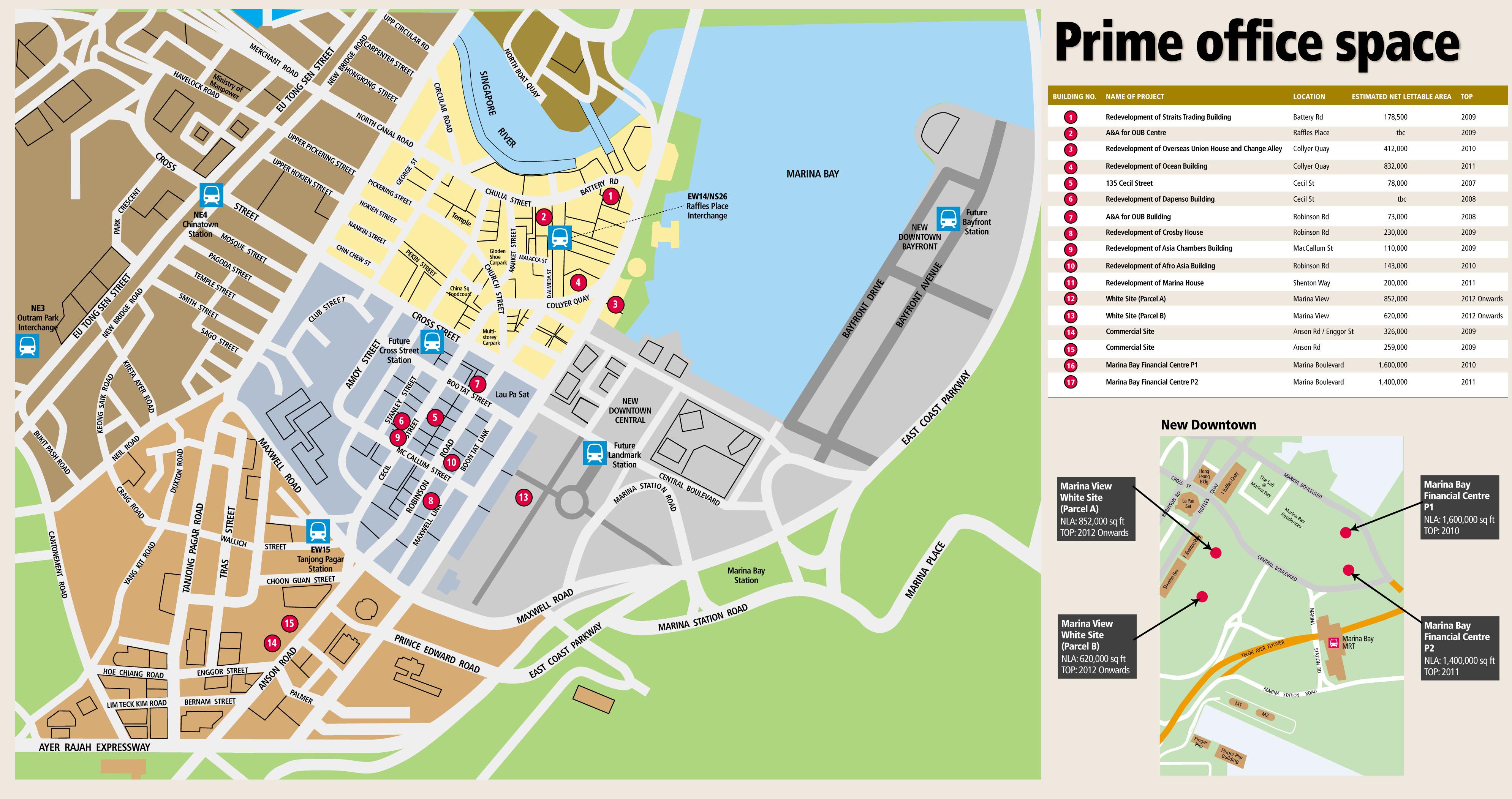

About 10.1 million square feet of new

office space will be completed between Q3 2008 and 2012, inclusive of the

645,000 sq ft of transitional offices, CBRE's numbers show.

Office rents to rise 10%: RREEF

But

no hike next year as new supply from key projects starts coming in

Office rents here are expected to rise a

further 10 per cent or more this year - before growth all but disappears in

2009.

|

| Upcoming bay views: Artist's

impression of the Marina Bay Financial Centre |

According to a report by Deutsche Bank's

property arm RREEF, rental growth is expected to 'evaporate' by 2009 as

extensive new supply starts to come onstream from projects such as the

Marina Bay Financial Centre (MBFC), Ocean Building and Marina View.

From 2010 to 2012 - when the market adds

570,000 square metres of new Grade A office space - Grade A stock is

expected to increase 25 per cent, the report says.

'The vacancy rate, currently near one per

cent, will shoot up to 2005 levels by the time this new wave of supply is

all brought on line,' it adds.

RREEF expects rent momentum - the

'general momentum behind the potential changes in rent, not an absolute

variation in rates' - to decrease in 2010 and 2011, then stabilise in 2012.

In its report, Asia Pacific Property

Cycle Monitor, it says each property sector has a clearly identifiable cycle

with four main phases:

- recovery (high but declining vacancy

rates - stable to rising rents);

- growth (low and declining vacancy

rates - rising rents supportive of construction);

- post-growth (low but increasing

vacancy rates - rising/flattening rents); and

- contraction (high or increasing

vacancy rates - falling rents).

' The office market has the

greatest volatility of the three main commercial sectors,' says RREEF. 'The

retail and industrial sectors are less volatile due to the relatively high

levels of owner-occupation, with less investment activity and limited modern

supply, particularly in the industrial sector.'

While the office sector is currently

still in the growth stage, a post-growth stage is expected in 2009, followed

by two years of contraction, and finally recovery in 2012.

On the upside, the retail property sector

is expected to remain in the growth stage until at least 2012.

RREEF attributes this to a 'broad

construction boom' and 'robust economy'. 'Two new malls in the Orchard Road

area will join the island's existing stock of dated retail space in 2008,

which could spur structural change in the market,' it says. 'Extensive

pre-leasing of this space will keep Singapore's retail vacancy rate steady

in the one per cent range.'

RREEF expects retail rental growth to

average 3 per cent per annum between now and 2012.

It also sees the industrial property

market booming - especially business parks. It projects growth until 2010,

when a post- growth stage will kick in until at least 2012. Rents, which

grew at double-digit levels in 2006 and 2007, should continue to rise this

year, before the rate of increase tapers off to single digits.

While the spillover effect from the

office sector has led some companies to turn to business-park space for

their back-office operations, RREEF reckons that this effect will 'diminish'

when the large supply of new office space comes onstream from 2010.

It also adds a note of caution: 'While it

poses no immediate competitive threat to Singapore, Malaysia's long-term

plan to develop the Iskandar Development Region in Johor will be a project

with structural implications for Singapore, and its progress should be

monitored over the long-term.'

- 2008 June 24 THE

BUSINESS TIMES

CBD offices still available at $6-9 psf a month

Small pockets of space can be

found in older buildings in the central district

The average Grade A office monthly rental

in Singapore touched $18.80 psf in Q2, while the vacancy rate for such

premium space stands at a mere 0.6 per cent.

|

| Older but cheaper: At Shenton House (foreground), asking

rentals for units on the seventh and 25th floors are said to be in

the $6.50 to $7.00 psf range |

However, small pockets of space ranging

from a few hundred square feet to 3,000 sq ft are still available in older

buildings in the Central Business District. For example, at Cecil Street,

Shenton Way and Tanjong Pagar, monthly rents range from $6 psf to $9 psf.

At International Plaza next to Tanjong

Pagar MRT Station, a 400 sq ft unit without a window is going for a monthly

rental of $6 psf, while a 1,500 sq ft unit on a higher floor has a $9 psf

rental tag.

Over at Octagon along Cecil Street, two

units (of 1,300 sq ft and 2,000 sq ft) are being offered at $7.80 psf.

At 146 Robinson Road, tenants are being

sought for a few units of between 1,000 and 3,000 sq ft on various floors

with an asking rental of $7.50 psf.

At Shenton House, asking rentals for

units on the seventh and 25th floors are said to be in the $6.50 to $7.00

psf range.

'While there are many office buildings

asking for double-digit monthly rents, users can still find office units at

single-digit rents on the fringe of Raffles Place, such as Robinson Road and

Cecil Street.

'These buildings are mainly older and

have smaller floor plates. In addition, they are mostly sandwiched between

other buildings and offer very limited or no car park lots in the building,'

says Knight Frank director, business space (office) Agnes Tay.

We would expect smaller companies

providing professional services and non-financial companies to find such

options attractive in terms of rental levels and at the same time without

compromising on the convenience of location. These tenants could be in

fields like auditing, accounting, consultancy, legal services, design,

shipping and IT,' she added.

Tenants willing to pay slightly higher

rents but still shy of Grade A rates also have several options in the CBD.

At UIC Building on Shenton Way, owner

United Industrial Corporation has put on hold its development plans for the

property and is said to have for leasing a total 43,000 sq ft comprising

units of various sizes from 700 sq ft to 9,000 sq ft.

The asking rental is said to be about $11

psf. UIC is said to be offering tenants leases of three years but without

options for renewal.

In more prime buildings such as the

Arcade near Raffles Place MRT Station and 8 Shenton Way (formerly Temasek

Tower), asking rents are higher, around $10.50-14.50 psf and $12-14 psf

respectively, BT understands.

Bigger office spaces in the CBD are also

becoming available, partly due to the government's initiative to move its

agencies out of the CBD to ease the acute shortage of prime offices.

Singapore Land Authority will be giving

up seven floors or 92,569 sq ft at 8 Shenton Way when it moves to Revenue

House in Novena in Q4 this year.

InfoComm Development Authority is also

expected to give up some space at Suntec City by the year-end.

Swiss banking group UBS is also believed

to be giving up about 47,000 sq ft of space it no longer needs on the 10th

and 15th floors of Suntec City Tower.

The space may be available for lease as

early as September, BT understands.

A UBS spokeswoman said: 'We are giving up

some space at Suntec City because we've achieved more efficient space usage.

But even after releasing this area, we'll still continue to occupy some

200,000 sq ft at Suntec City alone. In addition, since last year we've

leased 230,000 sq ft at One Raffles Quay. So we would still have grown our

Singapore footprint from 250,000 sq ft in 2006 to 450,000 sq ft.'

Industry observers are keeping their eye

on other big office occupiers to see if they, too, would release excess

space.

DTZ noted last week that the government's

efforts to create more immediate office space - such as releasing

transitional office sites and awarding disused state properties to the

private sector for conversion to offices - has helped to ease the supply

crunch and pressure on rentals.

This CBD office shortage will be eased

from 2010 as new office projects are completed.

'Going forward, as companies and

government agencies start to move out of the CBD and more new supply comes

onstream, office occupancy is likely to ease and limit rental growth in the

CBD for the rest of 2008,' DTZ said.

- 2008 July 7 THE

BUSINESS TIMES

Flight to quality may cool office rents in places

Spiralling rentals almost ground to a halt in Q2 with more cautious economic

climate

For office tenants in Singapore wearied by

steep rental hikes in the past couple of years, some relief is at hand.

The sharp escalation in office rents

screeched almost to a halt in the second quarter of this year as a more

cautious economic outlook became widespread. Average prime and Grade A office

rents edged up just 0.8 and 0.6 per cent respectively in Q2 over the preceding

three months, according to latest figures from CB Richard Ellis (CBRE).