2012 Jan 11

2012 Jan 11

London luxury home prices rise fastest in

14 month

MOST

EXPENSIVE :

This white-stucco-fronted house at 10

Belgrave Square, owned by Lebanese developer Musa Salem, is now the most

expensive home on the market in the world. Mr.

Salem bought this property many years back on a long lease from the

Grosvenor Estate, with a condition to restore the house to full Victorian

glory. The lavish amenities contained in 21,000 square feet of lavish living

space spread over 6 floors include an indoor swimming pool in the

basement, a gym, a home theater, a garage room, a news house .

The home has 12 bedrooms, 20 ft. ceilings, an indoor swimming pool in the

basement, a gym, a home and a home theater.

- TELEGRAPH

The number of London houses and

apartments that sold for more than £5 million rose 31 per cent to 262

in the nine months till September, real estate broker Savills plc said

last month. Overseas buyers comprised 65 per cent of the market for

homes costing that much, according to the report.

Russians have accounted for about 12

per cent of non-British purchases this year, compared with about 10 per

cent in 2010. The prospect of an election in the eastern European

country next year may prompt more investors to target the UK --

2011 Nov

5 Bloomberg

London luxury home prices rise fastest in

14 month

EU recession fears,

foreign purchases push up Nov prices by average of 12.6 %

Luxury home prices in central London climbed the most in 14 months in

November as the risk of a recession in Europe grew and overseas buyers

sought safer investments, Knight Frank LLP said.

Values of houses and apartments costing

an average of £3.2 million (S$6.5 million) rose by an average of 12.6 per

cent from a year earlier, the London-based broker said in a report on

Tuesday.

That's the most since a 14.2 per cent

increase in September 2010.

'This growth has taken place against a

backdrop of ever-worsening global economic news and rising threats of a

second credit crunch,' said Liam Bailey, head of residential research at

Knight Frank, in the report.

'A typical prime London property has

risen in value by more than £1,202 per day over the past year,' Mr Bailey

said.

The euro dropped 0.4 per cent to

US$1.2996 at midday yesterday, the first time the 17-nation currency

bloc's currency has traded under US$1.30 since January, in a fresh sign

that Europe's deal last week to enforce more budgetary disciplines on the

17 eurozone countries is being met with scepticism in the markets.

Before the deal reached by European

leaders last week, the leaders had also pledged that central banks will

channel 200 billion euros (S$339 billion) through the International

Monetary Fund, sped the start of a 500 billion euro rescue fund and

diluted a demand that bondholders shoulder losses in rescues to help

alleviate the region's debt crisis.

Values gained one per cent on a monthly

basis.

Prime central-London prices have

advanced about 40 per cent since the market's low in March 2009, Knight

Frank said.

House prices across the UK rose 0.4 per

cent from October, according to a Nov 29 Nationwide Building Society

report.

The number of homes on the central

London luxury market has increased by 8 per cent in the past 12 months,

Knight Frank estimates. The company didn't say how many properties were

available.

Prices in affluent neighbourhoods such

as Knightsbridge and Belgravia will reach £10,000 per square foot (psf)

by 2016 because of a lack of luxury-home supply in the city's best

locations, the property broker said.

An apartment at One

Hyde Park, the luxury condominium complex in Knightsbridge, sold for

£7,500 psf, Nick Candy, one of the two brothers who conceived of the

development, said in an October interview.

The glass-and-steel building has had

sales of more than £1.4 billion, he said. --

Bloomberg 2011 December 15

Asian Investor in

London

According to a recent report

one-in-three buyers of newly built London homes come from China. Property

developers say London offers a safe haven in the current global economic

downturn. But they also hope major Chinese investment will help them

finish building developments hit by cash-flow problems ever since the

financial crisis first hit

New UK properties find strong Asian

support

Singaporeans

make up 10% of buyers in projects where construction hasn't begun

Singaporean buyers

now account for around 10 per cent of all purchasers at 'new-build'

properties in Central London, industry players say.

According to estimates from sales agents at major property firms,

buyers from Asia make up about 40 per cent of all investors for new-build

projects (that is, projects where construction hasn't begun) in Central

London. And Singaporean buyers figure prominently, accounting for about a

quarter of transactions by Asian buyers, they said.

Many UK-based developers now launch properties in Asian cities such as

Singapore, Hong Kong, Jakarta and Kuala Lumpur ahead of their UK release

dates to capitalise on buying interest from this part of the world. In

Singapore, this has translated to some two to three new projects from

London and the rest of the United Kingdom being marketed here every

weekend, industry players said.

The Savills head of international sales, told BT recently

that UK developers hope to sell enough units in Asia to fund the start of

construction.

This is because Asian buyers are more willing to buy properties off the

plan, while buyers in the UK prefer to pick up units in only completed

properties, he said.

'Asian buyers accounted for about 40 per cent of new developments that

were sold in 2010, and the buying trend has continued into the first three

quarters of this year,'.

He said that Singapore buyers could account for about half of these

Asian buyers at some launches. Other agents put the figure at closer to 25

per cent.

UK-based property consultancy Black Brick Property Solutions has also

noticed the keen Asian interest in 'safe haven' London.

'Asian clients represent over 22 per cent of our client base as they

have a huge appetite for London property,' said managing

partner at Black Brick. 'It is viewed as a safe haven, many children are

educated in the UK, and the weakness in sterling is a key driver.'

Black Brick noted that Singapore clients are benefiting from a 35 per

cent discount on London property prices compared to 2007 as a result of

currency movements. Similarly, Hong Kong buyers now benefit from a 25 per

cent discount, while Malaysian buyers are seeing a 28 per cent discount.

Central London estate agency Kay&Co also noted that bigger homes

are still in vogue. Some 41 per cent of the firm's overseas applicants -

25 per cent of whom are Asian - purchase properties in excess of £2

million apiece, Kay&Co said.

But buyers here are not indiscriminate, agents said.

Asian buyers are looking for attractive 'buy-to-let' investments in

London. Mark Collins, head of residential at CB Richard Ellis (CBRE),

said: 'They are ideally looking for properties in areas of strong rental

demand and from developers with established and trusted brands.'

Added Knight Frank Singapore's head of international project marketing,

Linda Chern: 'Right now, week in week out, there are a lot of property

launches (in Singapore), so clients are spoilt for choice. So unless you

have a good location and attractive prices, the take-up is not going to be

good.'

But there is no doubt that sales are taking place every weekend. Buyers

are usually a mix of investors and those buying for their children who are

studying in universities in London.

Knight Frank, for example, marketed Baltimore Wharf (in London's Canary

Wharf) several weeks ago, and sold around 15 units in the 473-unit project

in Singapore. Ms Chern attributes the take-up to the project's good

location.

Boutique London developer Vision Homes also recently brought The

Metropolis to Singapore. The small 15-unit development in the Elephant

& Castle area sold well and Singaporeans bought around 30 per cent of

the units sold, the developer said.

Savills is marketing Caro Point, which is next to the Thames Embankment

(among other projects), while CBRE launched Langham Square in Putney,

London. Knight Frank recently previewed One Tower Bridge, a luxury

development on the banks of the River Thames.

-- 2011 November 7 business

times

Kensington & Chelsea Most Expensive

Addresses in UK

The 20 most expensive streets in

England and Wales

- Wycombe Square Kensington and Chelsea

Greater London £5,401,447

- Ingram Avenue Hampstead Greater London £4,872,500

- Cottesmore Gardens Kensington and Chelsea

Greater London £4,288,125

- Mallord Street Kensington and Chelsea

Greater London £3,864,444

- Stormont Road Highgate Greater London £3,375,277

- Brunswick Gardens Kensington and Chelsea

Greater London £3,085,590

- Bedford Gardens Kensington and Chelsea

Greater London £2,944,388

- Sloane Gardens Kensington and Chelsea

Greater London £2,695,125

- Parkside Merton Greater London £2,689,562

- Paultons Square Kensington and Chelsea

Greater London £2,667,500

- Moles Hill Leatherhead South East £2,645,000

- Duchess Of Bedfords Walk Kensington and

Chelsea Greater London £2,629,447

- Arthur Road Wimbledon Greater London £2,578,333

- Imperial Wharf Hammersmith and Fulham

Greater London £2,578,000

- South Road Weybridge South East £2,550,625

- Leys Road Leatherhead South East £2,549,545

- Woodlands Road West Virginia Water South

East £2,543,500

- Hans Place Kensington and Chelsea Greater

London £2,537,515

- Halsey Street Kensington and Chelsea

Greater London £2,358,333

- Phillippines Shaw Sevenoaks South East £2,351,538

--2009 December

28 TELEGRAPH

Prince Charles' Letter on Chelsea

Barricks

Real estate blog The

Rat and Mouse report : the judge in the Chelsea

Barracks case released a facsimile of a letter sent by Prince Charles to

Sheikh Hamad bin Jassim bin Jabr Al-Thani... part of a behind-the-scenes

campaign in which, investors claim, the Prince abused his position and

influence to scupper development plans. --The

Rat and Mouse

Market Sours for Condo

Kings : Candy & Candy

Nicholas Candy, who sells luxury

apartments to the super-rich, recently showed off a $41 million,

four-bedroom property here that boasts a private swimming pool and a

life-size statue of a boy, encrusted in Swarovski crystals, with his middle

finger raised.

But the brand of conspicuous consumption

that Mr. Candy and his brother and business partner Christian marketed to

wealthy clients is being put to a severe test by the economic crisis.

From London to New York to Dubai, the

luxury residential market is hurting as the economic crisis deepens.

Plunging property prices are making even the wealthy who still have money to

spend nervous about buying. Property specialists say it may be at least a

couple of years before demand recovers significantly.

In the U.S., luxury condo sales have taken a nosedive in recent months as

prices have fallen and job losses have begun to take their toll in the upper

ranks of a wide range of businesses. Some projects in Miami have been forced

to sell in bulk at fire-sale prices. Sales have fallen well short of targets

at the Trump International Hotel and Condominium in Chicago. In New York,

where there have been tens of thousands of job cuts on Wall Street, prices

of luxury units have fallen 15% to 25% since last summer, brokers say.

Over the past decade, the Candy brothers became splashy emblems of

London's boom and the extravagant lifestyles it spawned. Nicholas, 36 years

old, and Christian, 34, rocketed to celebrity status here by selling luxury

apartments, often as a second or third home, to the international

billionaire crowd that flooded into London from Europe, the Middle East and

Asia.

The brothers' property development business, CPC Group Ltd., has helped

change London's landscape with towers of glass and modern blocks in the

center of the U.K. capital. Their high-end portfolio includes One Hyde Park

in Knightsbridge, where an apartment sold last year for about $148 million.

Today, the brothers are emerging as a barometer of whether overseas

wealth can continue propping up the city's luxury market. Much of the

foreign money has gone into retreat or been wiped out during the global

financial crisis -- downsizing the lifestyle of the wealthy Russians, Middle

Easterners and other foreigners who made up much of the Candys' customer

base and causing the London real-estate market to fall, property specialists

say.

In November, the Candy brothers undid their biggest deal by agreeing to

sell their share in a prominent central London development. They are now

trying to save their first overseas development, a high-profile project in

Beverly Hills, Calif., where the brothers plan to build luxury condominiums

but have defaulted on a $365 million loan and are scrambling to restructure

it. They have given up a stake in another London project in exchange for a

greater share of the U.S. site.

The brothers' problem is twofold. Overseas buyers accounted for about 26%

of purchases of London's high-end real estate in 2007, according to British

real-estate company Savills PLC, but that dropped to less than 20% in 2008,

in a market that was half the size.

At the same time, prices are plummeting. Prices in London's high-end

real-estate market -- typically houses valued at about $1.5 million or more

-- plunged 8.7% during the last three months of 2008, according to Savills.

That compares with a 3.9% drop during the quarter ended Sept. 30, 2008. The

market for houses with an average value of about $7.3 million declined by an

even wider margin, falling 9.6% in the fourth quarter of 2008.

The Candy brothers say they can ride out the downturn. CPC Group has

about $300 million of cash, they say, and their business interests are set

up to prohibit the failure of one development project from affecting the

others. They say that one of their highest-profile developments, One Hyde

Park, is on track for completion next year and they have a healthy

interior-design business.

"It's tough times across the board," says Nicholas Candy, who

acknowledges "challenging times ahead." But he adds, "we put

ourselves in a very strong financial position."

The Candys created the property equivalent of a designer label around

their last name. The brothers, neither of whom are married, socialize with

the wealthy set they sell to and say they count the likes of Ivanka Trump

and Prince Albert of Monaco among their acquaintances. Based in Monaco, the

Mediterranean tax haven where they moved to a few years ago, they jet

between London, New York, Los Angeles, Dubai and elsewhere.

Sons of an advertising executive, they grew up in middle-class Surrey on

the outskirts of London. Nicholas, the more gregarious of the two, went into

marketing while Christian became a commodity trader. On the side, they made

their first property deal in the 1990s, using a loan of about $8,870 from

their grandmother as a deposit on a London apartment.

They began buying and selling properties, decorating them along the way.

In 1999, they launched Candy & Candy Ltd., decorating the homes of

wealthy Londoners. Their trademark look: black floors, minimalist furniture,

lavish flourishes such as $5,800-a-roll, hand-stitched, silk wallpaper and

oversized plasma screens.

Software entrepreneur Martin Edmondson, 40, bought a three-bedroom

apartment in Knightsbridge from the Candys about five years ago. He says he

liked the dark-walnut interior and "cool gadgets," including a

fingerprint reader to open the front door. An added attraction: The

apartment came fully decked out, down to bed linen, cutlery and silver

toothbrushes in the bathroom.

"They were creating a lifestyle," says Louise Hewlett, a

managing director at real-estate agent Aylesford International Ltd. In the

U.K. real-estate business, "no one had done it in that way."

The brothers took on increasingly ambitious property deals via CPC Group,

the business founded by Christian Candy -- plowing ahead as the real-estate

market swelled. In 2006, they teamed up with Iceland's Kaupthing Bank hf to

buy a three-acre site in London's bohemian Bloomsbury neighborhood with

plans to build some 180 luxury apartments, calling the project Noho Square.

Keen to expand into the lucrative U.S. market, they signed their first

overseas development deal in 2007 after a broker introduced them to the

Beverly Hills site. Partnering again with Kaupthing, they paid $500 million

for an eight-acre plot between Wilshire and Santa Monica boulevards, which

only four years earlier had traded hands for less than $50 million. They

named it 9900 Wilshire and drew up plans for some 240 luxury condominiums.

The brothers' other key source of finance came from Qatar, a small

oil-producing Persian Gulf emirate. Following an introduction by a banker,

the Candys teamed up with the Qatari prime minister, Sheik Hamad Bin Jassim

Bin Jabr Al-Thani, to develop a six-unit luxury apartment building in

London's affluent Belgravia neighborhood. Later, they again secured the

prime minister's backing for the massive One Hyde Park development, near

Harrods department store in Knightsbridge. An assistant to the prime

minister referred questions to an official at the Qatar Investment

Authority, who declined to comment.

Even as the real-estate market slowed, the Candys pressed ahead. Early

last year, they partnered with the Qatari government's real-estate arm,

Qatari Diar, on their biggest deal yet, paying $1.4 billion to acquire a

13-acre, former army barracks site in Chelsea. To celebrate, the brothers

hosted a party in Cannes on their 148-foot yacht Candyscape -- with acrobats

and stilt-walkers as entertainment -- even as they fended off opposition to

the project from Alexander Macmillan, grandson of former Prime Minister

Harold Macmillan, who described the glass-towered development as "an

abomination."

Undeterred, the brothers in September moved their staff to sleek new

offices overlooking the River Thames, where a wall of 32 plasma screens

descends in an L-shape from the black-marble lobby to the floor below.

Within days of moving into the new offices, however, U.S. investment bank

Lehman Brothers Holdings Inc. collapsed. That sent markets reeling -- wiping

out billions of dollars of net worth from the likes of the Middle Eastern

wealthy and Russian oligarchs who make up the Candys' client base.

The impact on the real-estate world was immediate. The market for such

ultra-high-end apartments, which cost tens of millions of dollars,

effectively froze, with some buyers even walking away from deposits,

according to property specialists.

As a result, the brothers were left sitting on plans for several hundred

apartments, most of which had not even been built. At One Hyde Park -- the

ongoing project that is furthest along -- about half of the 80 apartments,

which cost on average tens of millions of dollars or more, have been sold.

And those have only been paid for in part, the Candys say. The Candys

haven't made any new sales in the past few months.

"We're getting a few offers on things, but in reality, everyone is

sitting on their hands," says Nicholas Candy.

Dressed in a black Gucci blazer and white shirt, Mr. Candy recently

toured the vast One Hyde Park construction site. Looking over the site's

four unfinished "pavilions," Mr. Candy said they have sold enough

apartments in the development to pay back the construction loan -- assuming

all the clients that have already paid deposits do pay in full.

But, he adds, raising money to build new properties will be almost

impossible. "Construction finance across the world has completely dried

up," he says, before stepping into a black chauffeur-driven car where

his brother waited.

On Oct. 9, the credit crisis claimed one of the Candys' key financial

partners -- Kaupthing Bank, which was nationalized by the Icelandic

government. That same day, CPC Group and Kaupthing were due to repay the

loan on the Beverly Hills site. The Candys say they had the funds to pay

their $160 million share, but were forced to default with their partners.

Nicholas and Christian Candy tried to take full control of both the

Beverly Hills site and another they jointly owned with Kaupthing, Noho

Square in London. They cited a clause in the contract that allowed them to

take over in the event that Kaupthing went into some form of liquidation.

But their Kaupthing banker, Mike Samuels, fought back saying the bank

wasn't insolvent, it had been nationalized, so that clause didn't apply. Mr.

Samuels proposed instead that the Candys swap their equity stake in Noho

Square for Kaupthing's share of the Beverly Hills project.

The brothers agreed to the swap in late October. They lost more than $3

million on Noho Square but the swap left them owning 90% of the Beverly

Hills project.

"We still maintain a good working relationship with CPC and Candy

& Candy," said Mr. Samuels.

In November, the brothers also agreed to give up their stake in the

Chelsea barracks site to Qatari Diar. The Candys say they will remain

involved as development managers among other roles and that CPC still made

money on the project. "We've taken our profit today instead of in years

to come," says Nicholas Candy. "I try not to get emotional about

property."

The Candys still face losing the Beverly Hills project if they can't

restructure the debt or produce additional funds to the lending group, which

includes Banco Inbursa SA, the Mexican banking group led by billionaire

Carlos Slim.

Christian Candy, along with other CPC Group representatives, has been

shuttling to New York and Beverly Hills to meet with representatives of the

lending group to negotiate restructuring the deal.

CPC Group has proposed injecting funds in exchange for an extension of a

reduced loan, according to a person familiar with the matter. But it is

unclear whether differences over the amount of fresh capital, among other

details, can be bridged, this person says. Even if the Candy brothers can

strike a new financing deal, they may still need to reconfigure the project

to make it economically viable.

The Candys say they hope to get the deal done. Even if they don't, it

won't jeopardize their other projects, they say. If they ultimately lose the

site, it won't put them out of business, they say. "We just lose a lot

of money," says Nicholas Candy.

The ever-bullish Candys say they already are thinking about their next

move. They say they haven't canceled orders for two private jets, a

helicopter and a bigger yacht. Still, even they are making some adjustments.

"My brother and I are not buying new jets today," says Nicholas

Candy. "We are waiting to see what happens in 2009."

- 2009 February 12 WALL

ST JOURNAL

Ultra-luxury real estate developers,

Candy & Candy were sucked into what could have been a disastrous

situation recently when one of their partners in two large scale projects,

Icelandic bank Kaupthing, was nationalized by the Icelandic government this

month. Candy & Candy have apparently come to a deal whereby they have

relinquished interest in NoHo Square, a 12-acre project on the old Middlesex

hospital site in London, in exchange for a majority stake in 9900 Wilshire,

a luxury condominium development in Beverly Hills, Los Angeles.

Perhaps not the ideal timing, but I

understand CPC Group, who represent Candy & Candy were in a position to

take majority stakes in both shemes. This could have resulted in a lengthy

legal battle with Kaupthing, so a quick decision was reached. NoHo square

has already been put up for sale, although there are some suggestions that

it has now lost as much as £160 million in value, due to falling property

values in London.

Candy & Candy must still re-negotiate

the loan on 9900 Wilshire - which is now in default, and face the

issue of selling luxury condominiums into an already over supplied market.

Los Angeles is one of the hardest-hit US markets currently, with the S&P

Case shiller index showing a fall of 26.7% in home values in LA over the

last year.

Fortunately, Candy & Candy are well

placed to weather the current financial storm, and their Chelsea Barracks

project appears to have solid backing. Considerable opposition was voiced

when the project was first announced, with the Duke of Westminster voicing

the opinion that the development, which is being financed by the Qatari

royal family after buying the site from the Ministry of Defence, is “more

akin to office complexes,” than homes.

Many of C&C’s developments are at

the very top end of the luxury real estate market, such as One

Hyde Park in London, so assuming the Russian government continues to

pump money into their ailing financial markets at the rate they are doing,

there should be enough Russian billionaires left to keep them out of

trouble. - 2008

October

One of 太太's

best finds is a three-bedroom flat in Knightsbridge owned by

her friend. If not for the fact that

her 91-year

old Mother did not move in , this renovated unit would not be

available for purchase. This location is exceptional.

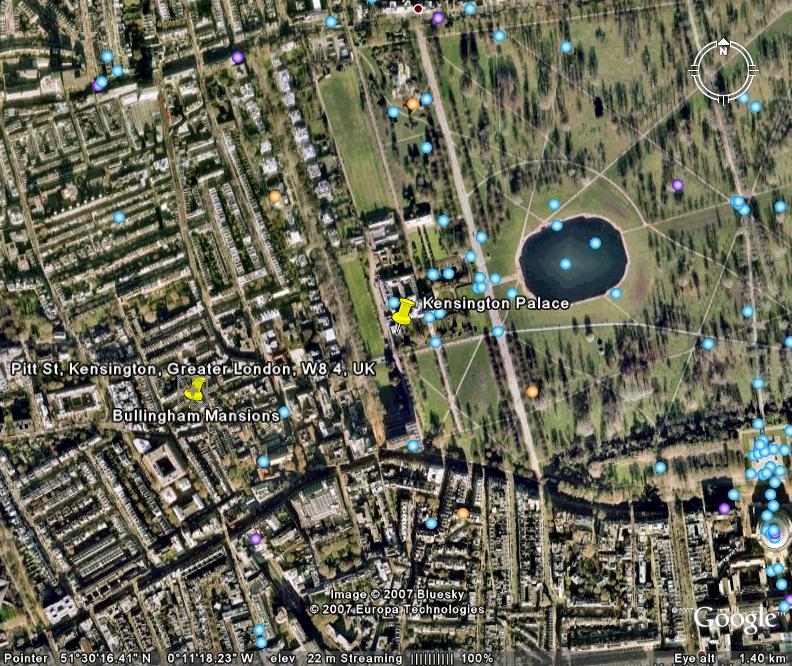

- Two blocks from Kensington Palace and

Hyde Park as well as the intersection of Kensington High Street and

Kensington Church Street

- The unit

-

2008 June 20 -

2008 June 20

This is my all-time favourite

but Anne says it doesn't have parking

Next door, across 'the walk' is

better

London luxury-home prices jump again

1.1% rise in average price of units costing £2.5m or more; overall market

unchanged

Symbols

of wealth: The UK's most expensive home (above) was purchased by Indian

billionaire Lakshmi Mittal for £57 million.

Luxury-home

prices in London, the world's most expensive city for prime real estate,

rose at the fastest rate in four months as the overall UK market stagnated,

industry reports showed.

The average price of houses and apartments costing at least £2.5 million

(S$6.96 million) climbed 1.1 per cent in January from December, Knight Frank

LLC said in a statement on Tuesday. There was no change in the average cost

of homes across the country, HBOS plc said in a separate report.

'It is being totally led by the purchase of properties of £10 million or

more,' Liam Bailey, head of residential research at Knight Frank, said in an

interview. 'The number of deals done at that level in the past three months

was double a year ago.'

The wealthiest property buyers don't need to borrow money to make

purchases, so they're not dependent on lenders that have made it more

difficult and costly to obtain mortgages, Mr Bailey said.

Britons are now buying between 40 and 50 per cent of all London homes

priced at more than £10 million, up from 30 per cent a year ago, according

to Knight Frank, a real estate broker based in the city.

London's most expensive new- built home was sold for £50 million last

month to Hourieh Peramaa, a 75-year-old real estate entrepreneur from

Kazakhstan, Sunday Times reported on Jan 27.

The house on Bishops Avenue in Hampstead, northwest London, has nine main

bedrooms, 16 bathrooms and five reception rooms, and was acquired from

Turkish businessman Halis Toprak.

Ms Peramaa plans to spend another £30 million extending and redecorating

the property, the newspaper said.

Earlier in January, Lev Leviev, an Israeli diamond billionaire, paid £35

million for a house in the same district as Ms Peramaa, according to Daily

Telegraph.

Indian steel entrepreneur Lakshmi Mittal owns the UK's most expensive

home. He paid £57 million in 2004 for a home close to Kensington Palace in

central London. Both Kensington Palace Gardens and Bishops Avenue have been

dubbed 'Billionaires Row'.

January's increase in luxury-home prices was the biggest since September,

when prices advanced 1.2 per cent.

For the year ended Jan 31, the gain was 26 per cent, the smallest since

October 2006.

Across Britain, prices in January were 4.5 per cent higher than a year

earlier, according to HBOS, the country's largest mortgage provider. Lenders

are selling fewer mortgages as they contend with losses stemming from the

collapse of the US sub-prime mortgage market.

Properties at the lower end of Knight Frank's prime index are now moving

more in line with the UK market, said Mr Bailey.

Bonus-earners in the UK's financial industry will invest £2 billion in

homes this year, compared with £5.5 billion in 2007, as they look for

higher returns, Savills plc said in November. Savills and Knight Frank are

the biggest brokers for prime London properties.

This year, top-quality dwellings in the UK capital will appreciate about

3 per cent, Knight Frank said on Tuesday, reiterating an October forecast.

The Bank of England's ability to cut interest rates to ward off an economic

slowdown may be hindered by inflationary pressures, said Knight Frank.

'It is fair to say that the issues of confidence and affordability that

have so far dogged the main market may now promote a more cautious

purchasing environment in the prime sector too,' Mr Bailey said.

Britain is home to about 68 billionaires, according to the Sunday Times

2007 Rich List. Many are investors from China, India and Russia who have

bought homes in London for its schools, stores, theatres and restaurants.

The most expensive houses can fetch as much as £4,000 a square foot, CB

Richard Ellis Hamptons International estimates. That compares with about £2,075

a square foot in New York, the broker said.

Purchasing at such prices so far isn't being inhibited by the prospect

that the UK may impose an annual tax of £30,000 on wealthy individuals who

live in the UK and keep their residence elsewhere for tax purposes, said Mr

Bailey.

'There is a lot of interest in deals being done by super-rich foreign

buyers,' he said. --

2008 February 7 Bloomberg

London luxury home prices lose

momentum

Homes worth

at least £2.5m up just 0.3% in Oct, slowest pace since July '05

Luxury-home prices in London rose last month at the slowest pace since

July 2005 as the prospect of job cuts and smaller bonuses deterred

investment bankers and other buyers, Knight Frank LLC said.

The average price of houses and apartments costing at least £2.5 million

(S$7.55 million) increased 0.3 per cent in October from the previous month,

according to an index compiled by the London-based property broker. Prices

gained about 34 per cent from a year earlier.

Companies in the City of London financial district may cut 6,500 jobs and

reduce bonuses by 16 per cent this year, the Centre for Economic and

Business Research said on Oct 8. For the past two years, most of the bonuses

have been spent on real estate, fuelling demand for apartments in London

neighbourhoods such as Chelsea, Kensington and Notting Hill.

'The impact of the credit crunch and a weaker City economy have

contributed to a more sober market,' said Liam Bailey, head of residential

research at the London-based firm.

Bonus-earners in the city will invest only £2 billion in homes next

year, compared with £5.5 billion this year, as they seek assets that offer

higher returns, according to Savills plc estimates. Savills and Knight Frank

are the biggest brokers for prime London properties, the most expensive in

the world.

The lack of investment will restrict the gain in luxury-home prices

to 3 per cent in 2008, less than a tenth of this year's rate, Knight

Frank forecast this week. The company cut its estimate from 10 per cent.

For homes costing more than £5 million, the average price increase

will probably be about 8 per cent next year compared with the estimated

2007 gain of 34 per cent, Knight Frank said. The main customers for the

most expensive houses and apartment are wealthy investors from Russia

and the Middle East, according to the broker.

The contrast with the rest of the London market 'illustrates the

strength of the super-prime market with demand from international buyers

remaining very strong,' Mr Bailey said. --

2007 November 6

Bloomberg

London Housing in the £1 million bracket may flatten

Fears that City bonuses will be slashed

have affected sales of Central London flats in the £1 million bracket.

The disclosure from Knight Frank, one of

the capital’s biggest upmarket property agents, comes with a warning that

any indication over the coming weeks that investment banks will cut bonuses

would cause house price growth in Central London to flatten for the rest of

the year.

Parts of Central and Northern England

have witnessed falls over the past month on the back of successive rises in

interest rates.

Until now, however, upmarket London homes

have been insulated from any wobbles in the general market by the estimated

£5 billion of City bonus money that has been flowing into the captial’s

smartest addresses after a record period of corporate and financial deals in

the past year.

Knight Frank’s riverside division,

which caters typically for bankers and other professionals looking for a pad

on or near the Thames, has reported demand grinding to a halt for homes

costing less than £1 million.

Sarah Haslam, head of the division, said:

“It has been like a ghost town in the under£1 million market so far in

August. We were very busy in the core market under £1 million for the past

two years and we are very busy in the £1 million and over market, but under

that it is as if there is no one out there. Typically, they are single and

young people. They are quite nervous and saying they will wait to see if

anything happens to their bonus.”

Liam Bailey, head of residential research

at Knight Frank, said that he could not foresee any crash in prime Central

London prices because of the chronic shortage of supply. However, he said

that prices could flatten rapidly if bonuses and banking jobs were cut.

September will be a crucial month for

testing the health of London’s prime markets, from Kensington and Chelsea

to Belgravia and St John’s Wood. Next month is the usual period for the

market to pick up as bankers return from their summer breaks.

Third-quarter figures from a quartet of

American investment banks are due out in a month, setting the tone for City

bonuses.

Last autumn agents at Savills

predicted that £5 billion of the £8 billion of bonus money would be

ploughed into London property. So far they have been right. Boom years for

the City in 2005 and 2006 have caused prime London properties to rise by an

average of 50 per cent over the past two years. - THE

TIMES 2007 August 23

UK house prices may rise 40% by 2012

Average prices in London will jump

48% on shortage of properties: report

UK house prices will increase 40 per cent

over the next five years because of a shortage of properties, a report by

the National Housing Federation said.

The average value of a home will rise to

£302,400 (S$929,716) by 2012, the London-based organisation, which

represents 1,300 housing associations, said yesterday. Prices in London will

jump 48 per cent to £478,300.

Prime Minister Gordon Brown has promised

to build more homes to make property more affordable for Britons after

prices tripled in the past decade.

A property crash is 'unlikely' because

Brown's proposals won't resolve the supply shortage any time soon, forcing

first-time buyers to rack up debt or rely on their parents to get a foothold

in the market, the report said.

'Continuing house price rises and the

resulting housing crisis are set to stay with us for a long time,' said

David Orr, chief executive of the National Housing Federation.

'Home owners may see this as good news,

but it carries a sting in the tail. 'More and more people are going to find

themselves priced out.'

The average price of a home is currently

11 times the average workers' annual earnings.

The government should push ahead with

plans to build three million homes by 2020, and should invest more in social

housing, the National Housing Federation said.

In London, where the average house value

is 13 times earnings, prices will continue to be driven higher by wealthy

foreign investors and financial-services workers, the report said.

-- BLOOMBERG

8 August 2007

One-bedroom flat for sale at record £3m

A one-bedroom flat, believed to be the

most expensive in Britain, is on the market for £3 million.

The flat in Eaton Place,

central London, is one of the most desirable addresses in the world and its

valuation is a sign that, in fashionable areas, prices show no signs of

slowing down. The 1,400 sq ft property, which has a 125-year lease, consists

of a drawing room, a bedroom with en suite bathroom, a separate lavatory and

a kitchen. At least 10 other flats are for sale in the same street for more

than £3 million, but they have either two, three or four bedrooms.

Elizabeth Hurley, the

actress, owns a £5 million house in the same street, while David Blunkett,

the former home secretary, Roman Abramovich, the Russian billionaire, and

Sir Roger Moore, the actor, live close by.

- TELEGRAPH 6 June 2007

London flat goes for £100 million

The

world's most expensive flat has just been sold in London for £100 million according to reports.

The most

expensive flat in London

has been bought by the foreign minister of Qatar - the largest and most luxurious apartment in the One Hyde Park scheme.

For Sheikh

Hamad it really is all about location, location, location - the £100

million penthouse is located opposite Harvey Nichols in Knightsbridge and

has stunning views over Hyde Park.

The site comes with underground parking

for 115 vehicles and private lifts direct to each flat so residents don't

have to accidentally bump into their neighbours.

The development, designed by Richard Rogers Partnership, also features a special

tunnel linking to the Mandarin Oriental Hotel.

When completed in 2010 it will comprise 86 flats spread across four blocks. Prices are expected to

begin at around £4 million.

It also comes equipped with some seriously high-end facilities: 24-hour room service of a quality

comparable to the Ritz Hotel, personal lifts from the underground car park equipped with eye-scanners, floor to ceiling fridges, panic rooms and

bullet-proof windows and walls.

The £1.5bn block has

been designed by Richard Rogers is being developed by brothers Christian and

Nicholas Candy and is backed by the Sheikh himself from his personal

fortune.

It will not be ready for

another two years. Previous estimates for the price of the apartment ranged

from £20m to £84m.

Two other penthouses have

also been sold sources told The Times.

The previous most

expensive flat sold in London

was in a Chelsea development for £27m in 2005 also sold by the Candy brothers to a British

financier.

At the time that was said

to be the most expensive apartment in the world.

The price easily beats

the price tag for what is marketed as Britain

's most expensive house – Updown Court in Windlesham,

Surrey

– which is on sale at £70million. - 2007

March 27 METRO

33% gains for prime London property

Analysts cite influx of foreign buyers for fastest price rise in almost 30 years

Prime central London property prices are

growing at their fastest in almost 30 years - and at three times the rate of

the wider British market, figures show.

The value of the best properties in

central London has risen by more than 33 per cent in the 12 months to

end-April, according to estate agent Knight Frank's prime property index.

That is the fastest rate of growth since

mid-1979 and means prices in central London are rising at three times the UK

average.

A property worth just 100,000 pounds in

1976 would now be worth more than 4.1 million pounds, the index shows.

Knight Frank said demand had been

supported by growing numbers of overseas buyers and money spent on property

by City bankers.

Over the past year, Belgravia and

Knightsbridge have seen the strongest market, with prices surging by more

than 40 per cent.

Head of residential research Liam Bailey

said: 'London's traditional spring market rush starts earlier and earlier

every year. For the past two years, the season has opened in December rather

than March, and has run on well into May.

'The early part of 2007 saw an incredibly

active market, with price growth totalling nearly 11.9 per cent in the first

quarter.'

He said, even after 18 months of strong

price appreciation, the pace of growth was yet to slow and, if anything, had

quickened.

In the six months to end-April, monthly

price growth averaged 2.8 per cent, against 1.7 per cent in the same period

last year.

'The strong performance of the top end of

the market can be attributed, at least in part, to the continuing health of

the City economy and the bonus season,' said Mr Bailey.

'However, it is our experience that,

whilst there have been growing numbers of deals completed by City workers,

it is the influx of overseas buyers - European, Russian, Indian and

increasingly Middle Eastern - which is the key to the substantial price

growth seen in many areas of central London,' Mr Bailey said.

Knight Frank data shows that the supply

of available property fell by more than 50 per cent in the first quarter of

2007, compared to a 17 per cent rise last year.

Looking forward, Mr Bailey believed stock

shortages would continue to buoy the market.

Higher transaction costs - stamp duty, in

particular - mean people are moving less often, while the introduction of

home information packs (HIPs) this summer is also likely to cause a drop in

supply, he said.

The controversial packs - designed to

make the home-buying process more efficient, cut the number of transactions

that fall through and encourage homeowners to reduce energy consumption -

are due to come into force in England and Wales on June 1, but have met

fierce opposition.

HIPs are expected to cost sellers around

500 (S$1,520) and estate agents have been reporting a rush to complete deals

ahead of their introduction.

The Knight Frank prime central

London residential index charts the value of property at the top end of the

market: flats and penthouses with an average value of 2.5 million and houses

valued at close to 5 million. - Reuters

2007 May 24

- Prices of the most expensive homes in central London have soared by

5.6% in January and February alone, says Knight Frank, a top-end estate

agency, making its predictions of a 12% year-on-year price rise in

central London by the end of 2007 look already too low. It attributes

the rise to a shortage of stock, especially in Belgravia, South

Kensington and Chelsea, where there is continuing high demand from

overseas buyers.

- Rents in central London are increasing

at their highest rate on record, says Cluttons, a lettings agency. Rents

have risen by 13.8% in the past 12 months, only the second time in 20

years that rental growth has entered double figures. The agency says

that the steep rise is down to a shortage of good-quality properties to

let, and many would-be buyers renting. The firm claims that landlords

are also aggressively insisting that rents rise when properties are

relet or tenants’ contracts are renewed.

London luxury-home prices rise at

record pace

Luxury- home prices in London rose at a

record monthly pace in March as Russians and Middle Eastern buyers competed

for a smaller number of properties with financiers from the City of London,

real estate broker Knight Frank LLC said.

The average price of the UK capital's

most expensive houses and apartments increased by an average of 3.1 per cent

last month from February, according to data compiled by Knight Frank. The

annual increase was 32 per cent, the highest in 28 years.

'The continued strong performance can be

explained by supply shortages and ongoing international demand now that City

bonus money has been paid out,' said Liam Bailey, head of residential

research at Knight Frank, in an interview.

The average price of a luxury house in

Knight Frank's monthly index is now almost £5 million (S$15 million), with

apartments costing £2.5 million. A typical house has appreciated by

100,000, or about four times the average annual UK wage, each month over the

past year.

Prime residential property prices in the

UK capital have now risen for 27 consecutive months. In the first quarter,

house prices rose by 10 per cent and apartments by 7.5 per cent. Chelsea,

favoured by bankers, and St John's Wood continue to perform well, said Mr

Bailey.

Luxury-home prices in London are rising

about three times as fast as UK house prices generally. Home prices rose

11.1 per cent in the three months to the end of March from the same period a

year earlier, HBOS plc, Britain's largest mortgage lender, said on April 5.

The most expensive homes in London, or

'super prime' properties such as the Hyde Park luxury apartment complex

project that is managed by Candy & Candy Ltd, are being pre-marketed

with price tags of about £4,500 a square foot, according to newspaper

reports.

In New York City, the most expensive

apartments bordering Central Park sell for close to US$7,000 a square foot.

Sheikh Hamad bin Jassim bin Jaber al-Thani,

the prime minister of Qatar, last month paid a record £100 million for the

highest and biggest penthouse in the Candy & Candy Hyde Park

development, according to the London-based Times.

Russians account for 21 per cent of all

buyers paying at least £8 million for Londonhomes, said Mr Bailey. Middle

Eastern buyers account for another 13 per cent. Britons buy 37 per cent of

such properties, he said.

Roman Abramovich, Russia's richest man

and owner of Chelsea Football Club, spent £49.3 million buying six

properties in London between June 2005 and August 2006, according to the

Daily Mail.

Other international business people

including Lakshmi Mittal, chairman of the world's largest steel company, and

brewing heiress Charlene de Carvalho-Heineken have bought property in London

in recent years.

For houses worth more than £3 million,

UK citizens account for 40 per cent of purchases. -

2007 April 12

Bloomberg

London prime homes surge at record pace

The price of prime London homes rose at

the fastest pace in at least 31 years in January as wealthy European, Indian

and Middle Eastern buyers competed for houses and apartments in Belgravia

and Knightsbridge.

Prices of houses in central London valued

at about £3 million (S$8.9 million) and apartments costing more than £1.5

million rose 3 per cent in January, real estate broker Knight Frank said

yesterday. That's the biggest monthly gain since Knight Frank started its

prime London property index in 1976. 'It's the bosses rather than highly

paid bankers who are leading the way,' Liam Bailey, head of residential

research at London-based Knight Frank, said. 'There is no doubt that the key

to the price growth seen in Belgravia and Knightsbridge is international

demand.'

International business people such as

Lakshmi Mittal, chairman of the world's largest steel company; Roman

Abramovich, Russia's richest man; and brewing heiress Charlene de Carvalho-Heineken

have all bought property here in recent years.

Luxury house prices in Belgravia and

Knightsbridge rose 38 per cent in the year to January, while apartments

gained 36 per cent in value.

The number of people registered as

looking to buy in the three prime districts in southwest London was 37 per

cent higher in January than a year earlier while properties for sale hadn't

risen so pushing up prices, said Knight Frank.

Sales in the two districts are regularly

exceeding US$4,900 a square foot, said Mr Bailey. CB Richard Ellis Hamptons

International Ltd said in September that London was the most expensive city

in the world for prime real estate.

Prime Manhattan addresses on Fifth Ave,

Park Ave and Madison Ave near Central Park cost about US$1,870 a square

foot, the company said.

The 330,000 workers in London's main

financial district may have earned a record £8.8 billion in bonuses last

year according to the city's Centre for Economics and Business Research Ltd.

Prices for prime London properties rose

by at least 2 per cent a month in 11 of the last 12 months. - Bloomberg

2007 February 14

London house prices surge on shortage

London house prices advanced in March as

buyers snapped up properties at the fastest pace in almost three years, led

by demand from wealthy foreigners and bankers.

London house prices advanced in March as

buyers snapped up properties at the fastest pace in almost three years, led

by demand from wealthy foreigners and bankers.

'London is the financial capital of the

world, and we've just got more people looking than properties available,'

said commercial director Miles Shipside in an interview. He sold part of his

stake in Rightmove to fund his own house hunt in the city.

A shortage of properties for sale has

driven up house prices even after the Bank of England raised the benchmark

interest rate three times since the start of August. The average stock of

unsold property per estate agent fell to 62.7 in February, the lowest since

July 2004, the Royal Institute of Chartered Surveyors said in a report on

March 13.

UK house prices rose 1.5 per cent on the

month, the most in four months, and 12.2 per cent on the year, to an average

of £228,183. Values increased from February in each of the nine regions

measured by Rightmove in England, led by a 2.6 per cent gain in the North,

while they fell by 0.3 per cent in Wales.

'The supply problem is extremely bad,

especially at the top end,' said Gary French, chief surveyor at the Friend

& Falcke agency in Belgravia, an area neighbouring Queen Elizabeth's

London residence at Buckingham Palace. 'If people with money in Russia, or

in the longer term China and India, start to see London as a safe haven,

rightly or wrongly, then it will keep prices going right up. We're not

affected by domestic interest rates.' Kensington and

Chelsea, the district where film star Hugh Grant lives, led annual

gains in London, rising 83 per cent from a year earlier to an average

of £1,208,981.

The next biggest gain was in Westminster,

at 50 per cent from a year earlier, followed by a 29 per cent increase in

Hammersmith and Fulham.

Luxury-home prices in London rose at an

annual rate of 31 per cent in February, the fastest pace since 1979,

real-estate broker Knight Frank said on March 15.

Interest-rate increases in August,

November and January may be discouraging some buyers.

The Royal Institution of Chartered

Surveyors' index of house-price growth showed the smallest increase in nine

months as the number of people registering to browse property dropped to a

two-year low. - Bloomberg

20 March 2007

The

world's most expensive flat has just been sold in London for £100 million according to reports

ONE

HYDE PARK

London flat goes for £100 million

|

| Artist's impression

of the One Hyde Park development: four blocks made of glass and red

weathered steel |

The most expensive flat

in London has been bought by the foreign minister of Qatar - the largest and

most luxurious apartment in the One Hyde Park scheme.

For Sheikh Hamad it

really is all about location, location, location - the £100

million penthouse is located opposite Harvey Nichols in Knightsbridge and

has stunning views over Hyde Park. It

also comes equipped with some seriously high-end facitilities: 24-hour

room service of a quality comparable to the Ritz Hotel, personal lifts

from the underground car park equipped with eye-scanners, floor to ceiling

fridges, panic rooms and bullet-proof windows and walls. The

development, designed by Richard Rogers Partnership for developers Candy

& Candy, also features a special tunnel linking to the Mandarin Oriental

Hotel. When

completed in 2010 it will comprise 86 flats spread across four

blocks. Prices are expected to begin at around £4

million. The development's staggering prices are indicative of the

extraordinary house price inflation that has gripped the city for many years

now. In Greater

London the average flat costs £275,267,

and the average detached house will set a homebuyer back by no less than

£628,239. This represents an increase of 11.3 oer cent over 12

months, far outstripping wage inflation and tightening the screw on

first-time buyers. While

the likes Sheikh Hamad can happily spend a tenth of a billion pounds on a

single flat, the average London worker has to contend with prices that

average more than half a million in several London boroughs. In

Kensington and Chelsea, the average price is £895,320,

up by 18.9% annually, and even less well-to-do boroughs like Tower Hamlets

and Hackney average close to £300,000 (up by 17.6% and 14% respectively)

If

the situation continues, a further interest rate rise may be in the

cards. However, in good news for those struggling with

affordability, the latest Nationwide survey indicates that the three rate

hikes introduced since last summer are beginning to take effect and house

price inflation is slowing somewhat across the country.

- May 2007

London flat goes for record £100m

If

you're struggling to get your foot on the property ladder spare a though for

a poor soul who is so far up it he needs an oxygen tank just to breath.

The world's most

expensive flat has just been sold in London for £100 million according to

reports.

Sheikh Hamad, the foreign

minister of the Gulf State of Qatar, is behind the purchase of the penthouse

home in the most exclusive block in the world -- One Hyde Park.

The apartment is one of 86 luxury flats being built on

the edge of Hyde Park opposite Harvey Nichols in Knightsbridge.

The flats have 24-hour room service to the level of the

Ritz, bullet-proof windows, eye scanners in lifts and spectacular views over

Hyde Park and The Serpentine.

The site comes with underground parking for 115 vehicles

and private lifts direct to each flat so residents don't have to

accidentally bump into their neighbours.

Huge baths are hewn from wood, marble work surfaces,

floor to ceiling fridges, panic rooms and former SAS security.

The £1.5bn block has been designed by Richard Rogers is

being developed by brothers Christian and Nicholas Candy and is backed by

the Sheikh himself from his personal fortune.

It will not be ready for another two years. Previous

estimates for the price of the apartment ranged from £20m to £84m.

Two other penthouses have also been sold sources told The

Times.

The previous most expensive flat sold in London was in a

Chelsea development for £27m in 2005 also sold by the Candy brothers to a

British financier.

At the time that was said to be the most expensive

apartment in the world.

The price easily beats the price tag for what is marketed

as Britain's most expensive house – Updown Court in Windlesham, Surrey –

which is on sale at £70million. - METRO

27 March 2007

Hyde Park flats 'on sale for £84m'

Four flats overlooking Hyde Park are on

sale for a rumoured £84 million each, the highest price ever asked for a

British flat.

The flats are part

of a development at One Hyde Park, designed by Richard Rogers

Partnership. They will not be ready until 2010.

Sources said today that the four penthouse flats could

feature bullet proof windows, specially purified air and even "panic

rooms". The security system is believed to have been developed after

consultation with the SAS.

A tunnel will link the flats to the Mandarin Oriental

hotel, which will provide a concierge service for the development, which

contains 86 flats with prices starting at £4 million.

The complex will also have a spa, squash court and private

wine-tasting facility. According to the One Hyde Park website, the scheme is

"a new residential scheme whose beauty, luxury and prestige will place

it in a class of its own".

It is being managed by Candy & Candy, a development

management company specialising in high end luxury flats. Nick and Christian

Candy, the two brothers behind the company, hold the record for the current

most expensive flat in London, which was in Chelsea and had a £27 million

price tag.

Clients for the flats, some of which have already sold

off-plan, are expected

to include Arab princes and Russian oligarchs.

Flats at the development, on the site of the old 1950s

office block Bowater House, are being sold for as much as £4,200 per square

foot, a record for London. The four largest penthouses are 20,000 square

foot each.

A spokesman for Candy & Candy, which is a notoriously

secretive company, would not comment on the price tags or facilities of the

flats today.

"The facilities are being worked on all the time by

the team," she said. She added that the building "was designed to

bring the Park across to Knightsbridge".

The Richard Rogers design features four blocks made of

glass and red weathered steel. The record asking prices for the flats

reflect the latest boom in the London property market, which has

outperformed the rest of the British market this year.

Prices for homes in central London have risen by around 20

per cent this year.

Homes worth more than £5 million have outperformed even

that. Figures from Haart estate agents, published yesterday, showed that

demand in the capital remained strong even after the latest interest rate

rise.

The average London house price increased by 0.5 per cent

in January to £260,140 up from £258,568 in December, the group said.

January applicant numbers in Haart’s London branches

were up 30 per cent on the same time last year, reaching record levels.

The agency predicts that house prices in the capital are

predicted to rise by up to 8 per cent in 2007 as demand continues to

outstrip supply and activity levels remain strong.

- by Rosie Murray-West TELEGRAPH 8 February

2007

London

prime homes surge at record pace

2007 Feb 14: The

price of prime London homes rose at the fastest pace in at least 31 years in

January as wealthy European, Indian and Middle Eastern buyers competed for

houses and apartments in Belgravia and Knightsbridge.

Prices of houses in central London valued at about £3

million (S$8.9 million) and apartments costing more than £1.5 million rose

3 per cent in January, real estate broker Knight Frank said yesterday.

That's the biggest monthly gain since Knight Frank started its prime London

property index in 1976. 'It's the bosses rather than highly paid bankers who

are leading the way,' Liam Bailey, head of residential research at

London-based Knight Frank, said. 'There is no doubt that the key to the

price growth seen in Belgravia and Knightsbridge is international demand.'

International business people such as Lakshmi Mittal,

chairman of the world's largest steel company; Roman Abramovich, Russia's

richest man; and brewing heiress Charlene de Carvalho-Heineken have all

bought property here in recent years.

Luxury house prices in Belgravia and Knightsbridge rose 38

per cent in the year to January, while apartments gained 36 per cent in

value.

The number of people registered as looking to buy in the

three prime districts in southwest London was 37 per cent higher in January

than a year earlier while properties for sale hadn't risen so pushing up

prices, said Knight Frank.

Sales in the two districts are regularly exceeding

US$4,900 a square foot, said Mr Bailey. CB Richard Ellis Hamptons

International Ltd said in September that London was the most expensive city

in the world for prime real estate.

Prime Manhattan addresses on Fifth Ave, Park Ave and

Madison Ave near Central Park cost about US$1,870 a square foot, the company

said.

The 330,000 workers in London's main financial district

may have earned a record £8.8 billion in bonuses last year according to

the city's Centre for Economics and Business Research Ltd.

Prices for prime London properties rose by at least 2 per

cent a month in 11 of the last 12 months. -

Bloomberg February 2007

Tiny London apartment on sale for £335,000

Location, location, location. Almost

anywhere else, the tiny dilapidated studio wouldn't attract much more than

mice. But this is London and the 77-square-foot former storage room

— slightly bigger than a prison cell and without electricity — is going

for £335,000.

The closet-sized space in the exclusive

Knightsbridge neighborhood may be only "about the size of a ship's

galley, said real estate agent Andrew Scott, who's handling the sale.

"But it's permanently anchored to one of the wealthiest neighborhoods

in the world."

At more than £4,340 a square foot, the

mortgage buys a spot within walking distance of tony stores like Harrods and

London's iconic Hyde Park.

Originally conceived as a maid's room,

the apartment at 18 Cadogan Place hasn't been used for years and is littered

with trash bags and crumbling paint.

A coffin-sized shower is en suite, and

storage is provided by a shallow closet and 10-inch-deep shelves cut into

the wall. Two hot plates and a small sink make up the kitchen. Two dirty

windows allow light to filter into the basement room, and the fire escape

could conceivably double as a shared patio.

With no electricity or heating, Scott

said it would cost an additional £59,000 to make the room habitable.

"It is an investment," he said,

as he stretched his arms the width of the room, laying his palms flat on

opposite sides of the wall.

The sale of this dark, mildewy room

illustrates the astronomical rise in property values across London, which in

the past year has seen average residential property prices increase 22.4

percent, to about £703,000, according to figures released Monday by

Rightmove, which tracks the British property market.

Prices in London's most desirable

neighborhoods have grown even faster, with average house prices in the

borough of Kensington and Chelsea — where Cadogan Place is located —

rising 61.8 percent over the past year to a jaw-dropping £2.2 million.

Ultra high-end property prices in London

are the most expensive in the world, with some recent sales hitting £5,900

per square foot — making the Cadogan Place studio a bargain by comparison,

according to research published last year by CB Richard Ellis Group Inc.

Similar properties in New York can go for

about £5,300 per square foot, while those in Hong Kong sell at around £3,950

per square foot.

Scott said he already had three offers on

the property, which might go to auction. Size, he added, is in the "eye

of the beholder."

"If you thought of this as the cabin

on a boat, you'd say, 'It's pretty spacious,' " Scott said.

- AP 2007 January 31

January hike in UK home prices hits

3-year high

House-price inflation in the United Kingdom

reached the fastest pace in more than three years in January, led by London,

as record bonuses for bankers blunted the effect of interest-rate increases,

Hometrack Ltd said.

The cost of a home in England and Wales rose an

annual 6 per cent, the biggest increase since July 2003, to an average £170,800

(S$514,665), according to a survey of 3,500 real-estate agents, the

London-based property researcher said on Monday.

On the month, prices increased 0.4 per cent.

An £8.8 billion bonus round and a shortage of

homes have kept house prices rising, even after three interest-rate

increases by the Bank of England (BOE) to 5.25 per cent.

A basement in the London district of Chelsea the

size of a snooker table was put up for sale last week for £170,000.

'It's London - and certain bits of London - that

are making house prices appear so robust,' said Richard Donnell, Hometrack's

director of research, in an interview.

'The markets that are seeing growth are the ones

that are driven by bonus money. The people that are driving it are less

sensitive to interest-rate increases.' he added.

Prices in the London area rose 0.8 per cent from

December, Hometrack said.

In all other regions, gains were 0.3 per cent or

less, apart from the East Midlands, where price growth stalled.

London, which accounts for 17 per cent of the

United Kingdom's economy, will have price gains of 7 per cent this year,

compared with 4 per cent for the country as a whole, Mr Donnell said.

'In London and the southeast we'll see a lack of

supply keeping an upward pressure on prices,' he pointed out.

A basement room in London measuring six feet by 12

feet, which real-estate agents Lane Fox described as the smallest property

to be offered for sale in the UK, has received three offers.

The flat is at 18 Cadogan Place in Chelsea, a West

London district with the country's priciest homes, populated by film stars

such as Hugh Grant.

BOE policy makers said at their Jan 10-11 meeting

they considered whether the high price of assets, including houses, may fuel

inflation.

They judged there was 'some risk' of that

happening.

Investors are betting on the central bank raising

the benchmark interest rate once more this quarter. The implied rate on the

March contract was 5.73 on Jan 26 as of 3.15pm in London.

The contract settles to the three-month London

interbank offered rate for the pound, which averaged about 15 basis points

more than the bank's benchmark rate over the past decade. - Bloomberg

2007 January 30

London bankers buying life of

luxury

About 4,200 bankers in the City will

pocket bonuses of more than £1 million each

When

you're a London banker with more than a million dollars in bonus money to

burn, the yachts, James Bond cars and luxury homes are yours for the taking.

Britain's financial elite are prowling

penthouses, visiting exclusive shops and considering the possibilities for

spending the £17.3 billion (S$52.5 billion) bonus pot that a blazing hot

market has earned them this year.

Sales of million-pound London houses and

flats are already booming, and the bonus bonanza for merchant bankers and

traders at global powerhouses like Merrill Lynch, Goldman Sachs and Lehman

Brothers is expected to drive demand through the roof.

International real estate sales company

Knight Frank said in a report available from its offices and entitled Rich

City that the market for the type of London residences sought by bankers is

expected to see the strongest growth in 2007.

'The super-prime market (US$4 million

plus) is significantly out-performing the overall London market,' it said.

'This boom is forecast to continue into 2007, with year-end bonuses for

London's financial elite estimated to increase.'

Housing in the capital is not the only

sector soaking up chunks of big money from bankers in the square mile of

London and its satellite enclave in Canary Wharf collectively known as 'The

City'.

Shiny new Ferraris, Porsches, Aston

Martins and other expensive cars piloted by well-heeled new owners have been

roaring along the streets of London's financial districts every morning

since bonus season began.

Pendragon, Plc - Europe's largest

automotive retail group - said its prestige car division Stratstone has seen

growing interest in Ferraris, Range Rovers and the Aston Martins made famous

by James Bond over the December to March bonus season.

'The two hot cars at the moment are the

Aston Martin V-8 and Range Rover Sport,' Pendragon chief executive Trevor

Finn said on Friday.

Punters at the recent London Boat Show

pored over the multi-million-pound yachts on display, checking out the

hot-tubs, cabins and considering where best to keep the champagne cold on a

sail around the sunny Mediterranean. 'To buy one of these boats is quite

simple,' said Brian Peters, chairman of Peters-Opal, one of Europe's largest

retailers of luxury motor yachts and sailing boats. 'You just write a

cheque.'

Those sentiments may have been on the

mind of Joel Plasco, the chief executive of London stockbroker Collins

Stewart. His company sponsored the boat show and as he admired one of the

biggest yachts at the show last week he looked thoughtful. 'I don't have a

yacht,' he said.

Music and film lovers are also splashing

out on high quality systems for home entertainment,

Sales staff at a shop for luxury

electronic goods maker Bang & Olufsen said one customer spent 45,000 in

a single visit on a 65-inch plasma-screen TV, state-of-the-art speakers and

a few other big-ticket items. 'We are expecting great things,' said Bang

& Olufsen sales consultant Richard Makings.

About 4,200 bankers in the City will

pocket bonuses of more than £1 million each, according to an estimate from

the Centre of Economics and Business Research.

A recent report published by Heartwood

Wealth Management found that 46 per cent of City workers who anticipated

receiving a bonus this year plan to spend it all.

Many high-end retailers have seen more

window-shopping than frenzied purchasing. They reckon that visitors who

don't buy just haven't seen the cash land in their accounts yet.

Tulsi Rao, a gemologist at fine jeweller

David M Robinson, said she anticipates more customers like the one who

bought a £34,000 watch from her more than a week ago. 'People are waiting

for their payments for bonuses,' she said, 'are researching ... as soon as

they get the cash they'll come in and buy.'

But one trader for a well-known US

investment bank and out celebrating at a champagne bar with chums did sound

a note of caution about the inevitable end to such a long boom. 'It may

never happen again,' he said. 'So put it in the bank.' -

Reuters

2007 January 22

The

'New' Rich in London

In the fantasy world of

multimillion-pound property deals the Russians are the new Fifth Cavalry.

This year, as the pool of takeover millionaires was drying up and

big-hitting bankers started to disappear through their balance sheets, in

rode the Russians with a fistful of newly converted dollars.

It is not the first time they have

appeared on the London property scene, but it is the first time they have

paid such huge prices. The early post-glasnost pioneers bought unassuming

flats and houses, typically for less than £500,000. In 2002 they have

joined the big league.

The most spectacular Russian buy of the

year was Stanley House, an elegant period property, just off the King’s

Road in Chelsea. Its drawing room is decorated with a frieze of the Elgin

Marbles, but the rest of the house is still in need of some finishing. That

did not stop Hamptons from selling it for £10 million.

If that was the biggest buy, Boris

Berezovsky was the biggest buyer. The Russian tycoon, who bankrolled Boris

Yeltsin’s election campaign, bought one of the most impressive flats in

Belgravia, kitted out to a James Bond specification, and also picked up a

mansion in the Surrey stockbroker belt. Several multimillion-pound flats

have gone to Russian buyers, who prefer modern, lateral space to tall, thin

London townhouses. It is a Russian who tops the list of potential buyers for

one of the country’s most expensive houses in Eaton Square.

There have been 15 sales at more than £8

million in London this year. One reason for the buoyancy is the return of

the Middle East market. Arabs have been sellers, rather than buyers, of

expensive properties in recent years, but 2002 marked a resurgence in

spending.

It is mainly the third generation of

oil-wealthy Middle Eastern families who have been in the market for UK

homes. The most expensive private sale in the country this year, of a

13-bedroom house in Chesham Place, Belgravia, is believed to have gone to an

Arab buyer.

Despite its size and its £19 million

sales price, the property is a discreet, white stucco Belgravia house. That

is entirely in keeping with the mood the current political climate demands.

Another major Arab purchase this year was of a second-floor flat in Eaton

Square, bought for £10 million from the Candy Brothers. This pair of young

brothers has had phenomenal success in placing high-tech, high-gloss

properties with buyers from the Middle East and Russia.

Some of the properties more traditionally

associated with Arab purchasers have not been so successful. The two most

expensive properties ever to come up for sale in the UK are a spectacular

Eastern-style mansion, complete with prayer room, hairdressing salon and

full Turkish bath in Kensington Palace Gardens, priced at £80 million, and

an unfinished modern version of the same, near Windlesham in Surrey, priced

at £70 million. No 18/19 KPG, as it is called in the trade, still awaits a

buyer. Updown Court in Surrey, famous for its five swimming pools and not so

famous for its road noise, was eventually sold by agents acting for the