|

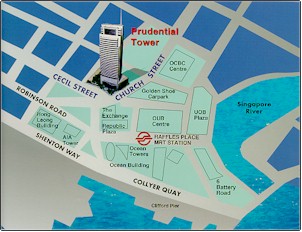

At the stratgic junction of Cecil Street and

Church Street this location befits from a network of roads directly linked

to Raffles Place MRT via an under pass

ESSENTIALS

| Street

Address |

30 Cecil Street |

| Postal

Code |

049712 |

| TECHNICAL |

| Floors (over

ground) |

30 |

| Year (end) |

1998 |

| Column Free

Space |

up to 250,000 sq ft |

|

6 floors of Prudential Tower being sold

K-Reit said to be buying space at

about $1,550 psf of net lettable area

In a deal that could help benchmark

office values in the Raffles Place area and smooth the way for more office

investment transactions, a property fund is said to be selling six floors at

Prudential Tower for about $1,550 per square foot or about slightly over

$100 million.

The buyer in the deal being stitched

together is believed to be listed K-Reit Asia, which already owns 44.4 per

cent of the strata area in the 30-storey building at the corner of Church

and Cecil streets.

Prudential Tower is on a site with a

remaining lease of about 85 years. Jones Lang LaSalle is said to be

brokering the latest sale involving net lettable area (NLA) of about 67,000

sq ft.

As at the end of last year, K-Reit's

existing space at Prudential Tower was valued at $224 million, or $2,066 psf

based on 108,436 sq ft NLA.

So the price of $1,550 psf that K-Reit

is expected to pay for its latest acquisition of six floors is about 25 per

cent lower than the end-2008 valuation on its existing space.

Some market watchers described the

latest pricing as 'not unreasonable'.

'They seem to be slapping themselves by

buying additional floors in Prudential Tower that could affect the valuation

of their existing space in the building. But one could argue that the

end-2008 valuation was too high in the first place,' one property consultant

said.

In any case, an industry observer points

out that K-Reit could still use a higher valuation than $1,550 psf for

Prudential Tower when it revalues its assets at end-2009.

It also made sense for K-Reit to raise

its stake in Prudential Tower and gain control of the building as that could

create other strategic options for the Reit.

The latest deal involves the 20th to

25th levels. The seller is Asia Property Fund, sponsored by LaSalle

Investment Management and PruPIM. The fund bought the six floors in 2007 for

$141 million or just under $2,100 psf from Prudential Assurance Company

Singapore. The latter received units in the fund in exchange for selling the

floors. Prudential Assurance Co Singapore and PruPIM are part of the

Prudential UK Group.

Prudential Assurance Co Singapore still

owns the 30th floor of the building, sources say. It had purchased the seven

floors in the development in early 1996 for $183 million from Straits

Steamship Land, now known as Keppel Land.

That transaction worked out to $2,200

psf. Although this figure was based on floor space and not NLA, property

consultants say the dollar psf price on NLA at which KepLand sold the space

in 1996 would be higher than what K-Reit (a KepLand unit) is paying in the

latest deal.

In short, KepLand group is buying back

the space at a lower price than what it sold it for 13 years ago.

Following its sale of the seven floors

to Prudential Assurance, KepLand also sold further space in the building to

other parties before divesting its remaining 44.4 per cent stake in

Prudential Tower to K-Reit, which was created from a de-merger from KepLand

and listed in 2006. - 2009

September 1 BUSINESS

TIMES

|